Summary:

- Tesla’s recalls, impacting over 2 million vehicles, stem from potential Autopilot misuse and safety issues, triggering regulatory scrutiny but not fundamentally eroding the company’s development path.

- Despite initial stock dips, TSLA rebounded, indicating investor confidence in the company’s proactive recall measures and product safety.

- Potential lawsuits loom over Tesla, highlighting concerns about legal liabilities and financial implications resulting from alleged Autopilot defects contributing to accidents.

- Technically, any downward movements in the stock can be considered an opportunity to accumulate the position.

- The Fed’s recent decision not to hike rates and possible rate cuts in 2024 are fueling Tesla’s rally.

Justin Sullivan/Getty Images News

Investment Thesis

Amidst intense regulatory spotlights and global recall drama, Tesla, Inc. (NASDAQ:TSLA) stock weathers the storm, showcasing investor faith in its swift, proactive stance. The story unfolds with potential legal twists and turns alongside Tesla’s cutting-edge AI leaps in the autonomous driving arena.

The massive recall of over 2 million vehicles was a move that shook the automotive world but didn’t break its stride. At the core lies Tesla’s Autopilot and Full Self-Driving (FSD) systems, tech marvels that raked in billions yet faced misunderstandings and regulatory red flags.

Following our latest coverage two months ago, TSLA delivered another 20%. Despite the temporary headwind and considering the company’s cutting-edge technology, particularly in autonomous driving and battery innovation, we reaffirm our buy rating for the stock.

Total Recall: The Issue Is Serious But Temporary

To begin with, Tesla’s key selling points are Autopilot and FSD, which generated $3.27 billion in quarterly revenue (Q3 2023). However, the capabilities of these systems are misinterpreted. For instance, Tesla’s Autopilot is a feature for driver assistance but has been considered an autonomous driving system. In this context, the National Highway Traffic Safety Administration (NHTSA) flagged concerns, citing increased collision risks when the Autosteer is engaged and drivers fail to maintain vehicle operation responsibility.

In detail, NHTSA’s review covered 956 crashes involving Autopilot engagement and identified 322 incidents related to frontal collisions and misuse scenarios. Tesla’s subsequent recall affected approximately 2 million vehicles in the U.S. alone, highlighting the scale of safety concerns. Moreover, regulatory investigations have been initiated due to concerns about Autopilot misuse, potentially indicating aggressive regulatory oversight.

nytimes.com

Historically, in May 2023, China demanded Tesla recall 1.1 million vehicles due to acceleration and braking flaws. Similarly, 362K cars with FSD were recalled in the U.S. for accident risks. In 2022, 54K cars had FSD disabled for allowing slow rolling through intersections without stops in specific conditions. So, this recall can be considered big in the tech development process of the product, but it should not be viewed as fundamentally deteriorating in any sense.

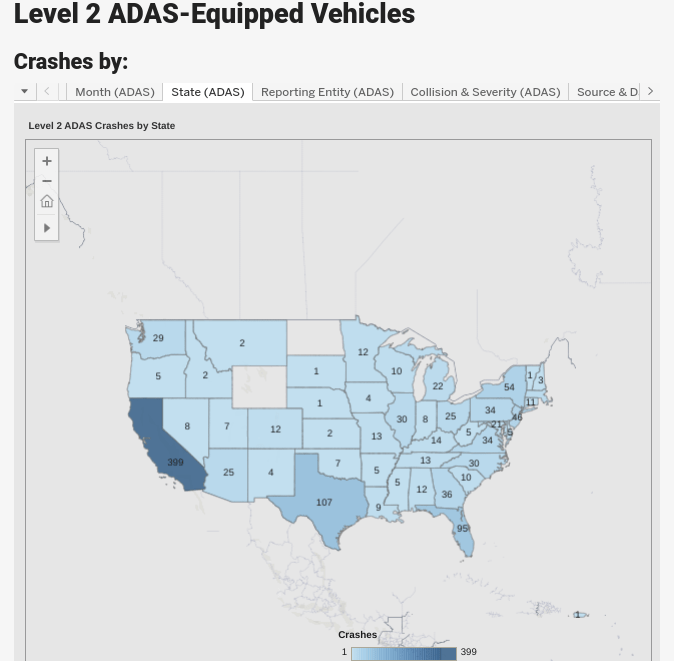

Another noteworthy numerical trend pertains to the geographical concentration of Advanced Driver Assistance Systems (ADAS)-related crashes. A substantial portion of reported crashes involving driver-assist systems occurred in California. This aligns with the state having the highest number of registered Teslas and electric vehicles.

The concentration of crashes in California suggests Tesla’s significant presence within that region, not a quality issue. Despite the recalls and safety concerns, Tesla’s stock initially experienced a dip but later rebounded, reflecting investors’ positive sentiment, as fundamentally, the recall is a proactive action demonstrating the company’s seriousness about its products (recalling all models built since 2012 in one shot).

www.nhtsa.gov

On the downside, any agency action on safety issues could potentially erode Tesla’s brand image, leading to a decline in market share and value, which is less likely. Again, Tesla’s dominance, which accounts for about half of the electric passenger cars sold in the U.S. could face challenges as competitors may eat up the company’s share in the electric vehicle market.

Finally, Tesla may face massive lawsuits alleging defects in the Autopilot system that contributed to accidents, raising questions about legal liabilities and potential financial implications. Therefore, Tesla’s recall extends to international markets like Canada, highlighting its spreading global impact.

Reinforcing Safety in Driver-Assist Tech

Tesla’s strength in driver-assist technology stems from its remarkable market penetration with Level 2 systems, notably Autopilot and FSD. The magnitude of the recall signifies Tesla’s extensive reach within the automotive market. The FSD feature costs Tesla an additional $12K, not intended to let the driver take complete control of the wheel. Also, Tesla agreed to issue a voluntary recall and roll out an “over-the-air software remedy” to fix the problems.

Tesla’s response to safety concerns historically involved over-the-air software updates and additional controls to prevent auto misuse. Tesla initiated wireless software updates for affected vehicles, implementing more prominent visual alerts and checks during Autosteer usage, illustrating the company’s earlier attempts to address safety issues proactively.

Diving deep, the Autosteer Basic Autopilot package feature provides controlled access on highways; the support is related to steering, braking, and acceleration. Specifically, drivers need to attentively keep control of the steering wheel during Autosteer, which provides a driving control shift back to the driver when required. The Autopilot system utilizes specific checks to ensure that human drivers are adequately attentive on the road.

However, the NHTSA observed control issues that may lead to misuse of the feature at the drivers’ end. Thus, the recall may not fundamentally hurt the company’s operations, as Tesla has voluntarily taken preventive measures based on the agency’s observation. For instance, in October 2023, a California jury found that the company’s driver-assistance software was not at fault in a crash that killed a Tesla owner and seriously injured two passengers.

Furthermore, Tesla’s unique advantage in collecting real-time telematics data from its vehicles provides a distinctive edge over its competitors. This advantage significantly expedites the reporting process of crashes involving driver-assist technology compared to traditional methods employed by other automakers.

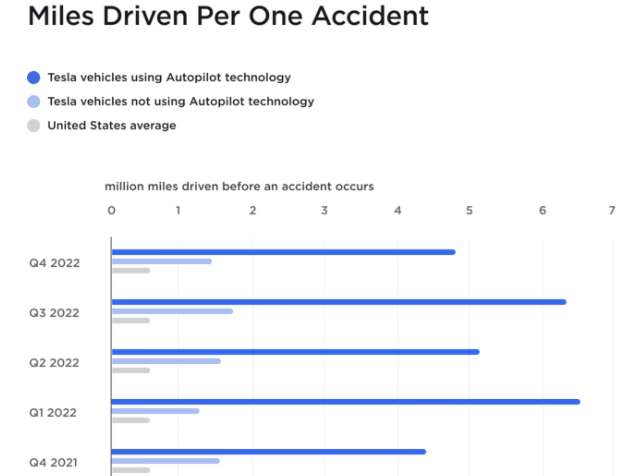

Tesla’s safety reports, released periodically, present numerical statistics depicting the miles between crashes with and without Autopilot. For instance, in Q4 2022, the company reported one crash for every 4.85 million miles when Tesla was driven with ADAS compared to one for every 1.40 million miles without ADAS. The strong advantage of the technology can be observed when compared to the U.S. average of one crash for every 0.65 million miles.

Tesla Vehicle Safety Report

Specifically, Tesla’s focus on AI software development is evident from its investment in one of the world’s largest supercomputers. The doubling of computing capacity in Q3 2023 compared to Q2 2023 highlights Tesla’s focus on advancing AI technology to boost the efficiency of FSD.

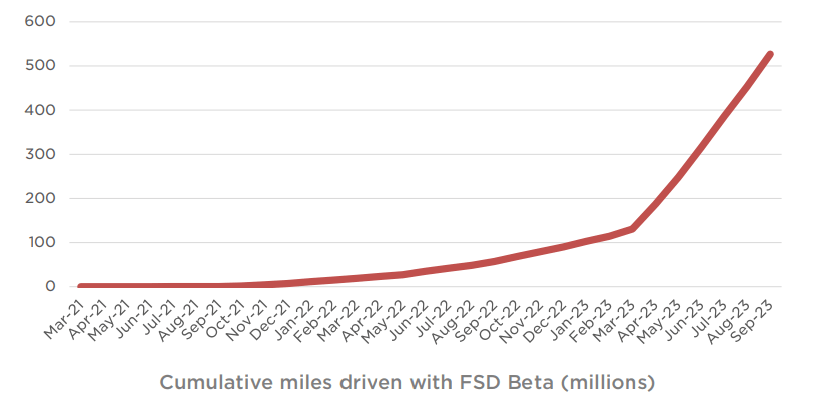

Overall, Tesla’s utilization of anonymized video and data generated by its large fleet of vehicles facilitates the development of FSD capability features. As of Q3 2023, the cumulative miles driven with FSD Beta reached above 500 million, expanding rapidly. Therefore, leveraging this vast dataset indicates Tesla’s reliance on real-world vehicle data to enhance its autonomous driving capabilities.

Quarterly Update Deck

2025 Technical Roadmap: Any Weakness in TSLA Stock Price Can Be an Accumulation Point

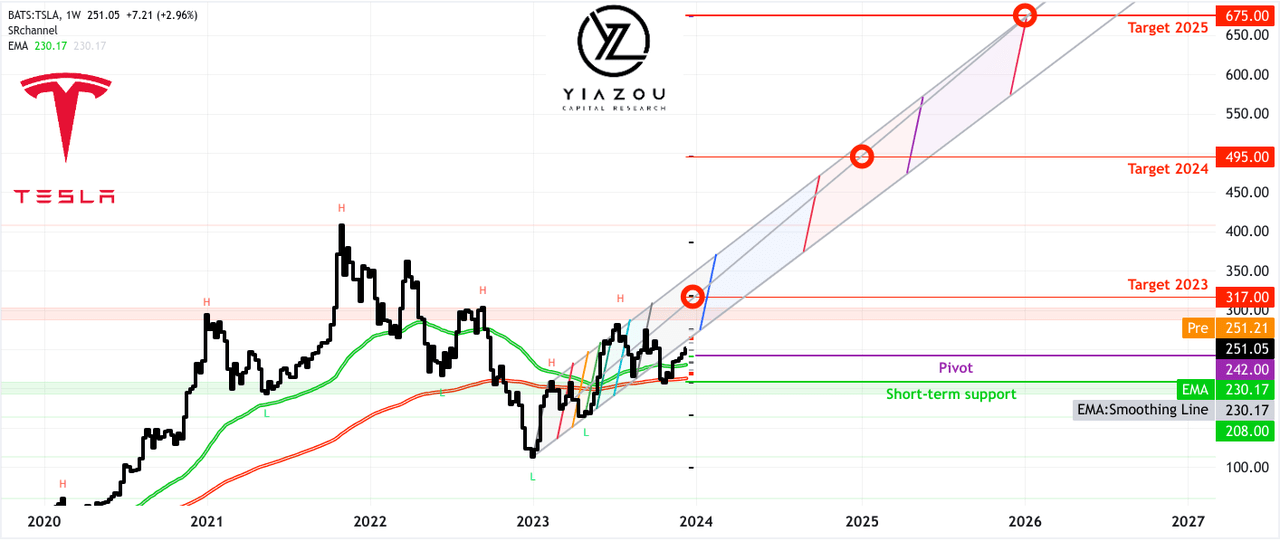

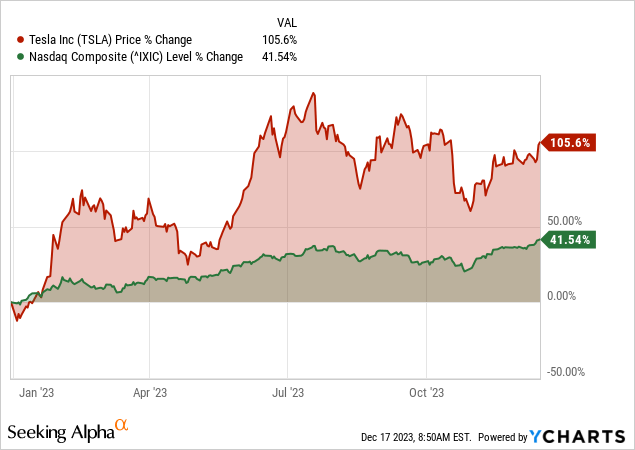

TSLA stock has outperformed the market in 2023 with over 100% return against the total return of 25% by the S&P 500. Considering the trend in 2023 as an impulsive wave based on Elliott Wave Theory and the Fibonacci Channel, horizontally, the application of Fibonacci retracement suggests the price may hit $317, while the stock is currently trading at near $250. The huge price gap can be filled by rapid-up moves before the end of 2023, inspired by the Santa Claus Rally, where $242 is a critical support for the stock price.

Forecasting over the mid-term, 52-week (green line), and 156-week (red line) exponential moving averages (EMAs) serve as navigators for the ongoing bullish momentum. However, $208 serves as critical support for any sudden price movement in the stock price, mirroring the 156-week EMA. Above $317, $475 serves as a target for 2024, which is a critical resistance level based on the Fibonacci retracement projected over the current uptrend.

Finally, following the Fibonacci channel, the stock may hit $675 over the long term, the final resistance of the current trend projected through Fibonacci retracement. Any movement down the channel can be considered an opportunity to accumulate the position and average the price of the long position. This bullish stance is supported by potentially improved market conditions, as signaled by the Fed’s recent decision not to hike rates and possible rate cuts in 2024.

Takeaway

In conclusion, while significant, Tesla’s recall saga should be a temporary hurdle in its ambitious journey. The company’s proactive approach to addressing safety concerns with its Autopilot and Full Self-Driving systems, underscored by a massive recall and technological adjustments, demonstrates its commitment to innovation and customer safety.

Despite initial market fluctuations, Tesla’s resilience is evident in its stock’s recovery and continued market dominance. The company’s ability to leverage real-time data and advanced AI positions it firmly for future growth. Tesla’s journey through these challenges reflects its adaptability and determination to redefine automotive safety and technology standards.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.