Summary:

- Comcast stock fell into a bear market before bottoming out in October, demonstrating its resilience as a top communications market leader.

- The company’s well-diversified business model and strong profitability are supported by its market leadership in broadband.

- Concerns over near-term broadband weakness are likely overstated as Comcast continues to drive quality growth and capitalize on its broadband leadership.

- I argue why CMCSA remains well-supported in an uptrend, with buyers returning in October to form its bottom. It’s still timely to deploy your cash before it potentially recovers further.

Justin Sullivan

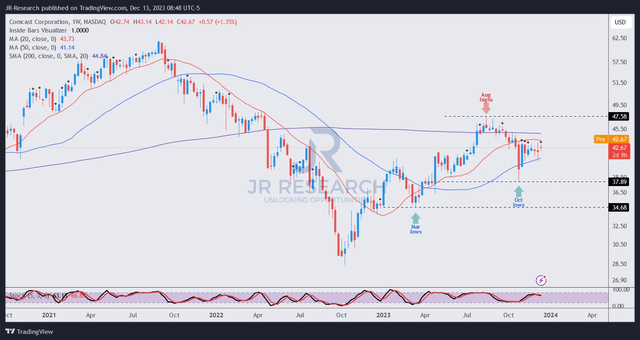

Comcast Corporation (NASDAQ:CMCSA) investors were likely stunned by the recent volatility that saw CMCSA underperform the S&P 500 (SPX) (SPY) since my previous update in September 2023. However, I also reminded investors to be wary about profit taking leading to downside volatility, as I assessed selling pressure at the $47.5 level. CMCSA did top out at that level before falling into a bear market (down about 20%) and finding a bottom at the $38 level in late October 2023. I highlighted that the “downside volatility could take CMCSA down further to the low $40s zone before more robust dip-buying support could be ascertained.”

As a result, I wasn’t surprised by the recent aggressive dip-buying seen at CMCSA’s October low. CMCSA recovered to close at the $42 level last week as it continues consolidating. With that in mind, I believe it’s timely for me to help investors assess whether CMCSA’s October bottom is robust enough for them to add more exposure.

The company reported its third quarter or FQ3 earnings release in late October. Investors should be able to recall that CMCSA experienced significant volatility post-earnings as the market reacted to weak broadband subscriber metrics. Comcast boasts of a well-diversified business model, underpinned by six business segments that account “for over 50% of their revenues.” As a result, it has helped the company to drive a “high single-digit revenue growth over the past 12 months.”

Despite that, Comcast’s wide-moat business model and robust profitability are predicated on the strength of its market leadership in broadband. Its connectivity platform remains the key driver of its profitability. Accordingly, its residential platform posted an adjusted EBITDA margin of nearly 39% in Q3, accounting for almost 70% of Comcast’s overall adjusted EBITDA base. Hence, adverse developments in its broadband business should be expected to impact near-term investor sentiments harder, notwithstanding the positive momentum experienced in its wireless growth. In addition, its theme parks business delivered nearly $1B in adjusted EBITDA, up 20% YoY.

However, concerns over the company’s near-term broadband weakness are likely overstated. The company has continued to drive quality growth by increasing ARPU, posting an ARPU growth of 4% YoY in Q3. Therefore, the company is keenly aware of balancing the needs of driving overall subscriber growth while also focusing on quality, helping to mitigate profitability headwinds.

The Fed’s high interest rates also have helped to rationalize the competitive landscape as the major wireless telcos concentrate on consolidating their market share. Also, Comcast’s wireless strategy is still in the early stages, with just 10% market penetration. As a result, the company will continue to work around strategies that emphasize “the value of bundling wireless with their 32 million broadband subscribers.” Therefore, Comcast is astutely capitalizing on its broadband leadership to drive the company forward in a faster-growth segment, improving “profitability, enhances customer retention, and becomes a key acquisition strategy.”

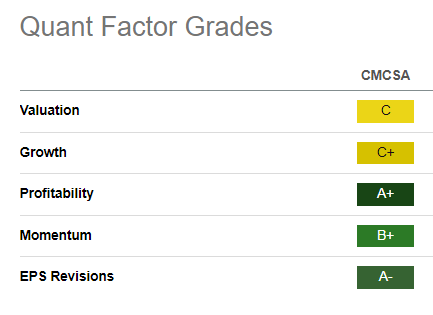

CMCSA Quant Grades (Seeking Alpha)

CMCSA isn’t expensive, as seen with its “C” valuation grade. Furthermore, its best-in-class “A+” profitability grade should undergird its market leadership. As a result, I’m confident that Comcast’s wide moat and well-diversified model should sustain its competitive advantages against lesser peers in a higher-for-longer Fed regime.

With solid momentum “B+” and execution “A-,” Comcast investors are expected to remain confident about buying steep pullbacks similar to the one we experienced in October. There’s even a reasonable dividend yield to go along, with its forward yield landing at the 3% mark recently.

Notably, CMCSA is rated as the top dividend stock in Seeking Alpha Quant’s dividend stocks screener, corroborating the quality of Comcast as a top-notch dividend play for income investors. In addition, CMCSA rates highly on Seeking Alpha Quant’s communications stocks screener, slotting in at fifth place out of 246 stocks included in the screener. As a result, I have confidence that CMCSA offers investors a fantastic opportunity to invest in a highly-rated stock with a defensible moat, attractive profitability metrics, and solid ratings assigned by Seeking Alpha Quant.

CMCSA price chart (weekly) (TradingView)

I gleaned that buyers returned and decisively helped CMCSA stay above the pivotal $40 support level over the past two months. As long as CMCSA remains above the 50-week moving average or MA (blue line), its uptrend bias should remain intact. In other words, investors shouldn’t be too worried about buying steep pullbacks on CMCSA, knowing that buying sentiments will likely remain robust.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!