Summary:

- Disney’s stock has underperformed the S&P 500 this year on the back of poor operating results.

- Nelson Peltz has re-launched his proxy battle and is seeking two board seats.

- While we think the long-term prospects for Disney are positive, the near-term picture is murky.

Joe Raedle

Magical No More?

We have been vocal in our bullishness on Disney (NYSE:DIS) this year. As a company in turnaround, we believed that the return of Bob Iger would portend a return to the company’s former glory after Iger’s successor was unable to keep the company out of political firestorms and oversaw ever-growing amounts of red ink in the company’s streaming business, Disney+.

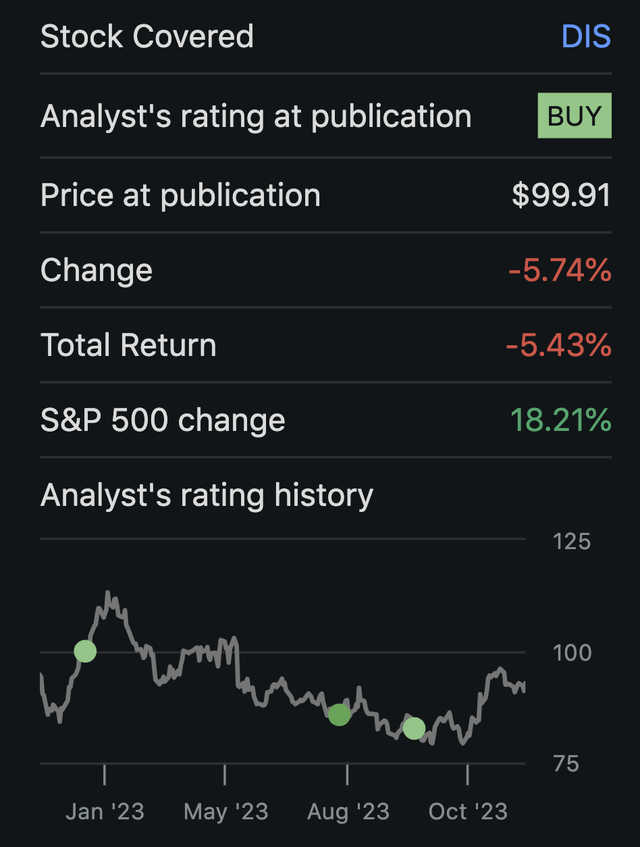

Analyst Rating History (Seeking Alpha)

In the last year, our bullish stance on Disney hasn’t paid off, with the stock delivering negative 5% against the S&P 500’s (SPY) return of 18%.

However, we believe that the market is often a voting machine in the short term and a weighing machine in the long term, and it isn’t often that we change our minds simply because the price moves against us–changing fundamentals are, for us, what drives and shapes opinion.

So, it is with this in mind that we eat a bit of crow and downgrade our view on Disney from Buy to Hold. Let’s dive in.

A Proxy Battle

At the start of the year, Nelson Peltz at Trian Partners launched a bid to gain a board seat (which we discussed here). The bid didn’t so much fail as much as fizzle out after Peltz met with Iger and came away believing that their visions were aligned.

However, after a year of seemingly no traction, Peltz is at it again and looking for not one, but two board seats for himself and former Disney CFO Jay Rasulo. Per the Wall Street Journal:

The announcement is the latest twist in a continuing proxy battle by Peltz’s Trian Fund Management against Disney—the fund’s second campaign against the entertainment giant in a year—which has pitted the 81-year-old investor against 72-year-old Bob Iger, who returned to Disney a year ago for a second stint as CEO.

Trian announced earlier this year that it had accumulated nearly 33 million shares of Disney stock and was seeking board seats for Peltz and at least one other, but Disney declined to add him to the board.

“As Disney’s largest active shareholder, we can no longer sit idly by as the incumbent directors and their hand-picked replacements stand in the way of necessary change, and peers and competitors continue to outperform,” Peltz said in a news release announcing the two board candidates.

Proxy battles can be messy, with the largest casualty often being the common shareholder. While we cannot say that Peltz has the right stuff to put the Magic Kingdom back on track, what we can say is that a) he has a good track record, and b) Iger and the board have largely not delivered this year.

It’s also difficult to gauge where the broad shareholder base stands on this battle–the market isn’t impressed with how things have gone this year, but it’s also unclear that a Peltz victory would be seen as a positive for the stock. It could be the case that a Peltz victory creates further turmoil, as investors may perceive that the company has a board and management team at odds with each other.

In other words, while the outcome of the proxy battle may be a net positive in the long run, the uncertainty around it today troubles us.

Promises Made

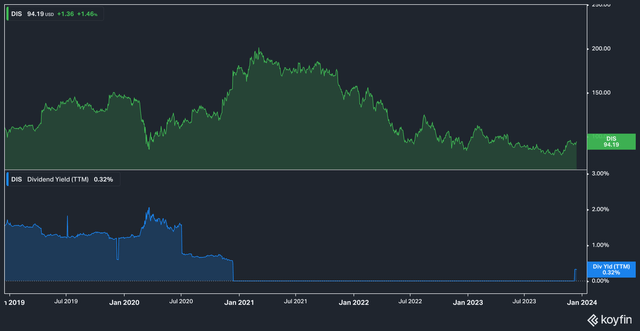

Disney’s dividend was once thought of as rock-solid, and its elimination the dividend in 2020 largely coincided with the stock’s slide from around $200 to the $90s.

DIS Price & Dividend Yield (Koyfin)

Iger and the management team made reinstating the dividend a priority, as evidenced in the company earnings call from February of this year:

Now that the pandemic’s impacts to our business are largely behind us, we intend to ask the Board to approve the reinstatement of a dividend by the end of the calendar year. Our cost-cutting initiatives will make this possible. And while initially it will be a modest dividend, we hope to build upon it over time.

The dividend was in fact approved by the board, as you can see at the far right side of the chart above. The question is, is it enough?

What we mean is that the reinstatement of a dividend is, in our opinion, almost symbolic. The dividend should be something of a cherry on top of improved operating results. Those results, however, have been a bit lackluster, which diminishes the value of the dividend.

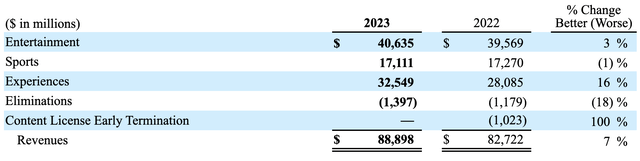

Disney Revenues By Segment (Company Filings)

Consider the company’s latest revenue results by operating segment (Disney recently re-shuffled its segments, they went into the details here in a recently filed 8K). While total revenues were up by 7% year over year, the growth was almost fully on the back of Experiences (parks, essentially) which grew in large part due to high-profile price hikes.

The focus for investors, however, is the Entertainment segment, which includes direct-to-consumer (aka, Disney+) and legacy linear offerings (television).

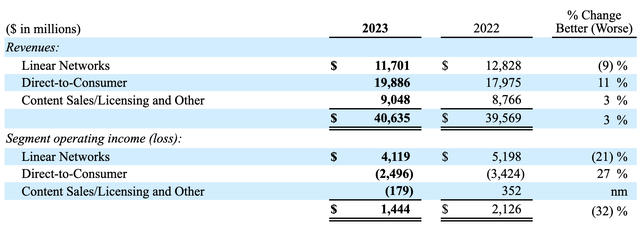

Entertainment Segment Results (Koyfin)

While the 3% bump in revenues in Entertainment is decent, the 32% reduction year-over-year in operating income from the segment is alarming.

Results from Linear Networks were negative almost across the board, with revenues from Affiliate Fees and Advertising down 5% and 15%, respectively.

The DTC segment top-line growth of 11% and narrowing of operating loss by 27% might give investors a ray of hope initially, but looking under the hood reveals some problems–operating expenses for DTC rose by 14% year over year. While the company made some headway in cutting its SG&A expenses for DTC, rising operating costs include items that may be out of the company’s control, and so costs outpacing revenue growth there is a concern.

Zooming out, the broad picture for operating income is not good, with only $1.4 billion in operating income for the segment compared to $2.1 billion the year prior.

The Bottom Line

We are not impressed with management’s execution this year, and as a result, move our opinion on Disney stock to Hold. While we think the long-term prospects for Disney are bright given the company’s unmatched IP, the near-term prospects are far more murky. We will await the outcome of the proxy battle to see where things go, but for now we are on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice and individuals should conduct their own due diligence before investing. The author is not suggesting any investment recommendations. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgement at the time of writing and are subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.