Summary:

- LUV is at a pivotal moment in the airline industry, with the fourth quarter potentially reinforcing its position in a recovering market.

- The airline industry is experiencing a surge in bookings, particularly in corporate travel, indicating a strong demand for holiday travel.

- Delta Air Lines’ recent performance and projections suggest a similar growth trajectory for Southwest, but Southwest’s historical revenue growth rates have fallen short compared to competitors.

Ljupco/iStock via Getty Images

Introduction

As the Christmas season unfolds, the airline industry, with Southwest Airlines (NYSE:LUV) at the forefront, is standing at a pivotal crossroads, facing a pressing question: Will the fourth quarter usher in a Christmas miracle, marked by a surge in travel and prosperity, or will it bring unforeseen challenges, metaphorically finding coal in the ol’ holiday stocking?

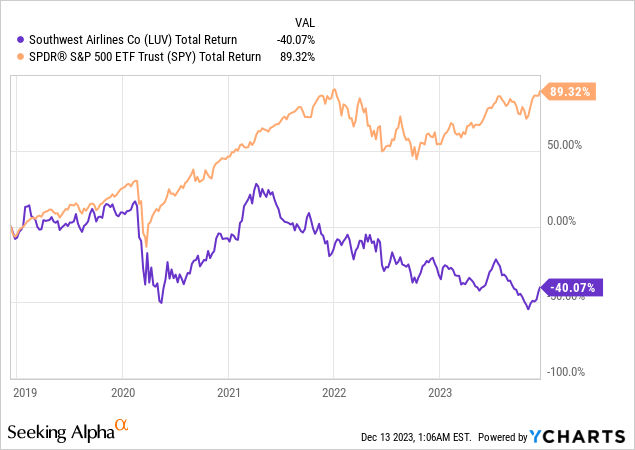

In this crucial period, after a long period of underperformance, Southwest is particularly in the spotlight, buoyed by a significant uptick in sector-wide bookings and an air of cautious optimism.

This coming quarter could be a defining moment for the airline, potentially reinforcing its position in a steadily recovering market. However, it also poses the risk of exposing vulnerabilities amidst evolving travel trends and economic uncertainties.

The outcome of this quarter will not only be telling for Southwest’s individual trajectories but may also serve as a barometer for the airline industry’s resilience and adaptability in these festive yet unpredictable times.

Airline Industry’s Strengthening Booking Trends

Shifting our focus to the broader market trends, let’s examine how Southwest Airlines is positioned to capitalize on the current upswing in the airline industry. This context is crucial in understanding the potential impact of sector-wide developments on Southwest’s performance in the upcoming quarter.

In an industry often characterized by commoditization, airlines stand to gain from the significant surge in bookings observed across the sector. This trend, consistently on the rise for the third week in a row, has been highlighted by an impressive 10.7% increase in system net sales for the week ending December 3, according to a report by Bank of America.

This performance, the strongest since mid-August, coupled with improvements in both pricing and volume, indicates a strong demand for holiday travel. Particularly significant is the acceleration in corporate travel, with a year-over-year increase of 6.9%, the highest since late April, a remarkable trend given the traditionally slower travel period between Thanksgiving and Christmas.

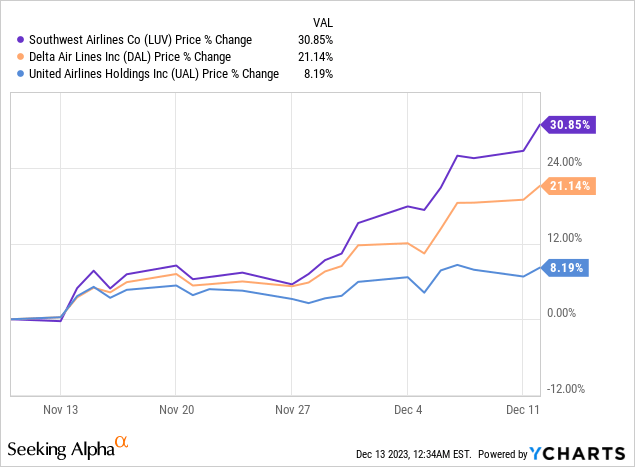

As a result, following the initial news of positive holiday travel trends, the share prices of many airline stocks have soared over the past month.

Delta’s Performance: A Benchmark for Southwest

Further supporting the growth story, I believe that Delta Air Lines’ (DAL) recent reaffirmation of its 2023 profit and revenue forecasts at the Morgan Stanley Global Consumer & Retail Conference presents an optimistic signal for the industry at large, including Southwest.

Delta is poised for a powerful Q4 performance, with management projected revenue growth of 9-12% year-over-year. This is accompanied by an anticipated increase in operating margins, estimated to be between 9-11% and an EPS range of $1.05 to $1.30. Looking at the full fiscal year, Delta expects to achieve up to 20% in revenue growth, maintain an operating margin of around 11.5%, and realize an EPS of $6.00 to $6.25.

Talk about a strong year!

Given the similarity of their businesses, I believe these figures are indicative not only of Delta’s robust recovery but also suggest a similar growth trajectory is likely to occur at Southwest. In terms of its financial outlook, as reported by Seeking Alpha, the consensus among investors points to Q4 earnings of $0.15 per share, a significant improvement from the negative $0.38 reported in the same quarter last year.

This forecast implies an annual EPS increase of 22% to $1.42, supported by a 9% year-over-year growth in revenue, aligning closely with Delta’s projected performance. These projections for Southwest, much like those for Delta, reflect a strong recovery trend in the airline industry.

Revenue Growth Rates vs. Peers

| Metric | LUV | (UAL) | (RYAAY) | (OTCQX:DLAKY) | (OTCPK:ICAGY) | DAL |

|---|---|---|---|---|---|---|

| Revenue Growth (YoY) | 12.11% | 28.82% | 37.49% | 30.07% | 41.56% | 22.83% |

| Revenue Growth (FWD) | 20.77% | 31.96% | 46.83% | 28.48% | 50.82% | 25.05% |

| Revenue 3 Year (CAGR) | 25.84% | 31.98% | 43.81% | 22.76% | 31.03% | 32.60% |

| Revenue 5 Year (CAGR) | 3.40% | 5.45% | 10.98% | 0.64% | 3.77% | 5.45% |

Source: Seeking Alpha

Despite the strong setup looking ahead to Q4 historically, Southwest Airlines’ growth in revenue, while steady, doesn’t quite match up to the strides made by some of its competitors.

Looking at the year-over-year increase, Southwest’s growth rate of 12.11% falls short when compared to the likes of Ryanair’s 37.49% and International Airlines Group’s 41.56%. Not only that, this pattern is evident in their projected revenue growth too, with Southwest’s 20.77% being outperformed by Ryanair at 46.83% and International Airlines Group at 50.82%.

Over a span of three years, Southwest maintains a respectable growth rate of 25.84%, yet it still trails behind peers like Ryanair, International Airlines Group, and Delta. The five-year growth scenario paints a similar picture, where Southwest’s 3.40% growth is among the lowest, signaling a more subdued long-term growth rate compared to counterparts like Ryanair and Delta.

However, it’s important to consider the context of these growth figures. The US market, where Southwest primarily operates, reopened post-COVID significantly faster than Europe. This earlier reopening in the US means that year-over-year growth comparisons may not be as dramatic as in Europe, where airlines like Ryanair and International Airlines Group are based.

This lag in reopening in Europe likely contributed to a steeper growth trajectory as restrictions eased later than in the US. Therefore, while comparing growth rates, the differing timelines of market recoveries post-COVID-19 in these regions should be considered.

Record Year-End Holiday Air Travel

Adding to the optimism in the travel sector, AAA has projected a holiday season like no other. They expect an incredible 7.5 million people to take to the skies, breaking past the pre-pandemic highs set in 2019.

And it’s not just the skies that will be busy; around 115.2 million folks are gearing up to journey at least 50 miles from home during the festive window of December 23 to January 1, 2024. This marks a 2% bump up from last year and ranks as the second most bustling year-end travel period we’ve seen since the dawn of the millennium.

This surge in travel activity, predominantly driven by the millennial demographic, underscores a growing preference for investing in experiences and sharing moments with loved ones despite economic uncertainties like a slowing job market.

This trend, reflecting a shift in consumer priorities, suggests significant growth potential within the travel and airline sectors, including for carriers like Southwest for many years to come.

Southwest vs. Delta Strategic Position and Potential

While Delta Air Lines’ strategies were highlighted at the Morgan Stanley Conference, similar strategic moves could benefit Southwest Airlines. Delta’s transformation into a leading consumer brand, its successful partnership with American Express (AXP), and its enhanced Skymiles loyalty program set a high bar in the industry.

Such initiatives, focused on de-commoditizing the brand and moving into the premium sector, are crucial for airlines like Southwest to consider to establish strong consumer loyalty and capture a larger market share.

For its part, Southwest is making moves here, too, with its partnership with Chase (JPM) on credit cards, and recent changes to its reservation systems, which allow customers to pay more for services like automated check-in, allowing access to earlier boarding groups.

Valuation

| Metric | LUV | UAL | RYAAY | DLAKY | ICAGY | DAL |

|---|---|---|---|---|---|---|

| P/E GAAP (FWD) | 25.96 | 5.06 | 13.93 | 5.48 | 4.04 | 7.91 |

| EV/Sales (FWD) | 0.58 | 0.61 | 1.49 | 0.42 | 0.57 | 0.84 |

| EV/EBITDA (FWD) | 6.63 | 4.17 | 6.12 | 3.12 | 3.02 | 5.50 |

Source: Seeking Alpha

In examining Southwest Airlines through the lens of key financial metrics, we observe a nuanced picture of its market valuation. Southwest’s forward PE ratio stands at a notably higher 25.96, compared to its peers. However, its forward EV/Sales ratio of 0.58 indicates a moderate valuation in terms of sales, lower than some competitors like Ryanair, and aligning closely with International Airlines Group.

The forward EV/EBITDA ratio of 6.63 places Southwest in a mid-range position, higher than Deutsche Lufthansa and International Consolidate Airlines, but lower than Ryanair and Delta Air Lines, implying a balanced valuation in terms of profitability and cash flow, at least based on this metric.

The result is a bit of mixed bad where Southwest is relatively cheap when looking at EV/Sales but expensive when looking at earnings or EBITDA as opposed to revenues.

Catalysts

Labor Challenges: A Significant Downside Risk

One of the most significant risks facing Southwest and Delta is the challenging labor market dynamic in the US, whereby blue workers are in shortage, and companies are being forced to pay up to compete for that labor.

Overpaying for labor could significantly impact the company’s operations and financial performance. This problem is only further compounded by the complexities of negotiating with unionized workforces, including flight attendants and pilots.

Recent developments have highlighted these challenges. For instance, Southwest Airlines’ flight attendants have voted down a contract offer with a substantial 20% pay raise from January, with additional annual raises through 2028.

Despite its competitive nature, the rejection of this offer underscores the complex dynamics at play. Issues such as work-rest balance, control over personal schedules, access to food, and safe accommodations while traveling remain sticking points in negotiations.

These issues reflect broader industry trends that could pose significant risks to Southwest’s operational stability and cost management.

Industry Consolidation: An Upside Potential

Conversely, a potential upside for Southwest lies in the ongoing consolidation within the airline sector. The recent announcement of Alaska Air Group’s (ALK) acquisition of Hawaiian Holdings (HA) for $1.9 billion is a case in point. This combined company would gain significant scale on the West Coast alongside far-flung regions of the country.

For Southwest, similar strategic moves could offer opportunities for growth and competitive advantage. Consolidation can lead to a more significant market share, improved economies of scale, and enhanced loyalty programs.

The industry’s move towards consolidation may accelerate once there is a new head at the Federal Trade Commission, potentially opening up more opportunities for mergers and acquisitions. As such, the 2024 election cycle may have large implications for major M&A deals in the years ahead.

Further consolidation could enable Southwest to expand its network, enhance its service offerings, and strengthen its position in the market. However, it’s important to note that while mergers like Alaska Air Group’s acquisition of Hawaiian Holdings promise benefits, they also come with challenges related to integration, regulatory approval, and execution.

Conclusion

In summary, while Southwest Airlines has shown resilience and a capacity for recovery, its current market position suggests caution for investors. Despite positive trends in the industry and an expected upswing in holiday travel, Southwest’s slower growth rates relative to its competitors, coupled with a higher valuation, paint a mixed picture.

This context, combined with potential labor challenges and the broader industry’s shift towards consolidation, indicates that significant gains may already be reflected in Southwest’s stock price.

Comparatively, Delta Air Lines emerges as a more balanced investment choice, offering a more attractive growth trajectory at a relatively better value.

I rate Southwest a Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.