Summary:

- Transocean Ltd. continues to renew several existing contracts and to sign some new ones at a higher dayrate. Transocean’s dayrate reached $391 thousand (+14% y/y) in 3Q 2023.

- The company is focused on the highest-specification fleet.

- The current oil price dynamics are impacting investor perception of Transocean stock and influencing its recent decline.

- In anticipation of an oil price increase in 2024 and rising financials, we expect increased investor interest to offset the current share price decline.

simonkr

Investment thesis

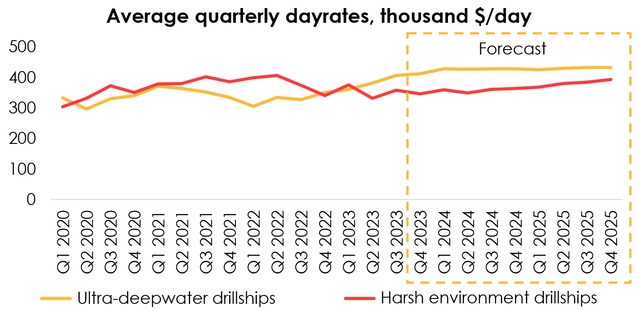

At the moment, average daily rates show good dynamics and continue to grow, which is due to the limited supply of high-tech offshore drilling rigs. Transocean Ltd. (NYSE:RIG) is riding a years-long growth cycle, as customers recognize the limited supply of high-tech offshore drilling rigs and hire drillships well before they commence their projects, booking them for several years at a time. The RIG rating is BUY.

We hadn’t previously published an analysis on this stock, but we’ve been covering it for a year and a half. Although the current oil price (CL1:COM) dynamics affect investors’ perception of the attractiveness of the company’s stock (which has also influenced the recent decline in RIG’s share price), we do not link the company’s earnings dynamics to the oil price dynamics in our forecasts. However, the expected rise in oil prices in 2024 should trigger an inflow of investor cash into the company’s shares and offset the current share price decline.

Transocean drillship utilization and dayrates

The company operates on a contract basis. A contract has two important components: the duration of the contract and the value of the contract. The duration of the contract can be a few months, a few years, or even a few decades. However, the contract price within the contract term is fixed and depends on the type of vessel, the location of the wells and the complexity of the work. In addition to the above factors, the dayrate for a particular contract will also depend on the supply/demand balance in specific drilling regions and the technical requirements of the rig equipment.

The company’s total fleet average rig utilization reached 49.4% (-5.3 pp q/q and -10 pp y/y) in 3Q 2023. The reduced ratio of utilized drillships is largely because some of the drillships were stacked or idled. According to the latest Fleet Status Report, from October, out of 28 ultra-deepwater ships and 9 harsh environment ships:

- 10 ultra-deepwater ships and 1 harsh environment ship were stacked, and, as the company stated in the previous quarter, they won’t be brought into operation for many years ahead, and in the event that one of them is unstacked, it would take three to five years and likely more than $1 bln to upgrade her to meet the fleet’s high specifications;

- 2 ultra-deepwater ships are now idled and there are no contracts or fixed-price options for them over the forecast period.

Rigs are still in high demand on the market, but no contracts have been concluded at the rate of $500,000/day, a level that was so much discussed following the company’s 2Q 2023 report. Transocean’s management believes customers are reluctant to be the first to push through that number. Even so, the average dayrate is performing well as it continues to rise: Average dayrate reached $391 thousand (+7% q/q and +14% y/y) in 3Q 2023, up from our forecast of $364 thousand. Given the limited supply of high-tech drillships, we are expecting the average dayrate to reach $378,000/day (+10% y/y) for 2023, and $406,000/day (+7% y/y) for 2024.

Transocean’s financial results

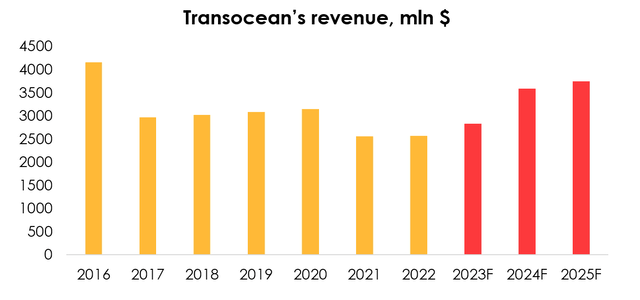

We forecast Transocean’s revenue based on the number of rigs under contract and the average daily rate, and we estimate that Transocean’s revenue will reach $2837 mln (+10% y/y) in 2023, and $3591 mln (+27% y/y) in 2024.

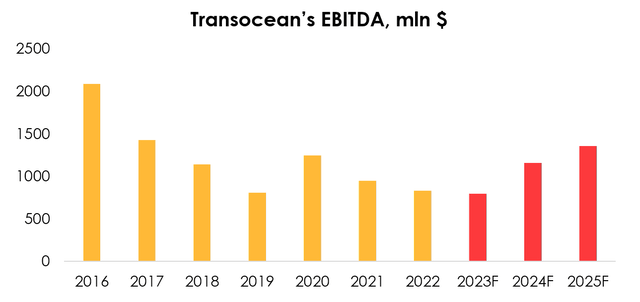

Operation and maintenance costs totaled $524 mln (+27% y/y) in 3Q 2023, which corresponds to a record high 73.5% of the company’s revenue and was driven by the idling of three ultra-deepwater ships and contract preparations for four other drillships. We do not expect high costs, as a % of revenue, to hold over the medium term, as any ship retrofitting requires high spending at the moment, which translates into a higher contract price. Given that Deepwater Aquila will be in the contract preparation phase until mid-2024 and that costs will be incurred for other rigs, we expect O&M costs to be 71% of revenue in Q4 2023 and 67% of revenue in 2024. As a result, we expect Transocean’s EBITDA to be $799 mln (-4% y/y) in 2023, and $1160 mln (+45% y/y) in 2024.

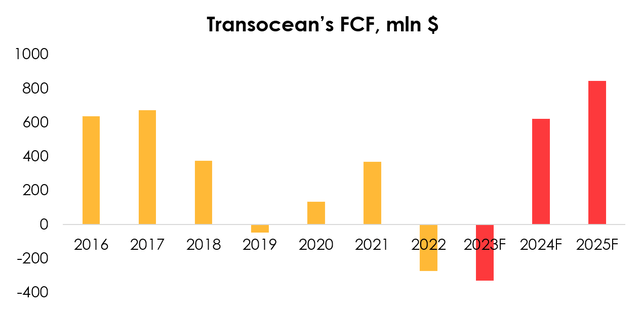

We estimate free cash flow (“FCF”) to be ($330) mln in 2023 and $622 mln in 2024. The negative FCF in 2023 is partly due to a significant increase in Q4 2023 capex guidance, from $50 mln to $270 mln, of which $210 mln will be used to prepare Deepwater Aquila for a 3-year contract in Brazil, which was acquired by Transocean in Q3 2023, reaffirming the company’s strategy to focus on the highest-specification fleet. Capital expenditures for 2024 are expected to be $195 mln.

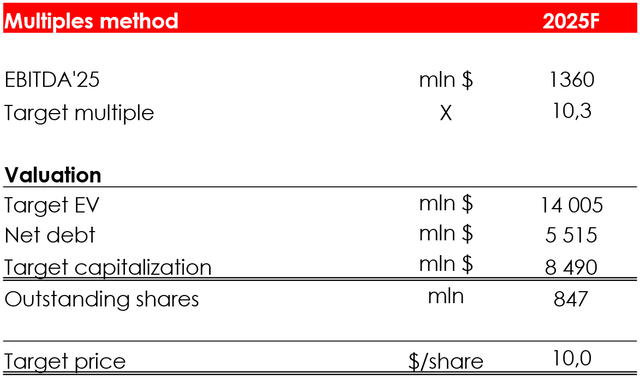

The reduced free cash flow forecast has prompted a revision of the trajectory of net debt repayment, causing the projected net debt to be $5.5 bln in Q4 2025.

Transocean will not have to repay any major debts until the end of 2025, which will allow the company to avoid refinancing for a long period of time. As of September 30, 2023, it had no overdue loans, had outstanding letters of credit worth $13 mln, and $587 mln of undrawn secured credit facility.

Valuation

The fair value for the stock is $8.6, based on our EV/EBITDA multiple approach. The price of $8.6 was achieved by computing a future price based on the multiples method and discounting it at the rate of 13% per annum.

Conclusion

Transocean is a risky investment bet because it is a small-cap company and has extremely high debt, which isn’t cheap to service. However, based on the good dayrate performance, the demand for high-tech vessels, and the expected increase in oil prices in 2024, we give Transocean Ltd. stock a BUY rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.