Summary:

- Apple’s dominance in the mobile phone market and strong brand have made it a powerful and potentially monopolistic company.

- The company’s ecosystem, high switching costs, and barriers to entry give it a competitive advantage.

- Apple’s expansion into new areas like health monitoring and VR/AR could make it even more powerful, potentially leading to a forced breakup in the future.

Wirestock

The Apple Investment Thesis

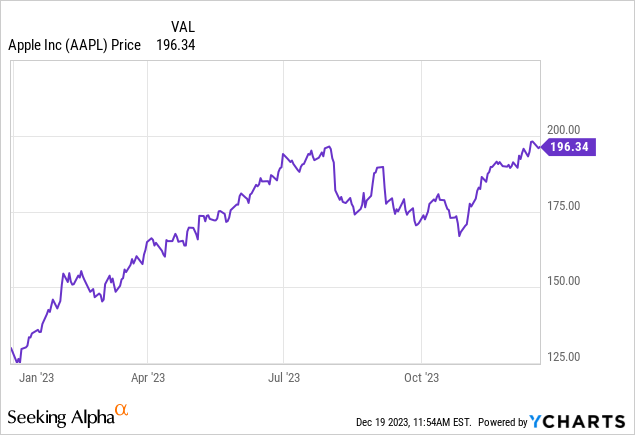

Apple Inc. (NASDAQ:AAPL) had another fantastic year in terms of stock performance. But with the exception of a few minor bumps in the road, Apple shareholders have gotten used to it since the release of the first iPhone, as Apple has been one of the best-performing stocks over the past 15 years.

Thanks to Apple’s market power and excellent design and management team, they have conquered the mobile phone market and created one of the best brands in the world. Maybe even the best. But because of its dominant status and monopolistic tendencies in some areas, I believe it is in danger of becoming too powerful and suffering the same fate as Standard Oil or AT&T Inc. (T).

Both companies were forced to divest in order to level the playing field. And with all the new areas in which Apple wants to compete, I can see them becoming even stronger than they are today. And they are already one of the best and strongest companies in the world. It seems like only the sky is the limit for Apple. So I would not be surprised if they have to spin off some parts of the company in the future.

How powerful is Apple?

I upgraded to the iPhone 15 a few weeks ago, and in terms of what I could have gotten for my money, another brand would probably be a better choice from a price/performance perspective. But I am deep into the Apple ecosystem, having my playlists in Apple Music, lots of notes in the Notes app, and Apple Pay is also an integral part of my daily life. So for me, the cost of switching would be immense.

The Apple brand is also synonymous with quality, and they really know how to create demand for their products. So Apple has pricing power because I’m willing to pay more for their products, and they don’t lose business when they raise prices, and they have really high switching costs. Customers who use an Apple Watch are even deeper into the ecosystem than I am.

The barriers to entry are also relatively high, as it is certainly not easy to compete with Apple’s operating system and intuitive user interface. Apple really does make life easier for its customers with all of their features, which is a huge competitive advantage on top of the ones mentioned above.

In addition, Apple continues to expand the ecosystem as the health monitoring space becomes more important to them, VR/AR Goggles are also likely to play a big role in the future, as we see with the Meta Platforms, Inc. (META) Ray-Ban collaboration that received a lot of attention recently. And even an Apple Car is a possibility. All of this makes you even more dependent on the Apple ecosystem once you are in it. Today, Apple Music is like Spotify Technology S.A. (SPOT) but with a slightly inferior algorithm, Apple TV+ is like Netflix, Inc. (NFLX) and Amazon.com, Inc.’s Prime Video (AMZN), even if it is currently inferior in terms of series and movies offered, and Apple Notes has quietly become one of the best solutions for notes and reminders.

Add in 24/7 personalized health monitoring, combined with Apple’s mountain of data and its analytics capabilities, and this company becomes even stronger. For example, monitoring sleep quality is extremely important and could help people live longer, healthier lives. Professor Matthew Walker from the University of California, Berkeley, wrote a really interesting book about this: Why We Sleep, and Apple could really help humanity here with data and analytics.

In addition, the App Store on iOS was a monopoly for a very long time, and the commissions on in-store sales and in-app purchases were a fantastic business for Apple. On Android, the Google Play Store is relatively similar, though a bit weaker in terms of market position. Still, both dominate their operating systems and are likely to continue to do so.

Looking at the current situation and the potential for growth, Apple can become even more powerful. And I think that could lead to a forced breakup like what happened to Rockefeller’s Standard Oil in 1911 and AT&T in 1984, both of which also got too big and powerful. Without the breakup, Standard Oil would have a good chance of being the largest company by market capitalization today. But Amazon, Google, and Meta may also face the same fate, as they are also dominant in many different areas and have monopolistic tendencies in some of them.

AAPL’s Metrics and Balance Sheet

Apple has $29 billion in cash and $106 billion in term debt, of which $9.9 billion is due in the next 12 months and $10.7 billion is due in FY2025. Net income was $96 billion, so net income plus cash is more than term debt, and therefore I consider Apple’s balance sheet to be very safe.

Apple’s FCF over the last 3 years was $82 billion in September 2023, $90 billion in September 2022, and $73 billion in September 2021. But as companies realize that investors are really focused on FCF, many are paying a good portion of their employee compensation through SBC to positively impact FCF and, of course, to allow employees to participate in the success of the company. So we have to adjust FCF for SBC. SBC was $10.8 billion in September 2023, $9 billion in September 2022, and $7.9 billion on September 21. Thus, SBC grew faster than FCF on a percentage basis over the period.

Adjusted FCF is as follows:

- 2023: $82b – $10.8b = $71.2b.

- 2022: $90b – $9.0b = $81.0b.

- 2021: $73b – $7.9b = $65.1b.

Even after the adjustment, FCF remains strong, but SBC costs cannot get out of hand and need to be monitored.

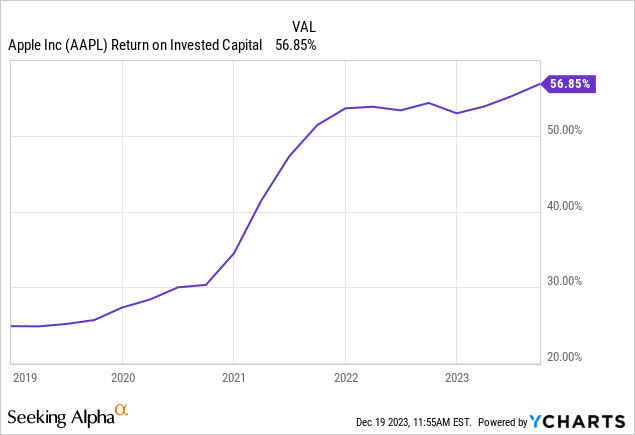

ROIC and Capital Allocation

ROIC is a backward-looking metric that tells us whether a company has earned a good return on its capital in the past, and because it is highly valued by investors today, it drives companies to maximize it. So the really high numbers today are hard to compare with the ROIC of companies in the 1990s or early 2000s. Still, Apple has a really strong return on capital and its ROIC-WACC spread is fantastic. With a cost of debt of about 4% and a cost of equity of about 8%, I get a WACC of about 8% for Apple. So the ROIC-WACC spread is in the high 40% range.

The number is probably a bit inflated due to accounting nuances, but Apple is still creating tremendous value with its investments. So in terms of capital allocation, especially through the multiple share buybacks, Apple has created tremendous value for shareholders.

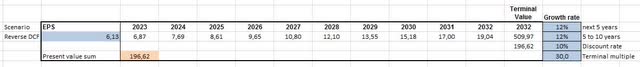

Apple’s Reverse DCF

A reverse DCF is my favorite tool to see what is priced into a stock, and with diluted EPS of $6.13, the stock is currently priced at a 12% annual growth rate over the next 10 years. Historically, the 5-year CAGR of diluted EPS is 15.52%, the 10-year CAGR is 15.75%, and the trailing 3-year CAGR is 23.18%. And I think a 15% 10Y CAGR could be achievable going forward as Apple still has growth left and will likely continue to buy back shares, which also helps EPS. So the stock looks undervalued.

What could EPS look like in 5 years?

Seeking Alpha Earnings Tab

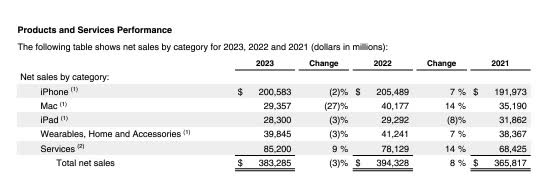

For many customers, the difference between the iPhone 15 and the iPhone 14 on the non-Pro models was not great enough to justify an upgrade, so iPhone sales took a hit this time around.

Apple Q4 Investor Presentation

However, Services continue to grow strongly and are now almost as large as Mac, iPad and Wearable combined. It is also the highest margin segment, with a gross margin of 70.8% compared to 36.5% for Products. So with your highest margin segment growing the fastest and with the potential of Apple’s health products and sales improvements from new iPhones, I can see EPS of about $12 to $13 in 5 years in September 2028, which is about a 15% CAGR.

Depending on the multiplier, the shares could then trade between $330 and $380.

Risks for Apple

With the Masimo Corporation (MASI) lawsuit and the suspension of Watch sales in the U.S., Apple has some temporary problems that could drag on longer. However, Apple is already working on a solution and will probably find one in a relatively short period of time. But the founder of Masimo is someone who doesn’t back down, so this is probably something that will keep Apple busy for a long time.

A potential breakup of Apple is obviously a risk, but if we look at the AT&T and the Standard Oil companies that were created, most of them continued to do very well.

Conclusion

If Apple were forced to sell some of its assets, some would still be best-in-class, but others, like Apple TV+, would lag behind the competition. But Apple is a clever company, and they will probably do everything in their power to prevent such a scenario. And even if this scenario comes to pass, it should be a great opportunity for investors to get into the favored segments. That said, segments like Apple Music and Apple TV+ are also important parts of Apple’s ecosystem and provide value. I think in a potential breakup, there would be a separation of the product and service segments because the combination of the two is incredibly strong. Maybe even the App Store would be spun off from Apple because it is kind of a monopolistic situation.

Since the services segment is the higher margin segment, I would say that would be an interesting prospect if that were to happen. Especially since the whole healthcare segment is likely to be extremely high margin if Apple can capture the potential of that industry. If Healthcare succeeds, Apple will be a hybrid of a major healthcare company and one of the world’s most important technology companies. A truly powerful combination.

But even without a breakup, Apple is attractively valued given its significant growth opportunities, incredible competitive advantages, and strong balance sheet.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.