Summary:

- A. O. Smith is the largest manufacturer of water heaters, boilers, and water treatment products in America, with a strong presence in China as well.

- The company is known for returning lots of cash to shareholders though dividends and buybacks and growing revenue constantly at mid-single digits.

- The outlook looks bright according to the company’s expectations laid out on its investor day, but we are concerned about the idea of growing through acquisitions.

- We valued the equity through different methods and found it hard to justify the current price. We believe it is best to wait for a price drop before starting a new position.

brusinski

Investment Thesis

A. O. Smith (NYSE:AOS) is the market leader in water heaters, boilers, and water treatment products in America. The company recently had its Investor Day, where it outlined a plan of growth for the coming years. We like it, but there are still many questions about it, especially the growth through acquisition plan. Given the recent rally and valuation, which we find hard to justify through different methods, we believe it is best to wait and not start a position yet.

Business Model

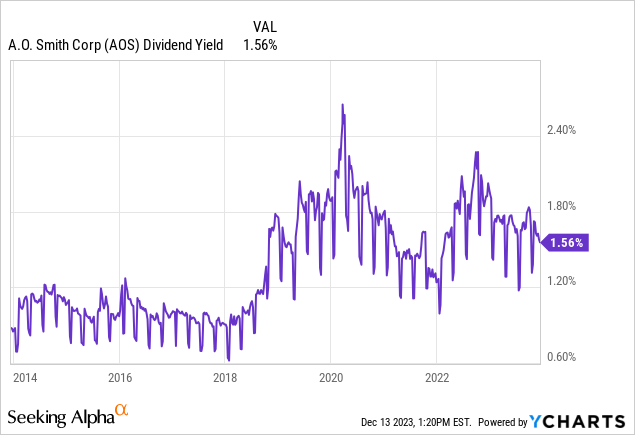

AOS is the largest manufacturer and marketer of water heaters, boilers, and water treatment products in America in both commercial and residential markets. Although it is a hot business (because they heat water), it doesn’t look very attractive for investors a priori because of its lack of growth and small dividend (1.64% yield). However, a deeper delve is worth it.

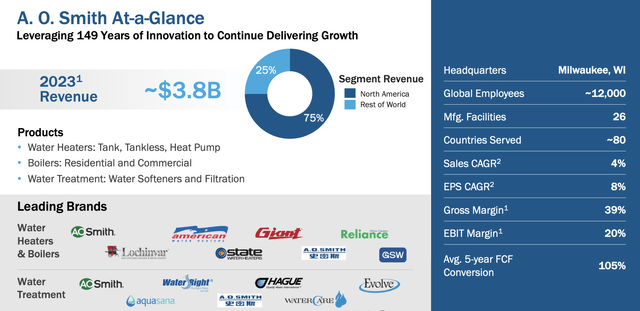

The company will have sales of $3.8 billion in 2023, which represents a CAGR of 4% for the past 5 years. 75% of that comes from North America, while the remaining 25% is from the rest of the world, primarily China. Although they say they serve 80 countries, in reality, of that 25% of international sales, 86% comes from China, 6% from India, and the remaining 8% from other countries.

It is important to note that most of these sales (80%-85%) come from a recurring replacement cycle. This means that few customers are first-time buyers of its products; rather, most of its sales come from clients replacing their existing water heaters and boilers because they broke or simply because they are old and inefficient.

In North America, they operate 20 manufacturing plants located across ten states and two non-U.S. countries, of which 17 are owned directly and three are leased from outside parties. Outside of this part of the world, they run another six manufacturing plants (four owned, two leased).

Investor Day

Outlook

AOS recently had its investor day where they outlined interesting points about the future of the company.

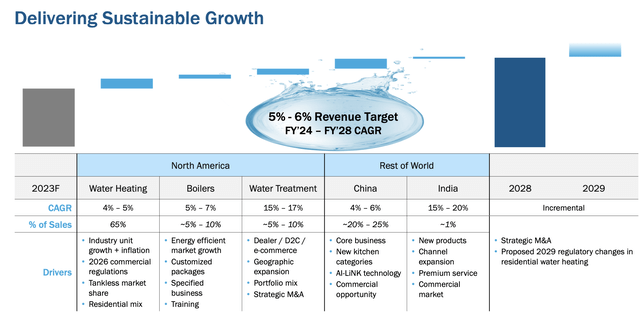

In terms of sales, they expect to compound revenue at 5%-6% per year through 2028. This includes growth through acquisition. They are quite bullish in the North America region, as they expect:

- Sales from the water heating segment to grow at 4%-5% per year (last 5 years CAGR was 8.7%) with constant operating margins.

- Revenue from Lochinvar-branded boilers to increase between 5%-7% per year (last 5 years CAGR was 4.7%) maintaining a similar profile margin.

- Sales from its water treatment business to grow 15%-17% per year (last 5 years CAGR was 13%) with an expansion of margins to the mid-teens.

And what about internationally? China has been a laggard this past few years (0.7% revenue CAGR last 5 years), but not anymore. They anticipate a 5-year revenue growth of 5%-6% per year with a substantial increase in operating margins from 11% to 15%.

However, its fastest-growing market will be India. The expected sales CAGR is between 15%-20% with a margin profile of 3%-5%.

The following graph provides a great summary:

Investor Day

More importantly, the company expects to generate strong cash flows in the coming years thanks to the margin expansion and free cash flow conversion rate.

The North America segment is expected to have an operating margin of 24% while the Rest of the world will sit at 10%. This means a consolidated margin of ~20%, 100bps higher than today.

EPS will grow between 7% and 9% per year, thanks to margin expansion and a 1%-2% share repurchase.

The free cash flow conversion will be >100% (last 5 years was 105%).

Overall, the company is on path to generate $600 million in free cash flow in 2028, as we will show you later.

AOS doesn’t have any significant debt (only $130 million vs. $341 million in cash and equivalents). However, they expect to take on debt to fund acquisitions and return capital to shareholders. Its target leverage is 1.5x-2x Net debt-to-Adj EBITDA ratio. In the context of high interest rates, we are a little skeptical of this idea, but if rates come down and they can take on debt at a reasonable rate, we see it as a good option, especially if the equity comes down.

Risks

AOS seems like a solid, low-risk business, growing above inflation and returning lots of capital to shareholders. But there are risks to take into consideration.

First and foremost is China. There has been the largest laggard for the company since 2018, at least when the trade war began, followed by the pandemic and the real estate crisis. We know the opportunity is big and the company has been doing business there for more than 25 years, but the Chinese economy is not growing as fast as before and the management’s ability to execute may fall short of its own expectations.

Secondly, I would mention the risk of poor capital allocation. Management has stated that some of the growth will come from acquisitions. How big will these acquisitions be? How will they fund them? Are they overpaying? There are a lot of integrants with this.

Lastly, a recession in the US. Although it seems like Powell doesn’t plan on it, it’s always worth mentioning.

Valuation

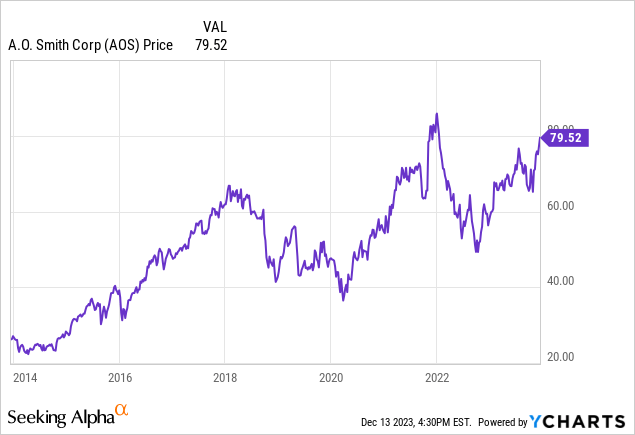

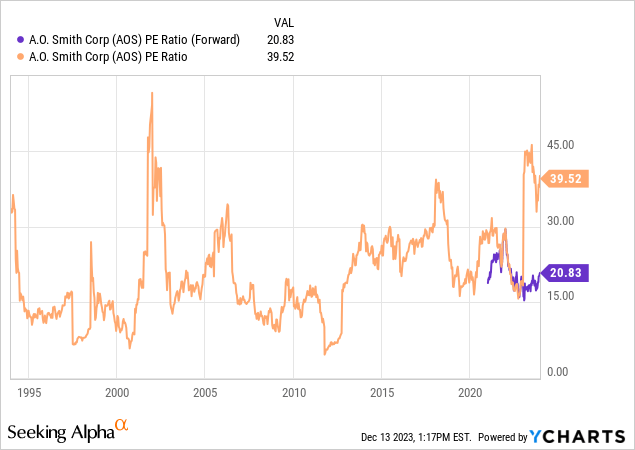

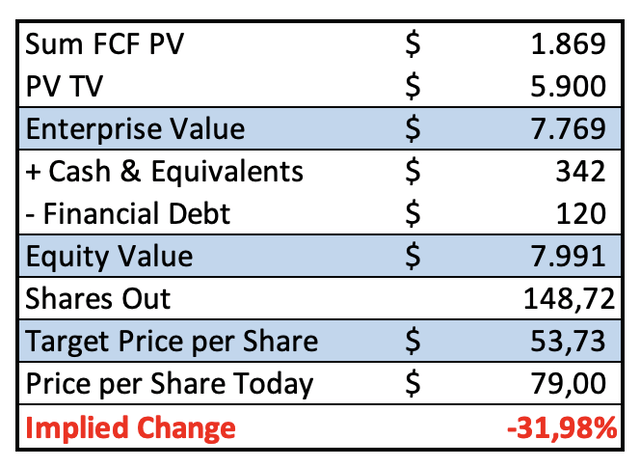

The stock is trading at ~$79 per share, which translates to a $11.6 billion market cap. That’s a 4.2% FCF yield or 21x P/E. If we look at the historical average of the P/E, we see that the stock is neither extremely overvalued nor undervalued.

Another way to look at it is that the FCF yield is the same as the 10-year treasury. So, the question is: why would you choose to own AOS over a treasury yield? It’s not clear to me yet given the slow growth of the company and interrogate about the future.

And what about the dividend? AOS pays a 1.6% dividend yield, or $1.28 per share. If we assume that they will grow its dividend 9% per year(last 5-year average) going forward and that the discount rate is 12%, the present value of all its future dividends is ~$46.5. This way it also seems overvalued.

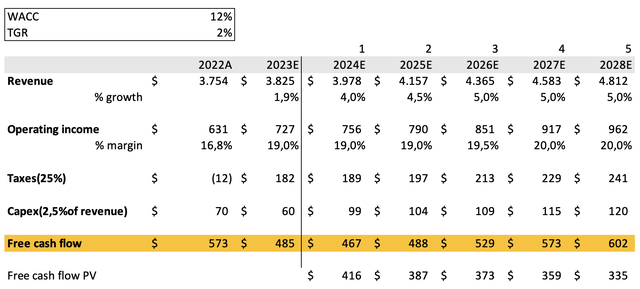

Now let’s model the financials for the coming years. As we mentioned, management expects revenue will grow at a 5%-6% rate per year, but we see this as a little ambitious. We are going to assume growth between 4%-5% for our base case. With respect to margins, we expect a small increase of 100bps through the years, starting at 19% and ending at 20%. The tax rate will be 25% and capex will be 2.5% of revenue. To discount the cash flows we will use a WACC of 12%.

Author

What does the DCF tell us? That the stock is, you guessed it, overvalued. The implied price per share of our model is $57.73, a 31.1% decrease from current prices.

Author

The recent price rally has made the equity look expensive, and even with the recent fall in interest rates, we think the current price point is not attractive enough to start a new position.

Takeaway

To sum up, AOS is a great business with a strong moat. But the valuation the market is assigning is too much for us. We think it would be best to wait.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.