Summary:

- Roku has seen a strong year-end rally in stocks, driven by hopes for rate cuts and its strong Q3 earnings.

- The company has executed a layoff, improved margins, and shown strong revenue growth, active accounts growth, and streaming hours growth.

- It cracked into positive adjusted EBITDA territory in its most recent quarter and continues to expect profitability going forward.

hapabapa

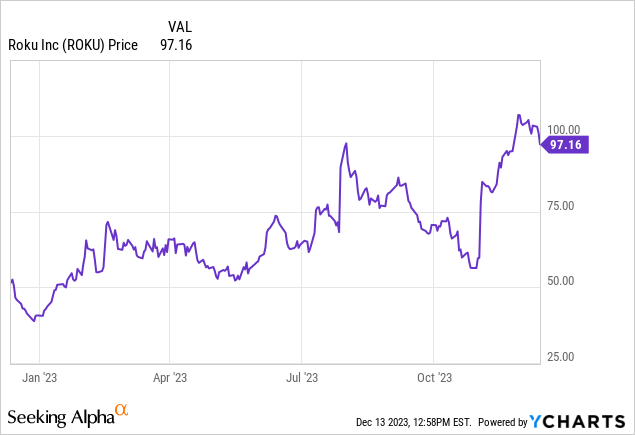

With rapidly cooling inflation all but signaling an end to the interest rate-hike era, investors have moved on to hoping for rate cuts next year, which has spurred a furious year-end rally in stocks – including and especially tech names that are so sensitive to rate movements.

Roku, Inc. (NASDAQ:ROKU), the smart TV maker and streaming platform, has been one of the largest beneficiaries of this year-end push. Coupled with a very strong Q3 earnings print released in early November, Roku has pushed its YTD rally to well above 100%:

Even with rapid stock price appreciation, plenty of drivers still support the bull case for Roku

I last wrote a bullish opinion on Roku in mid-September, when the stock was trading closer to $70 per share. Since then, the stock has seen more than 30% appreciation: but at the same time, it has also A) executed a tough layoff that will improve margins going forward, and B) released very strong results that showed acceleration in revenue, active accounts growth, and streaming hours. In light of all this, I am retaining my bullish position on Roku – and I think there is still substantial upside for this name heading into 2024.

It’s worth noting as well that Roku is executing despite a continued tough macro environment for advertisers. In its Q3 shareholder letter, the company noted that advertising dollars on linear TV in the third calendar quarter of the year were down -12% y/y – yet in spite of this, Roku grew ad dollars in the third quarter, showcasing both secular tailwinds toward streaming ads as well as Roku’s own execution ability to take market share in a difficult environment.

Here is my updated, full long-term bull case for Roku:

-

Roku has done an excellent job shifting its business to primarily a services/platform model. At one time, Roku’s revenue split between its low-margin hardware players and its platform revenue was closer to 50/50; now, hardware is less than 20% of Roku’s overall revenue. This has lifted Roku’s overall gross margins and paved the way for profitability.

-

Roku Channel continues to grow and expand its slate of programming. The company’s platform is now one of the leading streaming offerings in the U.S. This channel is also now producing original content, including a new documentary in partnership with the NFL that became one of the most popular shows on Roku.

-

Advertising spend continues to shift toward streaming, as cord-cutting continues. Advertisers have been slower to move off of “linear” TV and onto streaming than consumers have. Roku notes that while 45% of U.S. adults’ entertainment is provided by streaming services, U.S. companies only spend 18% of their ad budgets on streaming. Roku’s ability to grow in 2023 amid tougher trends for advertising as a whole demonstrates that it’s going to continue benefiting from secular shifts away from traditional TV and into streaming.

-

Active accounts and streaming hours continue to grow. Though growth rates have certainly slowed from the immediate boost that the pandemic delivered, Roku is still delivering constant growth in both active accounts and streaming hours, boosting its monetization capabilities.

-

International push. Roku has recently set its sights on expanding aggressively overseas, with recent overtures in the UK, Canada, and Mexico – representing the next leg of growth for the company.

Stay long here – there’s plenty of upside left to go on this stock as we head into next year.

Q3 download

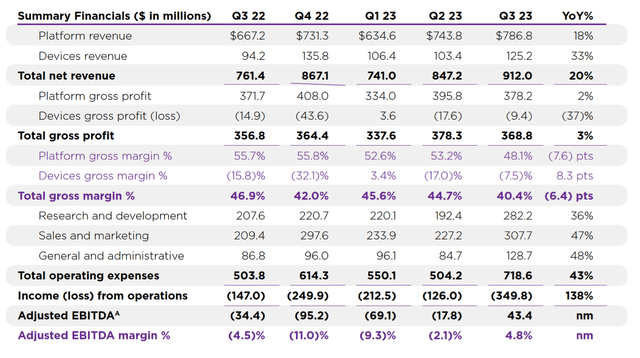

Let’s now go through Roku’s latest quarterly results in greater detail. The Q3 earning summary is shown below:

Roku Q3 results (Roku Q3 shareholder letter)

Roku’s total revenue grew 20% y/y to $912.0 million in the quarter, beating Wall Street’s expectations of $855.7 million (+15% y/y) by a massive five-point margin. Importantly, revenue growth also accelerated sharply versus 11% y/y growth in Q2. This was driven by an acceleration in both hardware/device sales (+33% y/y in Q3, versus 9% y/y growth in Q2; which was spurred by the successful performance of Roku-branded TVs which launched earlier this Spring) as well as platform revenue, up 18% y/y versus 11% y/y in Q2.

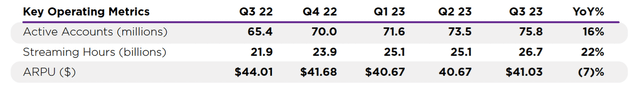

As shown in the chart below, the company added 2.3 million net-new active accounts in the quarter, up 16% y/y and better than 1.9 million net adds in Q2.

Roku core platform metrics (Roku Q3 shareholder letter)

Streaming hours, meanwhile, grew 22% y/y – one point better than 21% y/y in Q2. Content optimization and features continue to be a key driver here. The company made improvements to its Home Screen to drive better content discovery; and in turn, it reported that content launched directly from the Home Screen saw a 90% y/y increase in viewership. The company also added the ability to track favorite sports teams within Live TV’s Sports Experience, and it also deepened content partnerships with the NFL ahead of football season.

Here’s further anecdotal commentary from CEO Anthony Wood’s remarks on the Q3 earnings call:

We drove strong engagement with streaming hours surpassing 100 billion for the first time on a trailing 12-month basis. And The Roku Channel remains the top 10 streaming app with engagement comparable to Paramount Plus, Peacock, and Max, according to Nielsen […]

We continued to tap into new ad demand sources and are now integrated with more than 30 programmatic partners. Spend on the Roku platform through automated third-party demand sources in Q3 grew meaningfully year-over-year. And we expanded our partnerships with marquee brands this quarter. With Spotify, we introduced video ads in the Spotify app on Roku devices, and with the NFL, we launched the first league-branded zone in the Roku Sports Experience.”

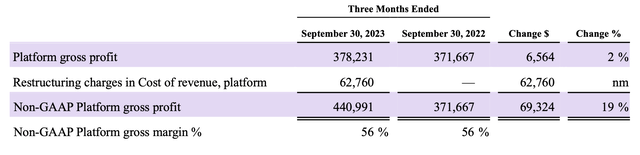

The only catch in the quarter from an as-reported basis was a 640bps y/y reduction in total company gross margins – however, this was largely due to a one-time restructuring cost related to the removal of content from the Roku Channel. As shown in the chart below, adjusting for this cost, the company would have seen consistent platform gross margins at 56%:

Roku adjusted gross margins (Roku Q3 shareholder letter)

Additionally, we like that while hardware continues to be a loss-leader for Roku, gross margins are trending in the right direction with an 830bps y/y increase to -7.5%. The company also generated $43 million in adjusted EBITDA this quarter at a 5% margin, benefiting from headcount reductions and reversing a multi-quarter trend of losses (and it’s pointing to adjusted EBITDA profit of at least $10 million in Q4, as well).

Key takeaways

With acceleration in platform revenue and strong active account growth, and with continued content development for the Roku Platform that continues to help the company take share from both traditional TV and other streamers, there’s a lot to like about Roku heading into 2024. Stay long here and keep holding on for more upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.