Summary:

- Microsoft’s stock has gained 55% since last year, but the risk/reward is no longer compelling due to stretched valuations.

- In a positive economic scenario, I see investment flows rotating into the rest of the markets given stark valuation differences between the “Magnificent 7” and the “SPX 493”

- In the event of an economic slowdown or a recession, Microsoft’s shares could suffer a sharp drawdown as it fails to live up to near-term double-digit growth forecasts.

Denis Linine/iStock Editorial via Getty Images

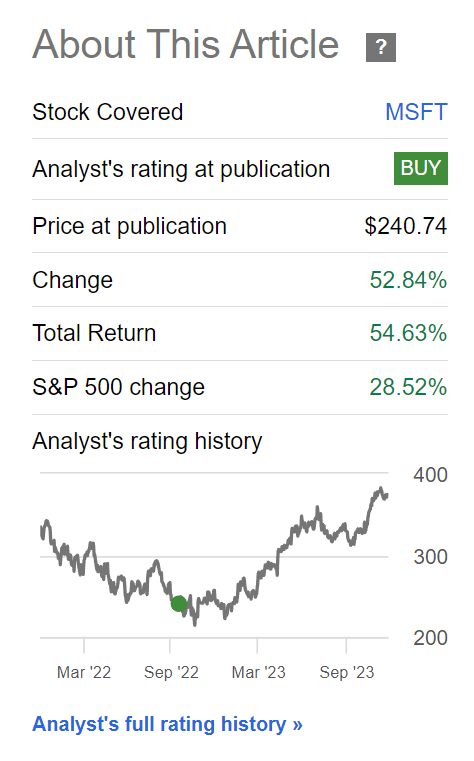

Let me preface this article by saying I believe Microsoft (NASDAQ:MSFT) is a fantastic company. Last year, during the depths of the 2022 bear market, I wrote a bullish article on Microsoft, calling it the best positioned of the technology mega-caps, due to its stranglehold on mission-critical business workloads. Since my article, Microsoft shares have gained 55%, making it one of the strongest performers in the markets (Figure 1).

Figure 1 – MSFT has bounced by over 50% (Seeking Alpha)

However, with the stock rebounding by over 50% to new all-time highs, I no longer believe the risk/reward to owning Microsoft shares are compelling relative to other opportunities in the marketplace.

Valuations Stretched Relative To History

I have three main concerns regarding Microsoft. First, when I wrote my article last October, Microsoft was trading at 23x Fwd P/E multiple, elevated, but reasonable given the company’s premium 37% net margin and low double-digit long-term growth rate.

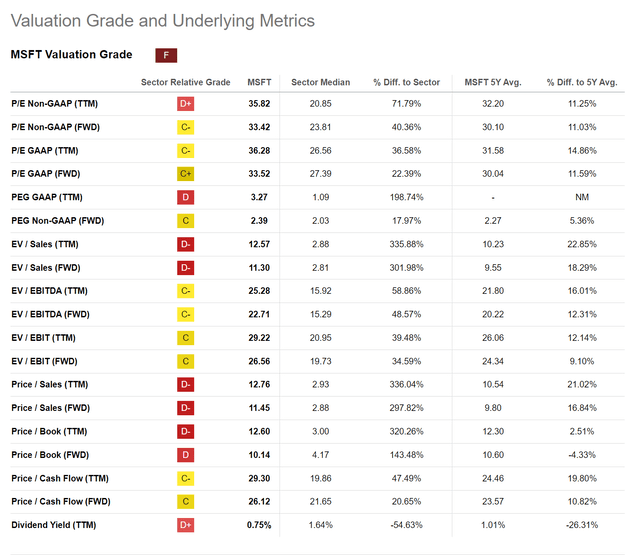

However, today, Microsoft is trading at an elevated Fwd P/E multiple of 33.4x. On price-to-sales, Microsoft is trading at a Fwd P/S multiple of 11.5x (Figure 2).

Figure 2 – MSFT has an elevated valuation multiple (Seeking Alpha)

In fact, if we look at trailing price-to-sales ratios, Microsoft is trading at an elevated 12.8x, the highest level since the dot-com bubble and late 2021, before last year’s sharp drawdown (Figure 3).

Figure 3 – Historical P/S ratio for MSFT (Seeking Alpha)

One of the best lessons I personally learned from the dot-com bubble was that valuations do matter, especially at market extremes. For example, we have this famous quote from Scott McNealy, the former CEO of Sun Microsystems (“SUNW”):

“…2 years ago we were selling at 10 times revenues when we were at $64. At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes, with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

Is Everything Priced In?

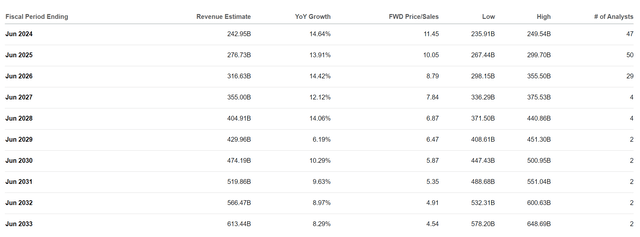

Whenever I see stocks trade above 10x revenues, I get nervous, as virtually everything that can go right has been priced in. For example, in Microsoft’s case, analysts and investors have fully baked in mass adoption of AI-technologies into Microsoft’s products, with revenues expected to rise 150% to $613 billion over the next decade (Figure 4).

Figure 4 – Analysts have aggressive growth priced into Microsoft shares (Seeking Alpha)

While AI is transformational, like how the internet was to businesses back in the early 2000s, assuming AI will be purely additive to Microsoft’s business seems a bit naive. If AI starts to replace white-collar jobs, as many pundits predict, will that not decrease the number of Office 365 subscriptions?

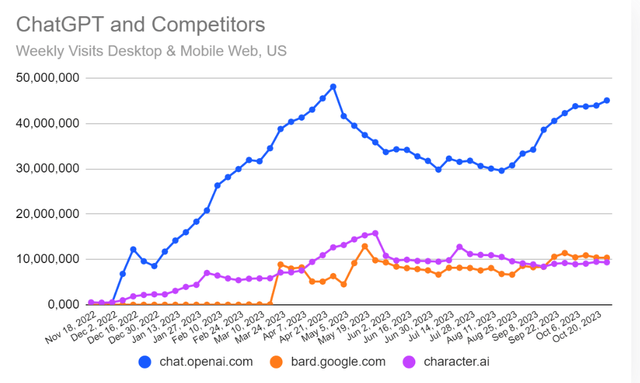

Furthermore, while OpenAI’s ChatGPT application saw a meteoric rise in adoption earlier in the year, we have actually seen usage plateau since April, suggesting that once the novelty wore off, many consumers went back to their non-AI lives (Figure 5).

Figure 5 – Usage of ChatGPT has plateaued (similarweb.com)

Microsoft May Underperform In A Soft-Landing Scenario

In addition to Microsoft’s elevated valuations, I also see two binary macro scenarios that could be negative for Microsoft. First, investors seem to have fully bought into the Federal Reserve’s ‘soft landing’ narrative, with inflation moderating and economic growth stable. This has allowed the Federal Reserve to start contemplating the end of the interest rate hiking cycle and potential rate cuts in 2024.

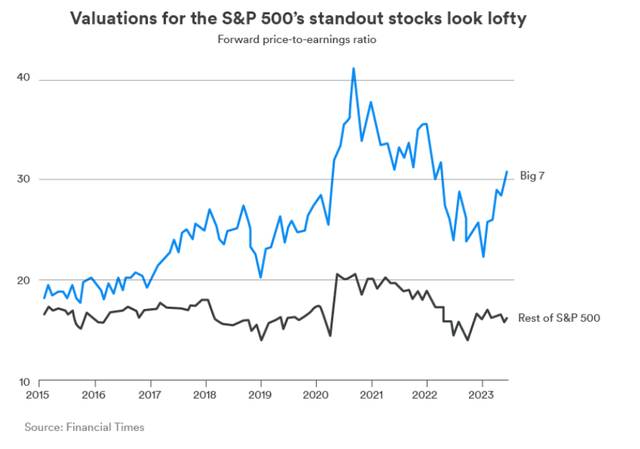

If 2024 is going to be the year of the ‘soft landing’, then investors may be better off switching out of the expensive ‘Magnificent 7’ stocks, which trade at an average 30x Fwd P/E multiple, and into the rest of the S&P 500, which are trading at only ~15x Fwd P/E (Figure 6).

Figure 6 – Magnificent 7 are expensive compared to rest of the market (Financial Times)

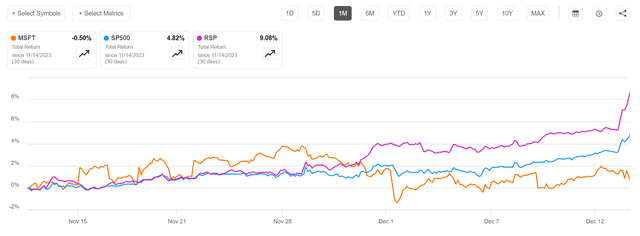

In fact, we are starting to see that happen in the last few weeks, as Microsoft shares have stalled while the S&P 500 Index has continued to rally. The difference is even more stark if we compare MSFT against the Invesco S&P 500 Equal Weight ETF (RSP), which has rallied over 9% in the past month (Figure 7).

Figure 7 – MSFT stalling while rest of markets catch up (Seeking Alpha)

If the Federal Reserve is finished with interest rate hikes and the economy achieves a ‘soft landing’, there is much better value to be had in the rest of the markets outside of the ‘Magnificent 7’.

What Happens To Microsoft In A Recession?

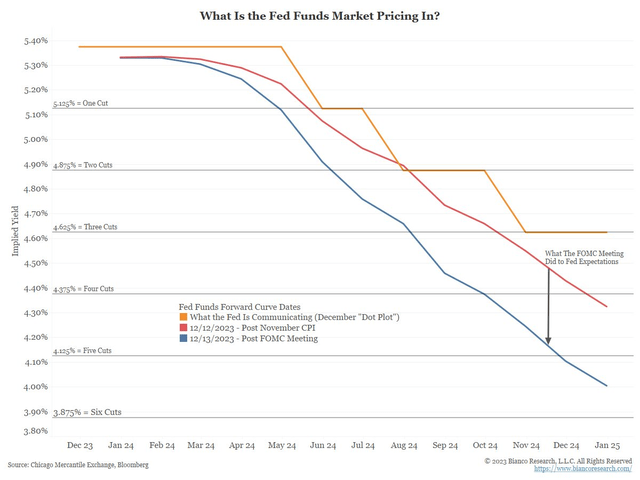

On the other hand, an argument can also be made that the market has gotten ahead of itself with its expectations for a rapid cut in interest rates. While the Federal Reserve have penciled in 75 bps of interest rate cuts in its latest Summary of Economic Projections (“SEP”), investors have gone ahead and priced in 150 bps of interest rate cuts (Figure 8),

Figure 8 – Investors have priced in too many rate cuts (Bianco Research)

This appears far too aggressive given the expectation for a ‘soft landing’. For the Federal Reserve to cut 150 bps in 2024, the economy will have to slow materially, perhaps even hit a ‘hard landing’ (i.e. recession).

A recession is not as far-fetched as one might think. Given the ‘long and variable’ lags in monetary policies, the Fed’s interest rate hikes from earlier this year could still be filtering through the economy.

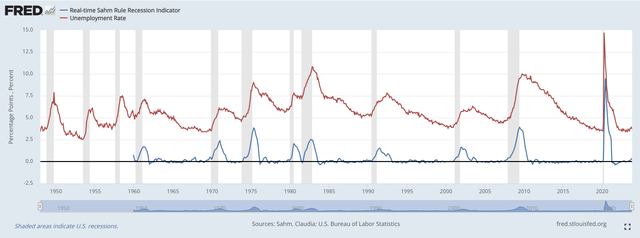

According to the Sahm Rule (named after Fed economist Claudia Sahm), a recession begins when the three-month moving average of the unemployment rate rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months. In real time, we are currently at 0.30 (Figure 9).

Figure 9 – Real time monitoring of Sahm Rule (St. Louis Fed)

If unemployment perks up a few more percentage points in the coming months, then the U.S. economy could already be in a recession.

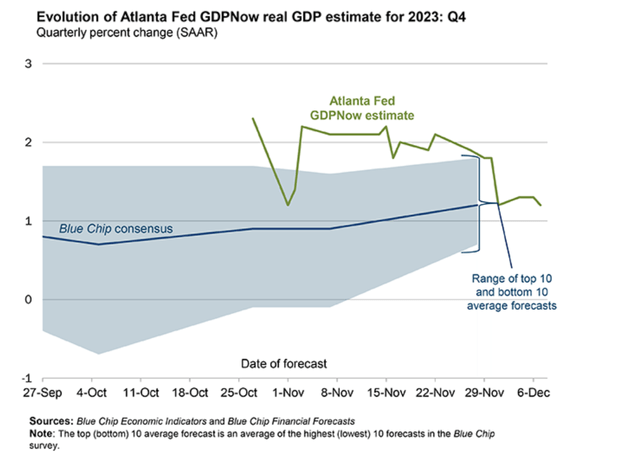

The Atlanta Fed’s GDPNow indicator certainly seems to think the U.S. economy is slowing, as it is projecting Q4 GDP growth of just 1.2%, down significantly from the Q3 official growth rate of 5.2% (Figure 10).

Figure 10 – GDPNow sees growth slowing significantly (Atlanta Fed)

What will happen to Microsoft in a recession scenario?

Given Microsoft’s elevated valuation, I believe the shares could suffer a sharp drawdown in the event of an economic slowdown and the company cannot deliver on investors’ expectations for strong near-term growth.

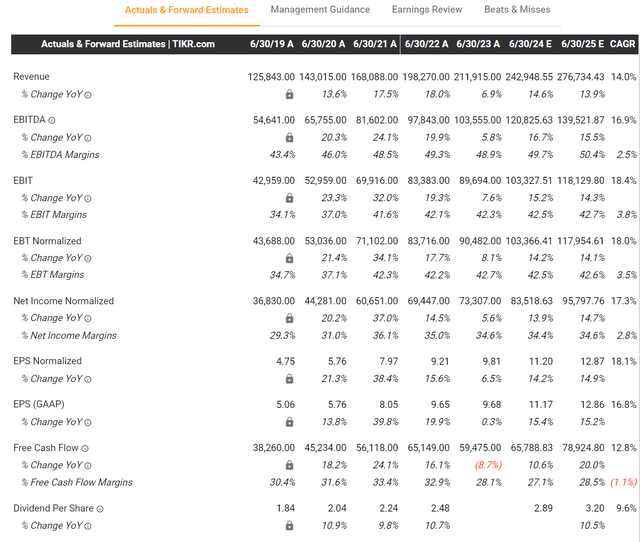

Currently, Wall Street is expecting Microsoft to grow revenues at 15% and 14% for F2024 and F2025, respectively (Figure 11).

Figure 11 – MSFT Wall Street estimates (tikr.com)

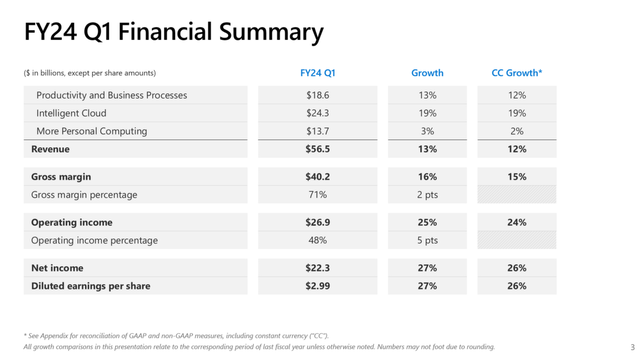

This is in line with what Microsoft delivered recently in Q1/F24, with 13% YoY growth (Figure 12).

Figure 12 – MSFT delivered 13% growth in Q1/F24 (MSFT investor presentation)

However, if these growth rates were to slip, for example towards F2023 growth rates in the mid-single-digits (“MSD”), then I believe Microsoft’s premium valuation multiple may have to compress. Don’t forget, Microsoft slipped to 23x Fwd P/E when its growth rate slowed to MSD in 2022.

Conclusion

After a fantastic year for Microsoft, I believe it is now time to take profits given the company’s elevated multiples.

I see two possible scenarios for the economy, neither of which is positive for Microsoft. On the one hand, the consensus view right now is for a ‘soft landing’. However, if a soft landing is achieved, then I believe investment flows will rotate out of the ‘Magnificent 7’ and into the 493 other members of the S&P 500 Index, given the stark valuation differences between the 7 leading stocks and the rest of the markets.

On the other hand, if the economy suffers a ‘hard landing’, I believe there is significant downside to Microsoft shares, as it is currently priced for perfection. A return to 2022’s 23x Fwd P/E could see 30%+ downside in Microsoft shares.

I am downgrading my opinion of Microsoft to a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.