Summary:

- PayPal stock has lost over 75% of its value since a bearish video was published in February 2021, highlighting the importance of valuation.

- PayPal’s current P/E ratio is cheap compared to the S&P 500, and its earnings growth rate is higher than the market average.

- Using a conservative valuation method, PayPal’s expected 10-year CAGR estimate for earnings returns is above 8%, making it a “Buy” with a 1% portfolio weighted position.

Userba011d64_201

Introduction

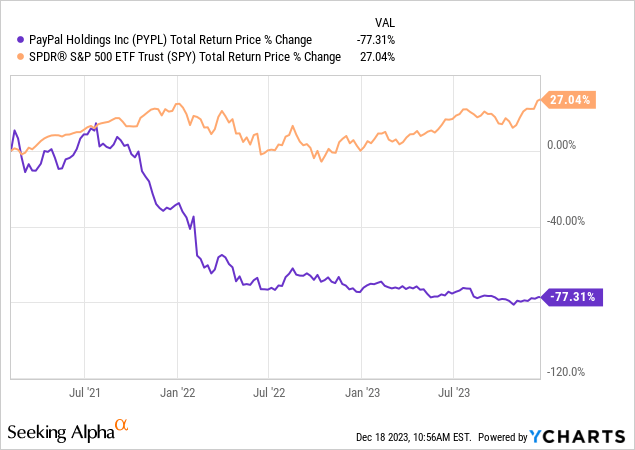

Because I create my own investing strategies and techniques rather than adopting or mimicking the strategies of other investors I always like to begin my articles by reviewing the performance of any past coverage of a stock I have shared so readers have at least some performance data to reference. For many years I didn’t comment too much on PayPal (NASDAQ:PYPL) stock because I prefer for stocks to have gone through at least one recession in the past so I can see how their earnings performed during that recession before I form an opinion about it. Back in 2008, PayPal was still part of eBay (EBAY) so that data wasn’t available. But on February 6, 2021 PayPal stock had gotten so overvalued that I decided to publish a bearish video on my YouTube channel titled “Why It’s Time To Take Profits In PayPal”. Since that warning, here is how PayPal stock has performed compared to the S&P 500:

PayPal stock has lost more than three-quarters of its value, demonstrating that valuation does indeed matter over the medium term.

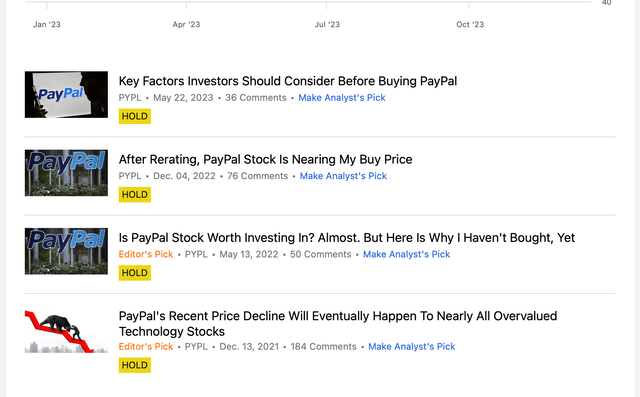

I followed up PayPal’s stock price decline with several neutral rating articles on Seeking Alpha over the past three years, explaining why I hadn’t bought PayPal, yet, and sharing the prices and metrics I was targeting for a potential purchase.

Seeking Alpha

In this article, I will break from my past neutral ratings and share why I decided to go ahead and start a position in PayPal. While there will be some small modifications, the basic valuation method that caused me to be bearish near PayPal’s peak is the one that causes me to be cautiously bullish now.

Estimating PayPal’s Future Returns

I always start by examining what a business’s earnings have done historically because I’ve found that about 80% of the time the historical earnings trend tells us the most about a business and serves as a good guide to the future.

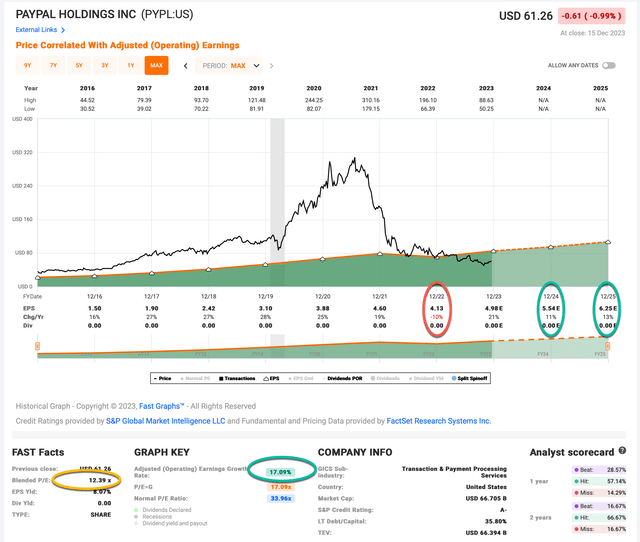

FAST Graphs

Let’s start by reviewing some basic metrics on the FAST Graph above. The first thing worth noting is the current P/E ratio for PayPal using this year’s adjusted earnings is only about 12.39. This is pretty cheap compared to the current S&P 500 valuation which I estimate is in between 19 and 20. Next, PayPal’s earnings growth rate from 2016 through its expected 2025 earnings is about 17%. The S&P 500’s average earnings growth over this same time period is about half that. So, PayPal has been growing faster but is valued cheaper than the aggregate S&P 500. Earnings growth in 2024 and 2025 is expected to be about 12% on average. So, on a forward-looking basis, PayPal currently has a PEG ratio of about 1.0, which is usually an attractive level at which to buy a stock. These simple metrics make PayPal look like a “no-brainer” at today’s prices.

However, I like to be conservative. So let’s look at basic earnings instead of adjusted earnings.

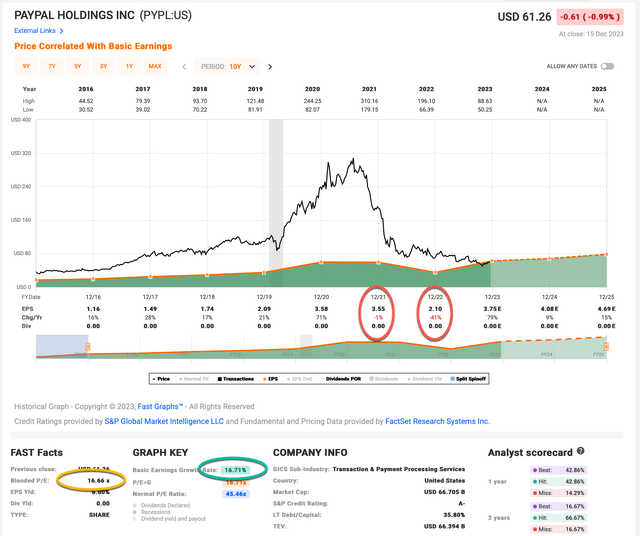

FAST Graphs

When we look at basic earnings we can see that a -42% earnings decline over the course of two years combined with the overvaluation I noted in early 2021 largely explains the massive stock price decline we’ve seen over the past three years. Additionally, the 16.66 P/E ratio is a little closer to the market’s P/E ratio and is about the market average historically. What remains strong, however, is PayPal’s earnings growth rate, which still comes in around 16% to 17%. This still works out to a PEG of around 1.0 if we use the historical trend (a little higher if we use 2024 and 2025’s expected average growth of about 12%).

I will use these more conservative numbers to run my valuation analysis.

PayPal’s Valuation

My basic valuation technique is to use a combination of earnings yield and earnings growth to project out how much in earnings I would be able to collect over the course of ten years if I was the sole owner of the business, then covert that amount of collected earnings into a CAGR percentage, and if that CAGR is acceptable to me, buy the stock.

This really only requires three metrics if we determine that earnings aren’t too cyclical, which is what I will assume for this estimate. However, it is worth noting that a drop in basic earnings between -40% and -50% I do consider at least moderately cyclical, so I expect that PayPal’s business has at least some economic sensitivity. If we had a recession tomorrow, it would certainly hurt their earnings, but with interest rates recently coming down after the last Fed meeting, the near-term risk of a deep recession has been reduced.

The three metrics we need are the stock price (which we can simply look up), the earnings, and the expected average earnings growth rate over the next decade. In my “Sell” video, I was actually quite generous with PayPal and projected 20% earnings growth going forward. In this “Buy” article, I am going to be a lot more conservative and project 12% earnings growth, which is more or less in line with what analysts are expecting. And, as I noted earlier, I’m going use the more conservative basic EPS of $3.75 per share for 2023, which is about a 16.71 P/E as I write this article. The earnings yield is the inverted ratio of the P/E, so earnings over price, or E/P. I have that at about +5.98%. The way I like to think about this is, if I bought the company’s whole business right now for $100, I would earn $5.89 per year on my investment if earnings remained the same for the next 10 years.

Next, I’ll apply the 12% earnings growth rate to current earnings, looking forward 10 years in order to get a final 10-year CAGR estimate. If I bought PayPal’s whole business for $100, it would pay me back $5.89 plus +12% growth the first year, and that amount would grow at +12% per year for 10 years after that. I want to know how much money I would have in total at the end of 10 years on my $100 investment, which I calculate to be about $216.99 (including the original $100). When I plug that growth into a CAGR calculator, that translates to a +8.05% 10-year CAGR estimate for the expected business earnings returns.

My current “Hold” range for stocks using this method of valuation is between 5% and 8% 10-year CAGR earnings expectation. So, below 5% I consider selling a stock, and above 8% I consider buying a stock. PayPal is above the 8% threshold so it is currently a “Buy” and I have recently added an approximately 1% portfolio weighted position. Using the valuation method I have shared here I typically do not exceed a 2% initial weighting in a stock. A bigger weighting would require more in-depth work on the business and speculation about the future outlook.

Conclusion

There are certainly still risks that remain for PayPal, a few of which I covered in my last article “Key Factors Investors Should Consider Before Buying PayPal“. Those questions include how cyclical their earnings will ultimately be, competition from things like Apple Pay, analysts’ inaccurate earnings estimates, and potentially central bank digital currencies. These sorts of risks are why I take small portfolio weightings. That’s my method of mitigating them, while still being able to buy stocks when they appear cheap.

I always like it when I’m able to warn investors about the high valuation of a stock near its peak, and then later get a chance to buy the stock when the price is much lower. Now it’s just a matter of waiting several years to see how PayPal’s business performs. If they do reasonably well, I expect the stock price will follow.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $40/month, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.