Summary:

- As a contrarian investor, I normally like to bet against Wall Street Ratings.

- However, I am going to side with it on AT&T this time.

- I believe its troubles are temporary and its assets are underearning.

- Moreover, valuation is compressed by pretty much all metrics.

- The gap between its recovery potential and cheap valuation is simply too large in my view.

BobHemphill

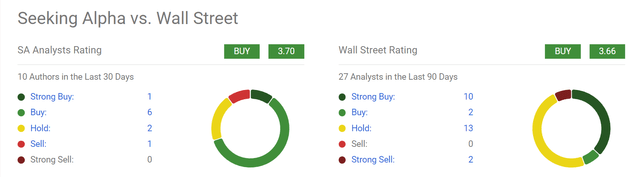

Wall Street now loves AT&T

It is no secret that Wall Street ratings are often biased and different from Main Street’s opinion. But for AT&T (NYSE:T), Wall Street’s bullishness aligns well with Main Street, as seen in the chart below. Both Seeking Alpha authors (which approximate Main Street ratings in my mind), and Wall Street analysts recommend the stock as a BUY. To wit, among the 10 SA authors who wrote on the stock in the past 30 days, 70% recommended the stock as either a “buy” or a “strong buy”. Wall Street ratings are equally strong. Among the 27 Wall Street ratings issued in the past 90 days, 12 (i.e., about half of them) recommended the stock as a “buy” or “strong buy”.

As a contrarian investor, I normally go against Wall Street. However, in the case of the T, I will explain why I am going to side with Wall Street this time. The remainder of this article will explain my thought process in detail. The key points are:

- I see the ongoing headwinds to be only temporary. These issues have caused its assets to underearn in the past few years.

- Furthermore, I see the negative catalysts in the past 2~3 to have largely run their course already. As a result, I see strong potential for its profitability to recover sharply, and so do consensus estimates.

- While the stock is still trading at the low end of the valuation range pretty much across all metrics (P/E, P/sales, P/cash flow, et al).

The troubles T has faced

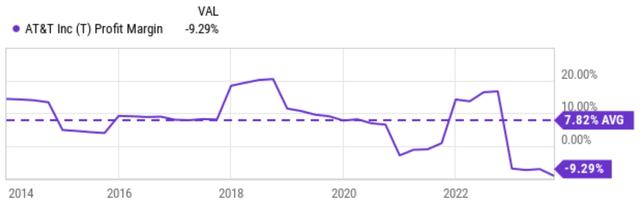

T used to be a symbol of consistent profitability and reliable dividends. As seen, its profit margin (“PM”) indeed has been quite stable in the past, only fluctuating mildly around an average of ~8% before the pandemic. The profit margin has been on a downward trend since then. It currently sits in negative territory as seen. There are a number of possible reasons for its decline in profit margin. Many of them are generic to the telecom sector, such as competition and high capital requirements. However, a few are more unique to T in my view. High debt burden is a key issue. T’s debt level has reached a concerning level to me before the Warner spinoff. A large part of the debt increase was due to a range of questionable acquisitions over the years. To make things even worse, many of these acquisitions not only failed to generate the synergies expected but made the company less focused and efficient. Then as a final blow, the recent interest hikes significantly increased borrowing costs and interest payments, further impacting its profitability.

Profitability recovery potential

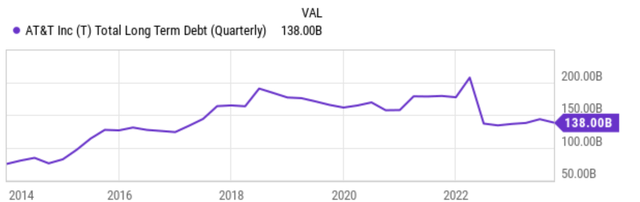

Looking ahead, I believe most of the above issues have run their course, especially after the Warner spinoff. As seen, its debt has dramatically decreased from a peak of over $200B to the current level of $138B. With the spinoff completed and a much lighter debt burden, it can now better focus on its core business such 5G rollout and profitability recovery.

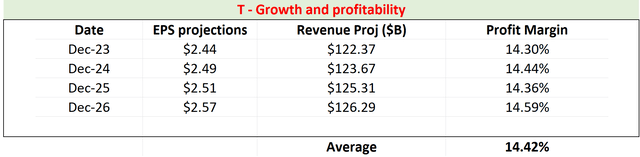

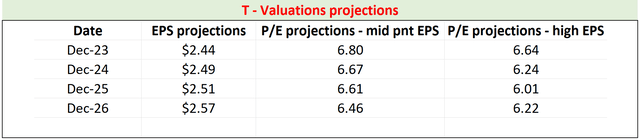

Consensus estimates imply a pretty rapid profitability recovery starting next year, as shown in the table below. The table below is my calculation of T’s profitability in the next few years using the EPS and revenue forecast from consensus estimates. I made one assumption in these calculations: I assumed its number of outstanding shares to remain at the current level of 7.17 billion shares for this period. As seen, the consensus estimates imply that its net margin would recover to 14.3% in the next years and stabilize in that regime afterward. Based on these projections, its margin would average 14.4% in the next 4 years between FY 2023 and 2026.

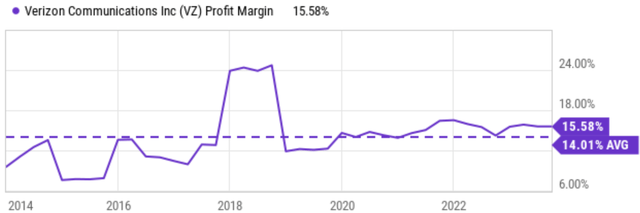

I believe such a recovery is quite plausible. Besides the catalysts mentioned above (lighter debt, improved capital allocation, better focus on growth areas, et al), an average margin of around 14% is also what its close peers have been earning on their assets. As an example, Verizon (VZ) has been earning a 14% average margin in the long term (see the second chart below).

Author based on Seeking Alpha data. Seeking Alpha

Other Risks and Final Thoughts

The stock has enjoyed a large price rally in the past ~3 months. Despite such a sharp rally, its shares are still offering excellent value here. It is now trading at the low end of the valuation range both in absolute and relative terms pretty much by any metric ranging from P/E, P/sales, dividend yields, et al. As seen, it is currently priced at 6.8x of its FY1 EPS only. Looking further out, the implied P/E is even lower considering the EPS growth as projected by consensus analysis.

Besides these above positives (margin recovery and cheap valuation), I also like its recent efforts on customer acquisition, and I expect the strategy to remain effective in the years to come. To wit, it has added 550,000 post-paid net adds as reported in the last earnings report (i.e., new customers minus accounts that have dropped their coverage). Its investments in Fiber wireline business have also been bearing fruit well. This segment added 296,000 net new subscribers in the September period. As our insatiable demand for more data continues to grow (thanks to the expansion of social media, streaming, AI, et al), I expect these segments to enjoy secular support for years to come.

Author based on Seeking Alpha data.

Now the downside risks. I have already touched on some of the risks generic to the telecom sector, such as competition intensification and also heavy CapEx requirements. Here I will single out a couple of risks that are more unique to AT&T but not to other telecom stocks. Compared to peers (especially the newer entrants), T relies more heavily on traditional revenue streams like wireline telephone services and satellite TV in my view. These segments have been suffering declines for years due to competition from streaming services and VoIP options. It is very uncertain how far such cord-cutting will go.

Also, AT&T has a unionized workforce (more details are quoted from its website below). While not inherently negative, having a unionized workforce could lead to higher labor costs, less flexibility in managing operations, and other operation disruptions. The strikes in the auto sector serve as a recent example.

AT&T is the only major U.S. telecommunications company with a fully union-represented, non-management workforce where more than 67,000 employees are unionized. While other companies are preoccupied with combating unionization, AT&T is focused on the core business of connecting people with a strong union workforce.

To conclude, I agree with Wall Street’s buy/strong buy recommendation on T stock. I think a strong buy can be justified here. To me, the gap between its recovery potential and valuation is simply too large under current conditions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.