Summary:

- Meta Platforms, Inc.’s stock price has increased by nearly 300% since late 2022 and is expected to have considerable upside ahead.

- Meta Platforms’ dominance in social media and its role in AI and the Metaverse should contribute to its growth and profitability.

- Meta’s family of products, including Facebook, Messenger, WhatsApp, and Instagram, attract billions of monthly active users, making it the king of social media.

Galeanu Mihai

Meta Platforms, Inc. (NASDAQ:META) is having a fantastic year. Its stock is up by nearly 300% since the tech wreck bottom. I was ultra-bullish on Meta when its stock crashed to below $100, adding to my position during this remarkably depressed timeframe. Despite the monster run-up, Meta’s stock likely has considerable upside ahead.

Meta remains the dominant, monopolistic-style force in social media. Meta will likely benefit from increased ad spending as the economy continues improving. The more accessible monetary environment should also provide a constructive tailwind for Meta.

Moreover, Meta’s leading role in the Metaverse, virtual/augmented reality space, should enable it to leverage the AI effect, allowing Meta’s earnings to continue expanding in the future. Meta should continue posting impressive growth and profitability metrics, surpassing analysts’ expectations, leading its P/E multiple to grow and its stock price to appreciate considerably in future years.

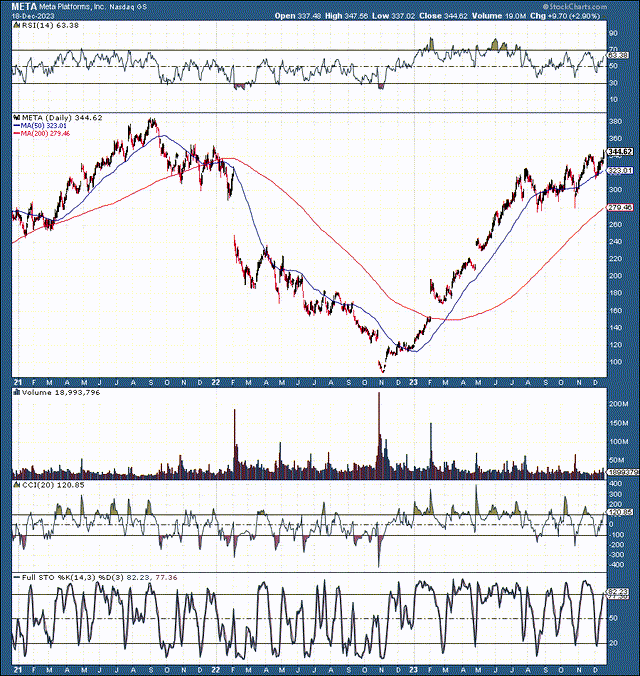

The Technical Blueprint – Excellent Recovery

Meta has clawed back most losses sustained during the tech market’s earnings recession. Meta’s stock was demolished due to a temporary growth slowdown and an earnings decline phase. However, once all the negative factors washed out, Meta bottomed and surpassed estimates several times after the stock bottomed.

Meta’s momentum is solid, and its stock should continue outperforming after a brief pullback/consolidation phase. Meta should achieve new ATHs in the new year. Meta also has substantial support around the $300-280 level, making the downside risk minimal. Moreover, if we look out longer term (5-10 years), we see that Meta has substantial potential to increase its stock price severalfold in future years.

Meta’s Massive Metaverse and AI Potential

Meta should benefit from a unique combination of AI and virtual/augmented reality potential. Meta is pioneering the way in seamless AI-enhanced communication. Moreover, Meta is developing a clever AI-propelled Ego How-to augmented reality video and tutorial system.

Meta is spearheading the AI Alliance, an AI collaboration effort with over 50 founding members and collaborators globally, including top AI market-leading companies, prestigious universities, and other organizations.

Meta has been one of the most prominent investors and developers of AI and the future platform of computing, the Metaverse. Next year, it will be ten years since the developments at Reality Labs started. These two emerging technologies are Meta’s most significant bets for the future and represent enormous revenue and profitability growth opportunities.

The mega social media giant has a gigantic platform for marketing its future technologies, products, and services. Many active Internet users globally already utilize one or multiple Meta-owned social networking platforms daily.

Reaching potential customers and consumers won’t be a problem for Meta. Additionally, we should witness increased efficiency with the advancements in AI and improving ad revenues as Meta makes it more advantageous for companies to reach customers from its platforms.

Meta: The King Of All Social Media

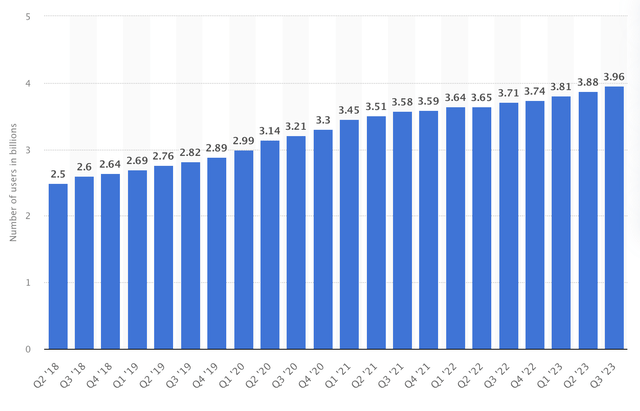

We all end up on Meta sooner or later. Cumulative, Meta’s family of “products” – Facebook, Messenger, WhatsApp, and Instagram – attract nearly 4 billion monthly active users.

Cumulative Number of Monthly Meta Product Users (billions)

Roughly 80% of the MAUs (monthly active users) are daily active persons (DAPs). About 3.14 billion users log into one of Facebook’s family platforms daily. Facebook, as a standalone platform, gets a whopping 3.05 billion MAUs. Some critics say Facebook is for “older people,” but it looks like we will all end up on Facebook someday.

WhatsApp, as a standalone platform, now has about 2 billion MAUs. It seemed like a big deal when Facebook acquired WhatsApp for $16 billion, but it now seems like one of the smartest deals of the last decade.

Instagram now gets more than two billion MAUs, and Facebook has done an excellent job monetizing it. About 75% of all active Internet users globally are Facebook-owned service MAUs, and about 49% of the world’s entire population uses a Facebook-owned service monthly. These stats are remarkable, considering that people in China don’t use Facebook.

The Valuation Perspective – Meta is Still Cheap

Consensus EPS estimates are for $17.32 next year. However, due to the better-than-expected growth atmosphere, higher earnings revisions, improving efficiency, and other factors, Meta could earn around $19 in EPS in 2024. This earnings dynamic implies that Meta may be trading around 18 times forward P/E estimates here.

Earnings Estimates Likely to Move Higher

EPS growth (SeekingAlpha.com )

Moreover, we should continue seeing double-digit EPS growth of about 15-20% or higher in future years. Additionally, Meta could benefit from continued revenue growth. Consensus estimates predict annual sales growth of about 8-10% in the coming years, but Meta’s growth could expand by about 10-12% or more. This dynamic implies that Meta’s revenues and profitability could improve faster than anticipated, leading to a higher earnings multiple and higher stock price in the coming years.

Where Meta’s stock could go from here:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $155 | $175 | $200 | $226 | $253 | $281 | $309 |

| Revenue growth | 16% | 13% | 14% | 13% | 12% | 11% | 10% |

| EPS | $18.75 | $21.90 | $25.85 | $30.21 | $35 | $40 | $46 |

| EPS growth | 25% | 17% | 18% | 17% | 16% | 15% | 14% |

| Forward P/E | 20 | 21 | 22 | 23 | 22 | 21 | 20 |

| Stock price | $438 | $543 | $665 | $805 | $880 | $966 | $1,050 |

Source: The Financial Prophet.

I updated my previous analysis’ sales, earnings, valuation, and price target estimates for Meta. While I utilized more robust sales growth estimates in this analysis, I used a more modest EPS growth rate, arriving at roughly the same stock price as my previous analysis. In a more bullish case scenario, Meta may achieve a higher EPS growth rate, enabling its stock to advance higher. Also, Meta could see more rapid multiple expansion. Its forward P/E ratio may rise above the current high of 23, leading to higher price target estimates. Still, in a base case scenario, Meta’s stock could achieve a $1,050 price tag before 2030, making it a top stock candidate to buy and hold for the next ten years.

The Meta Risks

Despite having enormous potential, there are risks with investing in Meta. We could see another economic slowdown, leading to slower sales and lower profitability. We may also see increased competition from Snap Inc. (SNAP) or other social media competitors. Also, the Metaverse or AI may become less of a deal than some think. Meta may play a minor role, taking less market share in the AI/Metaverse emerging industries. There may be efficiency issues and government regulations that could weigh future growth down cutting into earnings in future years. Investors should examine these and other risks before investing in Meta.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!