Summary:

- Lucid’s prospects remain pessimistic, as the premium EV pricing becomes an inherent barrier to its mass appeal and adoption.

- Investors may also want to note that the uncertain macroeconomic outlook has impacted its target group, with the management continuously slashing prices, impacting its gross margins.

- The lowered production guidance and lack of projected profitability over the next few years imply the increased likelihood of dilutive capital raises as well.

- With LCID now trading below $5 while being highly shorted at 28.31% at the time of writing, we believe that there may still be volatility in the near term.

- This is despite the cooling inflation, the increased likelihood of a Fed pivot, and the moderating lithium prices.

Dilok Klaisataporn/iStock via Getty Images

We previously covered Lucid Group, Inc. (NASDAQ:LCID) in September 2023, discussing its pessimistic prospects as the premium EV pricing became an inherent barrier to its mass appeal and adoption.

Based on its cash burn rate, we believe that the automaker might need a few more rounds of dilutive capital raises over the next few years. Combined with its underwhelming vehicle deliveries, we prefer to rate the stock as a Hold then.

In this article, we shall discuss why LCID’s intermediate term prospects may lift, attributed to the projected improvement in its operating scale, moderating lithium prices, and the cooling inflation with the Fed unlikely to further hike rates.

Even so, with the automaker unlikely to report break even anytime soon, the stock remains overly speculative ahead, worsened by its highly shorted position.

The LCID Investment Thesis Remains Highly Speculative

For now, LCID reports FQ3’23 revenues of $137.81M (-8.6% QoQ/ -29.5% YoY) and worsening gross margins of -240.8% (+27.6 points QoQ/ -88 YoY). This is attributed to the sustained production ramp of the Lucid Air Pure RWD/ Sapphire and the recent opening of its factory in Saudi Arabia.

Then again, the automaker has also reported lower Average Selling Prices of $94.58K in the latest quarter, down by -11.9% from $107.45K in FQ2’23 and by -31.8% from $139.81K in FQ3’22. The number is estimated from its revenues divided by the number of delivered vehicles.

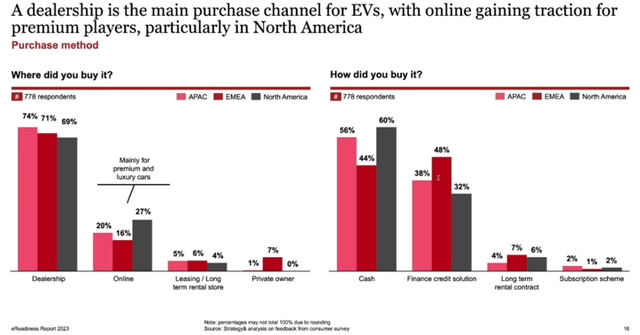

EV Financing Method

Therefore, while PWC’s automotive survey results have implied increased EV cash purchases at 60%, compared to 32% who use loans, it appears that demand has decelerated for LCID’s premium offerings.

With the automaker’s target consumer base not being immune from the uncertain macroeconomic environment as well, we can understand why the management has lowered its FY2023 production guidance.

This is from 10K (+39.2% YoY) to between 8K – 8.5K (+14.9% YoY) instead, as “a prudent approach to inventory management and working capital to better align with deliveries.”

We reckon that this is a strategic approach indeed since LCID has also reported an improved FQ3’23 production of 1.55K vehicles and deliveries of 1.45K vehicles or the equivalent of a 93.5% in production-to-delivery ratio (+30.8 points QoQ/ +32.3 YoY).

It appears that the management’s previous guidance of “a significant number of vehicles are in transit to Saudi Arabia” runs true, attributed to the moderation in its finished inventory to $386.2M on a QoQ basis (-13.2% QoQ/ +125.7% YoY).

While LCID continues to report $230.8M worth of inventory write-down (-21.8% QoQ/ +23.7% YoY) in the latest quarter, the rate has been decelerating as well.

We expect things to improve moving forward, especially with the opening of its first manufacturing plant in Saudi Arabia, with the PIF sales likely to boost its top and bottom lines in the near-to-intermediate term.

On the one hand, LCID remains highly liquid, with the $4.42B in cash/ short-term investments also yielding $62.72M in net interest income (+90.9% QoQ/ +274.2% YoY).

On the other hand, based on its annualized cash burn rate of $3.28B, it is only a matter of time before the management needs to dilute its long-term shareholders with an equity raise from the PIF.

By the latest quarter, LCID already reported 2.28B in shares outstanding (+0.37B QoQ/ +0.59B YoY), also partly attributed to the eye-watering $264.7M in its LTM stock-based compensation (-47.3% sequentially). This number is still elevated compared to its $695.83M in revenues over the same period (+84.6% sequentially).

This means that while the automaker has minimal danger of insolvency, shareholders may suffer an unpleasant dilution ahead, with the sky as the limit.

If we are to zoom out to the macro issues, it appears that LCID’s margin headwinds may lift in the intermediate term, attributed to the recent opening of its factory in Saudi Arabia.

With the automaker already delivering vehicles to the PIF by the latest quarter, we may see its production scale improve from henceforth, significantly aided by the cooling PPI and CPI inflation with the Fed unlikely to further hike interest rates ahead.

This is on top of the declining lithium spot prices, triggering the moderating battery pack prices, with EVs likely to achieve price parity with ICE vehicles by mid-2026 assuming a new normal in the Brent Crude oil prices at $70 per barrel moving forward.

These are optimistic developments indeed, likely to lift most EV stocks, LCID included, once market sentiments normalize and its margins improve. Before then, we believe that things may unfortunately get worse before it gets better.

So, Is LCID Stock A Buy, Sell, or Hold?

LCID Valuations

With LCID not generating any profitability yet, the only metric that we may use to measure its valuations is the FWD EV/ Sales of 14.01x, which is notably much higher than the sector median of 1.21x and even Tesla, Inc.’s (TSLA) at 7.80x.

The Consensus Forward Estimates

Perhaps this is attributed to the promising consensus estimates, with LCID expected to generate an impressive top-line expansion at a CAGR of +85.3% through FY2025, well exceeding many of its EV peers, including TSLA’s at +21.6%.

Then again, it brings no comfort that the automaker is not expected to report break even anytime soon, with its negative FCF margins implying sustained reliance on dilutive equity raises and potentially, debt.

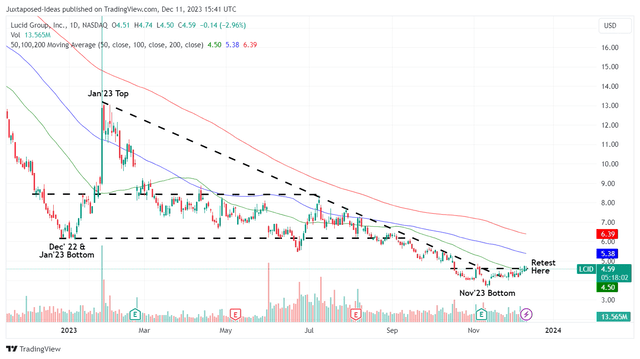

LCID 1Y Stock Price

LCID continues to chart new lows since the January 2023 top as well, with it appearing to bottom by November 2023. However, with the stock now trading below $5 while being highly shorted at 28.31% at the time of writing, we believe that there may still be volatility in the near term.

Combined with the decelerating EV demand and its impacted ASPs, we prefer to continue rating the LCID stock as a Hold here.

Do not chase this stock to the bottom.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.