Summary:

- Jefferies’ U.S.A. Equity Strategy report suggests that growth at a reasonable price (GARP) stocks could perform well in 2024.

- Textron Inc., an aerospace company, is a GARP opportunity with strong growth potential and an attractive valuation.

- Textron experienced robust growth in Q3, with increased revenues in its Aviation, Industrial, and Systems segments, and aggressive buybacks.

Fischerrx6

Introduction

There are a few things that I really like when it comes to putting money to work: industrial stocks, companies operating in the aerospace industry, and opportunities that offer growth at a reasonable price.

As it turns out, we’re in luck, as I found another opportunity that combines all of these things!

Seeking Alpha just published a news article titled “Growth At A Reasonable Price Stocks For 2024 – Jefferies.”

According to the article (emphasis added):

GARP — growth at a reasonable price — has performed well in the past two quarters, and it could be a driver for performance in 2024, according to a Jefferies’ U.S.A. Equity Strategy report, published on Monday.

Jefferies analysts have seen valuations work “exceptionally well” over the last year, with the cheapest stocks in the Russell 2000 up 29% year-to-date.

“Over 60% of the periods we reviewed the spread vs. the Rusell 2000 has been positive,” analysts said. “We think this factor will continue its strength in the new year.”

Textron Inc. (NYSE:TXT) is on that list, one of America’s largest aerospace players with a market cap of roughly $16 billion.

My most recent article on this company was written on May 9, 2022, when I used the title “Textron: A Post-Pandemic Winner.” Since then, shares are up roughly 24%.

In this article, I’ll take a closer look under the hood again, as I agree with Jefferies. Although Textron has a dividend yield of just 0.1%, it offers potential value through strong growth and a very attractive valuation, paving the road for buybacks.

So, let’s get to it!

A Diversified Aerospace Giant

Textron is a diverse multinational company with global operations in aircraft, defense, industrial, and finance sectors.

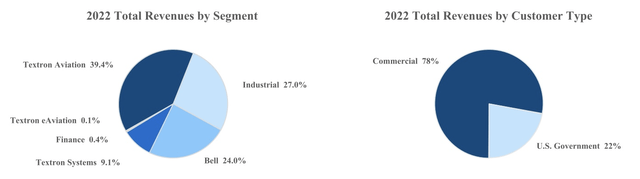

The company operates through six segments: Textron Aviation, Bell, Textron Systems, Industrial, Textron eAviation, and Finance.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Textron Aviation |

4,566 | 36.9 % | 5,073 | 39.4 % |

|

Industrial |

3,130 | 25.3 % | 3,465 | 26.9 % |

|

Bell |

3,364 | 27.2 % | 3,091 | 24.0 % |

|

Textron Systems |

1,273 | 10.3 % | 1,172 | 9.1 % |

|

Finance |

49 | 0.4 % | 52 | 0.4 % |

Unlike most defense companies I own in my portfolio (I have >25% defense exposure), Textron is very hardware-focused.

For example, Textron Aviation is a leader in general aviation, manufacturing and servicing Beechcraft, Cessna, and Hawker aircraft. The segment offers a range of products, including business jets, turboprop aircraft, military trainers, and defense aircraft.

Notable models include the Citation series and King Air. Textron Aviation also provides comprehensive aftermarket parts and services globally.

Then there’s the Bell segment, which is fascinating as well.

Bell is a prominent supplier of military and commercial helicopters, tiltrotor aircraft, and related services.

The company serves both U.S. and international military customers and offers a diverse range of commercial helicopters for various applications.

With products like the Bell V-280, the company is competing for major contracts against some of my holdings, including Lockheed Martin (LMT).

Not only is Bell boosting production rates for this model, but it is also working on a commercial version that could be launched close to 2030.

Essentially, the company is developing the V-280 Valor for the U.S. Army’s Future Long Range Assault Aircraft program and the Bell 360 Invictus for the U.S. Army’s Future Attack Reconnaissance Aircraft program.

Meanwhile, the certification process for the 525 Relentless, Bell’s first super medium commercial helicopter, is underway.

Moving over to the next segment, the Industrial segment covers Fuel Systems and Functional Components and Specialized Vehicles product lines.

Kautex, within this segment, is a leader in designing plastic fuel systems, safety systems, and cleaning systems for automotive applications.

The Specialized Vehicles product line includes a variety of recreational and utility vehicles.

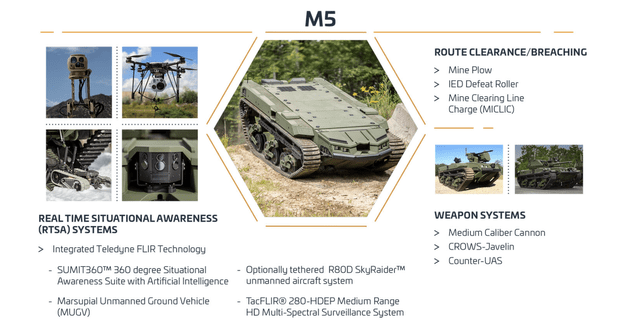

Textron Systems focuses on developing and integrating products for military, government, and commercial customers. Offerings include unmanned aircraft systems, electronic systems, advanced marine craft, and specialized vehicles.

The M5, for example, is an unmanned tank with a wide range of capabilities. Given the way the modern battlefield is changing, I’m very bullish on this segment.

Last but not least, formed in 2022 after the acquisition of Pipistrel, Textron eAviation focuses on sustainable aviation solutions. Pipistrel, a key component of this segment, is known for manufacturing electrically powered aircraft.

The bottom line is that the company generates less than a quarter of its money from government contracts, which means it has substantially more cyclical risks than its pure-play defense peers.

With that said, there’s some (relatively) bad news.

- TXT pays a $0.02 per share per quarter dividend. This translates to a yield of roughly 0.1%. This dividend has been kept consistent, meaning TXT is neither an income nor a dividend growth stock.

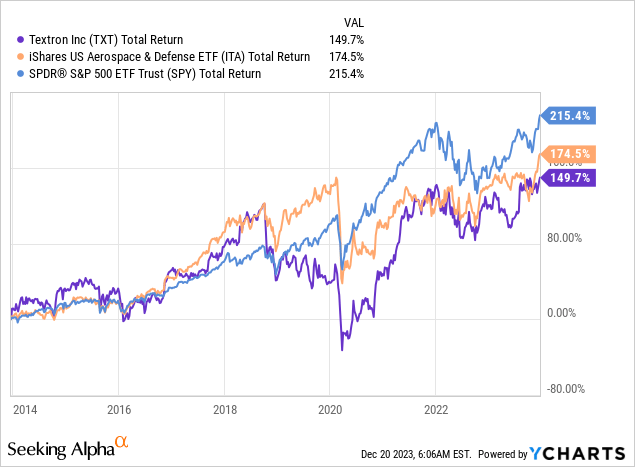

- Over the past ten years, TXT shares have returned just 150%. Although that’s not a bad number, it underperforms the S&P 500 by a considerable margin. This was mainly due to the pandemic, which made it close to impossible for Textron to keep up with the market.

The good news is that Textron is doing well. Growth has rebounded, and its outlook is great, making it a player with an attractive valuation and the potential to beat the market going forward.

Textron’s Deep Value

The pandemic started more than three years ago. It ended roughly two years ago, depending on our definition of “ended.”

Regardless, Textron is back!

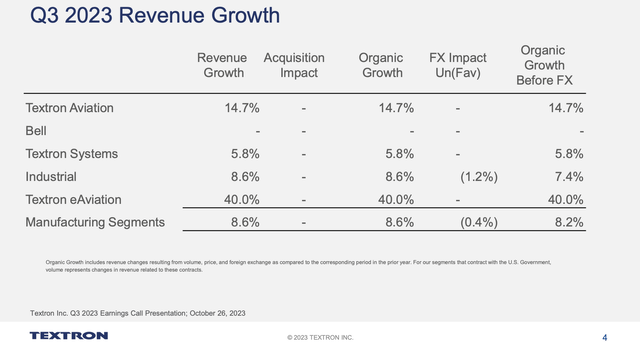

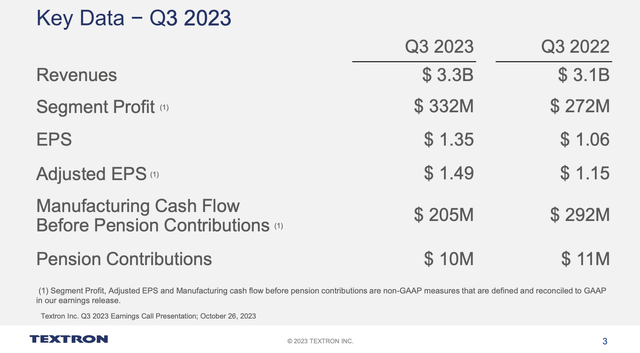

For example, in the third quarter, Textron experienced robust growth, with revenues up in Aviation, Industrial, and Systems.

Revenues at Textron Aviation reached $1.3 billion, marking a $171 million increase from the previous year’s third quarter. Total organic growth was 14.7%.

The boost is attributed to higher volume and mix contributing $89 million and higher pricing accounting for $82 million. The segment profit for the third quarter stood at $160 million, reflecting a $29 million rise from the previous year.

This increase is primarily attributed to favorable pricing net of inflation ($39 million) and a $23 million favorable impact from higher volume and mix.

However, there was a $33 million unfavorable impact related to supply chain and labor inefficiencies.

Textron Systems saw revenues of $309 million, marking a $17 million increase from the previous year’s third quarter, primarily due to higher volume. This increase translates to roughly 6% organic growth.

As we can see above, Bell reported revenues of $754 million, remaining flat compared to the third quarter of the previous year. The stagnation was offset by lower commercial helicopter volume but balanced by higher military volume.

The industrial segment saw 8.6% organic revenue, excluding currency headwinds.

This increase was attributed to higher volume and mix at both product lines, contributing $45 million and an $18 million favorable impact from pricing.

eAviation sales were up 40% organically. However, this segment is so small that it doesn’t have a major impact. Also, total revenues of $7 million ended up in a segment loss of $19 million, reflecting R&D cost headwinds.

Total business revenues were $200 million higher compared to the prior-year quarter. This translates to a 6.5% increase.

Thanks to these developments, the company was able to grow earnings per share by 27%.

Digging a bit deeper, we find that the good news continues.

For example, the highlight of the quarter was a 12% increase in orders for the Aviation segment over the previous year, resulting in a substantial backlog growth of $521 million, reaching $7.4 billion.

Meanwhile, Bell got an order for 15 Bell 505 aircraft.

Additionally, Systems was chosen as one of four competitors to build a light robotic combat vehicle prototype for the army.

The expansion of Aerosonde SUAS operations with the U.S. Navy marked another success, with the award of three C-based systems aboard total combat ships.

All of this was also good news for buybacks.

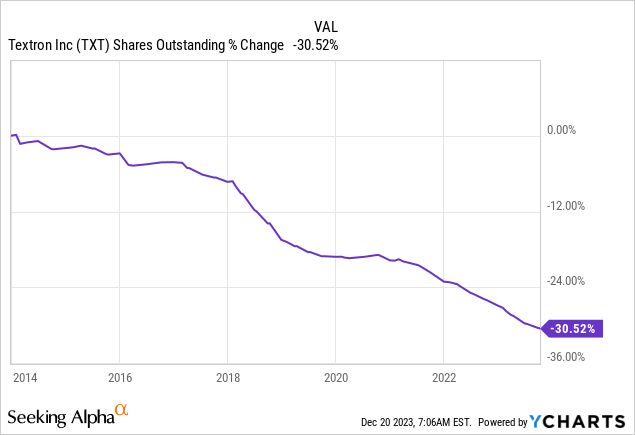

In Q3, Textron spent $235 million to buy 3.1 million shares. YTD, the company bought 12.5 million shares for $885 million returned to shareholders.

The year-to-date number translates to almost 6% of its market cap!

Over the past ten years, TXT has bought back more than 30% of its shares.

Even better, going forward, we should expect aggressive buybacks to continue as the company hiked its guidance.

The new EPS range is set at $5.45 to $5.55.

Additionally, Textron continues to anticipate full-year manufacturing cash flow before pension contributions in the range of $900 million to $1 billion.

That’s roughly 6.1% of its market cap.

On top of that, it helps that Textron has a very healthy balance sheet. This year, it is expected to end up with $1.5 billion in net debt. That’s less than 1.0x EBITDA.

It has an investment-grade BBB credit rating, which means it can distribute almost every penny of free cash flow to shareholders.

Now, with regard to “growth at a reasonable price,” let’s move to the valuation.

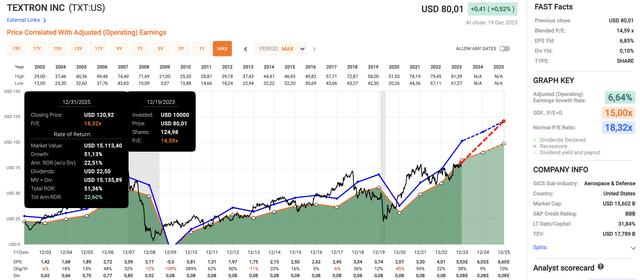

Using the data in the chart below:

- TXT is expected to maintain high growth rates. This year, EPS is expected to grow by 38%, followed by 9% growth in 2024 and 10% growth in 2025.

- The stock is currently trading at a blended P/E ratio of 14.6x. The long-term normalized valuation is 18.3x.

- A return to that valuation would result in a fair price of $121, including expected EPS growth rates. That’s 50% above the current price.

All things considered, while I do not have the research that Jefferies used, I can make the case that TXT offers great value at current prices.

If I didn’t have so much defense exposure already, I would consider adding the TXT ticker to my portfolio, as I believe that it is in a good spot to generate outperforming total returns for many years to come.

Takeaway

Textron stands out as a Growth at a Reasonable Price (“GARP”) gem with Jefferies’ endorsement.

With a $16 billion market cap, Textron boasts industrial strength and aerospace prominence, while 3Q23 showed robust aviation growth, a $7.4 billion backlog, and aggressive buybacks.

Despite a modest 0.1% dividend, Textron’s diversified operations and buybacks set it apart.

Trading at a P/E ratio of 14.6x, well below its normalized 18.3x, Textron presents a 50% upside potential, making it a compelling GARP opportunity for investors eyeing growth with an attractive valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.