Summary:

- Adobe shares drop after announcing slightly lower FY24 guidance.

- Price increase in Creative Cloud subscription expected to contribute to growth in FY24 and FY25.

- Integration of Firefly AI technology and potential acquisition of Figma face regulatory challenges.

gorodenkoff

Adobe (NASDAQ:ADBE) shares dropped after they announced their Q4 FY23 results, as their FY24 guidance is slightly lower than the consensus. I believe the recent price increase in Creative Cloud will contribute to their growth gradually in FY24 and FY25. I maintain a ‘Buy’ rating with a fair value of $610 per share.

Financial Review and Outlook

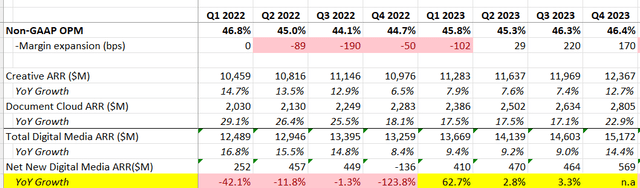

During Q4 FY23, they achieved a 13% revenue growth in constant currency and a 170bps adjusted operating margin expansion. Their Creative Cloud ARR grew by 12.7% year over year, and Document Cloud ARR increased by 22.9% year over year.

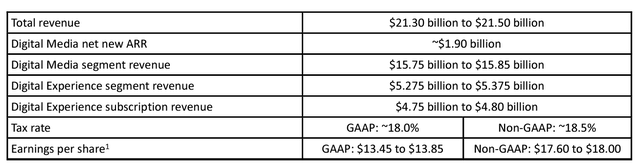

Their FY24 guidance is slightly lower than the market consensus. At the mid-point of their guidance, revenue is forecasted to grow by 10.3% in FY24, with EPS expected to increase by 10.7% year over year. As disclosed in their earnings call, they generated $7.3 billion in cash flows from operations, and the RPO was $17.22 billion. Additionally, they repurchased approximately 11.5 million shares of their own stock during the year at a cost of $4.63 billion. In short, they have a robust balance sheet and strong cash generation capabilities.

Price Increase in Creative Cloud

My biggest takeaway from the earnings call is the announcement of a price increase for the Creative Cloud subscription by Adobe. The increase, which took effect in November, is approximately 10%, making it quite significant.

During the earnings call, they indicated that the price increase will affect less than half of their existing client base, and the financial impact will be more noticeable in the net new ARR in the second half of FY24. I believe Adobe is poised to benefit from the price increase starting in the second half of FY24.

Firstly, Adobe has incorporated numerous additional functionalities into their Creative Cloud platform. The most notable addition is Adobe Firefly, which empowers users to generate content with AI. As I previously discussed in my introductory article, Firefly represents a crucial initiative for Adobe in applying generative AI to their platforms. The value added to their Creative Cloud lays the foundation for the implemented price increase.

Secondly, despite the approximately 10% price increase, the absolute dollar amount of the adjustment is relatively small. It’s unlikely that subscribers will take significant action in response to such a minor increase.

Lastly, Adobe is implementing the price increase across their various platforms, plans, and geographic regions. Consequently, the financial impact will gradually manifest in their results throughout FY24 and FY25.

Firefly Generative AI

Adobe is integrating its Firefly AI technology across various platforms, including programs like Photoshop and Illustrator for Creative Cloud subscribers. Importantly, Adobe is broadening its customer base through new products like Firefly, marking a crucial initiative for the company’s future growth. These AI-powered tools aim to alleviate the tedious tasks for designers, enabling them to leverage Adobe’s leading platforms to create content quickly and with higher quality. Moreover, there is significant upselling potential for Firefly and Express within their extensive enterprise client base. Adobe has reported surpassing 4.5 billion generations, indicating strong adoption and usage of Firefly.

Figma Deal is Facing Regulatory Challenges

On November 17th, 2023, the European Commission informed Adobe of its preliminary view that its proposed acquisition of Figma may reduce competition. Additionally, the CMA has issued provisional findings of competition concerns. Adobe has mentioned that the European Commission’s decision deadline is February 5th, and the CMA’s deadline is February 25th. The result is unknown at this moment.

I believe the acquisition might encounter robust regulatory challenges. In the realm of interactive product design tools, Figma stands out as the leader, with Adobe being one of its major competitors. If the acquisition goes through, it could propel Adobe into a dominant position in interactive product design.

Moreover, the U.S. Department of Justice might follow a similar regulatory path, but they haven’t established a formal timeline for the complaint. If both European and U.S. regulators move to block the deal, it’s unlikely for Adobe to proceed. Past cases suggest that acquirers can sometimes negotiate with regulators by divesting some assets to alleviate competition concerns. However, given that Figma is a singular software product business, divestitures seem unlikely.

Valuation Update

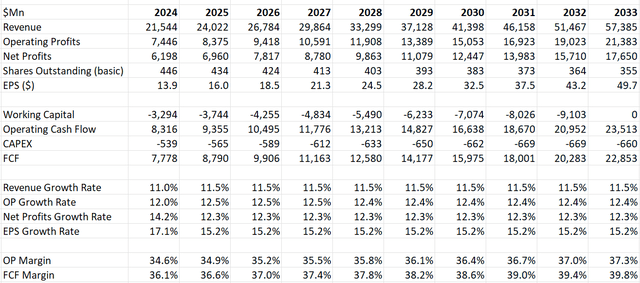

The assumptions for FY24 are in line with the company’s guidance, reflecting 11% growth in topline and 12% growth in operating profit. I maintain the normalized growth assumptions at 11.5%, comprising 11% for organic revenue growth and 0.5% for acquisitions growth.

Adobe DCF – Author’s Calculation

The model is utilizing a 10% discount rate, 4% terminal growth rate, and I have revised the tax rate to 18.5% in alignment with their guidance. The fair value is estimated to be $610 per share.

Conclusion

I anticipate that their price increase will begin to contribute to growth starting from the second half of FY24. Considering the current undervaluation of the stock, I maintain a ‘Buy’ rating with a fair value of $610 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.