Summary:

- AT&T’s stock price has weakened in December, making it an attractive gift for investors.

- The company has raised its free cash flow forecast for 2023, improving its ability to repay its high levels of debt.

- AT&T’s valuation is favorable at $16, offering a safe 7% dividend yield and potential for re-rating.

Brandon Bell

If you are looking for a gift to give to yourself just ahead of the holidays, buying AT&T Inc. (NYSE:T) might be just the gift you have been looking for.

AT&T has suffered new stock price weakness in December and with AT&T also raising its free cash flow forecast for 2023, AT&T might be in an even better position to repay a boatload of its high levels of net debt next year.

With debt repayments possibly accelerating in 2024, the dividend margin of safety could also improve (though it already is quite good). Finally, from a valuation perspective, AT&T is a bargain through and through at $16 and offers passive income investors a safe 7% and re-rating potential.

My Rating History

In my August article on the telecommunications AT&T: Progress In Debt Repayment Could Trigger Positive Re-Rating, I highlighted the possibility of a stock turnaround on the back of robust dividend coverage. AT&T’s stock at the time slid to new 52-week lows and passive income investors in particular appeared overly worried about the prospects of a dividend cut. AT&T raised its free cash flow forecast in the third quarter, leading to even better dividend coverage.

Potential Stock Catalysts: Free Cash Flow, Net Debt Reduction, Profit Growth

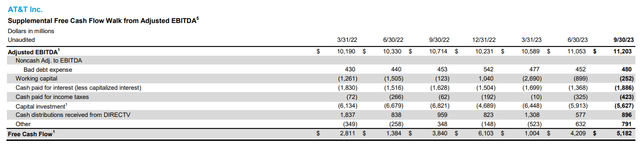

AT&T bumped up its 2023 free cash flow forecast for 2023 from $16.0 billion to $16.5 billion in the third quarter which is partially attributable to robust momentum in the company’s core segments 5G and fiber.

With now $16.5 billion in estimated free cash flow in 2023, AT&T is on track to produce a dividend coverage ratio of 206% compared to 200% previously. Frankly, I don’t expect AT&T’s dividend to grow, particularly against the backdrop of a rather considerable amount of net debt.

The big question for passive income investors in 2024 is going to be how AT&T is going to use its excess free cash flow. After all, the company pays round about $8.0 billion a year in dividends and if we were to calculate with $16 billion in annual free cash flow in the next couple of years, then AT&T has ~$8.0 billion in excess free cash flow available.

AT&T’s free cash flow was $16.5 billion on a rolling twelve months basis, so forecasting $16.0 billion in annual free cash flow, even without major growth in 5G and fiber subscribers, seems to be a very reasonable assumption.

In the last seven quarters, AT&T produced average free cash flow of $3.5 billion per quarter in the last seven quarters and $14.1 billion in 2022. A taking into account that AT&T plans to lower corporate expenses by $2.0 billion, I think the $16.0 billion annual free cash flow figure is reasonable.

I think that AT&T might use half of this free cash flow to invest in its core 5G phone and fiber segments which are really the only ones whose growth profiles could justify incremental capital allocation.

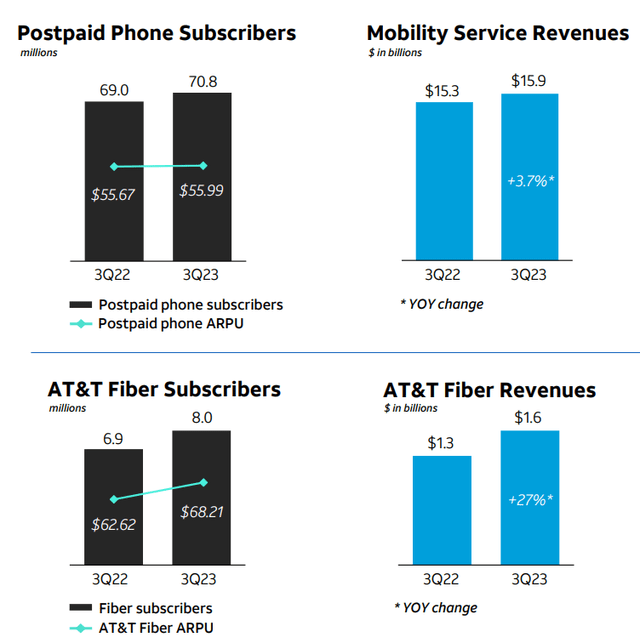

AT&T profited from ongoing growth in postpaid phone and fiber subscribers in 3Q-23, with growth being particularly robust in the fiber segment. AT&T grew its paying subscribers by ~300K in 3Q-23 pushing the total subscriber total up to 8 million.

The downstream effect of this subscriber growth was a 27% upsurge in fiber segment sales, momentum that I see continuing in 2024.

Subscriber And Revenue Growth (AT&T)

As I laid out in September in my investment thesis, AT&T could be on track to lower its net debt to $100 billion at the end of 2028 and I think AT&T, given its languishing stock price, could benefit quite substantially from accelerated debt payments, particularly now that free cash flow growth is brightening up AT&T’s prospect for incremental capital allocation.

With low single digit sales and profit growth expected for 2024, one lever that AT&T has at its disposal to grow its profits is to dial down its interest expenses. Since they are a function of the company’s absolute level of net debt, AT&T does have an opportunity here to grow its profits moving forward.

With $8.0 billion in free cash flow annually, after dividend payments, AT&T could afford $5.0 billion in cash payments to reduce its net debt. This means AT&T could maybe repay about 4% of its net debt balance in the amount of $128.7 billion (as of the end of the third quarter) annually and potentially save $240-260 million (pre-tax) in interest expenses annually which in turn would boost earnings by ~2%.

Why AT&T Is A Gift At $16

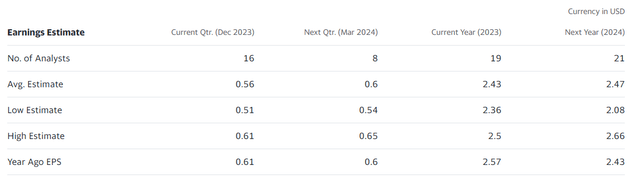

Taking into account that AT&T is presently expected to produce only 2% profit per share growth in 2024, AT&T actually has a chance to boost its profit growth rate moving forward.

Earnings Estimate (Yahoo Finance)

Too often passive income investors are overly preoccupied with the dividend and yield of an investment and ignore the value that is presented by buying a company like AT&T which has a balance sheet optimization catalyst.

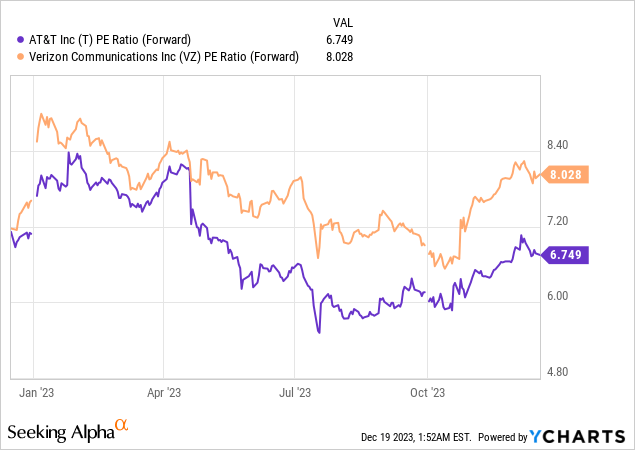

By that same token, the same applies to Verizon Communications Inc. (VZ) which also owes a boatload of debt. With $2.47 per share in profits expected in 2024, AT&T has a leading earnings multiple of 6.7x and is therefore an even better gift than Verizon Communications.

Verizon Communications sells for a leading earnings multiple of 8.0x, but based on average profit estimates, the company is poised to see a 2% profit decline next year.

Considering the potential for profit growth, robust (raised) free cash flow for 2023 and lower earnings multiple, at this time I prefer AT&T over Verizon Communications as a passive income instrument.

What Passive Income Investors Should Keep In Mind

AT&T has too much debt, I think we all agree on that and my assumption of $5 billion in annual net debt repayments may not be shared by other passive income investors.

With that being said, I acknowledge clearly the risks that stem from AT&T’s considerable net debt balance and a failure to address this issue will probably keep a lid on the company’s stock price growth.

A failure to repay, refinance or restructure AT&T’s formidable net debt might not only hurt AT&T’s stock, but also its potential for profit growth.

My Conclusion

AT&T is a gift at $16, but passive income investors should not only look at the 7% yield as the company’s most attractive attribute.

AT&T is a free cash flow king and raised its forecast for free cash flow to $16.5 billion in 3Q-23 which enhances its dividend margin profile given its new estimated coverage ratio of 206%.

More importantly, if AT&T throws $5 billion annually of its free cash at its net debt, the company could substantially lower its interest burden and actually boost its profit growth rate.

Since AT&T is a low growth company, I think what makes AT&T ultimately a value stock is its high free cash flow and the potential for a deleveraged balance sheet. Thus, AT&T has much more to offer passive income investors than just a 7% yield.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.