Summary:

- Carnival Corporation reported quarterly results this week for the period ending November, with focus on guidance for FY24 and beyond.

- The cruise line sector has experienced a bounce-back year, but Carnival stock may face downside pressure due to quarterly losses and negative media headlines.

- CCL stock is likely fully priced at 9.5x the 2025 EV/EBITDA estimate.

SeregaSibTravel

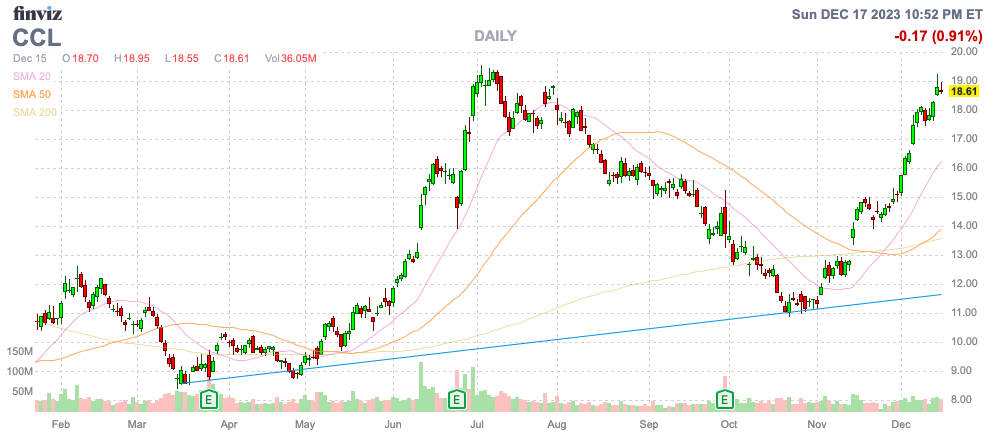

The cruise line sector just completed a big snapback year following massive losses since the start of Covid-induced shutdowns. Carnival Corporation & plc (NYSE:CCL) will report the quarterly report this week (expected Thursday December 21st) to end the bounce-back year, and the focus will be on where the cruise line goes in FY24 and beyond. My investment thesis remains Bullish on the cruise line sector, though the view on Carnival is Neutral after the rally to nearly $19 heading into a FQ4 quarterly loss.

Source: Finviz

Containing Losses

Carnival reports quarterly results slightly different than the industry with FQ4 results for the period ending November. The quarter includes the months of September, October and November, as the cruise line crams the most profitable Summer demand into FQ3 with June, July and August all in the same quarter.

For this reason, Carnival typically reports a very strong quarter in FQ3, with generally weak numbers the other 3 quarters of the fiscal year. Prior to Covid, all of the quarters were profitable, with FQ2 and FQ4 generally similar and FQ1 (Winter months) the weakest.

The market may struggle to understand the dynamics of the business going forward, with Carnival facing losses in these other quarters. The current consensus estimates for FQ4’23 before the market opens on Thursday is as follows:

- Consensus EPS estimate: ($0.13)

- Consensus Revenue estimate: $5.28 billion (+37.5%).

The stock could easily face downside pressure with the way algo trading works these days and negative media headlines from reporting a quarterly loss, even when forecast. In addition, Carnival may face some negative spin from guiding to a similar loss in FQ1’24. The February quarter is likely to face another loss, though revenues are forecast to jump 22.8% above the weak results last FQ1.

Royal Caribbean Cruises Ltd. (RCL) reported a strong Q3 and guided up for 2023. The cruise line reported results for the period ending September, but the big beat and strong guidance supports the period Carnival is about to report on as being a very solid quarter.

Despite the strong demand, the problem facing Carnival is that the reduced operating income in the non-Summer quarters aren’t enough to overcome the sharply higher interest expenses. The company is getting hit by up to $1.9 billion in net interest expenses now.

The good news is that fuel costs have quickly slumped from back in September, when Carnival warned of higher expenses. Management guided towards $130 million in higher fuel costs for the 2H of the year generally targeted at the FQ4 numbers.

The lower costs could help the FQ4 numbers Carnival reports on Wednesday.

Carnival Stock – Time For A Pause

Carnival should easily top the $4.1+ billion adjusted EBITDA guidance for FY23. The company expects a big increase in adjusted EBITDA in FY24, in large part due to the cruising market not really opening up until the March/April time frame in 2023, making for easy comparisons for the 1H of FY24.

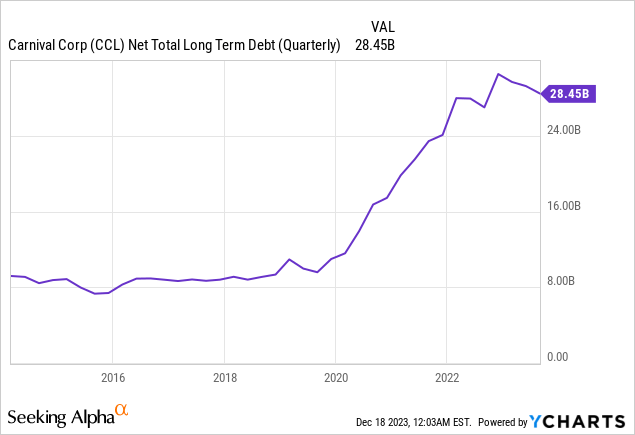

The reason to hesitate after the stock has soared to the yearly highs at $19 is that net debt levels remain elevated at $28.5 billion and Carnival forecasts even higher capex next year. The cruise line has cut debt levels by $4 billion this year, but net debt is still nearly $20 billion above pre-Covid levels.

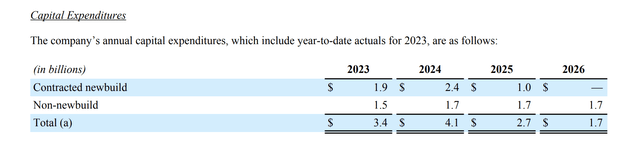

Even with a big jump in adjusted EBITDA to the tune of $6+ billion for FY24, Carnival still faces limited free cash flows. The company forecasts spending $4.1 billion on capex, up $0.7 billion from FY23, and the combination with $1.9 in interest expenses will virtually wipe out cash flows outside of a boost in advance ticket sales.

Source: Carnival FQ3’23 earnings release

The combination of the likely negative investor sentiment for more quarters of losses, along with elevated capex in FY24, makes the stock less appealing in the near term. Carnival could get appealing on a dip towards the end of FY24 when the company shifts towards reduced capex providing the free cash flow capacity to repay debt and cut interest expenses further boosting profits and cash flows.

Besides, Medius Research is probably accurate on the stock being fully priced at 9.5x 2025 EV/EBITDA estimates. The research firm set a $19 price target a few weeks ago when Carnival traded much lower.

Takeaway

The key investor takeaway is that investor will be all focused on whether Carnival Corporation & plc continues reporting losses in FQ4 and what guidance looks like in a fully open FY24. The stock is likely to pause, with investors absorbing a period of additional losses and elevated capex restriction the free cash flows needed to reduce debt. Carnival is definitely poised for a big FY25 after a pause this FY.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.