Summary:

- We think the 45-47/share level is a demand zone where Institutional Investors may defend the stock.

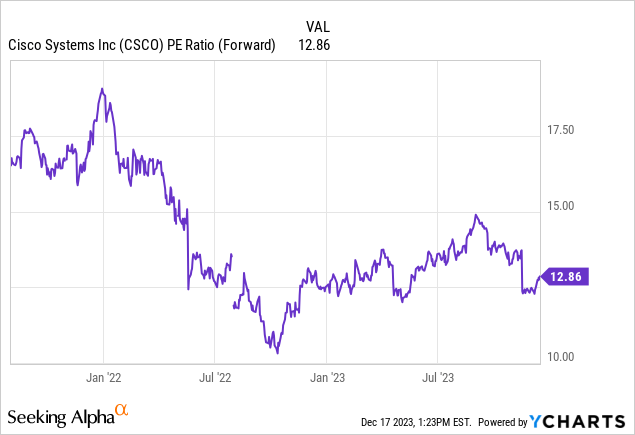

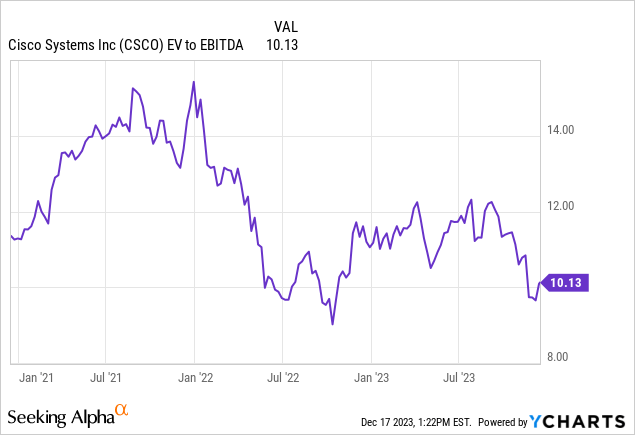

- The company trades at a 1-year valuation trough for Forward Earnings and EBITDA, offering an opportunity for management to prove their execution acumen.

- Risks include that Arista Networks and Huawei are eating into Cisco’s market share in its primary revenue driver – Ethernet Switches.

FinkAvenue

Searching for value in tech in an extended market

Investors searching for value stocks within tech may want to put Cisco (NASDAQ:CSCO) on their watchlist for a conservative 3-5% upside idea over the coming 4-6 months. The company has struggled to keep pace with the ferocious rally that popular themes within AI, Semiconductors, and Big Tech have benefited from in 2023. As investors start thinking about where pockets of the market may possibly still have de-risked levels, we think investor attention will give Cisco a modest lift in the coming weeks and months – though enthusiasm will be capped due to its single-digit growth profile.

We believe that CSCO’s recent bounce off 47.5/share can be durable and that the next target is 51.44-52/share, an area that we believe can be reached within Q1-Q2 2024. Due to a low de-risked valuation, we think that the 45-47/share level is essentially a demand zone where institutional investors will defend the stock in the case of further equity weakness. The mature characteristics of its business model means that the company’s beta relative to the S&P 500 will remain low, so this is a low-volatility type of upside idea if markets can remain stable.

Cisco Key Demand Zones (TradingView)

Let’s discuss their recent business fundamentals and potential catalysts

After Cisco’s latest earnings quarter back from November 2023, the Street revised forward EPS estimates lower as management provided softer guidance for the rest of the fiscal year. The company guidance implies a 13% sequential sales decline and the management team lowered their Fiscal 2024 revenue outlook by 5%. This was primarily due to tempered expectations for large enterprises implementing Cisco’s equipment before restarting their buying cycle for the next generation of inventory. We believe that the recent stock’s correction reflects that the rosy 2023 fiscal results along with its strong backlog may be not have the same easy momentum in 2024.

Behind the Street’s contained enthusiasm to permit Cisco a durable recovery is the fact that Cisco previously called for roughly 400 basis points of operating margin compression to around 32%, which is a primary reason behind weaker volumes. Given how high of a weight operating margins play into Wall Street valuation models, it is likely the Sell Side needs to see margins stabilize or see a modest lift before they upgrade the Stock.

As a mature player in enterprise technology, growth rate estimates for Cisco range between 3-5% and this makes the stock a tempered Hold in an environment where other technology companies (especially semiconductors) are growing in the 15-30% top line region.

Of course, Cisco’s valuation on both an earnings and EBITDA basis fairly reflects this with a modest 12.8X forward P/E multiple, which is essentially near the trough of its year-to-date valuation range.

Cisco’s EBITDA valuation multiple takes the company trading back to historical valuations back near the bear market lows of Summer/Fall 2022.

In terms of its overall business model and evaluation of its outlook, I want to share some helpful statistics to help readers understand Cisco’s positioning in the marketplace.

The company currently generates most of its sales from its Secure, Agile Networks segment (51% of FY 2023 sales), followed by Internet of the Future (9%), Collaboration (7%), End-to-End security (7%), and Services (25%) being the remainder.

The growth levers that I believe the buyside are focused on include the Collaboration and the End-to-End Security group segments as Cisco has been heavily investing in these two areas to move away from legacy hardware. The company has done several acquisitions to support the new offerings in this space (such as Spunk). Cybersecurity is a vastly growing field and companies in that category are commanding high valuations. If Cisco can successfully make cybersecurity a larger portion of their forward revenues and EBITDA, the recurring nature of future cash flows will allow the company to eventually hold a higher multiple rather than the 13.5X forward multiple it currently commands. I believe future quarters will shed more light on their ability to compete in that area.

Additional catalysts for Cisco include the WiFi 6 upgrade cycle, 5G core implementations as well as AI network development. The high demand for data center solutions and migration to cloud networking should eventually be a favorable macro landscape for Cisco’s fundamental positioning.

Risks, thoughts on Entry & Valuation

With the combination of Cisco’s lower relative valuation and lowered 2024 estimates since its last quarter in contrast with its recently increased share buyback program and strong financial cash position (over $26.3 billion in cash), we think Cisco’s downside is rather limited (although upside also has limits).

The company is currently a leader in Ethernet Switches with about 45-46% market share. The largest threat that I currently see is that competitors such as Arista Networks which has 11.4% of the market share and Huawei which now has 6% of the market could become formidable forces as recent trends have pointed to market share advances for both firms. In the coming quarters, we will see if Cisco’s gross margins – which are often a great indicator for competitive pressures – are impacted by Arista and Huawei’s share gains.

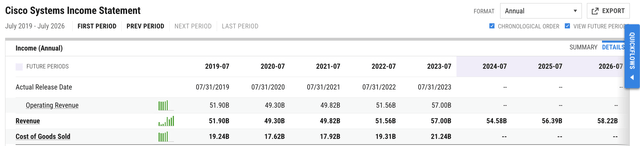

If Cisco can defend status quo business performance and maintain low single digit revenue performance over the coming 3 years (currently estimated at a -4% sales decline in FY 2024 but a rebound of 4-5% in FY 2025 and 2026), the stock may drift back to its median historical valuation of 13-14X forward earnings (now 12.8X) in the coming quarters.

Forward Revenue Estimate (YCHARTS)

In an expensive market in technology, Cisco has been a laggard (rightfully so due to its low growth profile). But the company still commands a long-term top line growth rate in the single digits and given its strong free cash flow generation, I think the stock has about 3-5% upside to revisit the 50-53/share area in the coming 4-6 months.

Once that conservative upside drift target is met, its mature business model will likely make its stock stay range-bound until investors have more clarity in its upcoming earnings reports.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CSCO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.