Summary:

- The Federal Reserve’s decision to pivot in terms of interest rates sets large Wall Street banks up for weaker profitability in FY 2024 and beyond.

- Bank of America’s shares have soared following the Fed’s announcement, despite a deteriorating outlook for net interest income growth.

- I see very little upside ahead given the strong price surge since November and sold into the strength.

- Investors should be fearful when the market displays signs of greed.

Brandon Bell

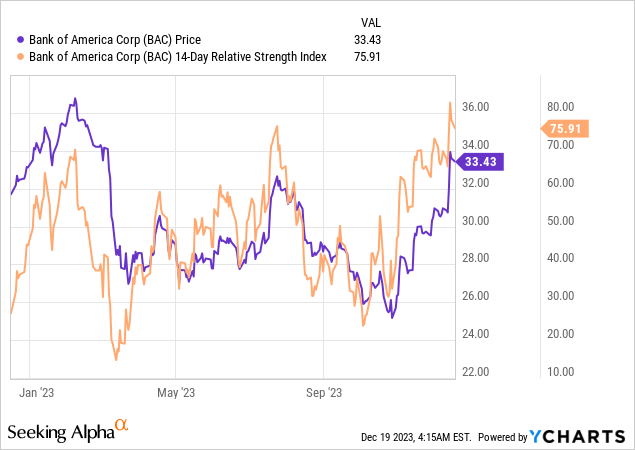

The Federal Reserve’s decision to effectively end its cycle of interest rate growth has been the major reason for me to liquidate all of my bank holdings, including PNC Financial (PNC), U.S. Bancorp (USB), Wells Fargo (WFC), and now Bank of America (NYSE:BAC). Bank of America’s shares have soared following the Fed’s announcement last week, making this a potentially attractive exit opportunity. While I still like Bank of America, the rise in valuation paired with a deteriorating outlook for net interest income growth in a changing interest rate landscape makes the bank a sell. With investors also displaying signs of greed, resulting in Bank of America’s shares being overbought based on the Relative Strength Index (Bank of America’s RSI exceeds 70, indicating overly bullish sentiment), I see a highly unattractive risk profile heading into 2024!

Previous rating

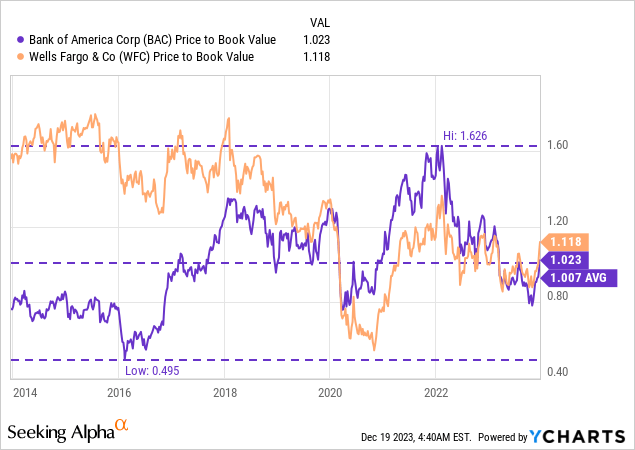

The failure of Silicon Valley Bank in March 2023 triggered a number of deposit runs on smaller lenders and destabilized the regional banking market to such an extent that the Federal Reserve found it necessary to effectively provide unlimited emergency liquidity. During Q2 especially I ramped up my investments in the banking sector as many banks traded at massive discounts to book value. My last rating on Bank of America, in October 2023, was strong buy due chiefly because of an attractive price-to-book ratio of 0.86x. This picture has fundamentally changed in the last two months, however, as bank valuations soared and the Fed announced a major policy pivot that will result in the federal fund rate dropping in 2024.

Pressure on Bank of America’s net interest margin is going to get more severe

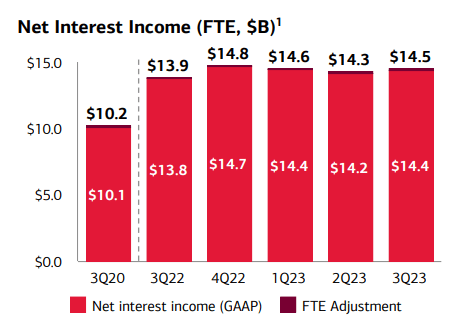

Bank of America’s net interest income started to soar in 2022 as the Federal Reserve changed its interest rate approach in light of massive inflation. Bank of America, however, has seen no real growth in its net interest income in recent quarters — in fact, the bank’s net interest income dropped in two out of the last four quarters — as interest rates undoubtedly peaked.

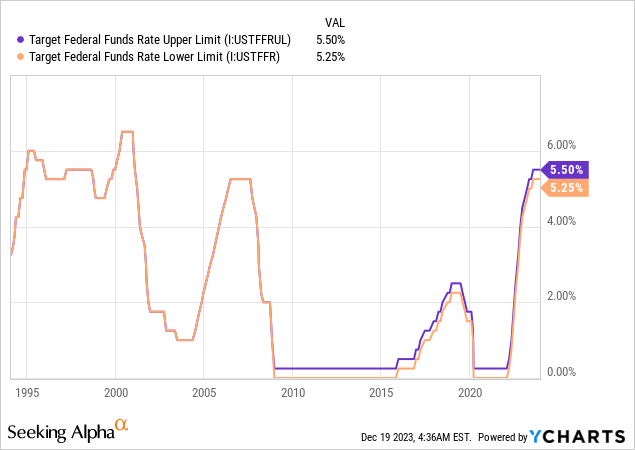

The Federal Reserve made clear that it is going to drop the federal fund rate and indicated it may lower interest rates three times next year with rate cuts expected, based on a CNBC survey, to start in mid-year 2024.

In the most recent quarter, Q3’23, Bank of America reported $14.5B in net interest income which was the second-lowest NII level in the last year. With the Federal Reserve set to lower interest rates in 2024, Bank of America’s net interest income is marked for a severe correction.

Bank of America

For banks, this change in the federal fund rate, which is still at its highest level in decades, is a problem as it indicates lower bank earnings and weaker capital returns going forward.

What could offset a decline in Bank of America’s net interest income?

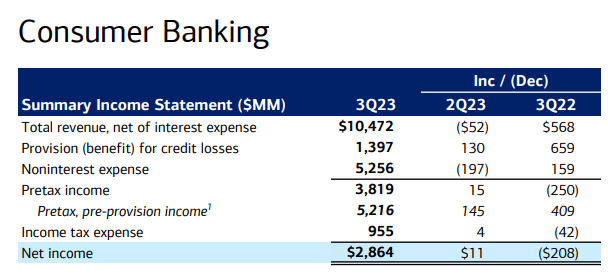

A strong showing of the U.S. consumer business could potentially cushion the blow that the banking sector, in my opinion, is set to take in 2024. With lower interest rates on the horizon, and contracting net interest spreads, banks will have to rely more on their loan operations to drive actual growth… and this will depend on the U.S. economy avoiding a recession. The largest segment is Bank of America’s consumer banking which generates the highest amount of net income, $2.9B in Q3’23. If the U.S. economy remains above water and the Federal Reserve can pull off a soft landing, I believe Bank of America has a reasonable chance of growing its core earnings (driven by loan growth) in FY 2024.

Bank of America

Bank of America’s valuation

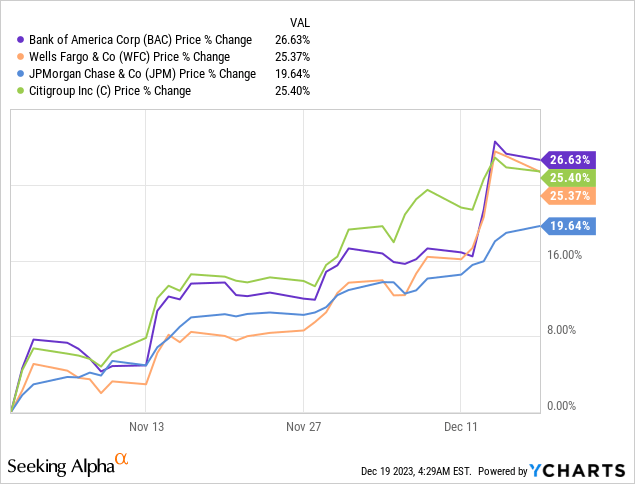

Besides a changing near-term interest rate trajectory and prospects for contracting net interest income/margins, I must say that I really don’t like Bank of America’s valuation anymore. Shares of Bank of America have increased 27% since the beginning of November and other major Wall Street banks have seen similar price increases, with price gains accelerating after the Fed announcement.

Bank of America is currently trading at a 2% premium to book value which may not seem like much as the bank traded at a much higher premium to book value last year. However, over a 10-year period, Bank of America has traded at an average price-to-book ratio of 1.0X. I would also argue that in terms of price-to-book ratio, Bank of America’s valuation likely peaked in FY 2022. My fair value estimate for Bank of America is the bank’s book value which was, according to its latest earnings sheet, $32.65 per share. Given that the federal fund rate is now set to revert to lower levels in FY 2024, I expect Bank of America to trade at a discount to book value again in the short term.

Risks with Bank of America

Bank of America’s valuation appears not stretched, but more in line with its historical average. Given the Fed’s pivot with regards to interest rates, Bank of America’s net interest income potential will be diminished in FY 2024 which should show itself in lower bank profitability and capital returns. If the U.S. avoids a recession and the consumer bank executes well, my thoughts on Bank of America may turn out to have been misguided.

Final thoughts

The best time to sell is when investors are displaying irrational optimism and greed which seems to be the case now. Shares of Bank of America are overbought based on the Relative Strength Index and have considerable correction potential, in my opinion. With the interest rate landscape to change fundamentally in the year ahead, I believe the risk profiles for cyclically-oriented Wall Street banks have significantly deteriorated and I am in the process of liquidating my last remaining bank investments. As much as I like Bank of America, the Fed has made shares of Bank of America a sell!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.