Summary:

- We believe Microsoft remain one of the best large-cap AI plays into 2024.

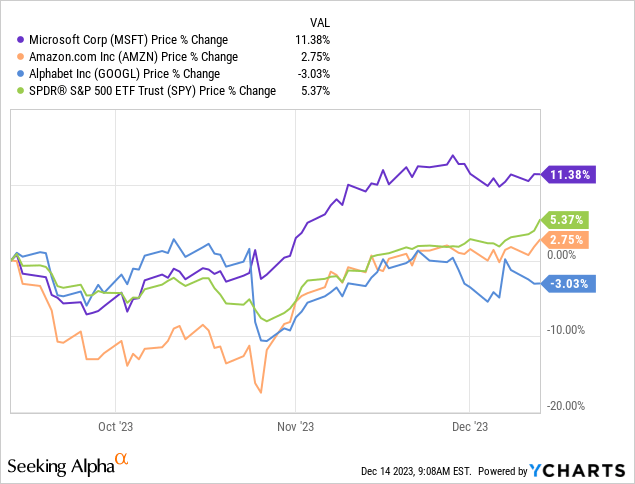

- The stock has clearly outperformed S&P500, AMZN, and GOOGL in the past 3-months.

- We expect outperformance to continue and be driven by AI monetization through Copilot Office 365, growth in its cloud business, and the recovery in the PC client market in 2024.

- We think investors should continue to add to positions as we believe risk-reward remains favorable for the stock.

acilo

We’re reiterating our buy-rating on Microsoft (NASDAQ:MSFT). In our opinion, MSFT remains one of the best large-cap AI plays into next year, largely due to the company’s AI monetization through Copilot Office 365 and first-mover advantage with OpenAI. Management has pushed its position in the AI wars further with the recent introduction of Cobalt, a 64-bit 128-core ARM CPU and 5nm MAIA AI accelerator for LLM and inference; basically, MSFT is building its own custom AI chip to train LLM and its own ARM-based CPU for cloud workloads. We don’t think Cobalt or MAIA will push top-line growth in the near-term, but we believe management’s discipline to show profitable growth through AI increases investor confidence in the stock. MSFT stock outperforms its large-cap competition in the cloud computing space; the following graph outlines MSFT against Amazon (AMZN), Alphabet (GOOGL), and the S&P 500 over the past 3M. MSFT is up roughly 6% since our upgrade to buy in early October. We see more upside potential ahead and think investors should continue to add to their positions as we believe risk-reward remains favorable for the stock.

YCharts

We expect outperformance to be supported by three channels: AI monetization through Copilot Office 365, cloud growth, and recovery in the PC client market in 2024. MSFT’s Copilot will now be incorporated in Word, Excel, and other Office programs with a price tag of $30 per person monthly; we estimate the price tag will materialize into substantial top-line growth for MSFT from enterprise customers. While enterprise spending is still recovering, we think Copilot will enjoy high traction as AI-related IT spend continues to be more resilient. Piper Sandler analysts now estimate that the opportunity could add up to more than $10B in annualized revenue by 2026. We’re also more optimistic about cloud growth as we don’t see any more downward revisions in the data center market. We see more room for Azure growth in 2024 as macro headwinds pressuring enterprise budgets ease. The third catalyst we see playing out in MSFT’s favor is the rebound in the PC client market next year; we estimate the PC TAM to grow 5-8% Y/Y. We think the PC unit sales will increase substantially next year due to an upgrade cycle after the peak during the pandemic. We see a more favorable risk-reward for MSFT into 2024 and recommend investors explore entry points at current levels.

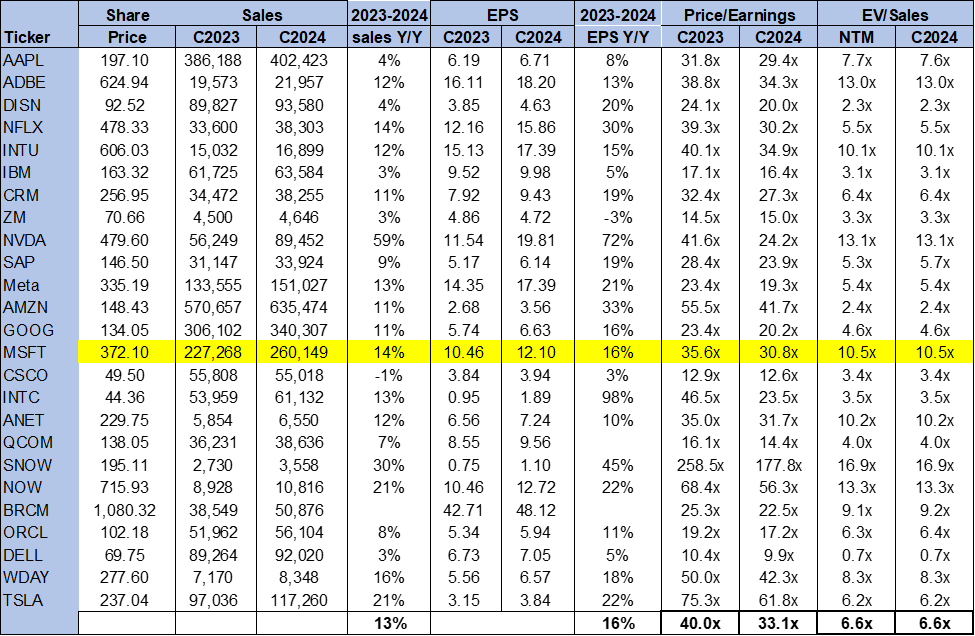

Valuation

The stock is not cheap; we think the premium valuation is justified considering MSFT’s first-mover advantage in the AI market and current capacity to turn a profit through AI. The stock is trading at 10.5x EV/C2024 Sales versus the peer group average of 6.6x. On a P/E basis, the stock is trading at 30.8x C2024 EPS $12.10 compared to the peer group average of 33.1x. We believe MSFT is a growth stock at current levels and see more upside potential for the stock in 2024. The following outlines MSFT’s valuation against the peer group.

TSP

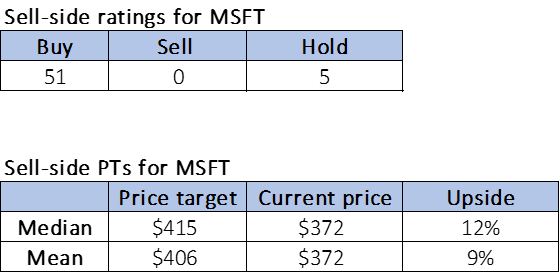

Word on Wall Street

Wall Street is also bullish on the stock. Of the 56 analysts covering the stock, 51 are buy-rated, and the remaining are hold-rated. The stock is currently priced at $372 per share. The median sell-side price target is $415, while the mean is $406, with a potential 9-12% upside.

The following outlines Wall Street’s sentiment on the stock.

TSP

What to do with the stock

MSFT is among the best-positioned names to see an upside supported by AI monetization through 2024, in our opinion. We think the company is better positioned to outperform due to the rebound in IT spending as the enterprise optimization cycle completes; we see improved growth for Azure as cloud capex expands and demand tailwinds from the PC TAM 2024 Y/Y growth rebounds. We recommend investors explore entry points into the stock at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.