Summary:

- WhatsApp is a crucial factor for the future of Meta, with the potential to revolutionize its revenue and drive growth in the next few years.

- WhatsApp’s user base continues to grow, with a 15% increase in users compared to last year, and there is still room for further growth, especially in countries like India.

- Meta’s plan to monetize WhatsApp includes click-to-message ads and WhatsApp Pay, which have already shown promising results and have the potential to change the habits of billions of people.

stockcam

When we talk about Meta (NASDAQ:META) the first thing that comes to mind is Facebook and Instagram or at most the metaverse. Typically WhatsApp is put on the back burner since there is not much data available and it is still in its early monetization phase.

In this article, I want to shed some light on this too-little-discussed app since it is a crucial factor for the future of Meta. While the metaverse is the main growth driver for the coming decades, WhatsApp represents the key driver for Meta’s growth as early as the next few years.

A bit of history

Before moving on to what WhatsApp represents today and what it might become in the future, I would like to start with the origins and what made it the world’s most widely used instant messaging app.

WhatsApp was founded in February 2009 by Brian Acton and Jan Koum, and in the beginning, it was totally different from how we know it today. In fact, it wasn’t even an instant messaging app: It simply showed if your contacts were at work or busy on another call.

Initially, the app crashed constantly and was not very successful in its first few months. The turning point came in June 2009, which was when Apple launched push notifications and users could receive status updates on their contacts without being inside the app. From this point on everything changed, mainly because of the bizarre and unexpected usage adopted by users: people began to continuously update their status using personal jokes or thoughts. In a sense, the initial function designed for WhatsApp had been completely turned upside down and had become a kind of instant messaging app: this was Acton and Koum’s greatest fortune.

This change was the trigger for WhatsApp’s exponential growth; in fact, it went from having a handful of users to 250,000 users around August 2009. From that point on, WhatsApp began to interest a range of private investors and corporations, so it was not difficult for Acton and Koum to raise capital. Sequoia Capital invested $8 million for 15% of the company in 2011 and another $50 million in 2013, valuing it at $1.50 billion. By 2013 WhatsApp had 400 million users.

Everyone wanted WhatsApp, years earlier Google (GOOG) tried to buy it, but in the end, the savviest of all was Mark Zuckerberg who bought it for $19 billion. The goal was to make people interconnected no matter how far away they were, and WhatsApp together with Facebook was the way to do it. At the time, this acquisition left everyone puzzled; after all, in 2013 the company had been valued at only $1.50 billion, so the offer seemed way out of line. Moreover, Facebook already had hundreds of millions of users and its own instant messaging service. Why buy a new one that was not even profitable? At first glance, it may have seemed like a gamble by Meta’s young CEO, but in retrospect, we can say that he was right.

Currently, 2.78 billion people use WhatsApp every month, a 15% increase over last year. So, a decade later, the growth of this behemoth is still in double digits. The most interesting aspect, however, concerns revenues.

Initially, WhatsApp was fee-based, but after the acquisition, it was made totally free. Its business model has often been criticized; after all, what’s the point of having billions of users if they don’t generate revenue. However, after years of expansion, the time has come to make WhatsApp profitable, and the company is working on a number of solutions that could disrupt both its revenues and the habits of our lives. At the moment, no company in the world has an ace in the hole of this magnitude, which is to monetize nearly 3 billion users. The potential is enormous and if harnessed well could revolutionize Meta’s future growth.

Finally, I would like to close this section with some personal thoughts about Mark Zuckerberg. My impression is that people often tend to underestimate him or not consider him on par with other CEOs of international caliber. In my opinion, this is a serious mistake, as Mark Zuckerberg has proven time and again that he is one of the most forward-thinking CEOs. Google if it could would gladly go back and buy WhatsApp, and let’s not forget Instagram, which was bought for $1 billion and in 2022 generated revenues of $51.40 billion. Typically, companies where the founder remains the CEO tend to perform better because the corporate vision is not altered. Meta’s investments may be misunderstood initially, since their target is long-term prosperity not exceeding analysts’ quarterly estimates. Today I read of people laughing at Metaverse investments but they are probably the same people who thought investing $19 billion for WhatsApp was absurd.

The future of WhatsApp: The prospects for user growth

Although WhatsApp is used monthly by 2.78 billion people, there is still a good margin to improve this number. After all, as already anticipated, compared to last year users have increased by 15%, and there is no reason why this growth should suddenly stop.

WhatsApp possesses one of the strongest competitive advantages around, namely the network effect. Messaging apps are used only when the people you want to converse with use them: The more users there are, the stronger the system becomes. So, the incentive to abandon WhatsApp to use another app with few users is practically nonexistent, even if the latter were objectively better. A mass exodus of 2.78 billion people to another app is virtually impossible, which is why the further we go, the more Meta’s dominance will stabilize.

WhatsApp has become a habit in the lives of billions of people, and it is not only used to converse with friends and family but also for business purposes. In fact, the world of WhatsApp Business is also gradually getting bigger. Moreover, Meta doesn’t even have to put too much effort into thinking about how to improve business; competitors are taking care of that. When a new feature is appreciated, after a while we can find it on WhatsApp, effectively destroying any kind of competitive threat. Many people believe that Telegram is better than WhatsApp, I do not doubt that, but in this market whoever is established first wins. Telegram was born 4 years later and by that time WhatsApp already had about 400 million users.

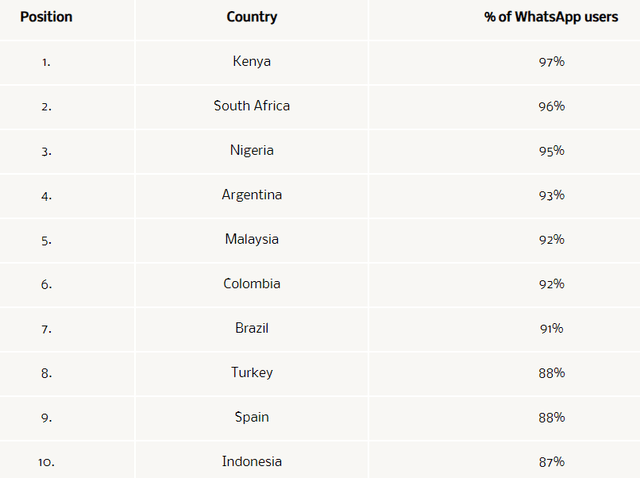

There are countries where WhatsApp’s popularity can hardly improve because almost every person with a smartphone uses it.

Typically, the countries where it is most popular are those where SMS messaging is expensive, so WhatsApp is a cheaper alternative.

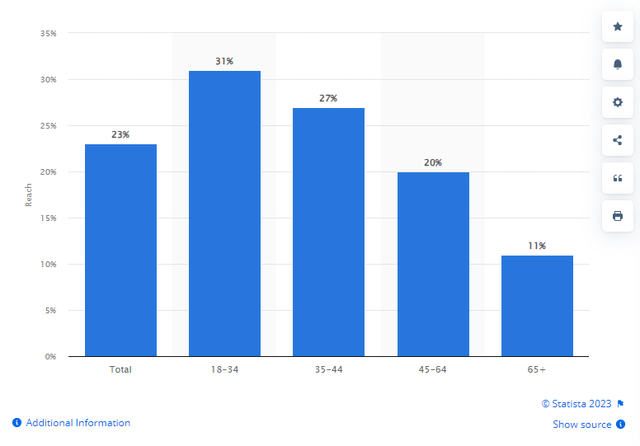

The country where most users reside is India, an impressive 535.80 million users. In second and third place are Brazil and the United States, respectively, with 139.30 million and 91.30 million. Although in third place, the United States represents a market where there is still much room for growth. In fact, only 23% of adults regularly use WhatsApp.

To date, there are two barriers Meta will face in penetrating this market:

- Overcoming competition from iMessage, Apple’s (AAPL) instant messaging app with a 34% market share. In the United States, 48.70% of smartphones are iPhones, so it is not surprising why iMessage has become so popular.

- Overcoming the dominance of SMS. In the United States, phone plans guaranteed unlimited SMS well before WhatsApp was created, so there was never a real need to use an app for conversation. Opposite reasoning for Europe and the rest of the world.

These two aspects represent the crucial factors that have limited the spread of WhatsApp in the thriving U.S. market. Anyway, as we will see in the next section, the new implementations could win acceptance here as well.

Finally, beyond growth, probably WhatsApp’s greatest strength is the stability of its users. Even if absurdly they were to stop growing, it is difficult to see them declining, and this is not a factor to be underestimated given the large audience available to Meta. For a U.S. person (I think most people who will read this article) it may seem silly to use an app for conversation given that there is SMS, but for those who grew up in realities where unlimited SMS was a mirage until 10 years ago, WhatsApp has become virtually an extension of any smartphone. Let me give you a tangible example that I experienced firsthand to give you a sense of how entrenched WhatsApp is in the rest of the world.

As absurd as it is, to date in Italy not all phone plans offer unlimited SMS, but the most surprising aspect is that no one cares. The main thing we care about is how many GB we have on the mobile network, because with them we can message on WhatsApp. In addition, calls on WhatsApp have been becoming increasingly popular for the past few years, effectively replacing even the traditional calls we have always been used to. In practice, we use SMS and traditional calls mainly when we do not have Wi-fi and mobile network available.

Based on the ranking I showed you earlier, Italy is not even in the top 10 countries with the highest percentage of WhatsApp users. So, try to imagine how dominant it is in countries where 90% of people with an Internet connection use it. It is virtually impossible not to do so on a daily basis, as it would mean being out of touch with the world.

The future of WhatsApp: The plan to monetize

Although WhatsApp is comparable to Facebook and Instagram in terms of number of users, at the moment it is by no means comparable to these two in terms of profitability. Since the acquisition the only goal has been to expand the app worldwide, and I would say that has been achieved: now it’s time to make a profit.

Our playbook over time has been build services, try to serve as many people as possible, get our services to a billion, two billion, three billion people, and then we basically scale the monetization after that, and we’ve done that with Facebook and Instagram. WhatsApp is really going to be the next chapter, with business messaging and commerce being a big thing there.

In order for WhatsApp to make a major contribution to profits, it is necessary to attract as many businesses as possible and this process is already underway: users of WhatsApp Business increased from 50 million in 2020 to 200 million in June 2023. Right now, the most concrete ways to monetize are mainly two: through advertising and through payments.

Advertising

To date, WhatsApp’s main revenues come from click-to-message ads, something that has been growing very fast in the last two years. Let me briefly explain what they consist of.

In order to improve their sales, companies can use click-to-message ads to attract and convince more people to buy their products.

Facebook Homepage

The preferred channels where these ads are directed are still Instagram and Facebook, but clicking on it redirects to a conversation on WhatsApp with the company that sponsored the product. Through direct contact, the interested consumer can get more information and will be more incentivized to purchase. Of course, this all comes at a cost to the company; in fact, it will pay a small fee for each conversation obtained with a potential customer. But there is more.

Since this is also a service used by huge companies with hundreds of thousands of potential consumers interested in their products, Meta also provides a business solution provider. After all, how many staff would the company need to respond to thousands of messages without keeping consumers waiting too long? Meta’s ChatBots can solve this dilemma but, of course, the latter is not free; there are various costs involved:

- Monthly fee for the software.

- Fee for each conversation (Yes, another one).

- Set-up costs.

At this point you may be wondering if it is possible to take advantage of click-to-message ads without necessarily using Meta’s business solution provider as well: the answer is yes, but it doesn’t pay off. First of all, Meta has invested billions in AI in order to make its ads more efficient, so it is difficult for companies to rely on a third party with a better business solution provider. Second, certain terms of service must be met in adopting an external business solution provider, which is not easy. So, in order to avoid wasting time and money, the company that wants to increase its revenue will be better off relying completely on Meta.

In light of the above, there may be some doubts about the convenience of using the service offered by Meta; after all, it has many costs and cannot guarantee with certainty a consistent increase in revenues. This is a legitimate doubt, but you can easily find numerous evidences online that this service works and is able to bring in new customers. After all, with all the investments made over the past two years, it was hard to assume otherwise.

Returning to click-to-message ads, taking a look at the last conference call we can see that the benefits in economic terms are already visible.

There are more than 600 million conversations between people and businesses every day on our platforms. To give you a sense of what this could look like when it’s scaled globally, every week now, more than 60% of people on WhatsApp in India message a business app account. A revenue from click to message ads in India has doubled year-over-year. Now I think that this is going to be a really big opportunity for our new business A is that I talked about earlier that we hope will enable any business to easily set up an AI that people can message to help with commerce and support.

Mark Zuckerberg

The relationship between business and people is stronger than ever, and India represents one of the countries where revenues are growing the most. The development of this country will in my opinion be one of the main drivers of growth in the coming years given the huge growing population and the radical adoption of WhatsApp (over half a billion users).

Payments

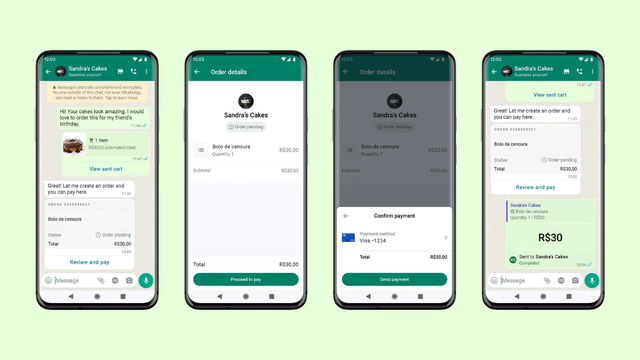

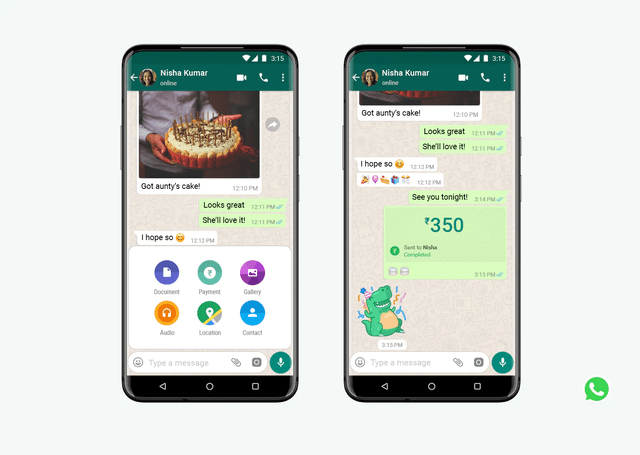

Click-to-message ads have proven to be very useful and appreciated, as the seller (or ChatBot) can converse directly with the interested customer and close the deal. However, Meta lacks the final step, in fact, the transaction that closes the purchase will take place on an external platform/website. Well, with WhatsApp Pay Meta will have control even in the final step. Let me briefly explain how it works.

Merchants and small businesses will be able to sell their products within the app without necessarily relying on external sites or other apps. Once they get the customer’s attention, they will be able to send an offer and receive the money once it is accepted. Individual use of the payment feature within WhatsApp is free, but businesses will be charged a fee of 3.99% per transaction received.

In addition to click-to-messages, to attract customers, companies will also have at their disposal channels, one of the latest additions. At the moment they do not generate money, but in the future, they might. The latter are nothing more than groups within which sponsored products will be purchasable directly from the app. But there is more.

Let’s say we need a nearby place to eat: we can search for the closest ones directly from WhatsApp and even pay. This applies to food as much as anything else, such as clothing stores and grocery stores.

The potentials of WhatsApp Pay are enormous and do not only affect merchants.

In the future we will also be able to send money to our family and friends, effectively taking advantage of a kind of worldwide P2P.

In practice, many of our daily activities that we do through multiple applications would be concentrated in just one.

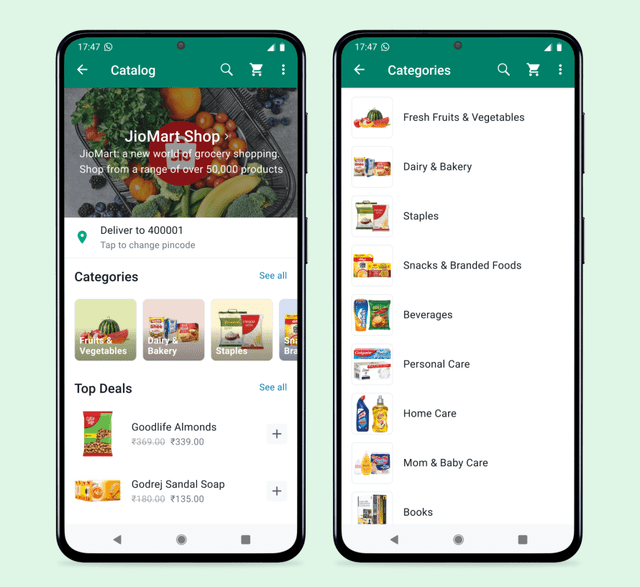

As utopian as this may sound, it actually represents a relatively near future since WhatsApp Pay is already available in Brazil and India.

Since last year, it has already been possible in India to do your grocery shopping directly from WhatsApp through a partnership with JioMart. Analysts estimate that the Indian digital payments market could reach $10 trillion by 2026, so Meta seems well-positioned to capitalize on this trend.

In other words, WhatsApp Pay will make the shopping experience even easier and more direct. Since billions of people use the app every day for conversations, I expect that the efficiency and immediacy of this service could appeal to at least hundreds of millions of people. Potentially, the convenience of WhatsApp Pay could be the trigger to penetrate even the U.S. market, which is still tied to traditional SMS. Having an app that can do so many things could lead people to create a habit of conversing on WhatsApp.

The company’s goal is to extend this service worldwide, but it is obviously not an easy project. Beyond the immense capital needed to create the infrastructure, numerous authorizations must be obtained before adding this feature on WhatsApp. Several conditions must be met in terms of security and privacy, which should not be underestimated. So, it may take several years before we can take advantage of this service. In the worst-case scenario, some countries may never join.

Valuation

In the last year or so Meta’s price per share has more than doubled but its valuation multiples remain quite attractive:

- NTM Market Cap/Free Cash Flow is 21.75x; the historical average over the past 10 years is 33.87x.

- NTM Price/Normalized Earnings (P/E) is 19.73x; the historical average over the past 10 years is 28.07x.

A forward P/E of about 20x is not that much considering the competitive advantage this company has in its market. In addition, the profit margins are high as are the growth prospects. So, Meta may be worth it even if it is no longer trading at ridiculous prices as it was last year.

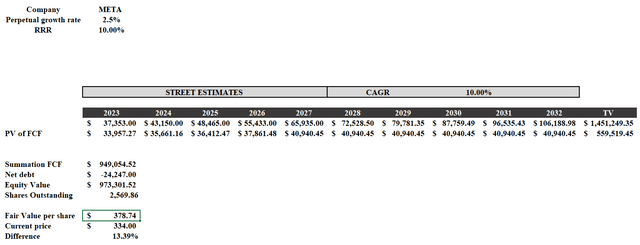

To calculate fair value, I used a discounted cash flow model built on the following assumptions:

- For free cash flow 2023-2027, I considered Street Estimates. From 2027 to 2032 I have included a CAGR of 10%. Finally, the perpetual growth rate is 2.50%.

- For the discount rate, I preferred to enter an arbitrary 10% since the CAPM formula shows only 8.86%: I personally look for returns of at least 10% per year if I invest in individual companies.

Based on these assumptions, Meta’s fair value is $378.74 per share, so the company is undervalued and can continue its run into 2024. It certainly will not be easy to generate a free cash flow of $106.18 billion in 2032, but I believe that Meta’s app synergy can achieve this. Facebook and Instagram are the certainties to start from; WhatsApp will integrate with them improving their efficiency and generating billions of dollars; Threads is the bet and the Metaverse is the very long-term project that could disrupt our lives: when a company has three billion users it has the power to do so.

From hold to buy

My last article on Meta was just after the release of Q2 2023 and my rating was a hold. Compared to a few months ago, my view toward this company has changed, as have my expectations. So, I found it necessary to raise my rating. There are three reasons for why this choice was made:

- First, in the previous article, my rating was influenced by the incredible rally that Meta had achieved in the previous months. Having bought a lot when it was around $100-$150 per share (there are several articles about it), the moment it reached I $300 per share I curbed my enthusiasm since I did not want to increase my average carrying price too much. To this day, I recognize that I was wrong since a company can be undervalued even if it has grown by 200%. This is a very common mistake in investing.

- The second reason I revised Meta’s rating upward concerns WhatsApp’s potential. I had underestimated how much cash flow it could bring by integrating WhatsApp to Facebook and Instagram ads. Also, in my previous article I was not yet aware of how fast WhatsApp Business was expanding in India and how click-to-message ads were performing on an annual basis: today we know that revenues have doubled in India.

- The last reason is purely quantitative. Within the FCF model of this article, I have included Street Estimates, and these have been revised upward. So, the expected future cash flows have increased. Also, I have entered a discount rate of 10%, slightly lower than the 11-12% in my previous articles. This is because the 10-year T-Bond has fallen below 4% and is heading for even lower values. If the risk-free rate falls, my equity risk premium must adjust accordingly.

In general, a better overall understanding of Meta’s business combined with an increase in Street Estimates and a declining T-Bond have resulted in a shift from hold to buy.

Risks

Typically when we talk about risks we tend to dwell on competitors, but in Meta’s case there are none or very few:

- Twitter/X though popular, is not comparable to Facebook and Instagram. They are different socials and the only one it really competes with is Threads. However, the latter has only recently been released and even if it turned out to be a failure it would change little for Meta. To some extent, Meta is Twitter’s competitor but not the other way around.

- YouTube with the introduction of shorts and posts has in fact become a new social. In my opinion, it is one of the best platforms around but I don’t think it can hold a candle to Instagram and Facebook. In other words, I think YouTube is complementary to Meta apps, so I don’t consider Alphabet a real competitor. Spending more time on YouTube does not necessarily mean spending less time on Instagram and vice versa.

- Snapchat (SNAP) was knocked out years ago by putting the stories feature on Instagram and Facebook.

- Telegram has 55.20 million daily active users, but more than a competitor to WhatsApp, it looks like a competitor to the Deep Web. Although the functions are the same, it is not used in the same way by users. In fact, the average Telegram user spends only 2.90 hours on the app each month: Far too little. The potential to be a serious competitor is there, but in recent years there have been too many scandals that have damaged its reputation.

- TikTok is probably the main competitor but Meta is gradually succeeding in annihilating it. The introduction of Reels has made Instagram much more like TikTok and this has pleased users. As usual, Meta’s technique for destroying its enemies is always the same: copying the most popular features of the moment. Its competitive advantage is so great that simply doing this is enough to make users return to spend their days on its apps. Finally, let’s not forget the China-US tension and how often there is talk of a TikTok ban.

Overall, excluding a declining TikTok, Meta has no real competitors. However, this does not mean that investing in it is risk-free; on the contrary, Meta has a great deal of risk that few companies have: regulatory risk. Although it does not sell tobacco and alcohol, we could almost consider Meta a sin stock.

As you are well aware, Meta has often been at the center of scandals regarding user privacy and has often had to pay large fines. In addition, excessive use of social networks is known to be harmful, especially in adolescents. Some users are addicted to Instagram and Facebook and may even spend several hours a day on these apps, effectively reducing their productivity and motivation. These are themes that may be increasingly recurring in the future, and this would not benefit the company’s reputation: even cigarettes were not seen as harmful in the beginning. The fact that the harm is mental and not physical does not mean that it is less important.

In my opinion, Meta is one of the most powerful companies in the world, and this is both a positive and negative aspect. I am not talking about revenue capacity because obviously there is better, but I am talking about the number of potentially influenceable users. When a third of the world’s population connects to your apps regularly and many are addicted to them, it is obvious that such power can generate several concerns for governments. If WhatsApp Pay were to spread worldwide, hundreds of millions of people would carry out almost every daily activity of their lives through WhatsApp, without taking advantage of external apps and websites. This could give Meta arguably too much power, which is why it has only been spread to two countries so far.

As for the Metaverse, now it is not possible to make predictions about what it will become in 10 to 15 years, but the company has its sights set on it and believes it could have 1 billion users in the future. Should the plan go through, we could expect several limitations to be met there as well.

In general, Meta is one of the best AI companies in the world, which is great. However, this new world is only in its infancy, and there is still no real legislative apparatus that can be consulted on the appropriate uses of new technologies. My impression is that these are integrating faster than we think into today’s society, but sooner or later there will be tangible consequences to deal with. Regulations will happen over time and some of them could likely affect Meta’s operations.

Conclusion

WhatsApp represents Mark Zuckerberg’s hidden ace up his sleeve, and in the coming years, it could drive up revenue growth thanks to its popular click-to-message ads and WhatsApp Pay. The latter has the potential to change the habits of billions of people, making it one of Meta’s most interesting projects at the moment. Certainly, the reality labs segment has surprises in store, but I think it is still in an embryonic stage; WhatsApp, on the other hand, is ready to explode. Of course, let’s not forget that Facebook and Instagram remain the most widely used social networks in the world, which makes Meta a company with a huge competitive advantage. Threads could also be added to the list.

The risks on future regulations are not to be underestimated, but at the current price I think it is worth buying this company: it could do very well even in 2024.

Finally, I would like to highlight an aspect that some of you may not know about WhatsApp’s expansion plan. My confidence in believing that WhatsApp Pay will disrupt the West lies in the fact that there is already an app in the East that does all this: WeChat.

WeChat, owned by Tencent (OTCPK:TCEHY), is the largest standalone app in the world and has 1.33 billion users: about 59% of the entire Chinese population is subscribed, which makes it clear how successful it has been. Describing all the features of this app is complex, but more or less we can compare it to the WhatsApp of the future with the integrated payment system. In 2021 WeChat generated $17.49 billion in revenue, mainly due to WeChat Pay. Now, try to imagine how much WhatsApp could generate considering that it has more than twice as many users and many of them in countries with far higher GDP per capita than Eastern countries.

All in all, if WhatsApp Pay were to spread around the world, I doubt there will be any discussion about which will be the best tech company out there.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2024 Long/Short Pick investment competition, which runs through December 31. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.