Summary:

- Netflix has sustainable competitive advantages and is expected to be the only profitable streaming business, apart from Disney.

- The decline in competition and the “Netflix effect” will drive further revenue and profit margin growth.

- Valuation is a concern, but Netflix has a dominant global position and significant growth opportunities.

Wachiwit

Investment Thesis

Netflix (NASDAQ:NFLX) has created sustainable competitive advantages due to 15 years of investments and innovation. Other than maybe Disney (DIS), I do not expect any other competitor to create a meaningfully profitable streaming business.

The decline in competition, in addition to the “Netflix effect”, will drive further revenue and profit margin growth in the years ahead.

My biggest concern is valuation, which has kept me from adding to my position for the last several months.

About

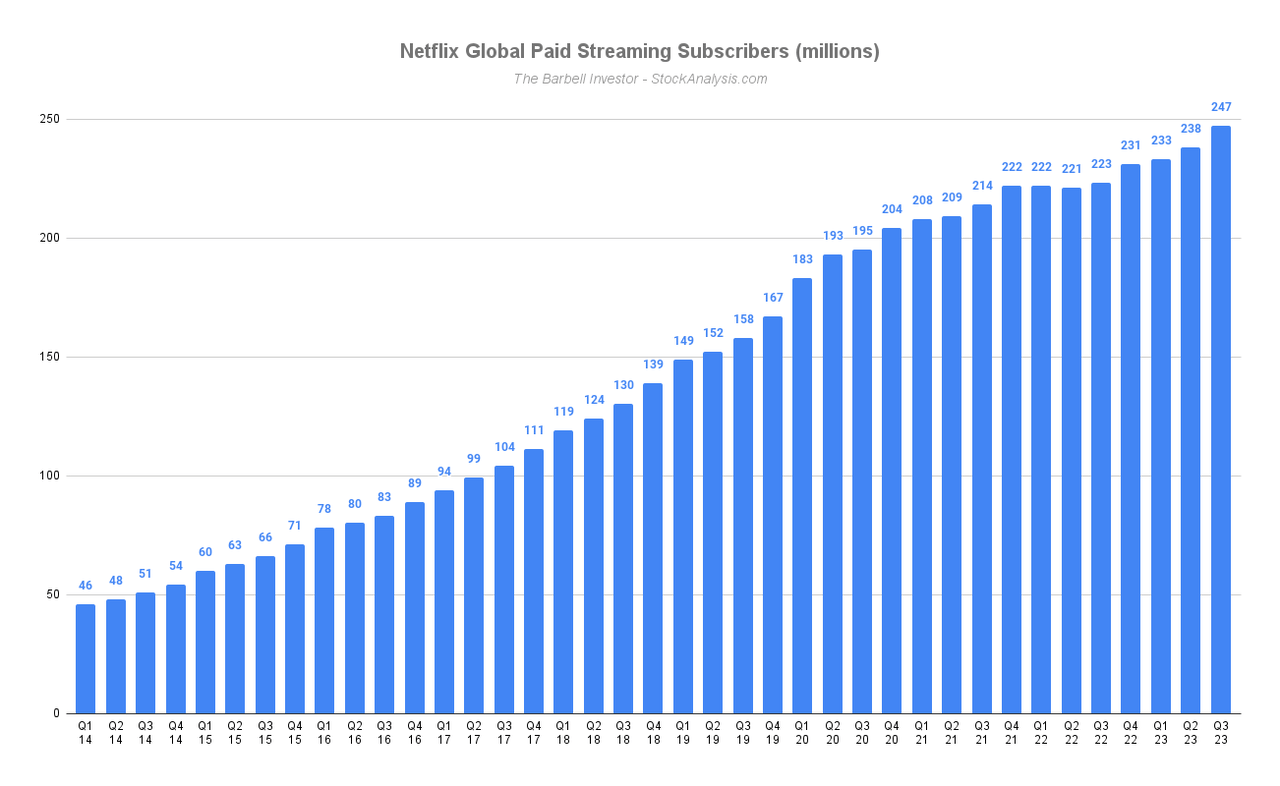

Netflix provides premium streaming services and content. The company will finish 2023 with more than 250 million paid subscribers globally.

Shares of NFLX are currently trading for $472.06. Here is the 5-year price history:

StockAnalysis.com

A League of Its Own

The bottom line of this write-up is this: Netflix is in a league of its own.

Let’s back up to Q4 FY19, when the direct-to-consumer (DTC) streaming wars began (Disney+ and Apple TV+ launched in November 2019, NBC’s Peacock launched in July 2020, HBO Max launched in May 2020, and Paramount+ launched in March 2021). At this time, Netflix had 167 million paid subscribers globally.

Despite the onslaught of competition, Netflix has maintained a double-digit annualized subscriber growth rate after 10+ years in the business.

The Barbell Investor – StockAnalysis.com

Not only did it stave off the competition and continue to grow, Netflix also managed to increase its average revenue per membership (ARM) from ~$10 in Q4 FY19 to ~$13 in Q3 FY23.

And remember, this was accomplished while its competitors were pricing (unsustainably) aggressively to establish a DTC subscriber base, a precursor to building a DTC business – a transition they’re still all struggling to make (more on this below).

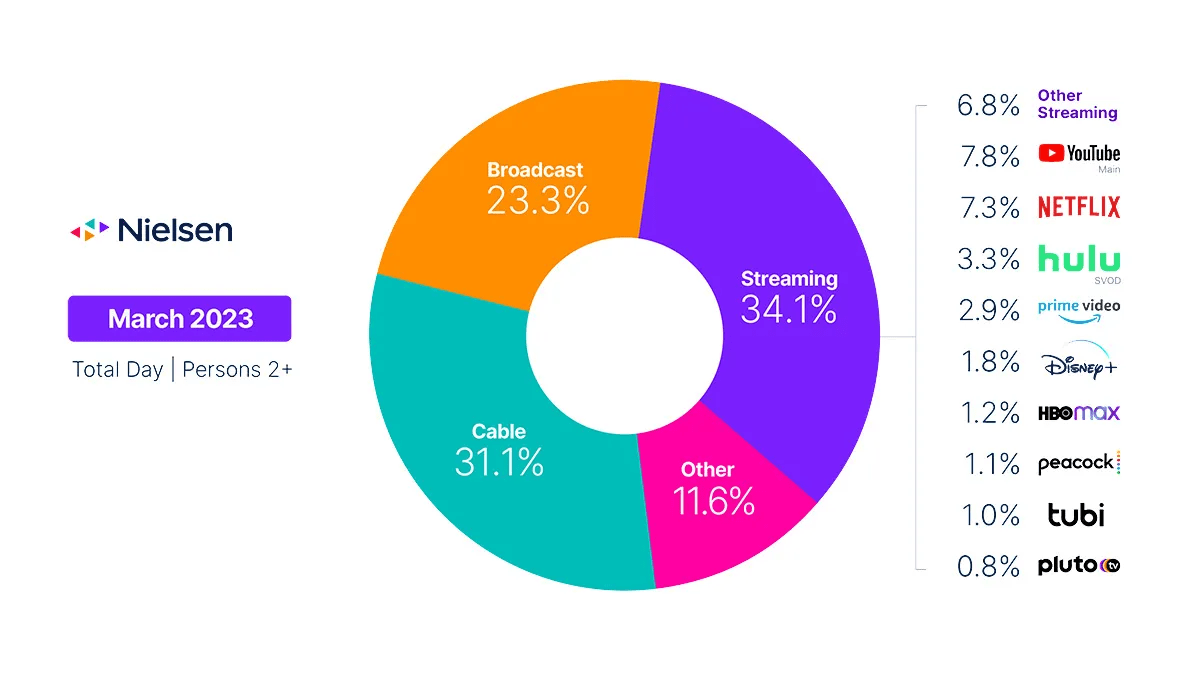

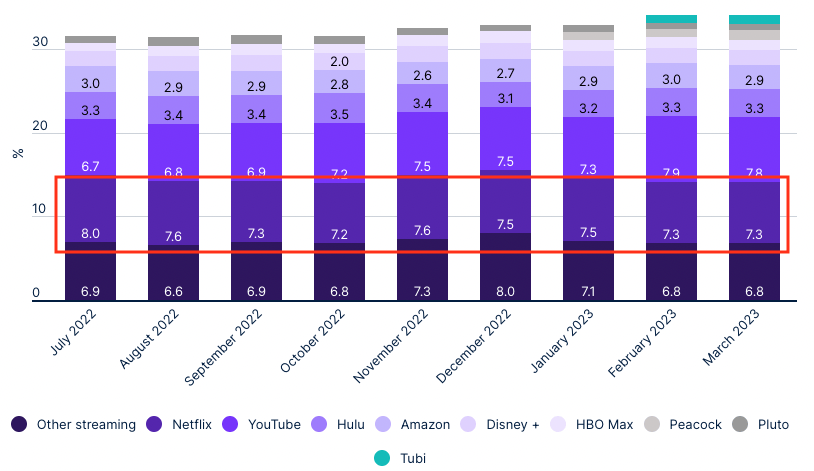

Regarding today’s competitive dynamics, Nielsen data shows Netflix and YouTube stand head and shoulders above the competition. Netflix accounted for 7.3% of TV time in March 2023 while YouTube accounted for 7.8%.

Nielsen

Netflix accounts for a larger share of U.S. TV time than Prime Video, Disney+, HBO Max, and Peacock combined. And these dynamics have been holding steady:

Nielsen

While it may not be increasing its percentage among streamers, Netflix has held its position despite the competition and at a time when many of its competitors are signaling they don’t have the ability or willingness to continue investing so heavily.

(Importantly, while it may not be taking market share from its competitors, Netflix is gaining users from the broader shift from linear TV to streaming.)

The Business of Streaming

Return on invested capital (ROIC) is one of my favorite metrics when evaluating the long-term prospects of a company. In simple terms, if a company makes $2 for every $1 it invests, you have the makings of a very good business.

There are a number of factors at play for streaming services. Three of the most important are:

-

Number of memberships

-

Average revenue per membership (ARM)

-

Content costs (which can be further subdivided into 1) licensing costs and 2) production costs for branded content)

Profitability in streaming requires more revenue (memberships x ARM) than content costs. While the business model is straightforward, driving those results is incredibly difficult.

Streamers end up with a chicken-egg problem — i.e., they have to provide a lot of great content (costs) to attract members (revenue). The model loses money until it (hopefully) reaches an inflection point.

That’s why Disney+, Peacock, and all the others have been so focused on growing their subscriber bases, even to the tune of billions of dollars in losses.

-

As of November 2023, Disney+ had accumulated more than $10 billion in losses.

-

As of June 2023, Comcast’s (which owns NBC) Peacock had accumulated over $5 billion in losses since launching the service in July 2020 and was projecting an additional $2.8 billion in EBITDA losses in 2023 alone.

-

Apple TV+ and Amazon Prime Video do not report on their figures.

(Hulu is rumored to have been profitable since 2020. As a side note, I expect Disney’s acquisition of Hulu, in combination with Disney+ and ESPN, to give Disney a profitable streaming business.)

It’s an incredibly difficult business, which is what kept me sidelined from an investment in Netflix until this year.

Netflix Profitability

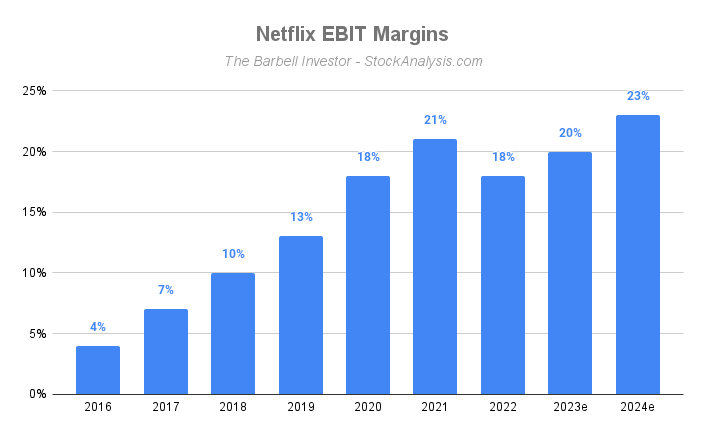

Netflix has cracked the code to run a profitable streaming platform.

Since 2016, the company has generated meaningful profit margin expansion:

The Barbell Investor – StockAnalysis.com

Furthermore, on the company’s Q3 FY23 earnings call, CFO Spencer Neumann noted “We don’t think we’re anywhere near a margin ceiling.”

The biggest driver of this expansion is and will continue to be the amount the company is spending on content. As a percentage of revenues, content spend is down from ~77% in 2016 to ~50% in 2023 (total content spend has stayed relatively flat while revenues have increased).

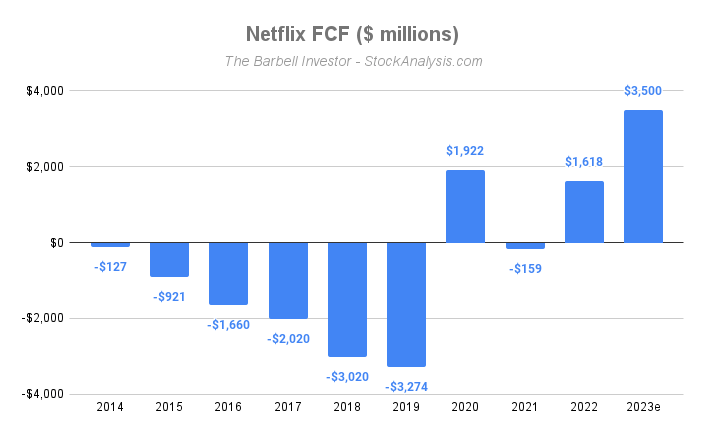

Increasing its members and ARM while keeping its largest expensive item (content spend) flat has also worked wonders for its free cash flow:

The Barbell Investor – StockAnalysis.com

The strategy Netflix has pursued for the last 10–15 years is finally paying off and has given it a dominant global position in the industry in terms of revenue, ARM, % of TV viewership, operating efficiency, and brand.

Brand/Moat

The investment to reach this position was substantial, and one I don’t expect any of the legacy media companies (other than Disney) to replicate.

Besides Disney, I expect the legacy media companies to ditch their streaming platforms and go back to strictly licensing. This will create further opportunities for Netflix to deepen its position, either through major licensing deals or M&A.

Speaking of licensing, I believe Netflix has major untapped pricing power.

How much value has Netflix created for Formula 1, through its “Drive To Survive” series, outside of the financial benefits? “Suits” is another example.

If I were a producer, given the exposure it offers, how much lower of a bid would I accept from Netflix versus another streamer? Probably a lot.

This “Netflix effect” is a testament to the company’s unique position and another reason I expect it to report higher profit growth over time.

Forecasts

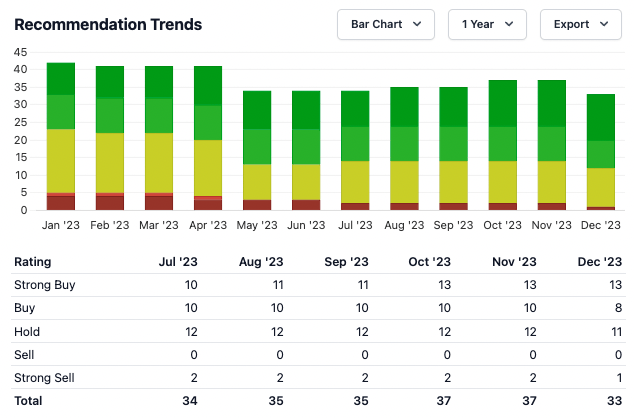

Netflix has a consensus “Buy” rating from Wall Street.

StockAnalysis.com

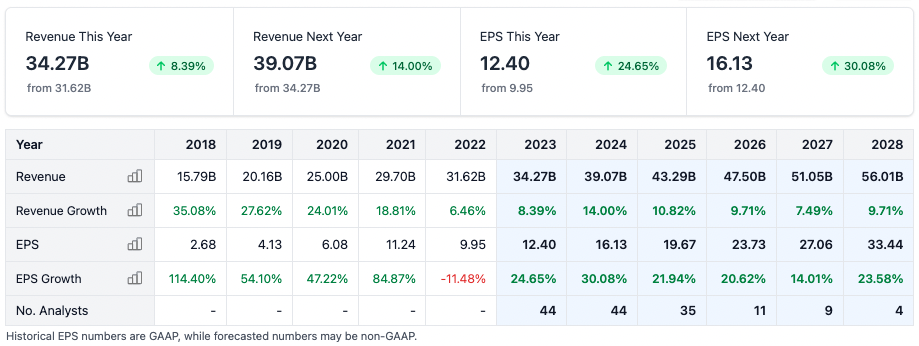

Revenue is projected to grow ~10% through 2028, while EPS is projected to nearly triple over the same period.

StockAnalysis.com

Valuation

I remain fairly confident that Netflix will maintain its competitive advantages in the coming years, and believe there are significant revenue growth (both organic and inorganic) and profit growth opportunities ahead.

That said, I’ll be the first to admit there’s plenty of good news priced in at $472 per share.

-

P/E ratio: 47.1x

-

P/FCF ratio: 36.4x

-

Forward P/E: 30.9x

-

PEG Ratio: 1.9x

-

EV/EBITDA: 10.4x

-

EV/FCF: 37.5x

-

5-year revenue growth forecast: 10%

-

5-year EPS growth forecast: 22.4%

I believe the current optimism is justified, though there are likely to be a few short-term stumbles along the way.

Risks

As I admitted at the beginning, I did not expect Netflix to be in this position.

The company proved the business model and hit a significant inflection point, threading the needle between membership growth, ARM, and content spend.

Additionally, it did this despite the onslaught of competition from legacy media companies, companies which I believe will provide more opportunities than threats in the years ahead (other than perhaps Disney).

While these two remain risks, for now, I’m considering them largely mitigated.

In my opinion, the biggest risk now is valuation. At ~$472 per share, are investors being properly compensated for the risk and opportunity cost (we could be using this money to invest in something else)? I’m not sure.

I will say this: If I didn’t own any shares right now, I would not be making it ~8% of my portfolio at ~$472.

On the flip side, the current price is not near where I’d need it to be to consider reducing my position.

With these two beliefs at once, I’d suggest Netflix is trading at a slight premium to fair value.

Conclusion

Netflix is beginning to demonstrably prove it can invest $1 to make $2. For an industry-leading streaming service with global reach, this is an enviable position to be in.

Regarding brand and moat, I view Netflix in a similar light as Costco (the “Netflix effect” discussed above), albeit with a lot more still to prove.

With that in mind, unless I’m given a very good reason to do otherwise, I’m comfortable holding a large NFLX position for a long time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.