Summary:

- Google’s Q3 results show strong fundamentals and a shift towards a more mature phase.

- The advertising industry strongly recovered in 2023 and it’s expected to more than double in the next decade.

- Google’s dominance in the industry and focus on efficiency make it an interesting long-term investment opportunity.

kasinv/iStock Editorial via Getty Images

Investment Thesis

With 2023 wrapping up, it’s safe to say the online advertising industry has strongly bounced back from the disappointing results of 2022, and despite Wall Street not being satisfied with Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Q3 results, Google reported strong fundamentals making it an interesting investment opportunity at current prices.

While the Street only cares about cloud revenues being $200 million shy of analyst expectations – $8.4 billion reported against analysts’ forecasts of $8.6 billion – the main takeaway of the latest earnings report should be the operational shift taking place with Google.

If in the past the main goal was growth, the cost optimization strategies implemented this year hardly suggest Google has started to be more efficiency-conscious rather than a pure growth seeker. Most notably, during 2023, it revisited the useful lives of its servers and network equipment, resulting in minor depreciation expenses, and reduced its workforce by 4.6% – a rare occurrence for the company – laying off almost nine thousand employees. And results are already tangible given the operating margin has been pushed towards the 30% range during the past three quarters.

Despite the cloud segment contributing to momentum, the times of double-digit growth rates seem to be over for Google, although, when you report revenues in the $300 billion territory not being able to grow at double digits every year shouldn’t be such a big shock.

The management dedicated a big chunk of the Q3 press conference to how they are implementing AI in their operations – culminating with the unveiling of Gemini, their newest AI model expected to surpass ChatGPT – however, whatever AI solution they come up with will have the primary purpose of preserving Google’s market share against competition rather than expanding its already undisputed dominance of the industry.

Google has relatively few to conquer left – accounting already for roughly 50% of total industry revenues – but on the contrary, has a lot to lose if competitors start to implement new cutting-edge technologies and its solutions start to fall behind.

Despite what the management is saying to sweeten the analysts, looking at the fundamentals, they have already started to shift towards a more mature phase.

Let Wall Street sulk as much as it wants if Google is not able to meet its exaggerated expectations, however, the lovely mix of large-scale operations and greater focus on efficiency will do nothing but shove Google into delivering solid and consistent cash flows in the coming years, making it an interesting investment opportunity, especially as it is currently trading around its intrinsic value.

Business Model – Moat & Profitability

As of the nine months ended in 2023, Google’s primary source of revenue is represented by the advertising business line comprising Google Search, Google Network, and YouTube which combined account for $172 billion or 78% of total revenues. The remaining 22% is derived from the sales of hardware products – equal to $23.8 billion – and by Google Cloud, the fastest-growing business line, which contributed another $23.8 billion in revenues since the beginning of the year.

The advertising revenues grew 4% YoY, not an astonishing result – especially if compared to the 20.1% median growth rate of the industry – however, considering ads revenues were equal to $172 billion in the nine months ended, it wouldn’t be fair to pretend revenues to grow at double-digit rates forever. Overall, total revenues – equal to $221 billion for the last nine months – grew 6.9%, primarily driven by Google Cloud revenues.

Despite Wall Street not being satisfied with cloud results, as it was expecting Q3 revenues of around $8.6 billion and they came shy of $200 million at $8.4 billion, the reported results can be considered nothing but disappointing registering a 26% increase YoY.

In addition to strong growth, the cloud segment turned positive during 2023, however, despite the positive trend, the break-even is highly imputable to the changes in accounting estimates that took place at the beginning of the year which extended the useful life of servers and network equipment – therefore reducing the depreciation expenses for the year – of which the cloud segment makes a vast use.

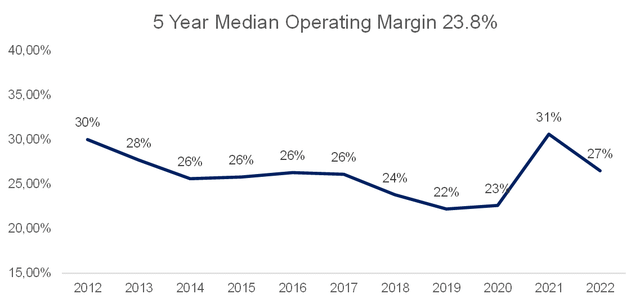

The operating margin for the nine months ended 2023 is equal to 27.5%, higher than the company’s 5-year median value of 23.8% and slightly better than the industry median value of 25%. Google totalled an operating profit of $60.5 billion for the period, growing almost 7% YoY.

5-year median operating margin (Personal Data)

Even though the management is trying to sweeten analysts pronouncing the word “AI” in every conference call, it’s evident Google is entering its mature phase. During 2023 the company has implemented a series of cost optimization strategies, one among all the reduction of its workforce. Considering it was used to hire an average of 4 thousand new employees every quarter for the past five years, it’s something that shouldn’t go unnoticed.

The times of strong growth might be over for Google, despite the recent unveiling of Gemini – Google’s newest Large Language Model that is expected to deliver greater results than ChatGPT 4 – it’s highly improbable that any AI solution will bring the company back to its glory days of crazy growing company. It’s more probable that whatever AI solution they come up with will be used to strengthen Google moat and preserve its dominance in the online ads industry.

Thanks to its immense scale of operation – owning 90% of the search engine industry – Google has an incredible advantage over any of its competitors in terms of data collection – used to tailor ad hoc ad solutions for companies wanting to promote their products and services – which more than justifies its incredible profitability.

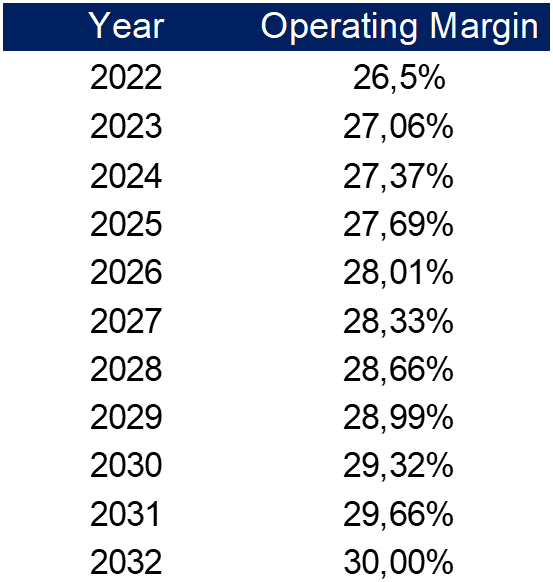

With Google shifting towards a more mature phase – while it’s reasonable to assume it will grow at more modest rates – it’s plausible to expect the operating margin to keep improving as the company will keep implementing more efficiency-conscious strategies cutting costs and reducing investments – at least in relative amounts – to better capitalise on its one-of-a-kind moat.

With that said, I do expect the operating margin to improve from 26.5% in 2022 to 30% by 2032.

Expected operating margin (Personal Data)

Industry Overview – Risks & Growth

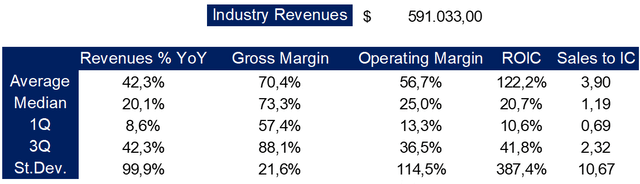

Google operates in the Interactive Media industry, an industry characterized by high growth – with a median revenue growth rate of 20.1% – and high profitability totalizing a median gross margin of 73.3% and median operating margin of 25%.

Interactive media industry data (Personal Data)

To be honest, saying that Google operates in the industry is way too reductive.

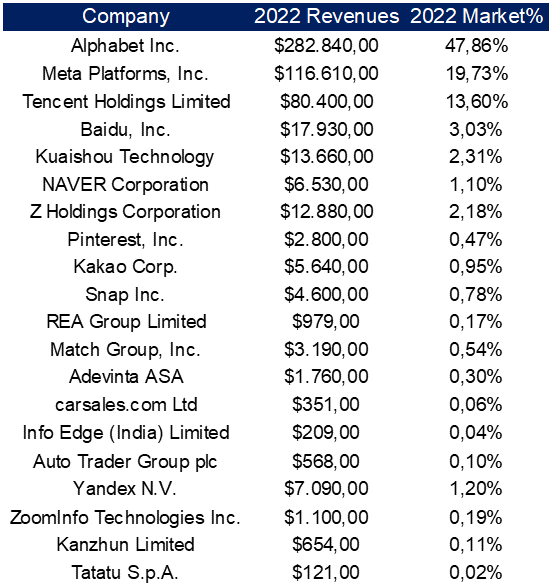

With its $282 billion in revenues in 2022, Alphabet alone accounted for 47.8% of the industry’s total revenues equal to $591 billion. Its most threatening competitor would be Meta Platforms (META) – owing a 19.7% market share – however, despite both companies’ business models relying on ad revenues, the way the two companies attract users – hence data providers – is very different.

Google attracts the majority of its users from Google Search, the most used search engine in the world, and for a lesser part from YouTube – the second most used search engine – while Meta relies on its social media platforms, which might clash with YouTube when it comes to users watch-time but does not represent a meaningful threat to the search engine business of Google.

Other than these two colossal players, another prominent operator in the industry is Tencent (OTCPK:TCEHY), the Chinese tech conglomerate, which owns a 13.6% market share, however, focusing primarily on the Chinese market doesn’t compete directly with Alphabet.

The rest of the industry is represented by smaller players, and none truly represent a threat to Google’s reign, not even Bing – Microsoft’s (MSFT) proprietary search engine – which despite its partnership with OpenAI to implement ChatGPT features to its search solutions still accounts for 3% of the search engine usage, meaning that when it comes to user base, and therefore data collection, Alphabet has practically no serious competition.

Interactive media top 20 companies by market share (Personal Data)

If single companies don’t scare Google, world governments and international institutions with their privacy concerns surely pose a serious threat to the company’s everyday operations. Being Google’s business model heavily reliant on data collection, any tightening of privacy policies might comport a reduction, or complete impossibility, of the company’s ability to collect sensible data which are crucial to tailor targeted – and very lucrative – ad solutions. However, despite Google being kept under severe scrutiny by international institutions – especially antitrust institutions which fined the company billions of dollars in the past – any increase in privacy concerns will badly influence the whole industry and not just Alphabet.

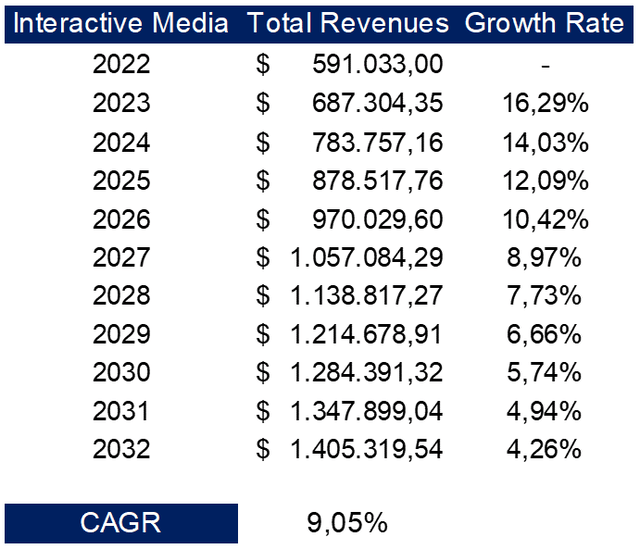

With that said, I do expect the Interactive Media industry to keep growing strong in the coming years. The expected growth rate for the industry – based on the reinvestments made by the companies operating in the sector – is 16.3%. A detailed explanation of how I came up with the industry’s expected growth rate, as well as many more useful industry data, can be found on my website.

Therefore, by 2032 Interactive Media revenues are expected to reach $1.4 trillion, increasing 2.4 times by the $591 billion registered in 2022 at a CAGR of 9.05%. I projected the industry’s expected revenues 10 years from now applying the expected growth rate of 16.3% and letting it slowly decline as the industry approaches the economy’s perpetual growth rate represented in this case by the USD risk-free rate.

Interactive media expected revenues (Personal Data)

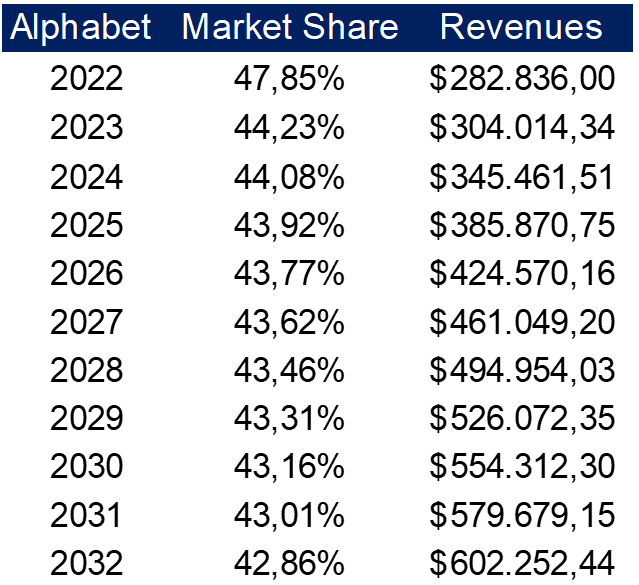

I assumed Google to remain the prominent player in the industry expecting it to maintain a market share greater than 40% thanks to its undisputed leadership in the search engine segment. However, I allowed the entrance of new players with potential new solutions thanks to AI implementations assuming Google to lose 5% of its market shares – worth roughly $72 billion in revenues – decreasing it from 48% to 43%.

Alphabet’s expected market share (Personal Data)

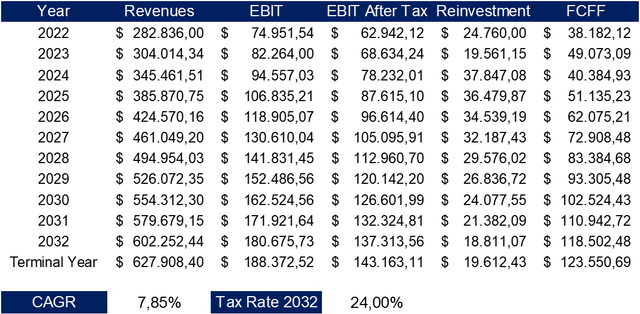

With these assumptions, Google revenues are expected to sit around $602 billion by 2032, more than doubling from the $282 billion reported in 2022, growing at a CAGR of 7.85% in ten years.

Future Cash Flows – Efficiency & Reinvestment Needs

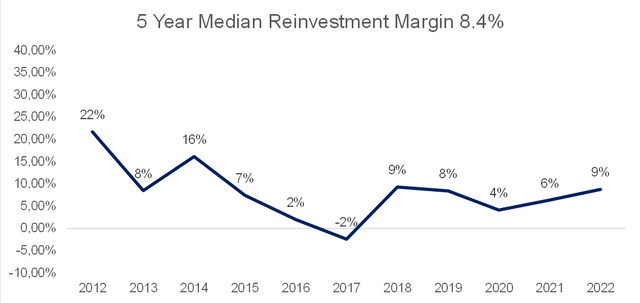

Google’s business model required significant reinvestments over the years. The 5-year median reinvestment margin is equal to 8.4% – comprising only capital expenditures and acquisition – however, treating R&D expenses as capital expenditures instead of operating expenses, as they generate a return over multiple years, the 5-year median reinvestment margin jumps to 14%.

5-year median reinvestment margin (Personal Data)

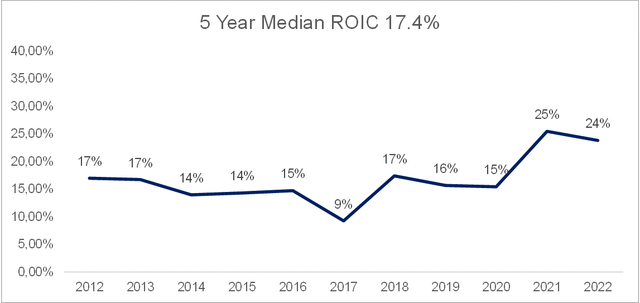

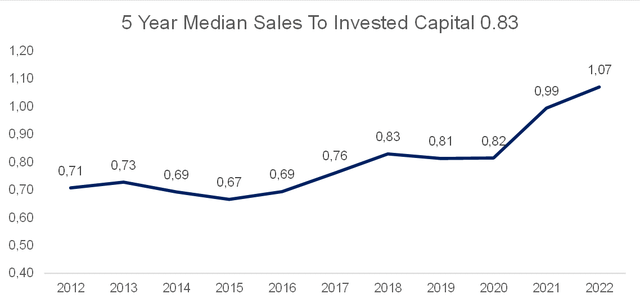

Looking at efficiency ratios, Google’s 5-year median ROIC is 17.4% while the 5-year median sales to invested capital ratio is 0.83. Both ratios, however, are lower than the industry median ones, respectively 20.7% and 1.19.

5-year median ROIC (Personal Data) 5-year median sales to invested capital (Personal Data)

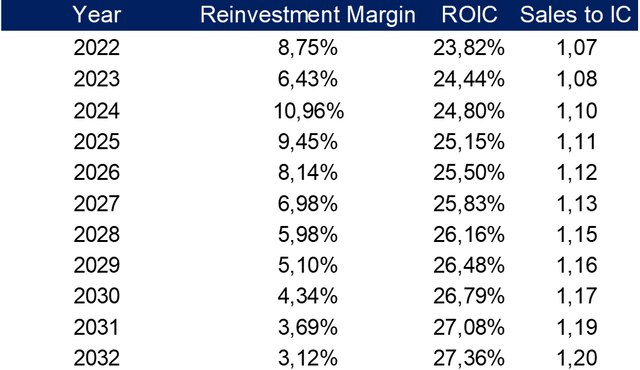

Carry on the tale of Google shifting from being a pure growth seeker to a more mature company focused on improving efficiency, I expect Google’s reinvestment needs to gradually decrease in the coming years, at least as a percentage of total revenues as on nominal terms Google will likely keep reinvesting billions of dollars.

With that said I assumed the sales to invested capital ratio, which shows how much revenues are generated for each dollar invested into the company, to continue its positive trend reaching the industry median value of around 1.2 by 2032.

Improvements in the sales to invested capital ratio will translate into improved ROIC, expected to increase from the 23.8% registered in 2022 to 27.3% by 2032, and in lower reinvestment margins, expected to be around 3.1% ten years from now.

Expected ROIC, sales to IC, and reinvestment margin (Personal Data)

Combining all the assumptions made so far – growth slowing down as Google enters its mature phase and focuses on efficiency by reducing its reinvestment needs to allow for greater profitability – the free cash flows to the firm are expected to be around $120 billion by 2032, more than tripling in the next 10 years from the $38 billion reported in 2022, growing at a CAGR of 12%.

Valuation

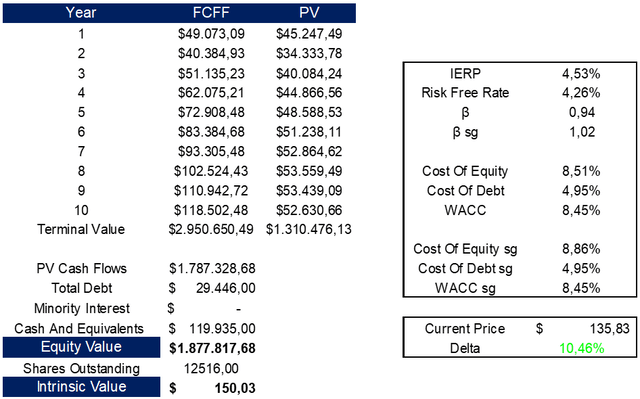

Applying a discount rate of 8.45%, calculated using the WACC, we obtain that the present value of these cash flows is equal to $1.87 trillion or $150 per share.

Compared to the current prices, Google’s stocks result to be undervalued by 10.46%.

Alphabet’s intrinsic value (Personal Data)

Conclusion

Google might not be the growth company it used to be, but clearly, it’s alive and kicking. Google is shifting towards its mature phase, meaning it will squeeze out every cent from its business model generating tons of cash flows for its shareholders.

Despite Wall Street wanting it to go back to its glory days of growth stock – and dumps it every time it misses its absurd expectations – at today’s prices Google can represent a good investment opportunity for long-term investors.

If you’re looking for in-depth analyses of stocks, follow me and turn on the notification button to avoid missing any new updates.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.