Summary:

- Abercrombie & Fitch has greatly outperformed the targets it set with its ‘Always Forward Plan’ back in 2022.

- ANF has done a great job of reinvigorating its Abercrombie brand and will look to use the same playbook with Hollister.

- With a valuation well above historical norms and tough comps, it will be more difficult for the stock to outperform again in 2024.

Justin Sullivan

One of the best-performing stocks in 2023, Abercrombie & Fitch (NYSE:ANF) will have a difficult time repeating that performance next year.

Company Profile

ANF is an apparel brand and retailer. The company sells its products both through its company-owned stores and e-commerce platforms, as well as through some third-party channels. Its namesake brand is its largest at just over 50% of its sales, while Hollister is just under 50% of sales. It also owns the Gilly Hicks, Social Tourist, and abercrombie kids brands as well.

The company can ship its products to over 110 countries. Meanwhile, it has Hollister, Gilly Hicks, Abercrombie, and abercrombie kids stores in the U.S., Canada, Europe, Asia, and Middle East.

Opportunities & Risks

Back in June of 2022, ANF set out with its Always Forward Plan, which it targeted to grow the company’s sales by a 3.5% CAGR (compounded annual growth rate) to between $4.1-$4.3 billion with an operating margin at or above 8% by the end of fiscal 2025. It expected the growth to be driven by Abercrombie adults, Hollister, and Gilly Hicks.

For the Abercrombie brand, including kids, it was targeting a 6-8% CAGR adding $300-450 million in revenue by 2025. It was looking for the women’s category to lead the way, including strength in jeans. It was also opening smaller, omni-channel locations and planned to lean into data and analytics.

For Hollister, meanwhile, it was looking for a flat to 2% CAGR, adding about $100 million in revenue. With the Hollister brand, it planned to add more stores to fill in white space in U.S. and Western European markets. It was also looking to lean into data and analytics and to broaden its offerings to reach older Gen Z customers between the ages of 19-22.

For the smaller Gilly Hicks, the company was projecting about a 15% CAGR to grow revenue from $110 million to $170 million by the end of 2025. Given its smaller size, ANF planned to increase sales by opening new stores and increasing marketing to drive brand awareness.

Fast forward to today, and those goals look not only highly achievable but they will likely be easily surpassed. When the company reported its fiscal Q3 2023 results in November, it saw its sales climb 20% to $1.1 billion, with same-store sales up 16%.

Abercrombie revenue soared 30% to $547.7 million with comparable sales up 26%. Hollister sales rose 11% to $508.7 million, with same-store sales up 7%. Revenue was strong across regions, with the Americas up 22% to $867.6 million; EMEA up 14% to $158.0 million, and APAC rising 13% to $30.9 million.

The growth market is a continued acceleration from earlier this year, as its Q1 sales grew 3% and its Q2 sales rose 16%.

Gross margins, meanwhile, jumped 570 basis points to 64.9%, helped by higher AUR (average unit retail) and lower freight costs. ANF already had some of the best gross margins among retail-based apparel brands, so this improvement was impressive. Operating margins, meanwhile, also improved by 570 basis points to 13.1%.

Year to date, the company has seen its sales rise 13% and its operating margins improve 900 basis points to 9.3%.

Discussing the playbook the company is using on its Q3 earnings call, CEO Fran Horowitz said:

“So as you watch the evolution with us of the brand, we’ve gone really from it, a jeans and t-shirt brand to a lifestyle brand. And that has afforded us the opportunity to expand both our age demographic as well as the categories that we are offering. The journey reaching our 11th consecutive quarter of growth is probably less based on reduced promotions for A&F because we’ve made a lot of progress over the years, and there’s a lot of mix happening. And the consumer is responding to categories like outerwear and dresses. And we’re seeing her respond based on obviously value and the fashion that we put out there for the price point. So as I’d like to say, products plus voice plus experience actually equals AUR and what the consumer is willing to play and pay for their goods. How do we apply that to Hollister? We work on playbooks here. So we had a playbook for A&F. We started with women’s. We then went to men’s, same thing in Hollister. We’re seeing nice progress in girls. Now we’re working on the guy’s business. And then we’ll continue to roll that playbook out now geographically, right? We’re rolling into international and seeing success across all of our regions as well.”

Right now, ANF is operating on all cylinders. With its Abercrombie brand. the company has been winning by getting the current fashions right while being able to expand its demographic reach and get into more categories. At the same time, it has helped turn around Hollister, and it is just beginning to apply the Abercrombie playbook to the brand.

At this point, the biggest opportunity for the company is to just do what it is doing, because it is working. Once left for a dying brand that had continued declining sales, Fran Horowitz has helped turn the company around since she took over in 2017. The pandemic not surprisingly derailed her progress, but this year once again is showing the strides she has been making in returning ANF to its prior glory.

The company is on track to hit its FY2025 revenue goal this year, two years ahead of schedule. It would also be the first time it generated over $4 billion in revenue since fiscal year 2013 (ended February 2014). Horowitz and her team deserve a ton of credit for repositioning a brand that had fallen out of favor and once looked out of touch.

When it comes to risk, fashion risk is one of the biggest. The company has hugely benefited from getting the fashion right and being on trend. However, fashion trends among the younger demographic that ANF caters to can be fickle, and brands can go in and out of favor. Once hot brands, such as Vans, show how quickly the tide can turn.

While Abercrombie tends to be a more upscale brand, neither it nor Hollister, are completely immune to the macro economy. The company has thrived during what has been a tough environment for many retailers, but that now just leads to more difficult comps.

Valuation

ANF currently trades around 7.7x the FY 2023 (ending January 2024) consensus EBITDA of $607.4 million and 7.7x the FY24 consensus for EBITDA of $610.6 million.

From an EBITDAR perspective, it trades at about 5.5x EBITDAR.

It trades at a forward PE of 14.6x the FY23 consensus of $5.76 and 14.5x the FY24 consensus of $5.81.

The company is projected to grow revenue 13.4% in FY23 to $4.2 billion and 3.3% to $4.33 billion in FY24.

At the end of Q3, ANF had cash & equivalents of $649.5 million on its balance sheet and $248 million in debt.

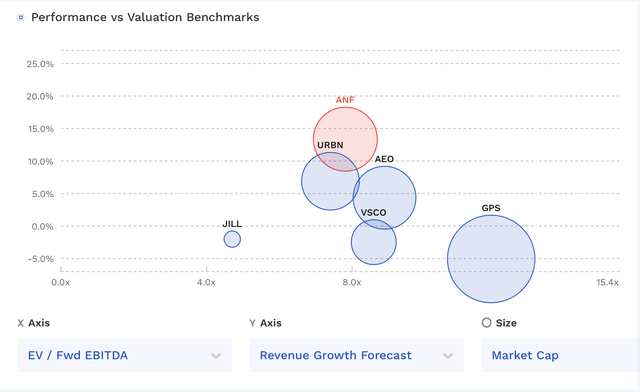

ANF’s valuation is among the cheaper names among its apparel brand retail peers, despite its superior margins and strong recent growth.

ANF Valuation Vs Peers (FinBox)

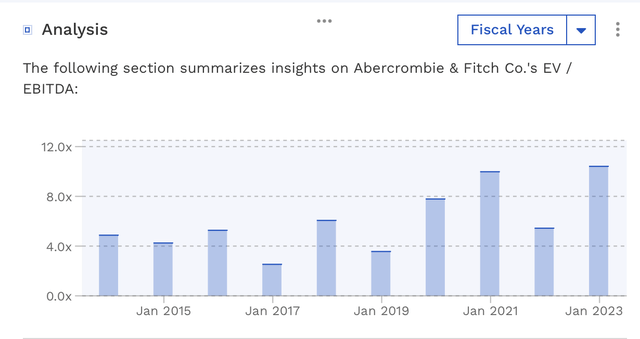

Prior to the pandemic, ANF commanded some low EV/EBITDA multiples of between 2.5-6x, although much of the time it was struggling with falling sales.

ANF Historical Valuation (FinBox)

Given its low historical valuation, valuing ANF isn’t the easiest task. It trades at a slight discount to rival American Eagle Outfitters (AEO) based on next year’s multiple, as AEO is trading an 8.0x vs 7.7x of ANF. Meanwhile, AEO has also tended to trade at a low multiple even when it was showing nice mid-single digit growth, often getting a 5-7.5x multiple.

Valuing the stock at between 5-9x EBITDA FY24 EBITDA would give you a fair value of between $50-$100, with $75 being the midpoint.

Conclusion

ANF has been one of the best-performing stocks of 2023, as it greatly outperformed the plan it laid out last year at its Investor Day in terms of both sales and margins. The big question is can this momentum continue against tougher comps, or will the company go back to its projected growth path. I really like what Horowitz has done at the helm as CEO, but continuing this trend in sales appears a tough task going against difficult compares in an uncertain macro environment.

With its valuation well above recent historical norms, albeit well deserved, I think it’s tough for new money buyers to jump in at this time. As such, I’m largely neutral on the stock. Kudos though to the company and its investors that got in earlier in the year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.