Summary:

- MO stock is very popular among income investors due to its 9.5% yield and Dividend King status.

- However, I do not think it is worth buying right now.

- I explain my less-than-bullish outlook on MO stock in this article, and share two alternatives with similar yields that offer much more promising long-term prospects.

JamesBrey

Altria (NYSE:MO) is a very popular high-yield stock for many investors – especially retirees – given its very lucrative dividend yield, impressive dividend growth track record, and defensive wide moat core business segment. That being said, MO is currently dealing with mounting growth headwinds and faces the prospect of suffering a significant long-term decline in its business model. Historically, MO’s success has been anchored in its dominant position in the U.S. tobacco market, particularly through its flagship Marlboro brand. However, this once-reliable and highly profitable business is increasingly being challenged by external and internal factors.

In my view, MO’s primary value comes from the brand power and brand loyalty that came with its Marlboro business. However, this business is in clear decline due to a lack of interest and loyalty from younger demographics. When combined with a valuation that is not compelling enough to offset this risk, I do not see MO stock as a Buy right now despite its big dividend yield. In this article, I will discuss my view on MO stock in greater depth and then share two stocks with similar yields that I believe have much brighter long-term payout sustainability and total return prospects.

Why MO Stock Is Not A Buy

The biggest headwind facing the company is the rapidly shrinking smokable products segment that is being driven by a shift in consumer preferences towards healthier lifestyles and alternative nicotine delivery systems like vaping and heated tobacco. Moreover, stringent regulatory measures (particularly in the United States which is MO’s primary market), such as potential bans on menthol cigarettes and restrictions on advertising, further exacerbate the challenges facing MO.

MO’s challenges have been further compounded by its failed attempts to pursue various strategic initiatives in an attempt to diversify away from its core smokables business. For example, its foray into the vaping market via its acquisition of Juul in hindsight has proven to be a disaster as its investment was made at a rich multiple and was plagued by large write-downs, leading to a significant destruction of shareholder value.

Moreover, MO’s efforts to diversify into the vaping and heated tobacco markets face stiff competition from a plethora of small and medium-sized companies, limiting its ability to take market share and generate attractive profit margins. One of MO’s biggest areas of struggle has been in its efforts to appeal to younger consumers because it is essentially having to start from scratch to win them over. In the past, there was strong brand loyalty to its Marlboro products, but given that cigarettes are increasingly unpopular with younger generations, MO’s brand power is growing increasingly obsolete.

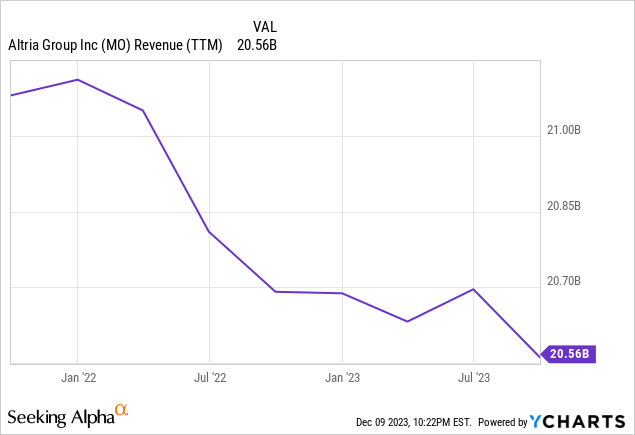

As a result, MO is having to increasingly raise prices on its Marlboro products to maximize profits from its ever-shrinking smokables business and is also buying back stock to prop up earnings per share and keep raising its dividend. However, there is a limit to how much MO can raise its prices and its target consumer pool continues to shrink for these products year after year.

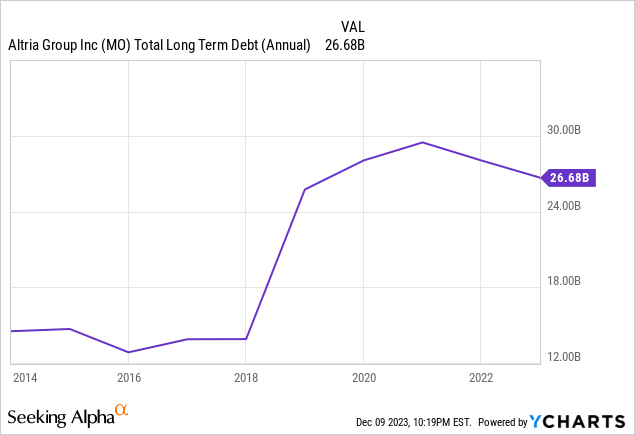

Moreover, MO’s balance sheet remains pretty heavily weighed down with debt that was taken on to finance various strategic initiatives and share repurchases in recent years. However, none of these efforts have meaningfully moved the needle for the company, so now it must deal with its debt – especially with its core business continuing to decline and interest rates have risen – while also continuing to support its substantial dividend payout.

While MO has a very impressive dividend growth track record of growing its dividend for 54 straight years (earning it Dividend King status), its long-term future as a dividend grower is less impressive.

With the company’s revenue declining over the past few years, its debt burden looking quite cumbersome, and the payout ratio expected to come in at ~83% this year, the company is unlikely to be able to grow its dividend even at the same rate as its earnings per share moving forward given that it will likely need to continue leaning on share buybacks and aggressive investment in diversification initiatives to continue growing earnings per share.

This means that – barring a meaningful success in MO’s diversification initiatives – the dividend will likely come under increasing pressure moving forward and we would not be surprised at all to see dividend growth slow to a crawl in the near future and eventually halt completely. Ultimately, if MO is unsuccessful in meaningfully diversifying its business, the dividend will have to be cut.

While the 9.5% NTM dividend yield looks very attractive, and the 8.18x NTM P/E ratio does stand at a discount to its 3-year average of 9.55x and its 5-year average of 9.94x, given that interest rates have meaningfully risen over that period and the increasingly uncertain long-term outlook for the company, we do not find this valuation and even dividend yield to be attractive enough to make us eager to buy the stock here. It could turn out to be a decent long-term investment, but the thesis ultimately comes down to betting on management being able to navigate its debt burden, support its big dividend, and successfully achieve a breakthrough in diversifying its business away from its core smokable products segment. We do not see them being successful at all three simultaneously, and expect that ultimately the dividend will have to be cut. As a result, we are steering clear of MO stock.

Two 9.6%-Yielding SWANs To Buy Instead

That being said, there is some good news for investors looking to buy stocks with 9%+ yields that should be able to support and even grow their distributions over the long term.

The first one we will discuss is MPLX LP (MPLX), an energy midstream partnership whose business model is centered around its strategic positioning in the midstream sector, primarily serving Marathon Petroleum (MPC) refineries. This close relationship with MPC refineries gives MPLX a reliable cash flow profile given that MPC is a strong counterparty that also has a vested interest in MPLX’s success given its large equity ownership in the partnership and the fact that it generates significant cash flow from this investment via MPLX’s distributions. As a result, we expect MPC to work with MPLX to ensure that MPLX’s distribution continues to flow and even grow over the long term.

Another reason to like MPLX is that its infrastructure assets are generally closely located to refineries, creating a higher barrier to entry for potential competitors. MPLX also enjoys decent growth potential via its assets in the Permian Basin and its efforts to develop a significant asset base in the emerging NGL market hub in the Northeastern U.S. Best of all, the vast majority of MPLX’s assets enjoy long-term commodity price and/or volume resistant contracts, making it a stable cash flowing business even during recessions and other macro/energy market shocks. One of the biggest testaments of this was how during the energy market crash and global recession of 2020, MPLX grew its EBITDA by 20% year-over-year and grew its distribution as well. MPLX’s relationship with MPC and its exposure to long-term production assets and NGL growth gives us confidence in its long-term sustainability and growth.

In contrast to MO – which has leveraged up its balance sheet over the past half-decade while spending aggressively in pursuit of growth – MPLX has steadily reduced its leverage ratio in recent years while also slashing growth capital spending from $2.6 billion to $800 million. Instead of spending aggressively, MPLX has put its balance sheet on a very solid footing while still pursuing very high-return, low-risk growth opportunities, including strategic bolt-on acquisitions, organic growth, and returning capital to unitholders via a very generous unit repurchase and distribution growth program.

MPLX has now grown its distribution for 11 consecutive years at a very impressive 10.8% CAGR, though the growth rate has certainly slowed in recent years. Still, the analyst consensus estimates have MPLX continuing to grow its distribution at a mid-single digits CAGR through 2027. Given that the NTM yield stands at 9.6%, the total return profile looks very attractive, and likely better than MO’s on a yield plus growth basis.

Moreover, the distributable cash flow payout ratio of just 63% – especially when combined with its low leverage, stable cash flow profile, and low capital expenditure budget – makes its distribution look very safe.

Energy Transfer LP (ET) is another compelling 9.6%-yielding opportunity that we think is a much better buy than MO right now. Like MPLX, it is a midstream energy infrastructure business.

While ET lacks a major counterparty relationship like MPLX has with MPC, it has tremendous scale and diversification that make up for that. ET particularly benefits from its extensive network of natural gas infrastructure, primarily in Texas and the U.S. midcontinent region, that it regularly bolsters with strategic acquisitions such as its 2023 additions in the Lotus and Crestwood deals. Its cash flow stability is evidenced by the fact that ~90% of its EBITDA comes from fee-based contracts that are largely commodity price resistant.

ET’s balance sheet strength has dramatically improved in recent years as its leverage ratio has plummeted to the low end of its target range after management paid down billions of dollars worth of debt over the past three years. In the process, it earned a credit rating upgrade and could enjoy further upgrades in the future. With substantial liquidity, strong free cash flow generation, and a well-laddered debt maturity profile, ET’s balance sheet has gone from a position of weakness to a position of strength, enabling investors to sleep well at night.

As previously alluded to, ET not only has a stable and sustainable current earnings stream, but it also has significant long-term growth potential via organic growth investments in its extensive infrastructure portfolio as well as leveraging its size and strengths to make accretive bolt-on acquisitions. While management has tempered growth spending some in order to improve the company’s focus on high-return projects, it is still pursuing growth fairly aggressively through acquisitions as well as through its $2 billion growth capital spending budget. ET’s most exciting growth avenue is its LNG export business, which could receive an additional boost if/when the Lake Charles project is finally completed.

ET has more than doubled its distribution after cutting it in 2020, and management has guided for a long-term distribution per unit CAGR of 3-5%, which seems very achievable given its strong long-term growth profile and low distributable cash flow payout ratio of just 52%. With a 9.6% yield and significant potential for further valuation multiple expansion to bring its EV/EBITDA multiple in line with peers, ET’s total return potential is likely significantly better than MO’s to go along with a lower long-term risk profile given that smokable tobacco appears to be in terminal decline whereas ET’s investments in natural gas and NGLs appear to have a bright future and its oil-related infrastructure assets will likely remain relevant for a long time to come.

Investor Takeaway

While MO’s impressive dividend history and high yield are attractive, the company’s long-term outlook is plagued by significant challenges and risks. The declining popularity of smokable products, regulatory pressures, unsuccessful diversification efforts, and a heavy debt burden cast doubt on its long-term dividend sustainability and overall investment appeal. Management has yet to earn my confidence that they can navigate all of these challenges simultaneously.

In contrast, MPLX LP and Energy Transfer LP present more promising opportunities. Their stable cash flows, strong balance sheets, and low payout ratios make them superior alternatives for investors seeking high-yield stocks with better long-term growth prospects and payout sustainability.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!