Summary:

- Alphabet Inc./Google stock has been consolidating around the $130 level in recent months, despite the unveiling of Gemini and broader macro tailwinds.

- Google’s AI prospects remain a key focus area for investors. But the lack of a tangible competitive advantage delivered to date has been a limiting factor to the stock’s performance.

- The deceptive demo for Gemini has also left investor confidence shaky, as it highlights Google’s continued struggles in catching up to Microsoft in the heated AI race.

Sean Gallup

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) stock has continued to find resistance at the $140 level. Despite its release of the Gemini large language model last week, the stock has been paring gains and consolidating around the $130-level in recent months. In addition to the market’s interest in artificial intelligence, or AI, much of the loftily-valued Magnificent Seven’s upside potential has also been hinged on the macroeconomic backdrop. Yet Google’s uplift in response to dovish cut prosects from the Fed’s latest dot plot has also been muted.

Google’s latest PR disaster on its demo video for Gemini’s capabilities was a potential setback. Investors remain hyper-focused on Google’s AI capabilities against top contender Microsoft (MSFT), which has OpenAI under its belt. Yet recent concerns over an overexaggerated demo on Gemini’s potential use cases in the immediate- to near-term have likely mired market’s confidence on the competitive aspect. Meanwhile, the company’s recent legal defeat against Epic Games on its app store revenue policy represents another looming challenge. However, the relevant financial implications are likely still years away, and relatively nominal when compared to AI’s mission-critical role in dictating Google’s future.

Taken together, we think it has only become harder for Google to maintain its valuation at current levels. Investors are increasingly focused on the company’s ability to reaccelerate growth in the core search advertising business, while also gaining share in cloud through AI-enabled total addressable market, or TAM, expansion. While 2023 has been a year of multiple expansion – particularly for the Magnificent Seven, thanks to AI – 2024 will see reverted focus to fundamentals. This means the need for actual delivery of AI monetization prospects currently priced into the cohort’s rich valuation at 32x earnings on average, versus the S&P 500’s (SP500) 21x. Although Gemini shows prospects in driving Google’s AI breakthrough and potential reclamation of its lead in the technology, confidence remains lacking.

Gemini’s Go-To-Market Strategy

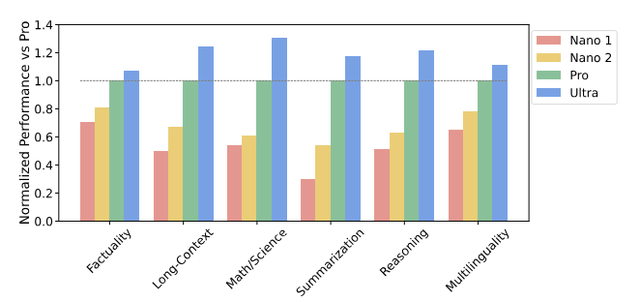

Gemini is Google’s most recently developed LLM, and has been dubbed the most competitive offering of its kind currently in the market. Internal testing results released by Google have shown outperformance against OpenAI’s latest GPT-4 model. In addition to text and images, Gemini expands its multimodality to drawing meaning from video and audio, which enables better output generation. This is corroborated by Gemini’s 90% score on Massive Multitask Language Understanding (“MMLU”), making it the first LLM to surpass the human expert score of 89.8%. Gemini has also outperformed OpenAI’s GPT-3.5 and GPT-4 model, as well as its predecessor PaLM 2 on a range of industry performance benchmarks that cover reasoning, math, multilinguality, and coding capabilities.

Google has once again opted for a differentiated go-to-market strategy for its newest AI product. The Gemini LLM will be offered in three sizes – Nano, Pro and Ultra – to more efficiently operate across “everything from mobile devices to large-scale data centers.”

Nano

Nano is the smallest variant of Gemini and is optimized for scaling generative AI deployments on mobile devices. Gemini Nano has two variants: Nano-1 and Nano-2. Nano-1 has a model size of 1.8 billion parameters, and Nano-2, 3.25 billion parameters. This compares to some of industry’s smaller LLMs like Meta Platform’s (META) LLaMA 2, which starts at 7 billion parameters.

Recall from one of our previous discussions that a LLM’s parameter count represents the volume of “nuances” that the model can process and understand for each data point’s meaning. This essentially means a model’s performance is a function of parameters. Typically, the larger the model, the higher the performance.

Gemini: A Family of Highly Capable Multimodal Models, Google DeepMind

However, the parameter count is not the only key factor in optimizing performance and scalability. In fact, many of the world’s largest LLMs are essentially “oversized” or “undertrained,” making them suboptimal (discussed here). Despite its small model size, Gemini Nano has been optimized for scalable mobile applications, and excels in “reasoning, STEM, coding, multimodal and multilingual tasks.”

Gemini Nano is currently available for Android developers and already powers new generative AI features in the latest Google Pixel 8 Pro smartphone. These include “Summarize” within the Recorder app and “Smart Reply” in Gboard, which consolidates information from extended messages and generates automated responses in the messaging app. Similar features are expected to be implemented into common messaging platforms like Meta’s WhatsApp and Kakao Talk over time.

Pro

Gemini Pro is the most scalable variant for supporting a diverse range of tasks. And Google has already started monetizing the product through various platforms across the business, spanning Bard and Cloud, with expansion later to search and advertising.

Bard: Gemini Pro has already been put to work in Google’s chatbot, Bard. It effectively replaces PaLM 2 as the underlying LLM that powers Bard, and is able to generate responses based on real-time data. Preliminary testing by users have observed an improvement in chat responses relative to both old Bard and ChatGPT. While this corroborates management’s allusion to enhanced Bard as “one of the best free chatbots in the world,” its lead remains limited for now.

Google Cloud: Gemini Pro has also entered general availability for the developer community through Google AI Studio and Vertex AI this week. Google Cloud customers can now access Gemini Pro and build products on it for free via one of the two platforms. Through the web-based AI Studio platform, developers can access the Gemini Pro API for launching solutions like conversational chatbots and other AI-enabled applications. For more customization, Cloud customers can securely portal their data to Gemini Pro on Vertex AI, and start building and fine-tuning the model for their desired solutions there. Vertex AI, which provides users with access to other popular LLMs as well, will be offering Gemini Pro for free until January 15, 2024.

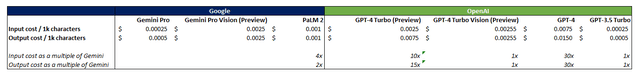

After the limited time promotion, Google will offer Gemini Pro access at a competitive price of $0.00025/1k characters prompt input and $0.0005/1k characters response output. This represents a 4x and 2x price reduction for input and output, respectively, on PaLM 2 released in June. It also compares to an input cost of $0.03/1k tokens and output cost of $0.06/1k tokens on OpenAI. One token is equivalent to four English characters, which translates to an input cost of $0.0075/1k characters and output cost of $0.015/1k characters at Google’s rival, highlighting Gemini Pro’s price advantage. Gemini Pro is priced closer to GPT-3.5 Turbo instead, though offering improvements to performance in multiple folds.

Data from blog.google and openai.com

In addition to Gemini Pro, which processes and spits out text only, Google has also introduced Gemini Pro Vision in preview. Gemini Pro Vision can process both text and imagery, and generate text outputs.

Others: The company is also experimenting Gemini Pro integration into Search Generative Experience (“SGE”), the generative AI-enabled search platform currently in testing. The product is expected to enter general availability next year. The technology is also expected to be incorporated into the advertising business. This will further complement AI-enabled efficiencies currently available through Performance Max, and improve the experience and economics of deploying ad campaigns for advertisers. Gemini Pro is also expected to play a role in the Chrome browser and the Duet AI developer productivity tool next year.

Ultra

Gemini Ultra is the largest variant of the LLM that is currently only available to developers in a limited early access program. The model is expected to enter general availability next year after completing further reinforcement learning from human feedback, and other safety checks.

Gemini Ultra’s exact model size was not specifically disclosed in Google DeepMind’s introductory paper for the LLM. However, a Bard query has drawn speculation that Gemini Ultra boasts as many as 1.56 trillion parameters. This compares to 340 billion parameters in training PaLM 2 and about 1.7 trillion parameters in GPT-4. If it is true that Gemini Ultra is smaller than GPT-4, then its outperformance on key standard industry benchmarks highlights efficiency gains in completing sophisticated tasks.

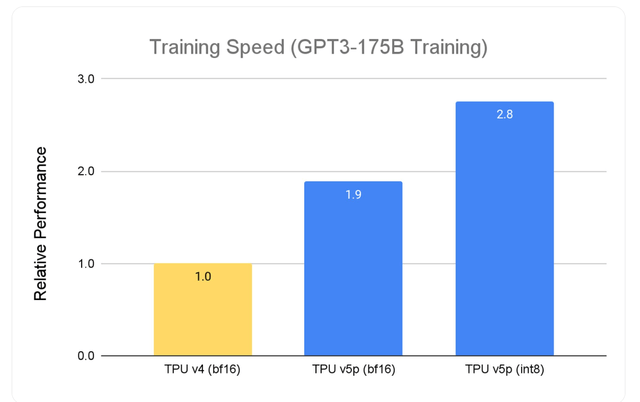

Gemini Ultra is designed for “highly-complex tasks,” with industry-leading efficiency realized through optimized scalability running on in-house developed Tensor Processor Unit (“TPUs”) accelerators. Specifically the Gemini models were trained using “TPU v5e” and “TPU v4” accelerators, which lays the foundation for Google’s latest “TPU v5p” optimized for AI workloads. TPU v5p is capable of as much as 2.8x faster training speeds on large LLMs compared to its predecessors. With Gemini Ultra still in limited access for developers and enterprise customers, we would not be surprised of incremental efficiency gains in the works with training on the latest TPU v5p.

Gemini’s Anticipated Financial Implications

Gemini’s efficiencies over PaLM 2 and rival offerings make it a key appeal to the cost-conscious enterprise cloud spending segment. As repeatedly discussed in our tech coverages, optimization remains a structural theme in enterprise cloud. By offering different-sized Gemini variants optimized for wide-ranging use cases, Google effectively addresses the TCO and performance considerations underpinning enterprise spending decisions. Users can flexibly scale up / down across the Gemini portfolio based on their respective needs and budgets.

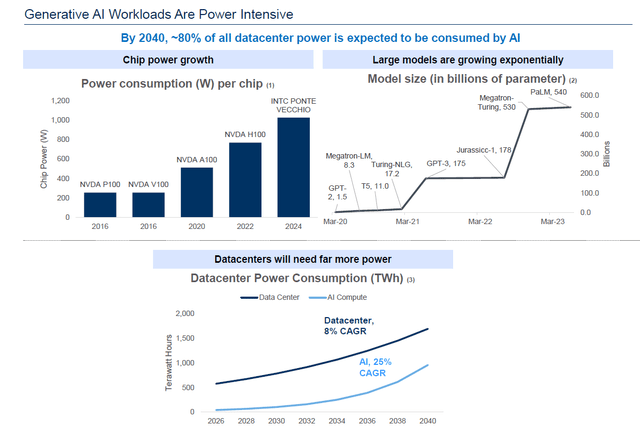

As discussed in the earlier section, many large models with billions to trillions of parameters remain oversized and undertrained. And as the technology becomes more familiar across the industry, enterprise customers are becoming increasingly interested in “somewhat smaller, more cost-efficient models” that can better fit their needs. Current market estimates show that AI workloads are on average 5x more expensive to run than traditional cloud workloads. This is due to their higher demand for compute power and, inadvertently, energy requirements. Specifically, power consumption from AI workloads is expected to rise at a 25% CAGR over the next two decades. It is expected to account for about 80% of data center power consumption by 2040, despite anticipated efficiency gains realized over time from technology and hardware improvements.

The combination of different model sizes, a competitive pricing strategy, and optimal training costs enabled by TPUs effectively targets the margin implications of generative AI adoption. Gemini’s attractive unit economics offered for both Google and prospective users is value accretive in our opinion.

Gemini PR Disaster Limits Confidence

Google’s blog post for Gemini’s launch was encouraging as it highlights two key value propositions that differentiates it from currently available LLMs. They are Gemini’s extended multimodality to audio and videos, as well as its optimization aspect realized through the three model sizes.

Gemini-powered Bard also validates the latest LLM’s performance gains over its predecessor and rival offerings. The free chatbot is trained on real-time data, which helps enhance accuracy of responses. This compares to ChatGPT-3.5, which is limited to information up to early 2022. It also much better reasoning and planning capabilities when compared to old Bard and ChatGPT, with a pinch of extra wittiness. This is a plus for acquiring and retaining day-to-day users’ interest on the platform. Bard engagement remains Google’s key gateway to raising awareness for its generative AI capabilities. It is also a crucial gauge for whether the future of Google’s core search advertising business can survive competition from AI-enabled competitors like Bing.

But the latest PR disaster over Google’s controversial demo for Gemini sets back confidence in how the LLM can immediately differentiate itself from currently available models. As discussed earlier, Gemini Pro-powered Bard has only demonstrated slight outperformance to its predecessor and industry’s most commonly used ChatGPT. While the latest demo shows audio responses, Bard has been limited to text output for now. The conversational tool also requires much more detailed prompts and generates much longer responses, which diverges from the quick, comprehensive and concise responses portrayed in the pre-recorded demo.

Admittedly, Google has included a disclosure that the demo has been edited and sped up, and is not a reflection of how Gemini is really put to work right now. Following the emergence of discrepancies raised by Google staffers online, the company has clarified that the demo shows “real outputs” from Gemini, despite being edited to better convey its capabilities. The company has also released Gemini Pro Vision in preview to enable limited developers’ access to the model’s imagery capabilities. The debacle highlights that the marketing factor to Gemini’s launch has been overdone. It has essential backfired by dimming investors and users’ confidence in the extent of which Gemini can immediately outcompete its peers and help Google reclaim its leadership in AI.

It is hard to not draw a comparison with Baidu’s (BIDU) disappointing pre-recorded demo of its Earnie chatbot that debuted earlier this year. Although Google had included a disclaimer to Gemini’s demoed use cases, concerns over discrepancies to its actual capabilities raised by internal staffers creates angst over how exactly its AI expertise has progressed.

It also puts Google’s continued struggles in catching up with rival Microsoft – which benefits from having OpenAI under its belt – back into the spotlight. In summary, we think Gemini’s launch has left investors both impressed and worried at the same time. Although Google has since rolled out Gemini Pro Vision in preview to assuage concerns on Gemini’s imagery capabilities demonstrated in the demo, they remain inaccessible to Bard users. This means the attractive prospects of being able to simply snap a picture of an unsolved problem to gauge guidance and a solution from Bard remains out of reach.

For example, in a video demonstration, Google showed off how a parent could help with a child’s homework by uploading an image of a math problem along with a photo of attempts to solve it on a worksheet. “Not only can Gemini solve these problems,” said Taylor Applebaum, a Google software engineer, in the demo, “It can read the answers and understand what was right and what was wrong, and explain the concepts that need more clarification.”

Source: Bloomberg News.

This is a mishap in our opinion, as drawing interest from the day-to-day Bard user is critical validation for Google’s AI expertise. As Intel (INTC) has recently noted – “A few people create models – lots of people use them.” Increased usage from end users will be critical to catapulting Google ahead of Microsoft in the AI race as well, as it would encourage adoption.

But Gemini’s “wow factor” remains overshadowed by recent concerns over its immediately available use cases to end users for now. It will likely be a while until Gemini’s multimodal advantage can be materialized into incremental usage to Bard and Google. Although Gemini’s capabilities look promising, the over hyped debut and delayed deployment of relevant use cases will likely put investors back into the sidelines. Paired with the stock’s AI-driven uplift this year, we see limited upside potential in the near-term. There is still an adverse perception that Google remains in “catch up” mode to Microsoft. Investors will likely wait for proof on Gemini’s technological lead, including its direct impact on margin-accretive ad and cloud revenue growth.

Valuation Update

2023 for Google can be summarized as a year of “catching up” to rival Microsoft’s AI expertise. Despite stabilizing growth in Google’s core advertising business, and expanding margins at Google Cloud, none have quite made as much of an impact on the stock as updates to its AI progress.

Specifically, the focus remains on the widening gap between Google Cloud and Microsoft’s Azure growth profile, and, inadvertently, their trading multiples. Microsoft grew Azure revenues in the September-quarter by 29% y/y, outpacing consensus estimates of 26.2%. Meanwhile, Google Cloud grew its revenue by 22% y/y over the same period, representing its slowest since 1Q21 and trailing the consensus estimate of 26% y/y.

Microsoft had also guided a two-point contribution from AI services to anticipated Azure growth in the current quarter. This translates to an estimated $1 billion in incremental annual recurring revenue, as we had previously discussed. The two-point contribution from AI services on Azure’s estimated growth in the current quarter expands from the one-point contribution in the June-quarter. And this progress had been a key driver to Microsoft’s valuation re-rate this year. The upsurge is a clear reflection of a combined impact from the incremental AI premium awarded by investors, as well as a fundamental growth-driven multiple expansion.

The situation underscores heightened urgency for Google to get its AI efforts right. In addition to preserving search engagement critical to its advertising business, Google’s AI progress is also a gauge to its prospective share gains in the expanding cloud market. Specifically, Gemini monetization will likely come primarily from Google Cloud, particularly on demand for Google Cloud Platform (“GCP”) services. This is also in line with the boost in Microsoft Azure’s growth driven primarily by burgeoning demand for AI services in recent quarters.

Brett Iversen, Microsoft’s vice president for investor relations, said much of the quarterly sales growth came from customers rekindling their use of Microsoft’s cloud in anticipation of using AI services.

“What AI is doing … is opening up either new conversations or extending existing conversations or getting us back in touch with customers that we maybe weren’t doing as much with,” Iversen told Reuters.

Source: Reuters News.

Meanwhile, direct monetization from the internal integration of Gemini through products like Google Workspace and potential Bard subscriptions in the future will likely be comparatively nominal. Gemini’s value for Google’s non-GCP products is expected to come primarily from indirect contributions, such as user engagement required for ad revenues.

Sensitivity Analysis

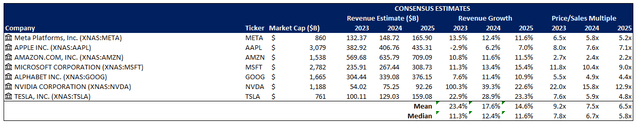

To gauge the potential impact of Gemini’s development on the Google stock, we have performed a sensitivity analysis that considers a valuation uplift driven by an incremental AI premium. The extent of the premium is determined based on Google’s growth prospects previously discussed (see more here and fundamental forecast attached) on a relative basis to its Magnificent Seven peers.

Google_-_Base_Case_Fundamental_Forecast.pdf

AI has been the biggest driver of market’s valuations gains this year. It has even benefitted names that have yet to show direct monetization of the technology. This accordingly highlights the pricing of an AI premium to valuation multiples across the board, attributable to investors’ lofty expectations. We believe the multiple-based sensitivity analysis is a proper reflection of the potential AI premium attributable to Google’s AI prospects when it proves it can get Gemini right.

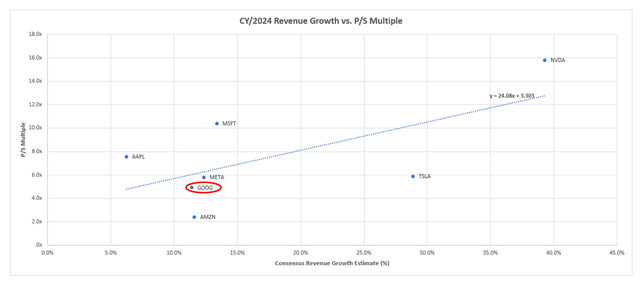

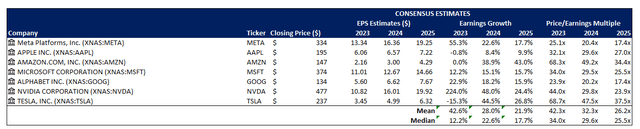

The Magnificent Seven stocks, which includes Google, has been one of the driving cohort’s to market’s AI rally this year. The group currently trades at about 7.5x estimated 2024 sales on average. This compares to Google’s 4.9x:

Data from Seeking Alpha Data from Seeking Alpha

And while the group is trading at an eyewatering 32.3x estimated earnings, Google is trading 20.2x. The S&P 500 is trading at about 21x estimated earnings:

Data from Seeking Alpha Data from Seeking Alpha

In order to gauge the extent of which Google could benefit from an incremental AI valuation premium with the rolling deployment of Gemini solutions, we consider the blended results from the following three multiple-based valuation approaches:

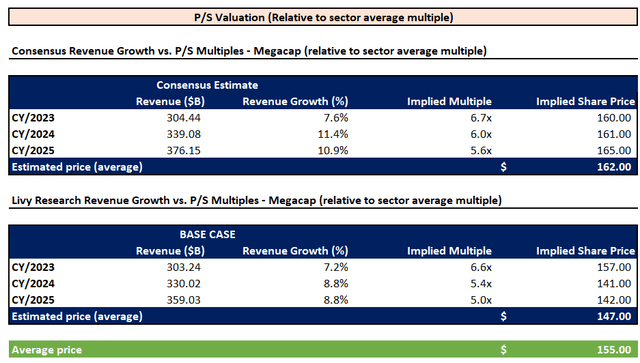

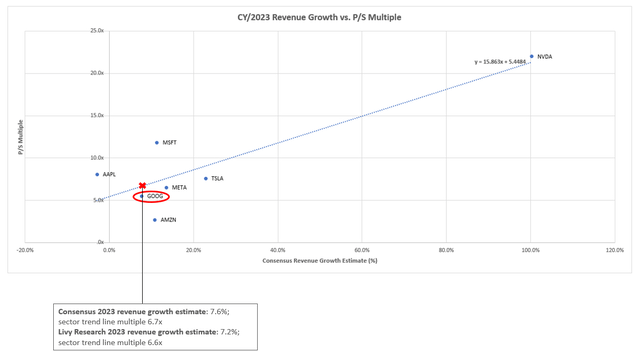

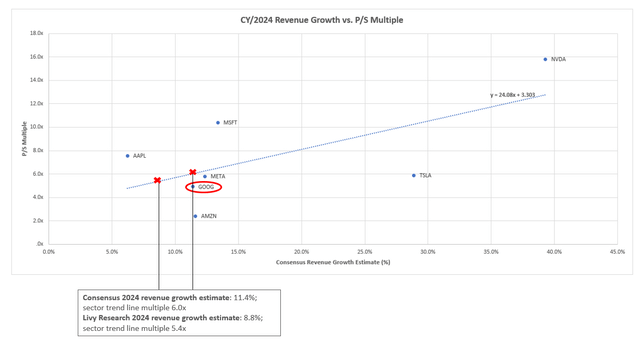

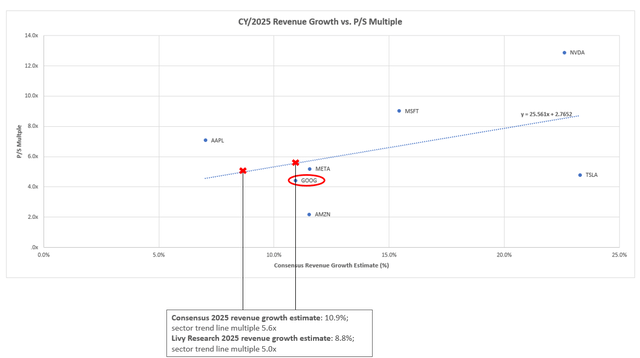

i. P/S multiple-based valuation approach on a relative basis to the sector average

Under this approach, we consider the sector trendline on P/S multiples relative to growth observed across the Magnificent Seven peer group through 2025.

Data from Seeking Alpha Data from Seeking Alpha Data from Seeking Alpha

The P/S multiple on the trendline that coincides with our base case growth estimates for Google through 2025 is applied to the respective year’s base case revenue projection. The same exercise is done on consensus estimates. The blended average yields an estimated price of $155.

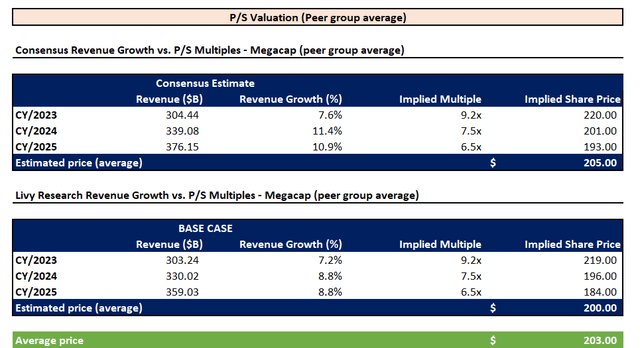

ii. P/S multiple-based valuation approach based on Magnificent Seven average

Under this approach, we have applied the average forward P/S ratio through 2025 observed on the Magnificent Seven peer group on our base case revenue projections for Google. We believe Google should be at least worthy of this multiple when Gemini capabilities fully materialize. The company remains a key participant in ongoing industry AI developments, despite its trailing monetization capabilities at the moment relative to AI beneficiaries like Microsoft and Nvidia (NVDA). The blended average yields an estimated price of $203

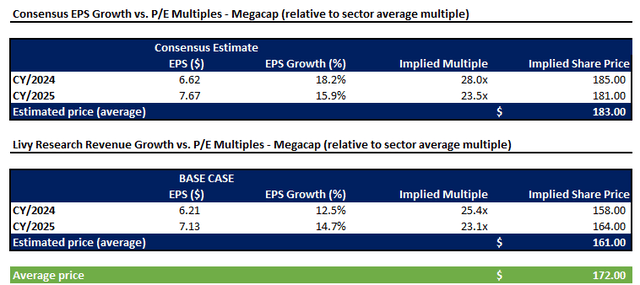

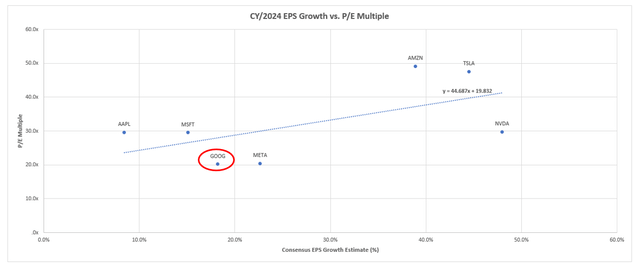

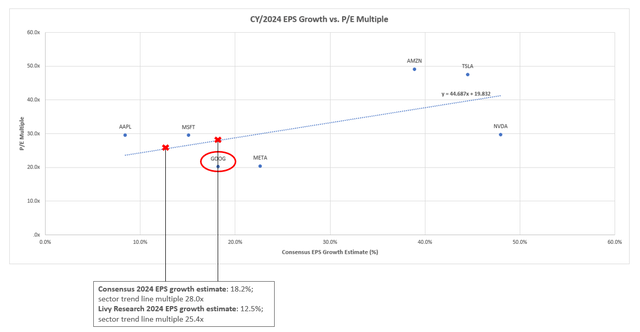

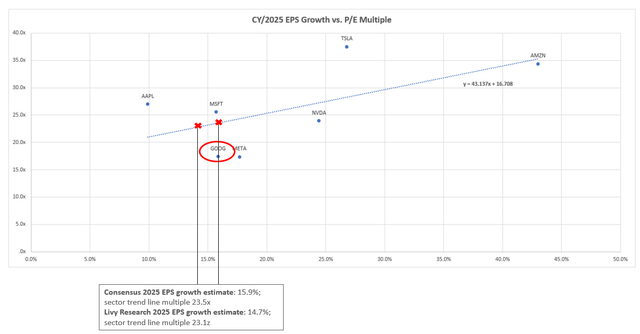

iii. P/E multiple-based approach based on Magnificent Seven average

This approach is similar to the exercise performed in part i. and considers the sector trendline observed on P/E multiples relative to EPS growth observed across the Magnificent Seven peer group through 2025.

Data from Seeking Alpha Data from Seeking Alpha

The P/E multiple on the trendline that coincides with our base case EPS growth estimates for Google through 2025 is applied to the respective year’s base case income projection. The same exercise is done on consensus estimates. The blended average yields an estimated price of $172.

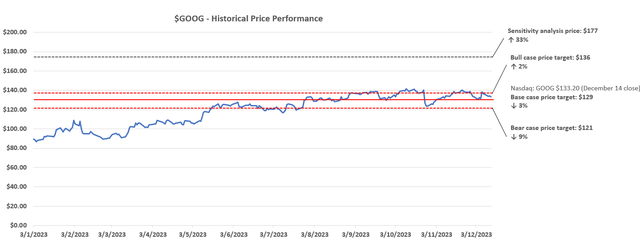

Taken together, the blended average from the sensitivity analysis results yields a price of $177. This would represent upside potential of 33% from the stock’s last traded price of $133.20 on December 14.

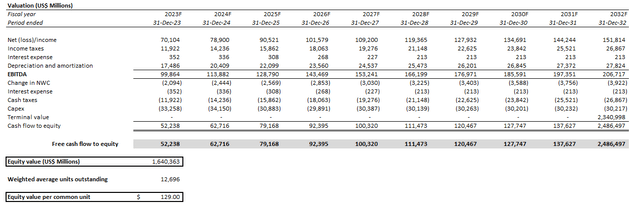

Base Case Analysis

We believe Google’s latest debut of Gemini lessens concerns that rival products will cause major disruption to its growth prospects. However, we are stopping short of underwriting incremental growth in the near-term from the technology’s debut, nor any substantial AI premium uplift to Google’s trading multiple. This primarily considers uncertainties to the value attributable to Gemini’s differentiating capabilities from currently available multi-modal products like GPT-4 as discussed in the foregoing analysis.

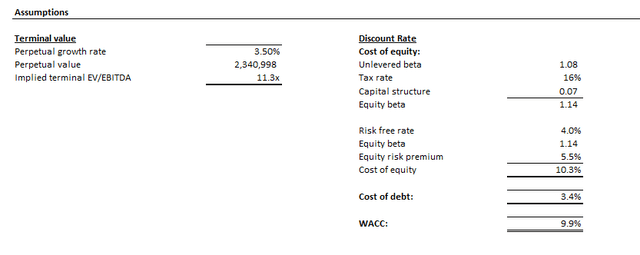

The stock remains fairly priced at the moment in our opinion, considering the company’s growth profile and AI prospects. It will likely be difficult for a sustained valuation re-rate uplift until Gemini (or other potential technologies in the works) can demonstrate a differentiating use case from what is currently available. Instead, we are revising the near-term base case price target from the previous $120 to $129 given recent shifts in the macroeconomic backdrop.

Specifically, the change accounts for adjustments to Google’s discount rate from the previous 10.4% to 9.9%. This is primarily to account for the recent drop in the risk-free rate assumption that is benchmarked to 10-year Treasury yield. Our risk-free rate assumption has fallen from the previous 4.5% to 4%, as Treasury rose on the Fed’s latest outlook on monetary policy given easing inflationary pressures. The underlying cash flow projections considered remain unchanged from our previous discussion, as Gemini is not expected to drive substantial incremental growth in the near-term.

The Bottom Line

Admittedly, Gemini’s debut underscores impressive prospects and lessens concerns over the prospects of Google’s AI ambitions. However, the limited technological lead stemming from currently available use cases does little in unlocking incremental value to the stock in the near-term. This leaves Google still in the shadows of Microsoft and OpenAI, with Google Cloud still in the backseat on capturing incremental opportunities from AI-enabled TAM expansion. With limited incremental fundamental contributions anticipated from Gemini, Google stock’s near-term performance will likely remain a function of evolving macroeconomic conditions and prone to broader market volatility.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!