Summary:

- Disney has a significant library of high-quality IPs in its portfolio; this gives them a rather impressive moat.

- The company is still trying to recover from the devastating margin contraction that occurred as they joined the streaming wars.

- Their recent media products have had lackluster returns.

- Using the PEGY formula, I calculated an intrinsic value of around $61.13 per share.

- I presently rate DIS a Hold.

Wirestock/iStock via Getty Images

Thesis

The Walt Disney Company (NYSE:DIS) has been a staple of western culture for decades. Many of us grew up watching their beloved animated classics. While they still have a significant quantity of high-quality legacy products in their portfolio, if their products are unable to maintain their broad market appeal, the impressive moat they have built is destined to degrade.

Disney’s moat is entirely based on public sentiment. As Warren Buffett has cited on numerous occasions, with many companies their moat revolves around the nostalgia that comes with their product. This was true when he bought See’s Candy in 1972, and it’s still true with Disney today. The positive feelings that we associate with any given product are directly tied to how often we want to consume it.

As much as this article sounds bearish, after looking over their financials, and current valuation, I presently rate Disney as a Hold.

Company Background

The Walt Disney Company is a global entertainment company. They currently operate through three segments: Entertainment, Sports, and Experiences. They were founded in 1923 and are headquartered in Burbank, California.

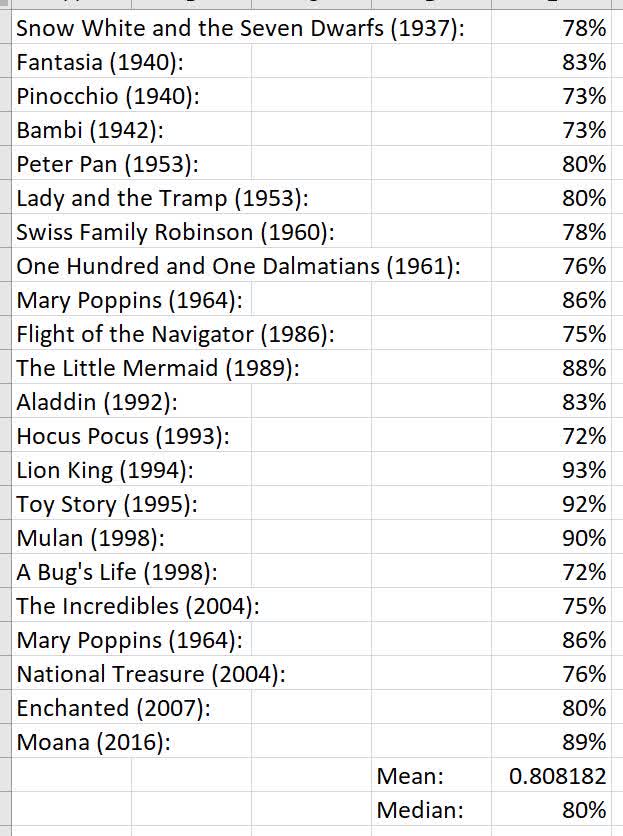

Disney made a name for itself with such classics as Snow White and the Seven Dwarfs in 1937, Fantasia and Pinocchio both in 1940, Bambi in 1942, and Cinderella in 1950. They spent the next several decades making movies with broad market appeal and the success of these movies allowed them enough breathing room to take the risk on opening Disneyland in 1955, and Disneyworld in 1971.

The core of their business always revolved around making movies people wanted to take their whole family to. This built up a public perception around their products that granted them a significant competitive moat.

Disney bought Marvel Entertainment in 2009, expanding their portfolio of media significantly. With the downfall of Blockbuster Video and the rise in popularity of Netflix, they decided to join the streaming wars and launched Disney+ in 2019. As I will go into later, somewhere along the way they stopped focusing on making movies that generate large amounts of buzz and were capable of drawing in significant crowds. Gone are the days of Disney mania with massive hits such as Aladdin (1992) and The Lion King (1994).

Long-Term Trends

The global motion picture market is projected to experience a CAGR of 8.5% until 2027. The global animated films market is expected to have a CAGR of 5.2% through 2030. The global children’s Animated show and drama market is projected to experience a CAGR of 5.09% through 2027. The global amusement parks market is projected to have a CAGR of 6.2% until 2030.

Evidence of Moat Erosion

Before you wonder why I am not starting this section by talking about the financial losses associated with their more recent movies, it’s because they need to be viewed in context.

I am going to review the audience scores of their movies as cited on Rotten Tomatoes. These audience scores often differ from the reviews given by critics because a majority of critics are not within the target audience of the film. This is how the critic reviews and the audience reviews for a movie can be significantly different. I also have to note that Rotten Tomatoes is owned by Discovery and NBC Universal, and has been accused on multiple occasions of censoring and deleting bad reviews, so even these numbers have to be taken with a grain of salt.

I should also be clear that this list is subject to selection bias. I chose these movies because they generated significant buzz when they were released and captured the hearts of millions of consumers.

First, let’s look at a few of their more famous movies:

DIS Classics Audience Reviews (Rotten Tomatoes)

I was a bit disappointed to find that Rotten Tomatoes does not have an entry for The Jungle Book (1967) or Robin Hood (1973).

Now, I fully understand that it’s not fair to compare their greatest hits to the content produced over a single year. If I was to select any given year from the past, it should contain a mix of movies with both high and low audience review scores. However, all of this is leading to a logical point.

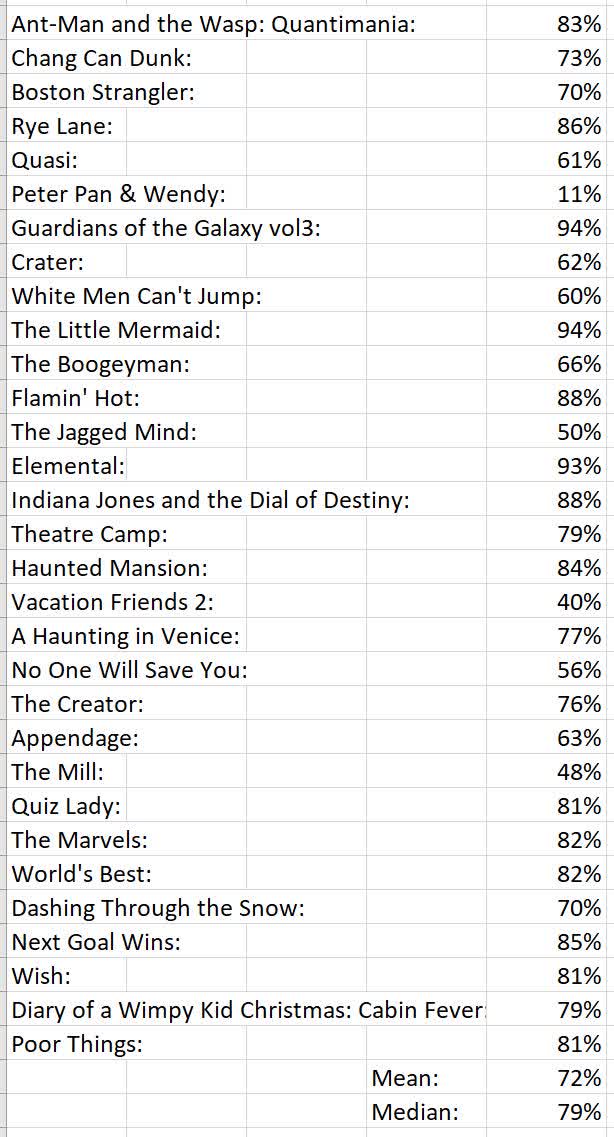

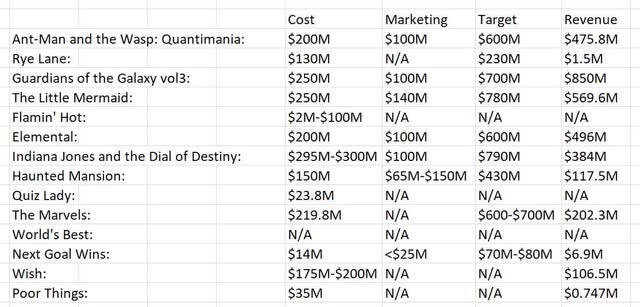

These are the productions and co-productions Disney released in 2023:

DIS 2023 Audience Reviews (Rotten Tomatoes)

As to be expected, not every movie they make is enjoyed by a majority of their intended audience. By looking at the above list, it’s clear that they are still making some movies which their target audience enjoys, yet for some reason they were not able to match the broad market reach of previous years.

The company has faced significant criticism for its lackluster box office performance. Excluding the pandemic, 2023 is the first year since 2014 that Disney didn’t have a movie which grossed above $1B.

With the classics list having a mean of 80.81%, let’s look the 2023 movies with an audience score above that. I pulled most of these values from Wikipedia, and a variety of websites that report on revenue, budgets, and marketing costs. I had trouble finding values for the marketing budget for several of them. Also, some of the above movies didn’t go to theaters and instead were limited to release on Disney+ or Hulu. I consider these to be rough estimates:

DIS 2023 High Audience Review Outcomes (Wikipedia, et al.)

With the theaters collecting half the revenue from ticket sales, the total revenue target for breaking even on a film is double the combined cost of production and marketing. Budgets and total revenue are typically easier to find than marketing budgets.

So when viewing this year’s audience scores and low ticket sales, the conclusion I am coming to is not that Disney is making low quality movies, it’s that the movies they are making do not have the same broad market appeal that the company is known for. When they decide to start a new project, their intended audience is too small.

I need to be clear that a portion of this is due to the slow demise of movie theatres. As many consumers are now watching media from home, it is to be expected that it is harder for them to break even on projects with larger budgets. Because of the very real problem of not being able to trust that corporate-owned media is handing me honest reviews, I intentionally avoid major publications and instead go to YouTube for crowdsourced reviews of movies. There is actually a rather large community of film critics on the platform who do nothing but review movies, and only some of them are paid to make puff pieces. Unfortunately for Disney, when I look for reviews on YouTube of their recent products, I typically find more that are negative than positive.

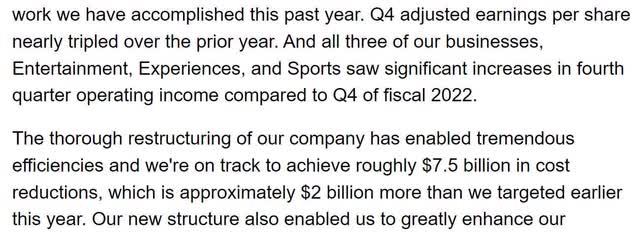

Guidance

I am only going to cover some highlights from their most recent earnings call transcript; I recommend investors read it in its entirety. Their Q4 adjusted EPS increased significantly when compared to the previous year. They have adjusted their cost reduction target by roughly $2B, and are now targeting $7.5B.

Guidance 1 (Q4 2023 Earnings Call Transcript)

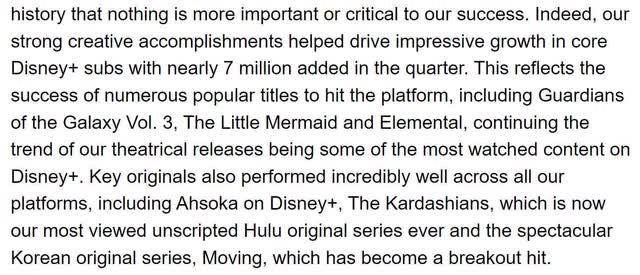

They added another 7M Disney+ subscribers this quarter and attribute this to the draw created by their more popular releases.

Guidance 2 (Q4 2023 Earnings Call Transcript)

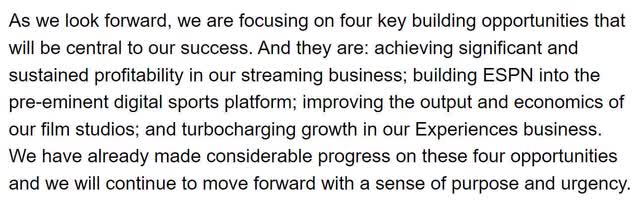

They are focusing on 4 key objectives. Achieving profitability with their streaming services, growing ESPN into a dominant platform, improving the profit vs. cost relationship of their film studios, and growing the revenue of their Experiences segment.

Guidance 3 (Q4 2023 Earnings Call Transcript)

Total Disney+ subscriptions have reached over 112M. The ad-supported version of the service is now up to 5.2M. With consumers still feeling significant pressure from our recent bout of inflation, I am not surprised to hear that more than 50% of this quarter’s new subscribers chose the ad-supported version.

Guidance 4 (Q4 2023 Earnings Call Transcript)

As a way of making their streaming service more attractive, they intend to purchase the remaining stake in Hulu and include it as part of a bundle.

Guidance 5 (Q4 2023 Earnings Call Transcript)

Their Sports segment continues to find solid viewership while growing revenue. They believe the addition of ESPN BET will add to the experience.

Guidance 6 (Q4 2023 Earnings Call Transcript)

This is the part I wanted to hear about the most. They are planning on reducing the number of films they produce while improving quality. Hopefully, this also leads to additional broad market appeal.

Guidance 7 (Q4 2023 Earnings Call Transcript)

In 2024, they plan on releasing several films which are tied to already established franchises.

Guidance 8 (Q4 2023 Earnings Cal Transcript)

Their domestic parks have been performing well, and are still producing attractive returns. This past September, they announced a plan on expanding their Experiences segment over the next decade.

Guidance 9 (Q4 2023 Earnings Call Transcript)

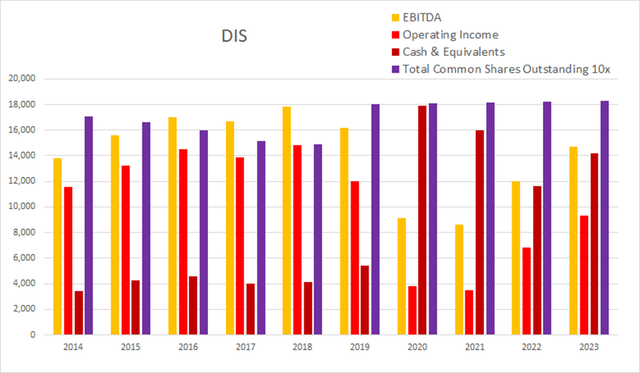

They project to be able to achieve roughly $8B in free cash flow for fiscal 2024.

Guidance 10 (Q4 2023 Earnings Call Transcript)

Annual Financials

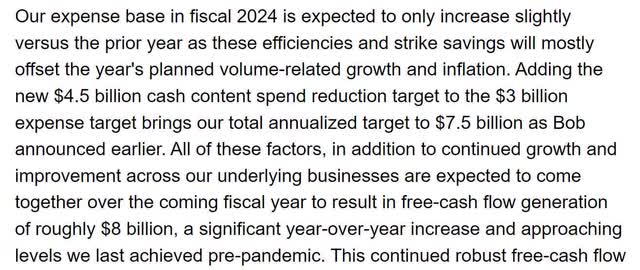

The company experienced a dip in revenue as a result of the pandemic, but has been growing fairly steadily otherwise. In 2014 they had an annual revenue of $48,813M. By 2023 that had grown to $88,898M. This represents a total increase of 82.12% at an average annual rate of 9.12%.

DIS Annual Revenue (By Author)

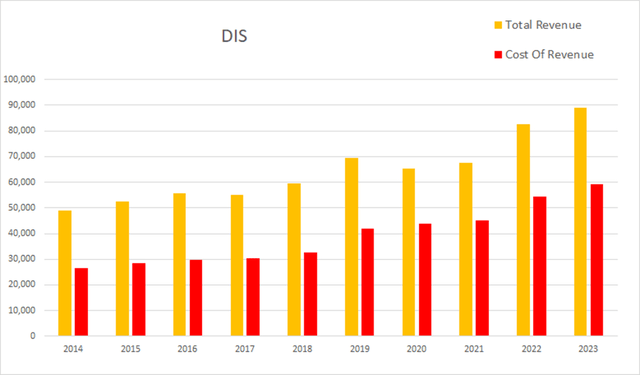

They had a significant margin contraction when they rolled out Disney+ in 2019. This trend continued into 2020. Gross margins have remained fairly stable since then, while EBITDA and operating margins have been increasing since 2021. As of the most recent annual report, gross margins were 33.41%, EBITDA margins were 16.54%, operating margins were 10.50%, and net margins were 2.65%.

DIS Annual Margins (By Author)

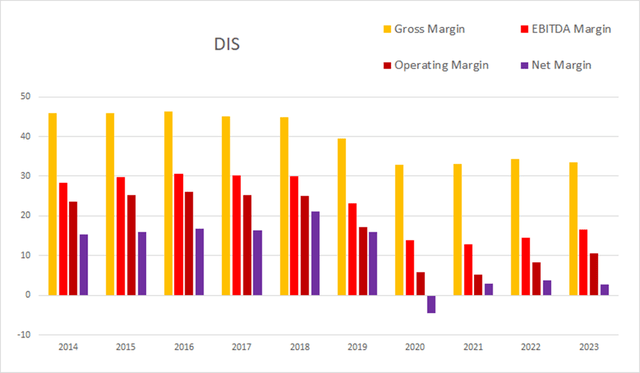

They experienced a significant amount of dilution in 2019, but the share count has been fairly stable since then. Total common shares outstanding was at 1,707M in 2014; by the end of 2023 that rose to 1,830M. This represents a 7.21% rise in share count, which comes out to an average annual rate of 0.80%. Over that same time period operating income fell from $11,540M to $9,332M, a -19.13% total decline, at an average rate of -2.13%. The total common shares outstanding are shown multiplied by 10 to allow for the trend to be more visible.

DIS Annual Share Count vs. Cash vs. Income (By Author)

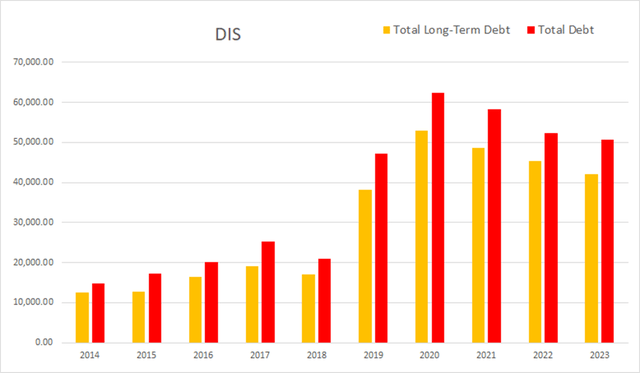

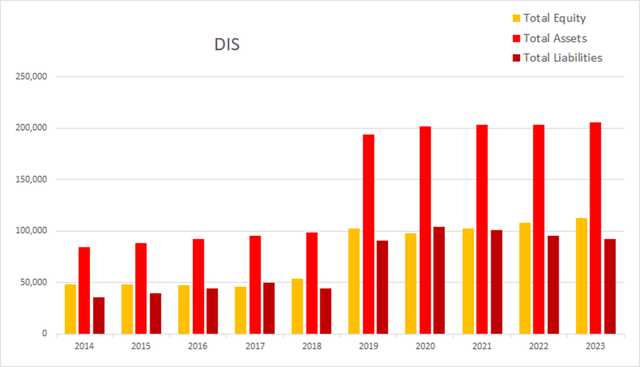

Their debt rose significantly from 2018 to 2020, but has been falling since then. As of the 2023 annual report, they had -$1,544M in net interest expense, total debt was $50,672M, and long-term debt was $42,101M.

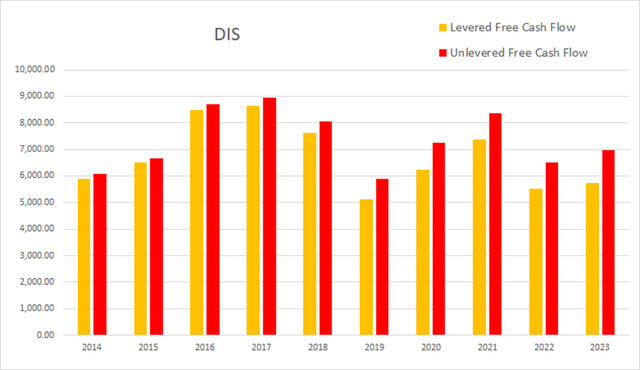

Even though they experienced a significant margin contraction, their cash flow has managed to stay above its low in 2019. As of this most recent annual report, cash and equivalents was $14,182M, operating income was $9,332M, EBITDA was $14,701M, net income was $2,354M, unlevered free cash flow was $6,957.5M, and levered free cash flow was $5,724.4M.

DIS Annual Cash Flow (By Author)

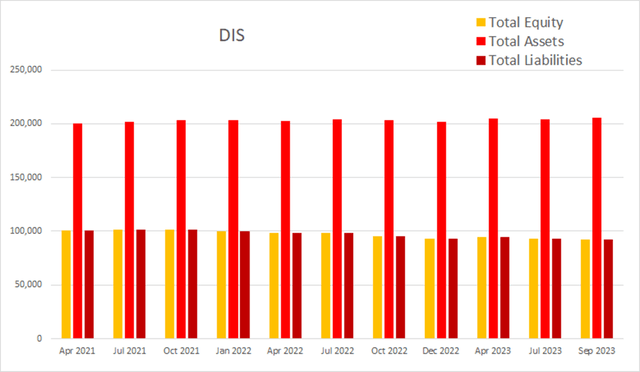

Their total equity experienced a significant rise in 2019, followed by a small dip in 2020, and has been slowly rising since then.

DIS Annual Total Equity (By Author)

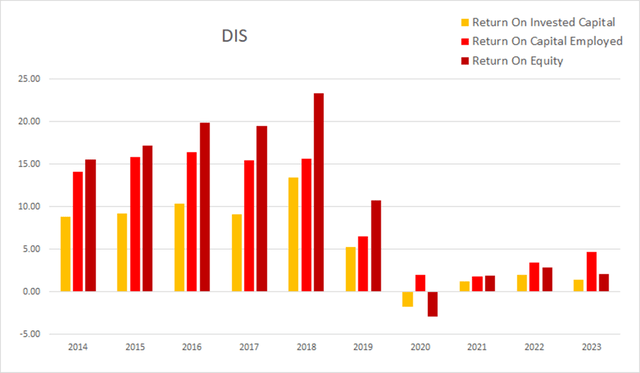

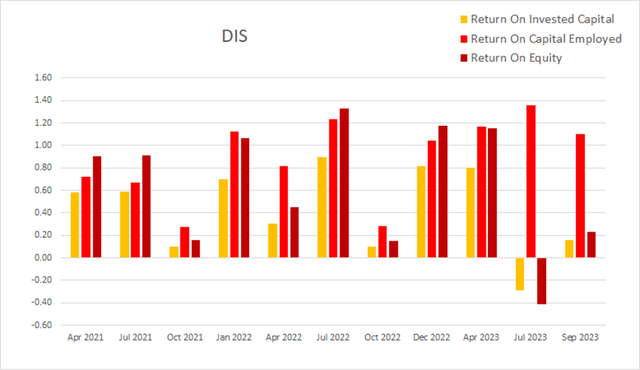

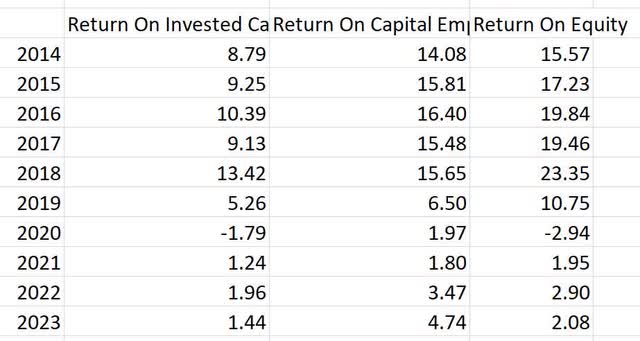

Their once attractive returns collapsed in 2019. ROIC and ROE both went negative in 2020, but have stayed positive since then. As of the most recent annual report ROIC was 1.44%, ROCE was 4.74%, and ROE was at 2.08%.

DIS Annual Returns (By Author)

Quarterly Financials

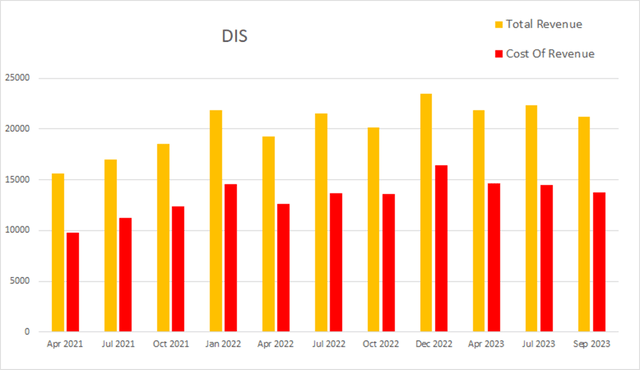

Their quarterly financials are showing a significant rise in revenue, but it has dropped since its high in December 2022. Eight quarters ago Disney had a quarterly revenue of $18,534M. Four quarters ago that had grown to $20,150M. By this most recent quarter that had grown further to $21,241M. This represents a total two-year increase of 14.61% at an average quarterly rate of 1.83%.

DIS Quarterly Revenue (By Author)

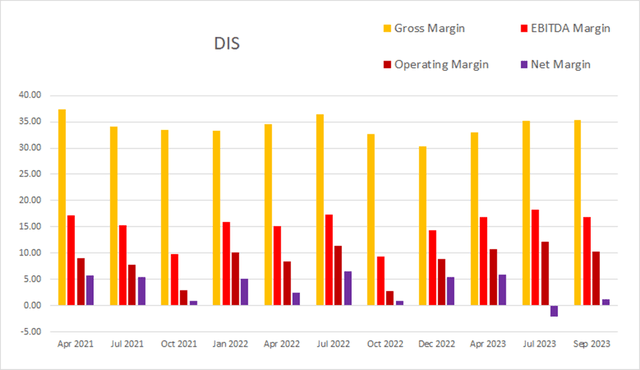

As of the most recent quarter gross margins were 35.37%, EBITDA margins were 16.83%, operating margins were 10.20%, and net margins were at 1.24%.

DIS Quarterly Margins (By Author)

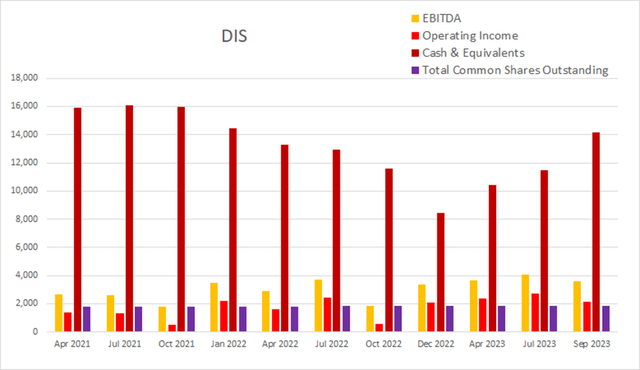

Cash & equivalents fell into a low in December 2022, but have risen significantly since then. When viewed on a quarterly basis, it is clear that their pace of dilution has been quite low. The sum of their last eight quarters of dilution comes to 0.66%; over the last four quarters this has held steady and came in as 0.33%.

DIS Quarterly Share Count vs. Cash vs. Income (By Author)

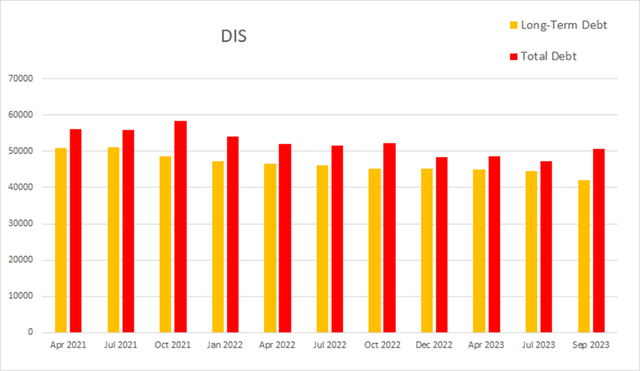

Their long-term debt continues to slowly fall. This most recent quarter, Disney had -$360M in net interest expense, total debt was at $50,672M, and long-term debt was at $42,101M.

DIS Quarterly Debt (By Author)

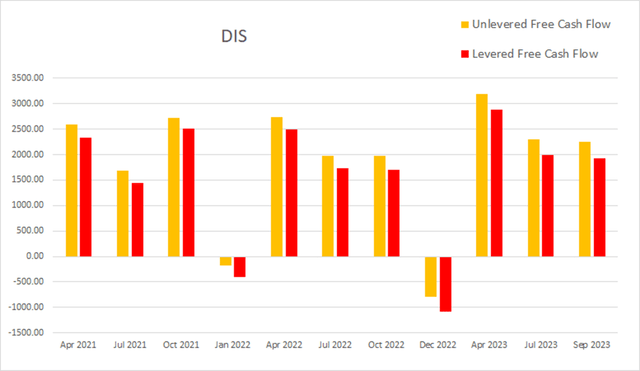

As of the most recent earnings report, cash and equivalents were $14,182M, quarterly operating income was $2,166M, EBITDA was $3,575M, net income was $264M, unlevered free cash flow was $2248.8M, and levered free cash flow was $1935.6M.

DIS Quarterly Cash Flow (By Author)

Total equity has been dropping at a very slow pace.

DIS Quarterly Total Equity (By Author)

Their returns show significant variance from quarter to quarter. As of the most recent earnings report ROIC was 0.16%, ROCE was 1.10%, and ROE was 0.23%.

DIS Quarterly Returns (By Author)

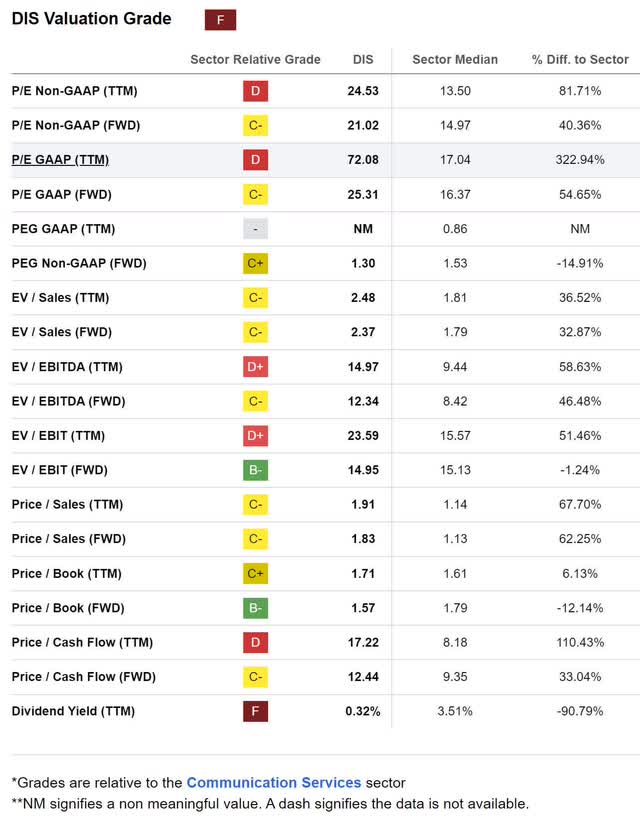

Valuation

As of December 11th, 2023, Disney had a market capitalization of $169.89B and traded for $92.20 per share. Using their forward P/E of 25.31x, their EPS Long-Term CAGR of 16.13%, and their forward Yield of 0.65%, I calculated a PEGY of 1.508x and an Inverted PEGY of 0.6630x. This implies an intrinsic value of $61.13 per share and indicates the company is presently overvalued.

Restarting Their Dividend

Instead of spending every available penny on improving their products or capturing additional revenue, they recently decided to begin offering a dividend again. With them currently earning $1.29 per share in 2023, and the announced dividend at $0.30 per share, they are planning on paying out roughly 23.3% of their earnings to shareholders. This money could be better spent on profit generating endeavors.

Spending that money buying back shares would be better. Once a company begins offering a dividend they are incentivized to not only keep offering it, but to keep raising it. The advantage of buying back shares at this phase in their margin recovery is that they can choose to do it when it’s convenient. This would give them a significant advantage in flexibility when attempting to improve long-term shareholder value.

I am reminded of the many railroads which were notorious for paying unsustainable dividends 100-150 years ago and then later fell into permanent decline. When they did it, it was a desperate attempt to draw in new investors and prop up their share price. While I don’t believe Disney is in that dire of a situation, paying a dividend before they improve returns is definitely not a confidence builder.

Risks

As I mentioned earlier, Disney has a significant library of high quality IPs in its portfolio. This gives them a rather impressive moat, but if their future projects do not maintain that high quality while generating broad market appeal, this moat may slowly erode over time. I believe it is extremely wise of them to pivot to fewer, higher quality movies. However, this also produces a ‘too many eggs in too few baskets’ risk. If one or more of their planned big-budget movies next year does not meet expectations, they could fall short of their projected financial estimates.

They rely on a combination of buzz and broad market appeal to drive additional Disney+ subscriber count. If future media projects fail to meet expectations, then subscriber count growth may suffer.

The expansion of their Experiences segment comes with significant capital expenditures and may not produce the improvement in revenue that they expect.

They always have the potential to damage an already existing franchise. I remember what a disaster the Star Wars sequel trilogy was. The Force Awakens (2015), The last Jedi (2017), and The Rise of Skywalker (2019) were heavily criticized for breaking established cannon, containing logical fallacies, and having discontinuities throughout the three movies. It was incredibly clear to me that the trilogy should have been written as a single coherent long arc instead of haphazardly written and produced independently of each other. A degradation is currently playing out with their super hero franchise. Audiences were less than enthusiastic to see The Marvels in theaters. It had only netted $47M by mid-November (domestically) and $110M globally. The movie suffered an 80% drop in ticket sales its second weekend. Because The Marvels had an 82% audience score, this backs up my stance that either Disney is paying Rotten Tomatoes to censor and delete negative reviews, or the company is producing media without enough broad market appeal. With the dramatic drop in ticket sales its second week, the culprit could be either, or a combination of both.

Catalysts

The company has a history of producing successful franchises from timeless stories such as Cinderella, Snow White, and Aladdin. They always have the potential to dig into history or cultural lore and find entirely new franchises.

As they continue to expand their Disney+ content, it may become more appealing. They may be able to continue finding additional recurring revenue from their streaming service.

What Would It Take For Me To Buy?

As Disney has an impressive moat, and is still growing revenue through Disney+, I do consider them a potential long-term investment. When looking at already mature companies, I try to limit my choices to ones which produce attractive returns. However their margins and returns are currently far too low for me to consider investing into them. As of the most recent annual report ROIC was 1.44%, ROCE was 4.74%, and ROE was at 2.08%. Their earnings call transcript indicated they believe they will be able to achieve their pre-pandemic margins in 2024, so that indicates that I should look at their 2019 returns. In 2019, their ROIC was 5.26%, ROCE was 6.5%, and ROE was at 10.75%. This is simply not good enough, for me to consider their returns attractive, I would need to see them recover to their pre-2019 levels.

DIS Annual Returns Spreadsheet (By Author)

Also, the company is presently overvalued. It would take a significant decline in share price for me to consider buying into their present business model. While it’s true that they project for 2024 to be better, I try to avoid buying companies when too much future growth is already priced in. Also, I do not have conviction that their financials will improve quickly. An investment into Disney now would mean potentially having to wait for years before their intrinsic value rises above today’s share price.

As far as movies go, I would need to see them abandon their current model and switch to something less interconnected. One of the problems with watching an MCU movie is that the plotlines are tied together. While this worked great for the lead up to Avengers: Endgame, audiences who aren’t fully invested as consumers and don’t want to watch the various television series and other movies, are left out. Why go see an MCU movie if you aren’t up to speed with the multi-movie plot arc and are unfamiliar with half the characters? Instead of building hype, the current model is driving apathy.

Conclusions

Disney is a legacy media company with an extensive moat. However, the adoption of their streaming service crushed margins to the point where they are no longer producing attractive returns. Although this may be temporary, they are no longer the long-term compounder they once were. I believe it may be several years before the high margin income from their streaming service begins to match their total pre-Disney+ margins. If they do not increase the broad market appeal of their media products, their legacy moat may slowly erode.

While I don’t have confidence that their share price is destined to fall, I also have no interest in investing into companies which appear to be losing their competitive advantage. Once their margins expand and they begin producing attractive returns, I may consider an investment in Disney. Until then, I am happy to continue buying other things while I wait.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.