Summary:

- Pfizer, Inc. stock has fallen nearly 60% from its peak in December 2021. Could a turnaround be near?

- In a promising sign, Pfizer has announced its 14th consecutive annual dividend increase, signaling confidence in its ability to cover payments.

- Pfizer stock is trading at a favorable valuation compared to its peers and has potential for upside, with a median price target of $32.

JHVEPhoto

Pfizer Inc. (NYSE:PFE) stock can be used as the stock market’s example for many of life’s adages. “What goes up must come down” and “Pride comes before the fall” sum up the stock’s recent fall. Pfizer stock is down

- nearly 60% from its December 2021 peak

- 52% in the last year

- 49% YTD

- 34% in the last 6 months

- 11% in the last month

- 8.50% in the last 5 days.

PFE Stock Chart (Seekingalpha.com)

Well, you get the drift. But investing is all about the future. And the word “future” almost always brings the word “hope” along with it. The adage that Pfizer investors like myself are hopeful of in the future is “darkest before down.” I present 5 reasons in this article why I believe Pfizer’s stock may be ready for a turnaround from here. Let us get into the details.

14th Consecutive Dividend Increase

Sticking with the adages, the safest dividend is the one that has just been raised. In a massive sign of confidence, Pfizer has just announced its 14th consecutive annual dividend increase, as Seeking Alpha has covered here. The fact that this comes mere days after the company reduced its guidance for 2024 suggests that Pfizer is extremely sure about its ability to cover its dividend payments. As a result of the stock losing significant ground and the uptick in dividend, Pfizer stock yields almost 6.50%, easily the highest in the last 5 years at least.

Valuation

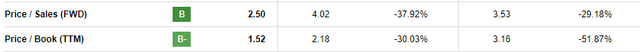

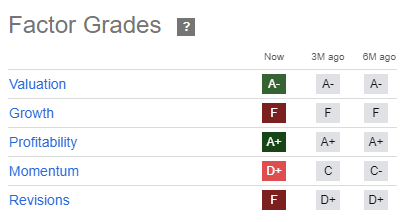

- Even with the revised guidance of $2.05 to $2.25 per share, Pfizer’s stock is trading at a forward multiple of 12.70 based on current stock price of about $26. As a comparison, Johnson & Johnson (JNJ) is trading at a forward multiple of 15.82. No wonder, Seeking Alpha’s quant rating has a favorable “A-” rating for Pfizer stock on valuation

PFE Valuation Grade (Seekingalpha.com)

- Even with the revised guidance of $58.5 billion in revenue/sales, Pfizer stock is trading at a price to sales multiple of 2.50. This compares favorably against the sector’s median of 4.02 and Pfizer’s own 5-year average of 3.53.

- Finally, the 19 analysts covering Pfizer stock have a median price target of $32, representing nearly 30% upside if you include dividends. In addition, the lowest price target of $23 offers a reasonable margin of safety with the stock trading at $26 now and yielding 6.50%.

Recovering Business

Obviously, the focus during and after the recent analyst call was on the company’s reduced guidance. But hidden away are some promising details:

- Pfizer increased its cost savings target for the end of 2024 to at least $4.0 billion, up $500 million from its previous guidance. A dollar saved is worth more than a dollar made due to expenses and taxation.

- Generally, any sizeable acquisition like Seagen hurts the acquirer’s operations and financials adversely in the initial stages. No matter how well-planned the acquisition was, surprises are always in store as the unified companies try to figure out the best places to cut costs, which products to sunset, and which products to nurture. With the Seagen acquisition finally closing officially, I expect things to get better here on and to have a materially positive impact. As the first sign, Pfizer announced “our remaining portfolio of combined Pfizer and Seagen products is expected to achieve year-over-year operational revenue growth in the range of 8% to 10%. “

- The overall tone of the company on the analyst call was more down-to-earth than the one they had when they announced the 400% price increase to COVID vaccines. Once again, we’ve since the pride before the fall. So, why not the dawn after this darkness?

New Year

Meta Platforms, Inc. (META) 2022 vs. Meta Platforms, Inc. 2023.

Tesla, Inc. (TSLA) 2022 vs. Tesla, Inc. 2023.

Exxon Mobil Corporation (XOM) 2022 vs. Exxon Mobil Corporation 2023.

I can keep going, but let’s cut it short. What is common with the stocks mentioned above? Their 2022 grabbed headlines for one reason, while their 2023 turned out to be the exact opposite. Well, not so much for Exxon, but after returning nearly 90% in 2022, a 5% down year so far in 2023 is worth noticing.

Pfizer is in the doghouse in 2023 with its near 50% route, and with tax-selling on the horizon, things may get worse till the calendar year closes. But with a new year rolling around soon, analysts have already started including Pfizer in their list of stocks to watch for a turnaround in 2024.

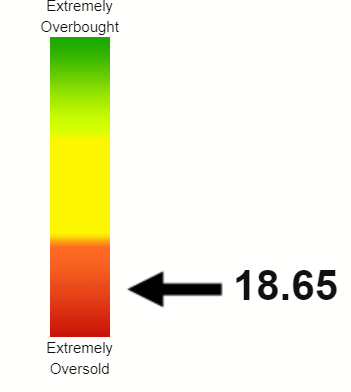

Extremely Oversold

While the general market has been rallying hard and reaching dizzying heights, Pfizer’s stock has been in a world (of pain) on its own. This is confirmed by the technical indicator, Relative Strength Index [RSI]. RSI below 30 is considered extremely oversold and Pfizer’s stock has a RSI of about 19 as of this writing. This is another reason I believe this is the darkest before dawn.

PFE RSI (stockrsi.com)

Conclusion

So, there you have my 5 reasons on why I believe Pfizer Inc. stock may be due for a turnaround in 2024. I especially welcome the dividend increase, as it conveys a strong message to the market that despite the bloodbath in the stock price, the business is strong enough. I rate Pfizer Inc. stock a “Buy” here as I’ve generally been rewarded for buying good stocks at bargain prices, especially when dividends add to the return.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE, META, TSLA, XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.