Summary:

- I have been giving Bank of America stock positive coverage all year long due to the opportunities presented by the Spring banking crisis and subsequent treasury yield panic.

- Unfortunately Bank of America has rallied 28% off the lows and is no longer all that cheap.

- Fortunately the company’s preferred shares yield 6.24% so that’s an alternative for those who don’t see Bank of America rising much further.

- In this article I explain why Bank of America’s preferreds may be a better value than its common stock.

Brian Moynihan Drew Angerer

Bank of America (NYSE:BAC) is a stock I’ve had some great experiences with lately. I bought it heavily during the Spring 2023 banking crisis, then again during the treasury yield panic, eventually making the stock the biggest holding in my portfolio. I thought it was a good buy because it was cheap and because I believed the unrealized losses on its balance sheet were not as big a problem as many people thought. I did not specifically foresee this week’s monster rally brought on by falling treasury yields, but I figured that significant price appreciation would occur eventually.

Despite my enthusiasm for Bank of America, its common stock is now getting a bit expensive–both in terms of valuation and in terms of historical prices. It is near a 52-week high, and is now decisively trading above book value. I say ‘decisive’ because Bank of America’s previous sub-book value status was questionable; its price/book ratio was below one, but it wouldn’t have been below one had the company’s HTM bonds been valued at market prices instead of accounting values. For these reasons I’ve considered trimming my exposure to Bank of America, although I probably won’t exit the position altogether.

Author’s X post (The author/X.com)

With that said, I think that those considering taking positions in Bank of America ought to consider the 7.5% Preferred Shares (BAC.PR.L), which presently yield 6.02%. There has been some talk lately about using these preferreds as a way to bet on the Fed cutting rates. I personally have not bought the shares for this purpose; my opinion on them is about equally as positive as my opinion on the common stock. However, I think the idea of holding BAC.PR.L as a bet on rate cuts is a good one, because it has enough yield that it could deliver an ‘OK’ total return even if the rate cuts do not materialize.

When I last wrote about Bank of America I rated the common stock ‘buy’ because I thought the stock was cheap enough and had enough yield to be worth the investment. I thought the concerns about the stock’s treasury bond losses were overblown because the bank had enough liquidity even after adjusting the treasuries to fair value to pay off some 50% of depositors. Its liquidity coverage ratio was 116% as of the most recent earnings release, which is 16% higher than the regulatory requirement.

So, Bank of America was cheap back when the banking crisis was underway, even though it was not as risky as most people thought it was. It was a good time to be accumulating the common stock. The problem is that BAC today is not nearly as cheap. It’s for this reason that I think the series L preferred shares are an intriguing buy idea. I’m not sure that they will necessarily perform “better” than the common stock going forward, but they do offer a high yield and a conversion option that makes sense to exercise if BAC goes above $60. I do not see Bank of America’s common stock hitting that price in the near future, but in five or 10 years? Stranger things have happened.

In this article I make the case that Bank of America’s Series L preferreds are a good buy today. They at minimum provide a relatively safe stream of dividend income and a 6% yield, they may provide a capital gain if interest rates decline, and the conversion option may be worth exercising in the distant future. These features make BAC.PR.L an attractive security.

Bank of America – Overall Thesis

Before getting into the characteristics of BAC.PR.L, it makes sense to review Bank of America as a company first. The company’s balance sheet and profitability are applicable to understanding the preferred shares as well as the common shares. The growth rates are mostly not applicable because BAC.PR.L pays a fixed dividend. A hypothetical “valuation” of the stock’s conversion option can be performed by calculating multiples for BAC assuming a $60 stock price.

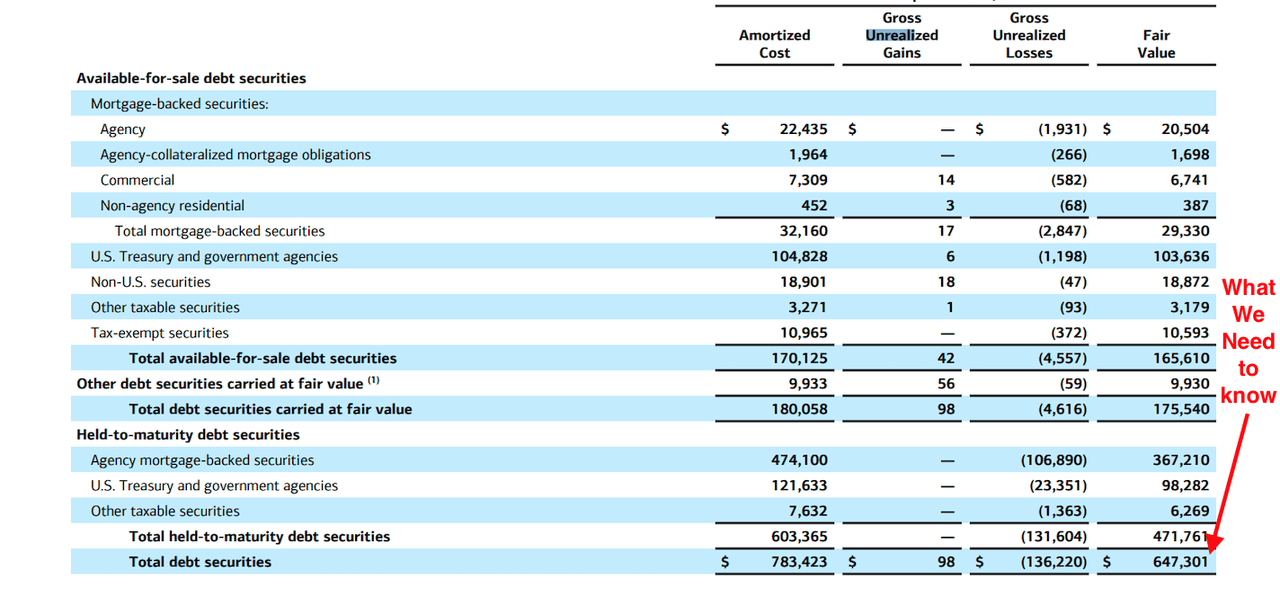

First, let’s look at the balance sheet. Bank of America has $287 million in total equity–the price/book ratio for the common stock is usually calculated with common equity, so this is an important point. The company has $690 million in long term debt, giving a 2.4 debt/equity ratio. This is extremely high, but investors generally expect financials to be highly leveraged, as deposits are needed to finance their loans. Speaking of which, Bank of America has $1.88 trillion in deposits. If you count those as ‘debts,’ the debt/equity ratio balloons to around 10, although most analysts don’t count banks’ deposits as debts. More significantly, these deposits tell you bank’s liquidity requirements. Bank of America self reports a liquidity coverage ratio of 116%. A cruder approximation of liquidity coverage can be calculated by simply dividing highly liquid assets by deposits. At fair value, BAC has $647 billion in securities, as well as $351 billion in cash. So, BAC’s highly liquid assets cover 53% of its deposits.

Bank of America investments (Bank of America)

Next up, we have profitability. In its most recent quarter, Bank of America delivered $25.2 billion in revenue, $7.8 billion in net income, and $9.3 billion in pre-tax, pre-provision income (this is roughly equivalent to EBIT for a non-financial company). These figures give us a 31% net margin and a 37% “EBIT” margin. Both are very good. The bank self-reports its return on equity (“ROE”) and return on tangible equity as 11.9% and 15.5% respectively. These are also quite good. Like the price/book ratio, these measures rise if you measure equity with the market value of the bonds instead of the book value.

Finally, we have the valuation. As mentioned previously, BAC.PR.L does not have meaningful “multiples” because it’s a fixed income instrument that is really more similar to a bond than a common stock. Its value is the dividends it can pay. I had a “hypothetical valuation” of Bank of America at $60 per share–the conversion price plus a $10 premium to reflect BAC.PR.L trading 20% above par–in my previous article on the topic. To update those multiples for today: BAC would be trading at five times sales, 16.71 times earnings, and 1.83 times book value if it went to $60. This is not a ‘valuation’ of the preferred shares but it does give you a hint at what kinds of earnings Bank of America has to put out to get to a price where it’s worth converting. If today’s earnings multiple doesn’t change then Bank of America has to grow its earnings 67.1% before converting BAC.PR.L to BAC becomes profitable.

Valuing BAC.PR.L with discounted cash flows is pretty easy. As a bond-like instrument that pays the same dividend in perpetuity, we simply discount the stock’s dividend under a 0% growth assumption. Discounted at 6%–the current 10 year treasury yield plus a 2% risk premium–BAC.PR.L is worth $1,208. If treasury yields fall to 3%, then with the same risk premium, the stock is worth $1,450. So, it is worth buying at today’s price of $1,200. The dividends are worth that price on their own, and we could see a 21% capital gain if the 10 year treasury yield comes down a point. On the 2% risk premium: I think using a small risk premium is warranted here because preferred share dividends get paid before common share dividends. Bank of America would have to get in very serious trouble for its preferred dividends to not be paid.

BAC.PR.L Characteristics

Having shared what I think about Bank of America on the whole, it’s time to look at the characteristics of the preferred shares specifically:

-

They are non-cumulative. This is theoretically a negative because Bank of America’s management could legally ‘get away’ with not paying the dividend. However, as mentioned previously, the bank is profitable enough that this isn’t likely to happen. BAC common shares paid dividends all through the 2020 COVID recession and the Spring 2023 banking crisis; a cut to the preferred dividends seems unlikely given today’s relatively buoyant economy.

-

They are convertible, and can be converted at any time. This option is a positive for shareholders but the current stock price does not justify actually exercising it.

-

They pay a $72.50 dividend. This income stream is worth buying today given a 6% discount rate, and a complete no-brainer if you think interest rates will come down 1%.

-

They are not callable. This is a positive for shareholders because it means that the bank can’t just “buy” your shares without your consent. The bank does reserve the right to convert its preferred stock to common stock en masse if the latter goes to $65. This is a negative because it takes rights away from you as a shareholder.

As you can see, BAC.PR.L has an attractive conversion option and pays a dividend that is unlikely to be eliminated or reduced. It’s a decent security. You do need to watch out for the risk of Bank of America’s management converting the preferreds to common stock en masse. That can happen if the common stock rises to be 30% higher than the conversion price. Apart from that, Bank of America’s profitability and financial strength make its high yield preferred shares worth buying.

The Bottom Line

The bottom line on Bank of America’s 6% yielding preferred shares is that they are a worthy alternative to the common stock today. They have a high yield, and the dividends when discounted at 6% are worth slightly more than the current stock price. If you buy BAC.PR.L, you’ll probably do well. I’d gladly buy some myself if I didn’t have other things to invest in.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.