Summary:

- I sold my remaining shares of Home Depot, locking in a 90.05% profit.

- I’m reducing exposure to physical retail due to concerns about competition from eCommerce and rising retail theft numbers.

- I believe that Home Depot is overvalued compared to Lowe’s and has slower growth prospects, leading me to sell my shares.

Tim Boyle

About a month ago, I trimmed half of my Home Depot (NYSE:HD) position at $289.41.

I discussed that trade in this article.

Here’s the gist: I bought a house last month and owed the builder a check for the deposit. To raise those funds, I began trimming shares of my lowest conviction companies (with regard to long-term growth prospects).

Well, last week I parted ways with the rest of my position, selling the remaining half of my position at $351.82.

In doing so, I was able to lock in 90.05% profits.

Reducing Exposure To Physical Retail

Despite those big gains, Home Depot is one of the names that I’ve been selling for two primary reasons:

One, I’m not overly bullish on the physical retail industry moving forward.

I have concerns about the ongoing impact of competition from eCommerce competitors.

And more importantly (because I know that HD continues to invest in its digital sales segment), I’m worried about the rising retail theft numbers and a potential societal shift with regard to crime & punishment that presents an unprecedented hurdle for retailers to clear.

For instance, Target (TGT) recently stated that it closed locations because of theft, violence, and organized crime.

Simply put, the company said that in certain locations it has become too dangerous to operate stores.

Moving forward, I imagine that they won’t be the only retailers contemplating similar decisions.

Both Home Depot and Lowe’s have mentioned theft as a problem in recent quarters as retail shrink across the industry rises.

This doesn’t bode well for margins for companies that are experience growth headwinds coming off of the pandemic comps.

And two, I wanted to reduce redundancy across my portfolio and ultimately, reduce my overall position count.

Buying this home involved a lot of long-term financial planning. Thankfully, I’m healthy and God willing, I still have a long life ahead of me. But, when getting all of my ducks in a row from a financial legacy standpoint, I realized that my current portfolio would be a burden to manage/deal with for my wife/kids in the event of a tragedy, so I’m going to slowly take steps to solve that.

The timing of the big check that I had to write to my builder was unfortunate.

The S&P 500 has risen by nearly 7% since then. And many of the stocks that I sold to write it are up much more than that.

But, the fact is, the market could just have easily been down 7%.

No one knows what the future holds. The market is unpredictable in the short-term. I remind myself of this every time I get frustrated by the timing.

At the end of the day, I’m still thankful for the opportunity that we have to move into what will hopefully be our forever home (or at least, our family’s home until the kiddos leave and my wife and I are empty nesters ready to downsize).

And instead of pouting about the recent rally, I decided to capitalize on it.

HD shares are up by 22% since I originally trimmed my position on 11/13.

This rally has pushed the stock into overvalued territory, in my opinion.

And therefore, I was pleased to sell my remaining shares, killing a couple of birds with one stone (addressing both concerns listed above) while locking in significant gains along the way.

Home Depot vs. Lowe’s

Without a doubt, Home Depot is a great business.

This company has been generating outsized returns for its shareholders for decades.

HD’s 5 and 10-year price returns are 106.8% and 330.8%, respectively.

And I want to be clear here: I do not think this stock is going to crash or disappear moving forward.

I just think it’s unlikely that management is going to be able to duplicate its past success moving forward.

Furthermore, Home Depot trades at a significant premium to Lowe’s (LOW) right now and I don’t believe that this premium is justified.

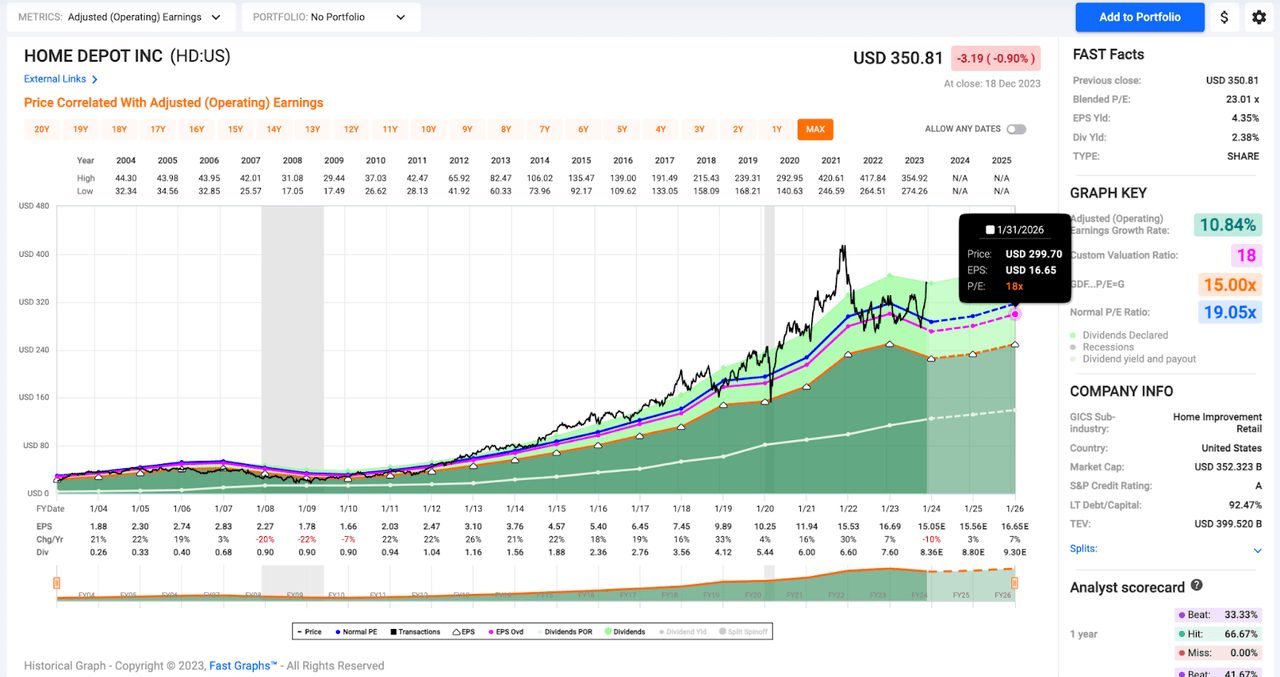

Right now, HD shares trade for 23x earnings. That’s north of its long-term average P/E of 21.9x. And it’s much higher than Lowe’s 17.1x earnings multiple.

Historically, these two companies have traded with somewhat similar multiples.

HD’s 10 and 20-year average P/E ratios are 21.9x and 19.05x.

Lowe’s 10 and 20-year average P/E ratios are 20.55x and 19.08x.

I’d be alright with HD trading with a much higher multiple than Lowe’s if its growth justified the premium.

For years, it did.

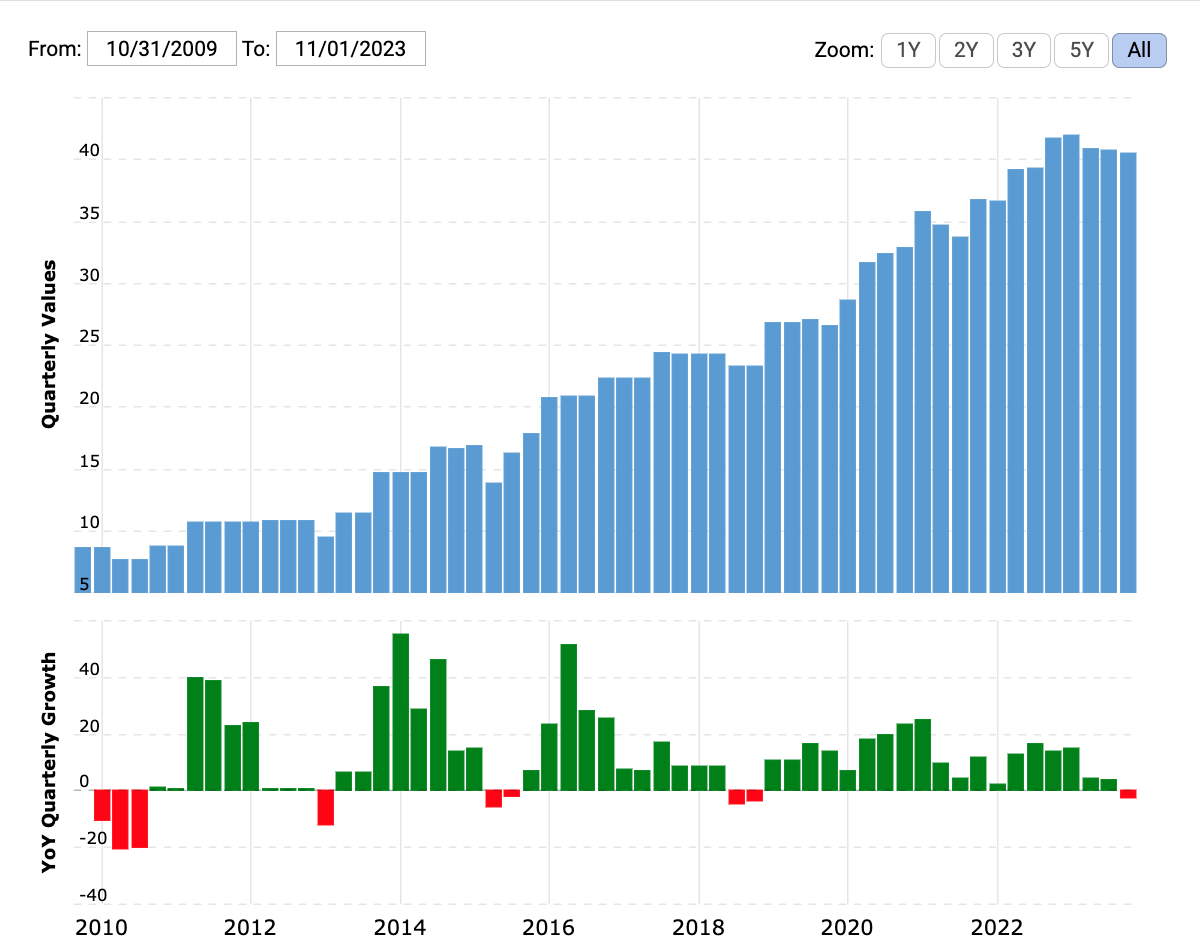

And from 2010-2020 it produced a much higher earnings-per-share CAGR than Lowe’s.

During that decade, HD’s EPS CAGR was 19.97% while LOW’s result came in at 16.8%.

However, since Marvin Ellison took over at Lowe’s things have changed.

From 2020-2023, Lowe’s has generated a 22.8% EPS CAGR while Home Depot’s EPS CAGR has slowed to just 10.1%.

It appears as though Ellison’s plans have allowed Lowe’s to take market share back from HD and that’s allowing Lowe’s to outperform its much larger peer.

Yes, HD has a stronger balance sheet (with an A- credit versus Lowe’s BBB+ score).

But, it’s important to note that HD’s debt has skyrocketed over the last decade or so and that presents yet another potential headwind in a rising rate environment.

Although HD has used its cash flows to pay down a bit of debt in recent years, its long-term debt has risen from $8.6b in 2010 to $40.5b at the end of its most recent quarter.

Macrotrends

All of HD’s debt ratios remain healthy and I’m not concerned with default or a dividend cut. But, I do believe that the massive buybacks that HD has been known for the years are going to slow/stop now that it makes less sense for the company to raise debt to retire shares.

That should hurt EPS growth moving forward.

Historically, HD has generated higher margins than Lowe’s. That’s been a quill in the bull’s hat here. But, that’s changing under Ellison as well.

Last quarter, both LOW and HD’s gross margin came in at 33%.

Furthermore, on a forward looking basis, Lowe’s has more attractive growth prospects.

The Wall Street consensus for Lowe’s EPS growth in fiscal 2024, 2025, and 2026 are -5%, -1%, and 12%… for a 1.4% CAGR, overall.

The consensus estimates for Home Depot for the same years are -10%, 3%, and 7%… for a -0.08% CAGR, overall.

Home Depot has a higher dividend yield than Lowe’s (2.38% versus 1.96%); however, Lowe’s has a stronger 5-year dividend growth rate (19.29% versus 15.20%).

Although dividend growth is slowing (relative to that 5-year CAGR) for both companies with HD posting a 10% raise in early 2023 and Lowe’s posing a 4.8% raise in May.

It’s clear that the poor growth prospects coming out of the pandemic period (where the economy was relatively strong, interest rates were still historically low, and consumers were being propped up by helicopter money from the government) are beginning to show up in the one metric that matters most to me (dividend growth).

This is why both of these two companies are rising up my potential cut-list.

But, Home Depot was a higher priority sell for me because of its relatively higher valuation and my belief that it no longer deserves the premium to Lowe’s that it has traded with for all these years.

Fair Value Estimates

So, I’ve established that I like LOW more than HD here, but let’s talk about my fair value estimate for HD, specifically.

Because of HD’s slowing growth, I don’t think that the current 23x multiple associated with shares makes sense.

F.A.S.T. Graphs

And honestly, I don’t think the long-term historical norm of 19x makes sense either.

HD was growing at ~20% per year for much of the period that led to that 19x multiple… and moving forward, its 3-year EPS growth outlook is basically flat.

Therefore, I think a 17-18x multiple on HD’s earnings is about right.

I’ll give HD the benefit of the doubt and apply those multiples to forward-looking estimates; however, even so, we’re looking at fair value estimates much lower than today’s prices.

17x the consensus analyst estimate for HD’s EPS 12 months down the road of approximately $15.50/share is $263.50.

18x the consensus analyst estimate for HD’s EPS 12 months down the road of approximately $15.50/share is $279.00.

Therefore, with slowing growth in mind, I’m looking at a fair value range between $265-$280.

Heck, even if you think that long-term average P/E of 19x is fair… 19x next year’s EPS gets us to a $294.50 price target (still significantly below today’s share price).

Similarly, if I were to be even more patient and place that 18x multiple (the upper end of my fair value range) of projected earnings 24 months out, I arrive at a $299/share price target.

This is highlighted in black box on the chart above. And that price level still represents ~15% downside from today’s prices.

So, no matter how you slice it, unless you’re willing to place a historic premium on shares, or you believe that the company will outperform Wall Street’s estimates by a wide margin – neither of which are bets that I’m willing to make – it’s difficult to justify today’s $350 price point.

With that in mind, I believe the risk/reward related to HD shares over the next several years is poor and therefore, I was pleased to sell the rest of my shares with such a high premium attached.

Conclusion

It’s always hard to part ways with a wonderful company.

HD has surely treated me well over the years and I’m grateful for the 90%+ profits that I made on this trade.

I still think HD’s dividend is safe. And looking ahead, I think mid-single digit dividend growth remains likely.

But, I don’t think HD will be able to use debt to fuel buybacks as effectively as it has in the past in today’s rising rate environment and that lack of financial engineering combined with a poor macro environment leads me to believe that there are better places for my capital than big-box retail.

I allocated those proceeds towards another dividend growth stock in my portfolio with a lower valuation, a higher dividend yield, faster earnings growth prospects, and a stronger dividend growth outlook (Air Products and Chemicals (APD) at $272.17, in case you missed my original trade alert).

All in all, I’ve achieved several goals with this trade. Moving forward, I hope that Lowe’s continues its recent rally because I’d love to make a similar move with those shares if they rise significantly up above my fair value estimate of $225 as well.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of A, AAPL, ABBV, ACN, ADC, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, BAH, BAM, BEPC, BIPC, BIL, BLK, BN, BR, BTI, BX, CARR, CME, CMI, CNI, CP, CPT, CRM, CSCO, CSL, DE, DHR, DLR, ECL, ENB, ESS, FRT, SPAXX, GOOGL, HON, HSY, ICE, ITW, JNJ, KO, LHX, LMT, LOW, MA, MAIN, MCD, MCO, MKC, MO, MRK, MSCI, MSFT, NKE, NNN, NOC, NVDA, O, ORCC, OTIS, PEP, PFE, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, RY, SBUX, SHW, SPGI, TMO, TD, TXN, USFR, UNH, V, VLTO, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.