Summary:

- Adobe Inc.’s stock price recently dropped 6-7% due to concerns about its subscription cancellation practices, which is a nothingburger of an issue.

- Adobe has created a flywheel that ensures its growth for many years to come.

- Adobe has a highly profitable SaaS business model and a competitive moat, which makes it an attractive long-term investment for patient, quality investors.

- Regulators have done shareholders a favor by effectively forcing the mutual termination of Adobe’s acquisition attempt of Figma.

- The recent hype over AI has probably forced Adobe to a price that is too expensive for new investors to gain market-beating returns.

GoodLifeStudio/E+ via Getty Images

Moats and Monopolies

Here at Moats and Monopolies, we run a concentrated portfolio of high-quality compounding assets from across the world. This is shared publicly and openly on Seeking Alpha. We have owned Adobe Inc. (NASDAQ:ADBE) shares since March 2021 and feel that even with the growth in the stock price this year, the company is still one of the very best available for buy-and-hold, long-term investors.

In this article, we’ll dive into how the company has been able to aggressively grow over the past decade, how its flywheel will continue for many years to come, and whether you should consider opening a position at current prices.

Fears and Opportunities

Adobe recently dropped 6-7% on the news that it was under investigation for its subscription cancellation practices by the FTC. Lina Khan, the head of the FTC, has been a long-time opponent of big technology companies, and last summer went after Amazon (AMZN) for its enrollment and cancellation practices for Prime Membership. As Adobe subscriptions have 14-day cooling off periods with no cancellation fees, and clear ways of cancelling subscriptions listed online, it feels like this is a bit of a nothingburger of a case and that any drop in Adobe’s share price will present an opportunity for buy-and-hold, long-term focused, quality investors. Further, the company’s high-profile acquisition of collaborative design application provider Figma was just terminated by both parties following regulatory scrutiny. We will argue that this is not necessarily a negative for shareholders.

A Little History

Founded in 1982, Adobe was famously the first company from “Silicon Valley” to be profitable right out of the gate due to its interesting connection to a young Steve Jobs, who wanted to buy the company for a few million dollars. Under pressure from early investors to sell, the co-founders John Warnock and Charles Geschke instead negotiated a deal that gave Jobs a fifth of the company’s shares for a price that included an advance fee for the use of their first product Postscript, which enabled printers around the world to understand different type fonts and print them consistently.

These early technology innovations would continue, and through a mix of internally developed applications and acquisitions, Adobe has grown its revenue in every one but 2 of its years as a publicly listed company, which in itself is pretty amazing.

Long-term shareholders have been handsomely rewarded for holding the company’s shares for virtually any period of time, but particularly over the past 10 years as Adobe moved from its legacy license business to a subscription-based Software as a Service (SaaS) model, where the majority of its products are only available through one of 3 different “clouds” or business segments.

Which leads us to reason number 1 why you should ignore the fear and consider Adobe – its diversified revenue streams.

1) A Smörgåsbord of Applications

If you only really encounter Adobe when reading PDFs, you may be wondering how they have a market cap of over $250 million that is quickly rising. Adobe primarily earns its income from creative types, for example: photographers, film editors, graphic designers and website developers. However, it has also spread out into other verticals and can be parsed into its 3 business segments:

Digital Media, the company’s largest segment, is made up of both Adobe Creative Cloud and Adobe Document Cloud. The former is their suite of applications such as Photoshop, Lightroom, Premiere, Dreamweaver and Illustrator that are key to the workflow of creators and developers. The latter is a small collection of specific e-signature and advanced PDF applications – think the soon-to-be-taken-private DocuSign (DOCU). In fact, Adobe’s Document Cloud segment and DocuSign have almost exactly the same trailing 12 month revenue, $2.69 billion and $2.709 billion, respectively.

Adobe Experience Cloud is a mostly acquired collection of online marketing and web analytics products that make up its CRM offering – think something similar to what Salesforce (CRM) does, but much smaller. This market is quite fragmented and forecast to grow at around 12% CAGR over the next few years, which would see it more than double by 2030. Adobe is currently the 5th biggest CRM software vendor, and even maintaining its roughly 4% market share could be quite accretive to the company if the addressable opportunity continues to grow at a 12% clip.

The final segment is quite a lot smaller, bringing in only $300 million of revenue (approximately 2% of the company), and that is Publishing and Advertising. Adobe offers a DSP (Demand Side Platform) for advertising – basically an automated application for businesses looking for somewhere to advertise their product or service, think The Trade Desk (TTD) but so small that Adobe itself doesn’t really seem to care about it. There is clearly a huge opportunity in digital advertising, but Adobe is unlikely to win much share against monsters such as Meta Platforms (META) and Google/Alphabet (GOOG) nor the myriad of other companies in the space.

2) Moat and Margins

Is Adobe a monopoly? No. It does have a lot of products that are ubiquitous in their respective field, such as Photoshop, Premiere and Lightroom; however there are alternatives, they are just either not as good or as popular. Statista, for example, suggests that Adobe has over 80% of the Graphics Software market with Photoshop, InDesign and Illustrator. Having a very high market share in professional design software means that creatives will upskill themselves to use these tools and expect to be able to use them at future jobs. Studios will also expect that their employees can use these tools and not want to invest money unnecessarily into training for different applications. This two-sided demand ensures that Adobe can keep their prices high and know that they will still sell subscriptions. This means fantastic margins for shareholders.

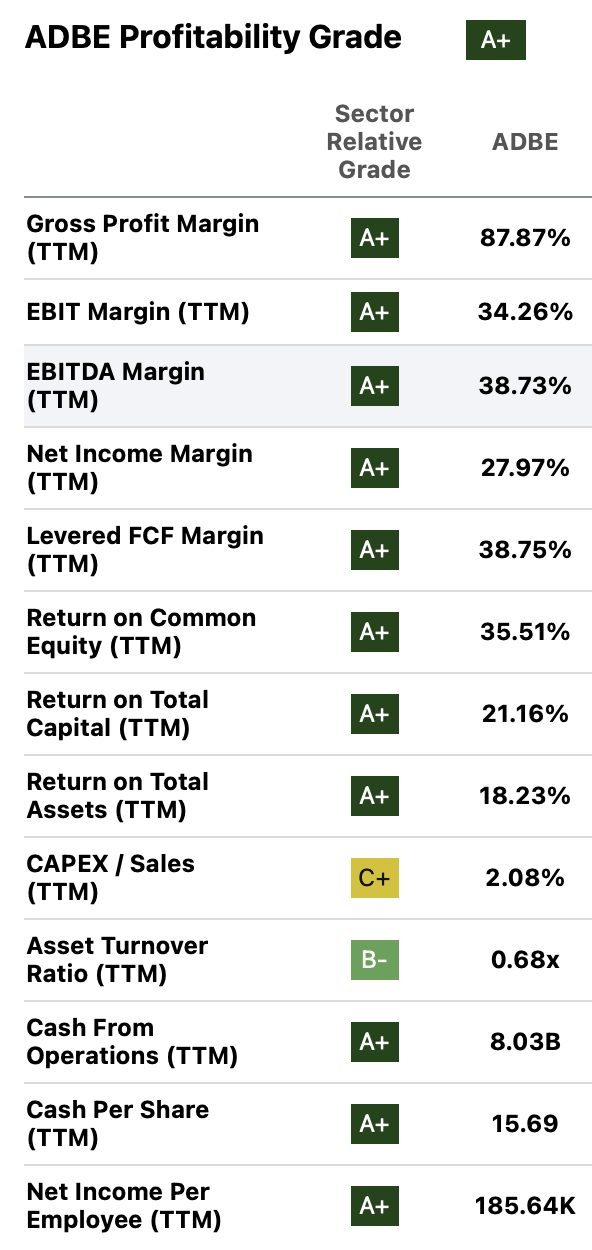

Adobe’s Profitability Metrics (Seeking Alpha)

As you can see from the screenshot from Seeking Alpha above, Adobe has net income margins that hover around 30% and Free Cash Flow margins that are approaching 40%. Software as a Service, or SaaS, businesses generally require software developers and a skilled workforce that leads to stock-based compensation (“SBC”) being quite high, and this is the same for Adobe. Around 22% of its free cash flow is a result of SBC. However, as they are running pretty efficiently with a net income per employee (an underused but important metric in our opinion) of $185k, even with these extra stock payments the company is still able to reduce its share count, with 2023 seeing a net 2.5% of its diluted shares being purchased and retired.

3) SaaS Business Model

One of our favorite business models here at Moats and Monopolies is the SaaS model. Each month/year, a regular amount of revenue is given to a company and they can slowly increase the price of this over time as well as selling more subscriptions to new customers and upselling more products to existing ones. The best SaaS companies have healthy margins, typically with high amounts of either Sales and Marketing or Stock-Based Compensation, but the best of them should demonstrate smooth compounding of sales over time. Adobe is one of the very best, and currently as of full year 2023 has around 94% of their revenues that are subscription-based. Further, their revenues have not dropped year-on-year once in the past decade, as it has moved its various products over to cloud/subscriptions – that is impressive, and unlikely to change any time soon, as it is difficult to cancel subscriptions for work-critical software.

4) Revenue Growth + High Margins = Strong Balance Sheet + Acquisitions

Adobe has a wonderful balance sheet. In fact, it has only ended one fiscal year in the past decade with a net debt. The company creates a lot of cash flow that is then available for acquisitions. There have been almost 60 acquisitions since Adobe was founded, and they are getting larger over time. Most are not household names, but are bolt-on acquisitions that strengthen their suites of applications. For example, the $1.7 billion purchase of open source e-commerce platform Magento in 2018, a kind of a mini Shopify (SHOP), was over time made available on the Adobe Experience Cloud and rebranded Adobe Commerce.

The elephant in the room is the recently failed acquisition attempt of Figma, a collaborative design application, that had been taking market share from Adobe XD. Adobe, being the highly cash generative acquirer that it is, saw the threat, but not early enough to attempt to buy it under an eye-watering $20 billion of cash and stock, which was around 50 times sales at the time. This drove Adobe’s price down nearly 20% and would have meant a negative balance sheet as well as dilution for current shareholders… and, you know, 50x revenue is a lot.

It is easy to see how Figma would have fit nicely into Adobe’s Creative Cloud. However, as of Monday 18th December, the deal has been mutually terminated by Adobe and Figma after regulators effectively required Adobe to sell off the very application that they wanted – Figma’s design software – or the deal would have been blocked.

Our take is that regulators have done shareholders a favor here. Yes, Figma is well loved by its users. Yes, it was taking share from one of Adobe’s products. Yes, it would have been accretive to consumers in terms of useful applications within the Creative Cloud. However, the price was egregiously high and would have had a negative impact on company’s balance sheet and diluted us shareholders. Truth be told, Adobe has plenty of other revenue streams and will probably steal some features from Figma to slowly improve its own offering anyway. If you can’t buy them, copy them.

5) Integration

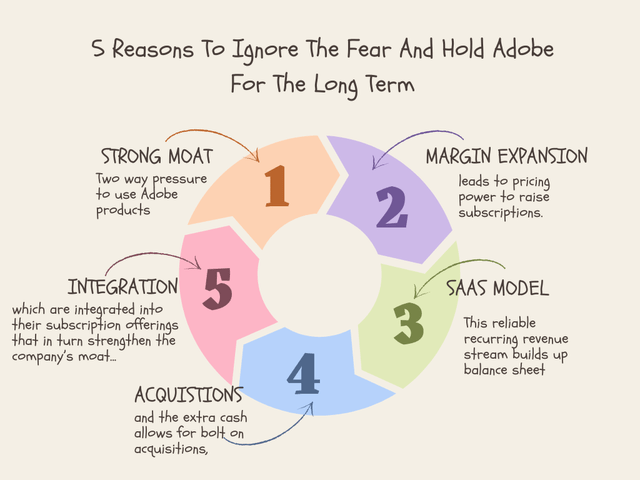

So, that is what Adobe does. They utilize the moat that they have on their software to drive up margins, and use the dependability of their recurring revenue business model to purchase smaller companies and then integrate them into one of their subscription offerings, which in turn allows them to translate the increased moat to increase prices, and sell more subscriptions. This flywheel is presented below for those visual investors.

5 Reasons To Ignore The Fear And Hold For The Long Term (Author using Canva)

It is also important to understand how Adobe is planning to use AI for its suite of products. We believe that Adobe is doing something very clever with the way in which it is integrating Adobe Firefly. If one searches “AI image generator” into Google, they will find a myriad of applications that can use prompts to create an image. To simplify this process: it basically scrapes the Internet for images that might fit the spec and then amalgamates them into what is an ostensibly original image. The results are generally very impressive, including our own knight in top hat logo; however, there is a future issue that will no doubt lead to a litigious outcome – copyright law.

The technology behind machine learning and AI has improved exponentially over the past couple of years, and our legal systems are notoriously slow at adapting to new challenges. But it will. And when it does, the excrement will hit the extractor. What Adobe is doing is utilizing its huge data sets of creatives’ work that it holds either rights to or permission to use for its image generating AI application, Firefly. This has led to some funny clips online showing some prompt comparisons across applications in which Firefly looked embarrassingly bad; however, the point was being missed – it didn’t rip images of Marvel characters or Mario or other recognizable IP, which led to worse results but legally defensible ones. Firefly will improve, and out a few years when rivals are being bankrupted by legal fees, Adobe will again further strengthen its moat against rivals.

Investment Risks

To summarize some risks that we have already discussed here: Adobe does have competition and is not the market leader in every vertical in which it is competing. It is under investigation by the FTC for its subscription practices, and although the announcement has been a little thin in detail, we can see previous claims against Amazon as being a benchmark for this one.

SaaS business models are not necessarily bad for the consumer – they ensure there is a financial incentive for developers to keep applications up-to-date, relevant and feature-rich; however, the investigation may examine cancellation practices or whether users lose access to their created content once subscriptions end.

Either way, we do not feel that there is very much that the FTC has over Adobe, Khan has to slowly move away from her philosophical issue she has with the power, scale and financial strength of Big Tech should she fail to prove that their practices harm the consumer. We do not feel there is evidence to say that Adobe will be particularly affected. The failed acquisition of Figma is probably not a negative in itself, but might signal that Adobe has grown to a size where it will not be able to buy itself out of trouble by acquiring larger companies in the future.

Valuation and Chances of Beating the Market

Adobe is undoubtably a top-tier company, of which to be a part owner, the issue is that we are not the first to notice, and recent excitement about AI has bid up the stock price.

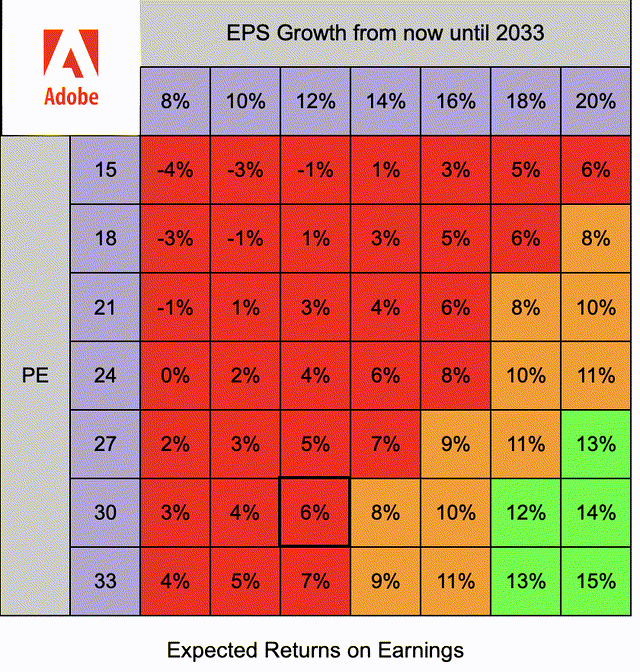

The matrix below allows one to make their own forecasted annual returns over the next 10 years. For a frame of reference:

Current TTM non-GAAP PE: 36

Red = 8% or less CAGR from the current share price

Orange = between 8% and 12% from current share price

Green = 12% or more from current share price.

Adobe has being growing its EPS very quickly over the past decade as it has transitioned to its SaaS model at a 35% CAGR, which is roughly a double every 2 years. This growth is slowing and has been half that over the past 5 years. Amalgamating analyst forecasts over various platforms suggests that Adobe is expected to grow its EPS at around a 12% annual clip, which feels about right and will be our base assumption. If you disagree, you can simply look along to a different column of the matrix.

Out 10 years to 2033, we would expect that Adobe’s margins will have grown a little, but its profitability will likely stay around its current place. We can see a world in which its Adobe continues to grow at a steady 10% into the future, using its pricing power and the increased uses of its creative software, the increased uptake of it CRM offerings as well as further moves into data analytics. We would expect their multiple on earnings to stay above that of the market, as it is an above-average quality business. Having already moved lower than its 5 year average P/E of around 40, we would expect it to fall further into the range of 28-30. We would also expect that the company will not pay a sizeable dividend in the next 10 years.

Our assumptions:

10 year future EPS CAGR: 12%

P/E in 2033: 30

No dividend of note is paid out of earnings.

Are marked on the matrix with the bolder border.

Expected returns based on EPS growth and PE Ratio over next 10 years (Author’s own work)

As you can see above, the company is currently overvalued, and even with a quite aggressive forecast of 12% EPS growth compounded over 10 years and a high multiple of 30, it would at these prices only return 6% per year. Not terrible, but probably below the market returns for the same period.

We used the same matrix to create the following prices targets:

Strong Buy – $350 – At this price, the same assumptions would lead to an annual return of 12%

Buy – $440 – At this price, the same assumptions would lead to an annual return of 10%.

Sell – We would not recommend selling Adobe for long-term investors, instead any dips should be strongly taken advantage of. A poor forecast or a quarterly report that suggests a slower growth or any fines relating to regulation could see opportunities.

Final Words

Adobe is a serial acquirer and has its fingers in many pies. It has suites of applications that are market leading and has created a flywheel that should ensure its continued success for years to come.

We find Adobe Inc. stock quite richly valued at these prices and would greedily buy more should there be dips on the way. It is a hold for those who own Adobe already, and we do not give a recommendation to begin a position unless you are happy to receive a lower return in the medium return in order to own a great company for the longer term – what we call “The Costco (COST) Paradox.”

Thank you for reading, and as always we appreciate constructive and respectful feedback.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.