Summary:

- Apple Inc. stock has reached all-time highs since the November rally driven by improving market optimism on impending rate cuts.

- However, Apple’s underlying fundamental prospects remain weak, as investors temper growth expectations due to macroeconomic and geopolitical challenges across its core U.S. and Chinese markets.

- The impending ban on Apple Watch sales in the U.S. beginning later this week is likely to further weaken the stock’s near-term performance.

raditya

Apple Inc. (NASDAQ:AAPL) stock has rallied to its all-time highs this month, benefitting from growing market optimism on impending Fed rate cuts and a potential soft-landing next year. Much of the stock’s recent uplift, which has propelled Apple back to exclusivity with its $3 trillion market cap, is attributable to market’s expectations for easing financial conditions ahead. This is in line with the steeping upsurge of downward revenue adjustments observed over the past three months.

Investors are likely tempering expectations on Apple’s near-term demand environment as macroeconomic and company-specific pressures on the consumer catch up. This follows four straight quarters of revenue decline at Apple, which was previously viewed as safe haven amid macroeconomic uncertainties due to its unmatched balance sheet. The company has continued to reel from a slowing consumer spending environment following the pandemic-era buying hangover and tightening financial conditions at home in the U.S. Meanwhile, emerging challenges to Apple’s Chinese market due to the region’s deteriorating economy and intensifying geopolitical headwinds adds salt to the wound.

Further complicating matters is the impending ban of Apple Watch sales in the U.S. heading into the critical holiday shopping season. Due to the adverse patent infringement ruling on Apple in October, the company is preparing to pull its best-selling Apple Watch Series 9 and Ultra 2 from the shelf later this week until further notice. The company is prohibited from selling Apple Watches featuring the blood-oxygen monitoring capability within its self-operated platforms in the U.S. beginning December 25. This leaves the lower-end SE model as the sole revenue generator for the product category until Apple finds a remediation that complies with the International Trade Commission’s ruling.

Although the timeline of the upcoming ban has largely bypassed the Black Friday / Cyber Monday and pre-Christmas shopping season, it is likely that Wearables, Home and Accessories revenue will be impacted through the coming quarters as Apple works on a solution. Specifically, Apple Watch sales have been a key growth driver for the Wearables, Home and Accessories segment in recent years. The product has also played a critical role in reinforcing Apple’s build-out of its broader services ecosystem needed for monetizing its sprawling, though stabilizing, devices installed base. Particularly, the Apple Watch is the key gateway to realizing the company’s growing focus on health features in recent years.

Management had also already warned of a significant slowdown to Wearables, Home and Accessories sales in the current period due to adverse lapping dynamics. And taking down one of Apple’s best-selling gift categories in its core U.S. market until further notice only exacerbates the situation. Taken together, we believe the latest development is material enough to single-handedly pull the stock back below the $3 trillion threshold, and further weaken durability to its near-term performance.

Apple Watch Patent Dispute

Apple lost to the patent dispute brought up by Masimo Corp. in October. The latter had accused the tech giant of stealing the blood-oxygen monitoring technology it had invented, and monetizing from it through Apple Watch integration. Specifically, Masimo accused Apple of infringing its proprietary blood-oxygen measuring technology that relies on light sensors to the skin. The ITC had ordered Apple to stop importing and selling any already-imported products that incorporate the infringed technology in 60 days from the date of the ruling, which occurred in late October. And the effective date of the ban is looming near, coinciding with Christmas Day.

The company cannot even bypass the ban by temporarily stripping the blood-oxygen monitoring feature from Apple Watches sold, as the infringement involves hardware designs as well. The only immediate solution is if the Biden Administration vetoes the orders, which is unlikely. In addition to this being a rare occurrence, the U.S. government would also be choosing the survival of one of two American companies. This differs from an overturned ban on iPhone sales under the Obama Administration in 2013, as it was a U.S. versus South Korea patent dispute.

The current ruling is expected to ban sales of the Apple Watch Series 6, 7, 8, 9 and Ultra 2 models starting next week. Specifically, Apple had introduced the blood-oxygen monitor through the Series 6 smartwatch. The technology has become a default in proceeding models ever since. Only the lower-end SE model is spared from the upcoming U.S. sales ban, as it does not offer the blood-oxygen monitoring feature.

Apple plans to remove sales of related products on its U.S. online store on December 21, and at its brick-and-mortar retail stores on December 24. Apple direct sales of the Series 6, 7 and 8 smartwatches have already discontinued across its U.S. storefronts. As such, the upcoming ban will primarily impact its latest and greatest – and best-selling – Series 9 and Ultra 2 smartwatches. Both models were recently launched alongside the iPhone 15 in September. They were a mere “minor refresh,” as Apple prepares for a symbolic revamp next year in celebration of the product category’s 10th year anniversary.

Currently, Apple engineers are working on potential software fixes that can assuage the infringement dispute. The company is already preparing for a submission of its remediation to the U.S. customs agency for approval to resume sales. However, Masimo has pressed for a “hardware overhaul” to remediate the issue. This, accordingly, adds uncertainty to when the Apple Watch would resume sales in its core U.S. market.

Financial Implications of the Apple Watch Sales Ban

Management had already warned of a significant slowdown in the Wearables, Home and Accessories segment in the current holiday quarter. This is primarily due to product launch tailwinds in 2022 – primarily the Apple Watch Ultra’s debut – that the company does not expect to repeat from this year’s refresh cycle. Looming macroeconomic challenges across its major U.S. and Chinese markets are to blame as well. Considering the typical slowdown in proceeding quarterly sales, the segment is set to kick off a slow fiscal 2024 outlook.

The latest sales ban on Apple Watches also restricts Apple’s intentions of shifting focus away from iPhone sales this year. The company has been banking on reviving momentum across its Wearables, Home and Accessories, iPad and Mac segments in fiscal 2024 to compensate for slowing iPhone demand. The Wearables, Home and Accessories segment will get the biggest upgrade. In addition to the long-awaited Vision Pro, Apple will also focus on overhauling its AirPods and Apple Watch offerings and sales strategy this year. This includes the anticipated 10th year anniversary revamp to the Apple Watch, as well as improvements to the product’s health and wellness capabilities. The strategy will be key to reinforcing Apple’s ecosystem of products adjacent to the iPhones, as well as services critical to improving overall monetization of its expansive devices installed base.

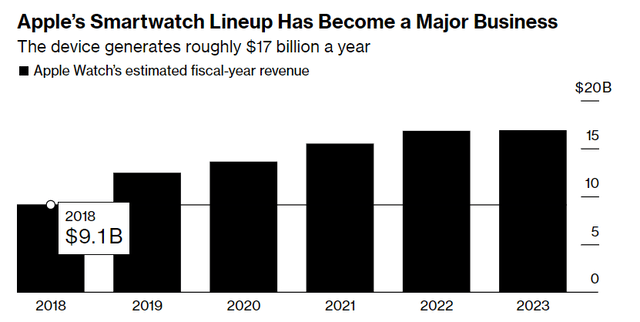

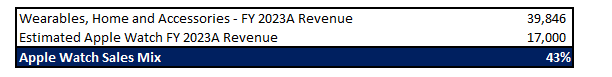

The Apple Watch is one of the fastest growing products within the Wearables, Home and Accessories segment. It is estimated that the product has contributed $17 billion to fiscal 2023 revenues – or about 43% of annual Wearables, Home and Accessories sales. This compares to a mere $9 billion in 2018.

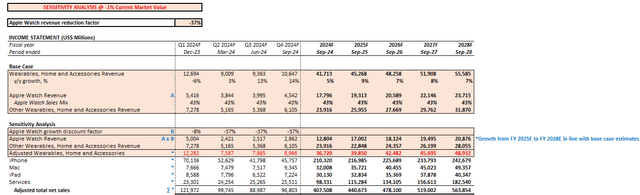

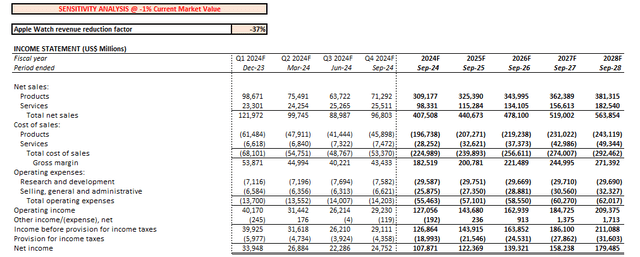

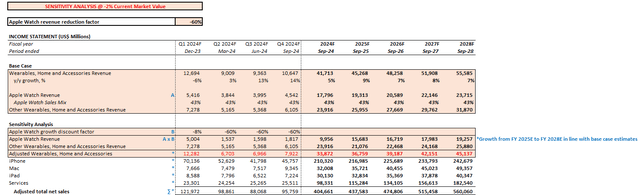

To gauge the financial implication of the impending Apple Watch sales ban, we have performed a sensitivity analysis to determine the extent of related revenue reduction needed over the next three quarters to impact Apple’s current valuation by 1%.

Revisiting the Base Case

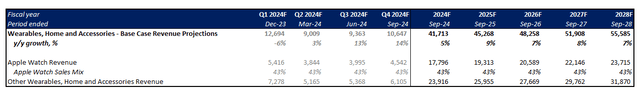

Before we begin with the sensitivity analysis, here is a recap of our base case analysis previously discussed.

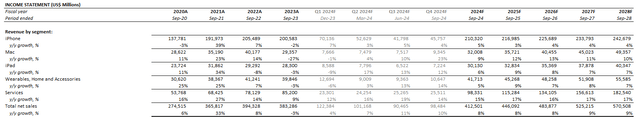

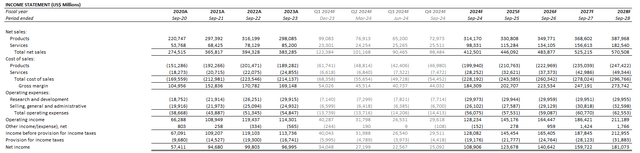

Revenue growth is expected to remain impacted by normalizing demand trends in product sales. Specifically, product revenue is expected to expand at 4.3% five-year CAGR. The Wearables, Home and Accessories segment is expected to be a key growth driver, with anticipated sales to expand at a 6% five-year CAGR. Meanwhile, Services sales are expected to stay resilient. The segment is expected to expand at a 13.2% five-year CAGR as the monetization of Apple’s expansion devices installed base continues to ramp. However, profit margins are expected to be adversely impacted by anticipated ramp-up cost challenges pertaining to the Vision Pro in the near-term. Related headwinds are expected to normalize through fiscal 2024, with margin expansion to resume as higher margin Services sales continue to scale.

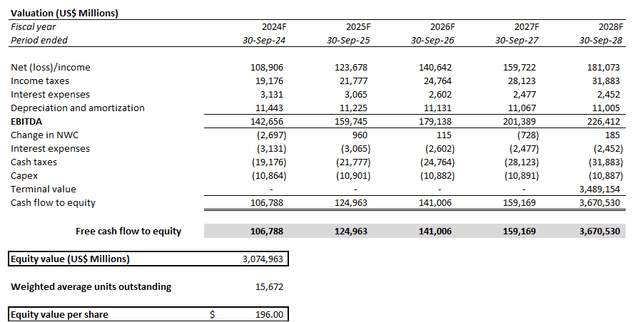

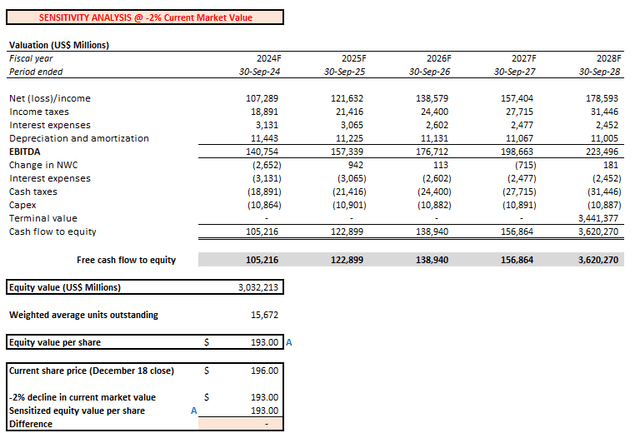

The relevant cash flow projections imply an estimated intrinsic value of about $3.1 trillion for Apple, or $196 apiece in line with the stock’s currently traded levels.

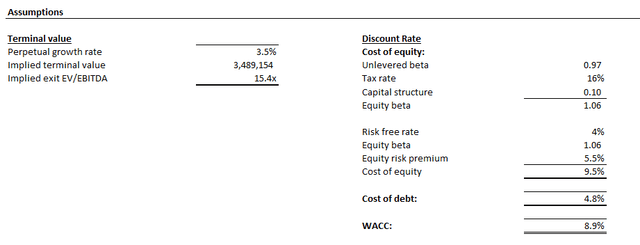

The price is slightly higher than our previous analysis to account for recent shifts in the macroeconomic environment. Specifically, Apple’s discount rate has been reduced from our previous estimate of 9.6% to 8.9%. This is primarily to account for the recent drop in the risk-free rate assumption that is benchmarked to 10-year Treasury yield (US10Y). Our risk-free rate assumption has fallen from the previous 4.5% to 4%, as Treasury rose on the Fed’s latest outlook on monetary policy given easing inflationary pressures. All other valuation assumptions, such as cash flow growth and estimated perpetual growth rate, remain unchanged from the previous base case discussion.

The resulting uplift in our base case price expectation is in line with the stock’s currently traded levels. This corroborates our expectations that the stock’s recent rally is primarily a function of broader macroeconomic considerations, rather than company-specific fundamental implications.

Apple Watch Sensitivity Analysis

However, the upcoming U.S. sales ban on Apple Watches could dampen the narrative further. In our sensitivity analysis performed, we assume Apple Watch revenue contributions to the Wearables, Home and Accessories Segment remains stable at 43% through the forecast period for simplicity purposes. This is in line with the estimated proportions coming out of fiscal 2023 as discussed in the earlier section. We believe the 43% sales mix assumption is conservative, given the Apple Watch has been a fast-growing business, and remains a critical component of the Wearables, Home and Accessories segment.

In order to gauge the impact of anticipated Apple Watch revenue reductions on Apple’s valuation, we have sensitized relevant sales. Specifically, anticipated fiscal Q1 Apple Watch revenue in the base case has been pro-rated for the number of sales days through December 24 in our sensitivity analysis. We have also applied a “revenue discount factor” to each of fiscal Q2, Q3, and Q4’s estimated Apple Watch revenue. Estimated Apple Watch revenue growth from fiscal 2025 onwards will be in line with the base case CAGR of 5.3% through fiscal 2028. Meanwhile, the growth and profit margin assumptions applied to all other revenue streams remain unchanged from the base case.

We have only applied a direct revenue discount factor to estimated Apple Watch revenues through fiscal 2024 in the sensitivity analysis. This is in line with expectations that Apple will find a remediation and resume Apple Watch sales in the U.S. by fiscal 2025, thus restoring the base case pace of growth thereafter.

In the best-case scenario, we expect Apple to find remediation through software changes, which is nearing submission to the U.S. customs agency for review. If approved, ensuing testing should take several months, with Apple Watch sales to resume thereafter. However, if hardware changes are required, the sales ban could be extended as subsequent adjustments to the supply chain would add to the impact timeline. As such, we believe the nine-month sensitivity timeline is sufficient to gauge the extent of direct impact to Apple Watch sales stemming from the patent dispute.

Our sensitivity analysis shows that a 37% reduction to our base case Apple Watch revenue estimates would be sufficient to drive a 1% decline in Apple’s current valuation.

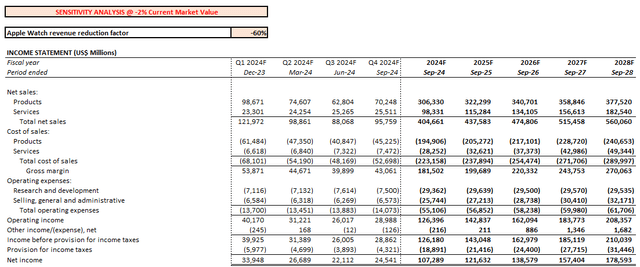

Meanwhile, a 60% reduction to our base case Apple Watch revenue estimates would be sufficient to drive a ~2% decline in Apple’s current valuation.

Paired with potential impairment charges on previous Apple Watch technology investments, as well as remediation costs, the ensuing cash flow impact could potentially drive the stock below the $3 trillion market cap.

We believe the 60% revenue reduction factor is very much a possible scenario over the upcoming quarters. Recall that the Series 9 and Ultra 2 are currently the best-selling Apple Watches, while the SE model only represents a relatively nominal portion of the product category’s U.S. sales. Preserving 36% of the base case Apple Watch revenue projection in our sensitivity analysis is already a generous representation of anticipated SE sales in the U.S., as well as overseas Apple Watch sales in our opinion. This is further corroborated by a close to 50% revenue contribution rate from the Americas at Apple, highlighting the significance of the upcoming Apple Watch sales ban in its core U.S. market.

The Bottom Line

As discussed in our previous coverage, we believe that the Apple stock is quickly losing momentum as the recent streak of weakening growth starts to eat into investors’ confidence. Despite its robust cash flows to protect against the impact of rising capital costs, deteriorating economic conditions and the slowing consumer is starting to affect Apple’s fundamental performance.

Consecutive revenue declines observed in fiscal 2023 also highlights company-specific challenges in preserving product demand. In addition to competition, Apple also faces the risk of an extended product lifecycle due to continued improvements to the technology. This accordingly discourages the frequency of upgrade-driven product sales. Some prospective buyers have even complained of an overwhelming and confusing line-up in the Mac, iPad and AirPods categories as a deterrent factor. This explains Apple’s urgency in remediating the issue by allocating greater focus to non-iPhone segments through fiscal 2024.

Meanwhile, the new Vision Pro headset is also unlikely to be a material contributor to sales growth and cash flows in the near term. Taken together with the upcoming temporary Apple Watch sales ban, we believe Apple Inc. stock is unlikely to find durability at current levels, with further risks of pullback on the horizon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!