Summary:

- PepsiCo is one of the most durable and well-diversified consumer staple companies.

- 2023 has been a challenging year, with elevated interest rates leading people to opt for money markets over dividend kings.

- The Fed’s pivot in 2024 will signify a year where investors return to blue-chip dividend companies. PEP is well-positioned to benefit, offering a 2.93% dividend yield and double-digit DGR.

- With my expectation of high single-digit EPS growth, along with a healthy dividend, I anticipate annual returns exceeding 10% until 2027.

JHVEPhoto

PepsiCo, Inc. (NASDAQ:PEP) is much more than a traditional soda company. Instead, it is a well-diversified food and beverage giant, making billions by selling the world’s favorite tortilla chips (Doritos) or the refreshing Pepsi itself.

Yet, the company has faced a difficult 2023, but that may be about to change.

With its operational excellence and strong leadership, it’s no surprise that the company has become a juggernaut. Presently, PEP, with its $239 billion market cap, holds the position as the third-largest company among the Consumer Staples Select Sector SPDR® Fund ETF in the S&P 500 (XLP), just behind Costco Wholesale Corporation (COST) and The Procter & Gamble Company (PG).

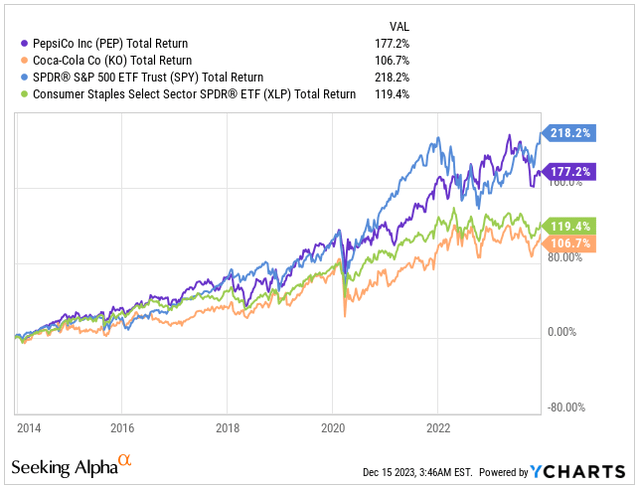

While over the past decade PEP has not managed to beat the market (SPY), it has still delivered a 10.55% CAGR return. This performance easily outperformed its closest competitor The Coca-Cola Company (KO), which achieved only a 6.93% CAGR in total returns, and it also outperformed the Consumer Staples Sector.

Despite slightly trailing the market returns, I still consider PEP a great investment for investors seeking a defensive addition to their dividend growth portfolios, especially in volatile times.

While PEP has underperformed the market in seven out of 10 years in the last decade, the company has proven to be much more resilient during economic hardships, such as in 2022 when PEP returned 6.77%, while the market experienced an 18.17% decline.

In 2023, as the Fed’s interest rates peaked at 5.25-5.50% and investors’ appetite for dividends subsided in favor of virtually risk-free money markets offering yields of over 5%, PEP faced pressure, resulting in a -6.22% year-to-date decline.

Nevertheless, with the Fed signaling a pivot this past Wednesday and the possibility of as many as three rate cuts in 2024, bond yields have fallen and investors will eventually return to seek yield in top-tier dividend growers like PEP. With its A+ credit rating and a 2.93% yield, I anticipate 2024 and 2025 to deliver total returns exceeding 10%.

I expect PEP’s stock to outperform in the risk-off environment and if your baseline expectation for 2024 is a hard landing or perhaps a mild recession, PEP is a stock to own. Let me show you why.

Business Update

The recent earnings report tells a story of strategic triumph, prompting an upward revision in the 2023 earnings forecast. Despite the waves of inflation and pricing challenges, PEP navigated smoothly, notably excelling in its North American food divisions.

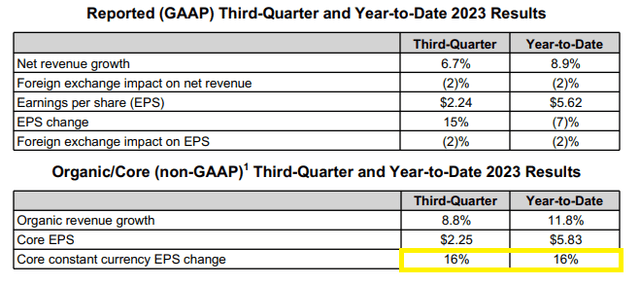

In Q3, PEP continued to adeptly navigate complex economic conditions. Revenues stood at $23.45 billion, a 7% year-over-year increase, meeting estimates. Organic revenues surged by 8.8% year-over-year, despite a moderate decline in global beverage and convenience food volumes. Even with this decline, PEP managed a 105-bps expansion in core gross margins and an 80-bps expansion in core operating margins.

The standout figure was a 16% rise in core constant-currency EPS for the period. This prompted an updated guidance for the year, projecting a 13% growth compared to the previous forecast of 12%.

This metric isn’t just about raw profit; it reflects efficient cost management and operational strength, crucial in unpredictable economic conditions. PEP’s ability to exceed EPS projections suggests a robust business strategy that adapts well to challenges like inflation and pricing pressures.

If PEP can sustain its growth rate compared to its competitors, investors can rely on the company’s size and experienced management to drive operational efficiency and consistently boost EPS.

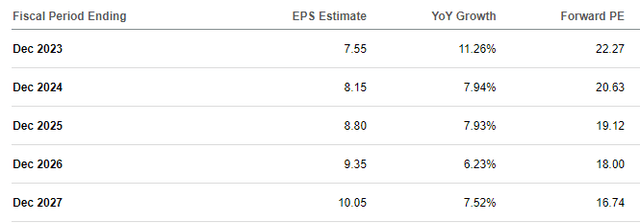

Analysts are anticipating exactly that trajectory for PEP – EPS growth. Originally estimated at 11.26% for FY23, the company is already projecting 13% growth, exceeding earlier expectations.

Looking beyond 2023, analysts foresee high single-digit EPS growth. However, it’s worth noting PEP’s track record of outperforming estimates. It wouldn’t be surprising if the company achieves around 10% annual growth in the foreseeable future. The investments made in efficiency over the last five years are expected to yield results, coupled with successful pricing strategies and market share gains, like the Frito-Lay market share increase due to smaller pack sizes and the introduction of bite-size versions of Doritos, Cheetos, and SunChips brands.

It’s important to bear in mind that 55% of PEP’s net revenue comes from convenience foods, with only 45% from beverages.

You might be wondering about the impact of GLP-1s on PEP’s sales.

While these medications are groundbreaking in combating obesity and diabetes, it’s crucial to consider:

- Clinical trials have revealed links between GLP-1 drugs and gastrointestinal side effects such as nausea, constipation, and, in rare cases, pancreatitis. As usage increases, I anticipate more side effects may emerge.

- Moreover, these drugs come with a hefty price tag, currently covered by insurance solely for Type-2 diabetes patients. For example, Novo Nordisk A/S’s (NVO) Ozempic costs $935 per pen.

- PEP has been diligently pursuing a product premiumization strategy for years, focusing on low-sugar and low-fat product categories.

Dividends & Buybacks

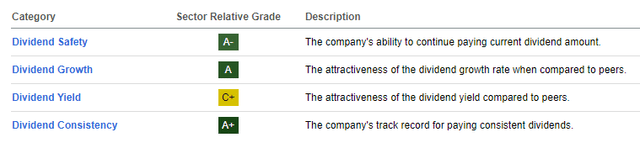

PEP’s dividend receives three A ratings based on Seeking Alpha’s Dividend grading, but it scores a single C for the dividend yield.

I’m not surprised by the overall positive rating as I view PEP as one of the best Dividend Kings out there.

Dividend Grade (Seeking Alpha)

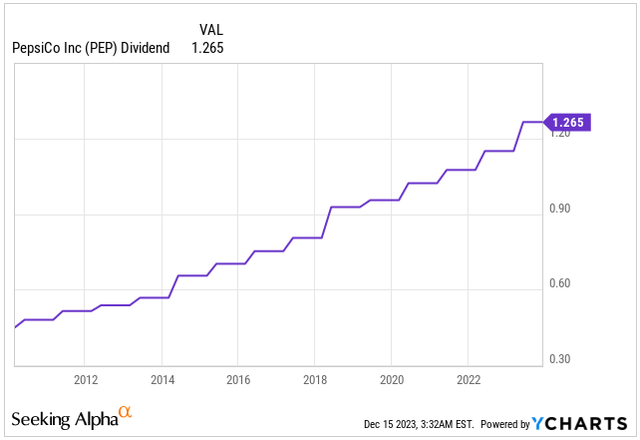

- PEP is currently paying a dividend of $1.265, resulting in a 2.93% dividend yield, which is significantly higher than the sector’s 2.42% yield but falls behind KO’s 3.14% yield.

- PEP maintains a safe current dividend payout ratio of less than 55%.

- Since 2010, PEP has increased its dividend by 181.1%, averaging a 12.9% growth rate over the past 14 years.

- The most recent dividend increase was 10% in May 2023, and I anticipate a similar increase next year.

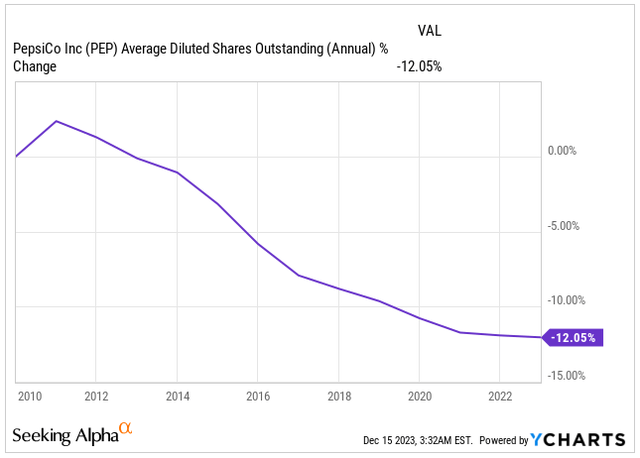

While dividends serve as the primary method of returning money to shareholders, PEP has also been active in share buybacks, and I anticipate this activity to accelerate in the coming years, as PEP’s growth appears ready to accelerate as investments made over the past five years start to pay off.

Since 2010, PEP has repurchased approximately 12% of its outstanding shares.

Shares Outstanding (Seeking Alpha)

Valuation

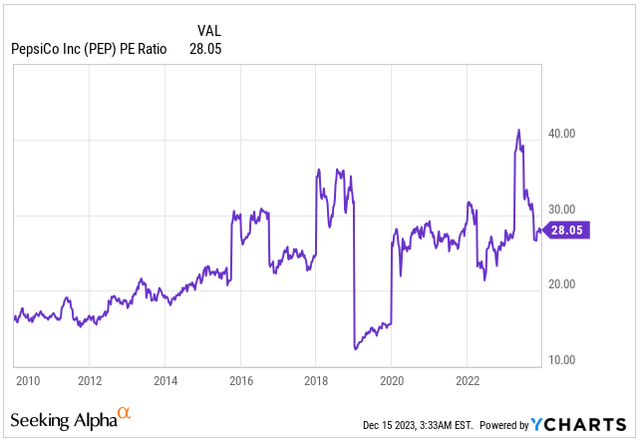

When assessing valuation, numerous analysts in the consumer staples sector rely on the standard PE ratio. However, in this instance, this measure isn’t truly indicative.

PEP currently trades at a multiple of 28x over its trailing twelve-month earnings, indicating an elevated valuation compared to historical averages. However, this figure doesn’t reflect one-time charges related to the divestiture of its Russia business, substantial impairment of its Soda Stream holding, and a one-time gain from the sale of Tropicana, significantly distorting the figures.

Instead, let’s consider the Non-GAAP PE Ratio, which currently stands at 22.40x. This indicates that PEP is trading at a premium compared to the sector’s Non-GAAP PE median of 18.10x its earnings. However, historical data shows that for almost the entire last decade, PEP has consistently traded above 20x non-GAAP PE.

A shorter time horizon, the last five years, illustrates the stock trading around 24.73x its earnings. This suggests that presently, the stock is actually approximately 9.5% cheaper than it was over this duration.

Similar confirmation is found by examining the Forward EV/EBITDA, which sits at 16.15x, 4.6% lower than its 5-year historical average.

For some, it might be challenging to grasp that PEP, trading at 22.4x, is currently at a discount of around 5- 9% to its fair value.

If the company were to return to trading at its 5-year average Forward PE of 24.5x earnings by 2027, assuming an average EPS growth of 6% CAGR between today and 2027, we could reasonably expect the stock to reach $246 by the end of 2027.

This would imply a stock appreciation return of 7.9% CAGR over the five years from today’s stock price of $168. Considering the close to 3% dividend, we could reasonably expect PEP to deliver returns well over 10%.

| Fiscal Year | 2023 | 2024 | 2025 | 2026 | 2027 |

| Revenue (b) | $92.2 | $96.5 | $101.2 | $106.4 | $111.4 |

| Revenue Growth | 6.7% | 4.7% | 4.9% | 5.1% | 4.7% |

| EPS | $7.6 | $8.2 | $8.8 | $9.4 | $10.1 |

| EPS Growth | 11.3% | 7.9% | 8.0% | 6.2% | 7.5% |

| Forward PE | 23.0 | 24.0 | 24.5 | 24.5 | 24.5 |

| Stock Price | $174 | $196 | $216 | $229 | $246 |

Conclusion

PepsiCo’s shares have dropped by 7% this year, mainly influenced by market sentiment rather than fundamental issues. After the S&P 500 index’s recovery from the 2022 bear market, investors steered away from defensive options, including consumer-staples stocks. Additionally, higher bond yields reduced the attractiveness of the sector’s dividends. Concerns grew over the success of weight-loss drugs like Novo Nordisk’s Ozempic, raising worries that snacking might decline, impacting PEP.

However, as 2023 wraps up, there’s a potential shift in sentiment. Bond yields have retreated from their highs, and concerns about economic growth are resurfacing, which could reignite interest in staple stocks. Moreover, the anxiety surrounding weight-loss drugs seems to have eased. Furthermore, PEP’s growth trajectory seems poised to accelerate as investments made over the past five years begin yielding results.

PEP is currently one of the most defensive businesses that I own in my dividend growth portfolio and understanding that the path forward for over 10% returns is rather clear, I am aiming to add on any weakness.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.