Summary:

- Intel Corporation’s recent unveiling of new chips like Gaudi3 failed to impress Wall Street, as the stock barely moved after the announcement.

- On the other hand, AMD’s recent event launching MI300X chips was received very positively by Wall Street, with the stock up by 20% since the launch.

- Intel is in a tough position if it decides to directly compete in the AI GPU, as Nvidia and AMD have already gained big customers.

- Other big tech players like Google, Amazon, Microsoft, Tesla and others are also developing their own AI chips which will increase the competition within this industry.

- Intel is too late to the party and it would be difficult for the company to carve out a sizable market share in the AI GPU chip industry.

hapabapa

Intel Corporation’s (NASDAQ:INTC) recent event failed to impress Wall Street despite many analysts pointing to this event as a key milestone for the company. Intel’s Gaudi3 chips will be competing directly with Nvidia’s (NVDA) H100 and Advanced Micro Devices’ (AMD) MI300X. Nvidia already has the majority of the market share in the AI GPU industry while AMD has announced a very competitive product. At the same time, other big tech players like Google (GOOG), Amazon (AMZN), Microsoft (MSFT), Tesla (TSLA) and others are also building their custom artificial intelligence (“AI”) chips that handle different types of workloads.

The competition within this field will increase significantly in the next few months, and it is unlikely that Intel will be able to carve a market share within this industry which can have a material impact on the stock. Many commenters in the previous article pointed to the product pipeline of Intel and indicated they expected the recent event to be a major turning point for Intel. We can already see that the stock has not been rewarded for the announcement of these new chips

After AMD’s MI300X event, the stock went up by a staggering 20%, which shows that Wall Street was enthused by the product. The announcement of the buying decision by Meta Platforms (META) and Microsoft gave further credence to management’s claims. However, Intel stock has not seen any bullish reaction after its own AI Everywhere event. The stock is already trading at high valuation multiple even when we consider EPS estimates 2 fiscal years ahead. It would be difficult for the stock to outperform the broader market in the next few quarters in this scenario.

No surprises in the recent event

There were no positive surprises in the AI Everywhere event in which Intel’s management announced Gaudi3 chips which would be used to handle AI workloads and compete directly with Nvidia and AMD. Many bullish analysts had been pointing to this event as a key milestone for the company. But the management failed to announce any significant steps that would help them corner a big slice in the AI GPU market.

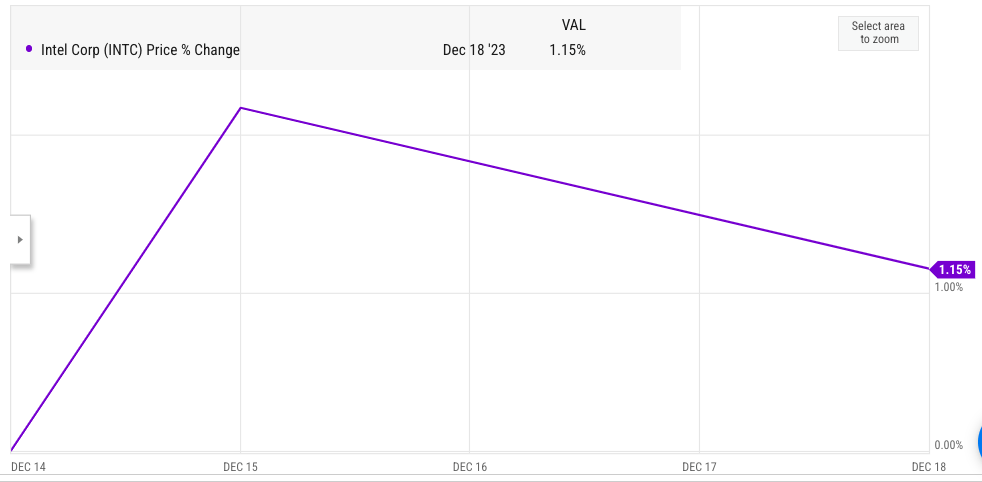

Ycharts

Figure: Intel stock after the recent AI Everywhere event. Figure: Ycharts.

One of the reasons why AMD stock performed well after its own AI event launching MI300X chips was the announcement to buy these chips by Meta and Microsoft. Both these tech majors have been among the biggest users of AI chips in the last few quarters. Nvidia’s chips have performed the task well, but they are very expensive, even for big tech companies and well-funded startups. OpenAI’s Sam Altman mentioned earlier that the cost of running these AI chips is “eye-watering.” This has given AMD an opening where its own AI chips could provide similar computing power at a cheaper cost.

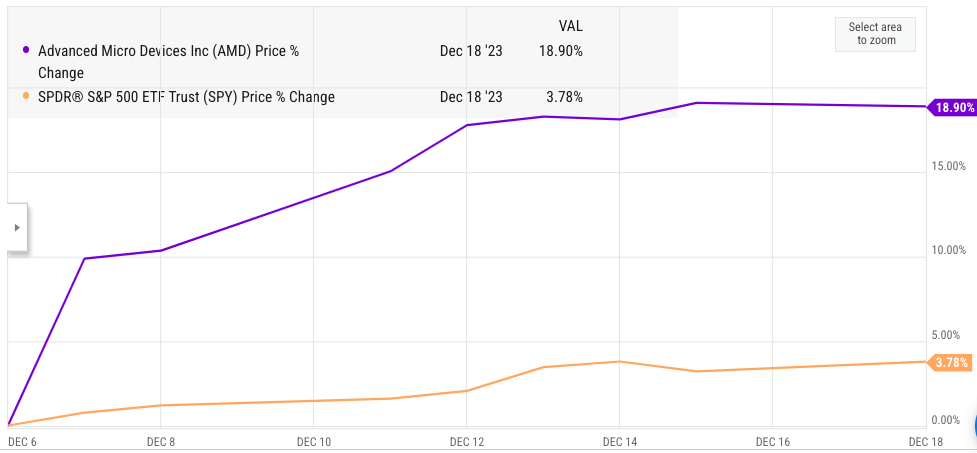

Ycharts

Figure: Jump in AMD’s stock price after its AI event. Figure: Ycharts.

Massive increase in competition

There is likely going to be a massive increase in competition within the AI GPU chip industry. Nvidia’s H100 was the only game in the town for most of 2023 which allowed the company to post very high revenue growth and margins. This helped the stock jump by over 250% YTD. However, going forward, the dynamics in this industry will be very different.

AMD has already announced its MI300X, and this chip is performing at close to similar levels when compared to Nvidia’s H100 chips. Nvidia itself has also announced the next gen H200 chips which would provide further improvement. In this environment, Intel’s Gaudi3 chips will be too late to the party.

There is likely going to be a massive increase in AI workloads and demand for AI chips in the next few years. This increase in the overall pie could help companies which are only a step behind the market leader. However, Intel is significantly behind Nvidia and AMD in the AI race. The management has not announced any roadmap for when they will be able to catch up. This means that Intel will need to fight on pricing and would likely gain a small sliver of this lucrative business.

Is there a place for 4th position in AI GPU industry?

Besides Nvidia and AMD, other tech giants are also ramping up their own AI chip-producing capabilities. Almost all big tech majors including Google, Microsoft, Amazon, Tesla and others are looking to develop their own custom chips. This helps them develop better tools for their own cloud business and other segments in which they operate. Custom chips also provide an ability to differentiate the company from other competitors. There are immense resources available with these Big tech companies, and it is unlikely that Intel will be able to compete with them solely on the basis of its cash position.

The likely AI chip order over the next few years will be:

1.Nvidia

2.AMD

3.Big Tech players including Google, Microsoft, Amazon, Tesla and others

4.Intel.

Even if Intel manages to gain a few important clients and build its AI GPU chips, it will still be behind many competitors. This will be a major negative impact on the profitability of Intel’s chips due to its lower market share ranking compared to other competitors.

Investors hoping for a major boost in Intel’s revenue and profitability trajectory need to look at the competitive landscape. Intel’s management has not announced any initiative that will allow it to overcome the massive time gap in launch of its new AI chips and the previous generation chips by Nvidia and other players.

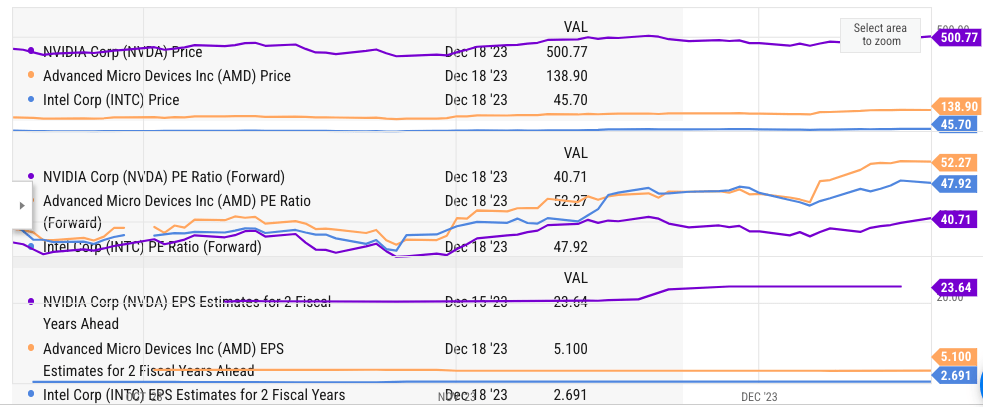

Intel stock is not cheap

Intel’s stock price is not cheap at the current valuation multiple, and the growth runway for AI and other segments is not very strong. Intel stock is trading at 48 times forward P/E ratio compared to 52 times for AMD and 40 for Nvidia. Even if we take a longer horizon and consider EPS estimates for 2 fiscal years ahead, Intel stock is still quite expensive. According to EPS estimates for 2 fiscal years ahead, Intel’s EPS will be $2.7 while AMD will $5.1 and Nvidia will be $23.6. This means that Intel stock is trading 17 times the EPS estimate for 2 fiscal years ahead. This ratio is 26 for AMD and 21 for Nvidia.

Ycharts

Figure: Comparison of Intel, AMD, and Nvidia in key metrics. Figure: Ycharts.

Intel’s current strategy of betting on the foundry business relies heavily on geopolitical situations. There are a lot of risks to the heavy capex made by the company, and yet Intel still failed to impress Wall Street with its new chips. This can end up hurting the returns potential of the company in the next few years as higher growth chip stocks gain favor with Wall Street.

Investor Takeaway

Intel recently unveiled new chips in its AI Everywhere event. The new Gaudi3 chips are supposed to compete directly with Nvidia, AMD, and other big tech players. Wall Street has not been impressed with the announcement, and the stock did not show any movement despite many next-generation chips announced in this event.

The competitive landscape for AI GPU chips will become more intense in the next few quarters. It is highly unlikely that Intel will be able to gain more than a low single-digit market share in this lucrative industry. At the same time, the stock is quite expensive even on a longer-term horizon compared to AMD and Nvidia. Intel has a number of risks that can hurt stock performance over the next few quarters making it a Sell at this point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.