Summary:

- Intel is undergoing a significant turnaround led by CEO Pat Gelsinger to reclaim market share.

- Despite carrying over $25 billion in net debt, Intel’s stock is reasonably valued at approximately 24x next year’s EPS compared to peers.

- Despite challenges in the competitive semiconductor landscape, Intel’s Q4 outlook indicates promising near-term prospects for growth.

Editor’s note: Seeking Alpha is proud to welcome Seeking FCF as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

hapabapa

Investment Pitch

Intel (NASDAQ:INTC), one of the world’s leading semiconductors, is embarking on a significant turnaround under its CEO Pat Gelsinger. Intel is not happy with the status quo and is determined to take back market share. One of its top struggles, perhaps its most significant risk factor, is that Intel carries about $25 billion of net debt, which will restrict its maneuverability.

On the other hand, I believe that a lot of the bad news is already priced in, with the stock at approximately 21x to 24x next year’s EPS (that’s a forward P/E of ~21x), which is meaningfully cheaper than its peers.

Therefore, I recommend this stock as a buy.

Why Intel? Why Now?

Intel is a semiconductor company known for designing and manufacturing CPUs, GPUs, and other computing components. The company focuses on products like Gaudi accelerators and provides foundry services. In fact, Intel’s foundry services are a critical driver of Intel’s strategy roadmap.

Furthermore, Intel’s roadmap includes advanced process technologies like Intel 18A, featuring innovations such as RibbonFET and PowerVia. Intel makes the case that it is committed to broadening its applications, from cloud servers to edge devices, and aims to regain its footing as a key player in the semiconductor industry.

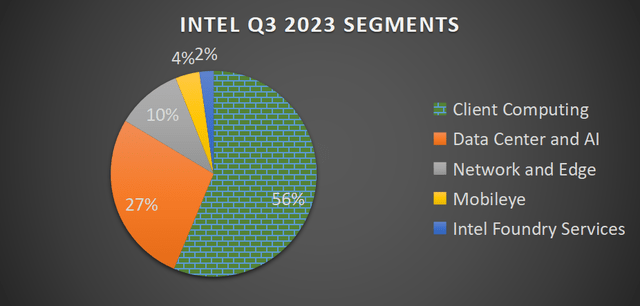

Author’s calculations; doesn’t round to 100%, as All Other segment is not included

As you can see above, the business is roughly split between its Client Computing, which is its legacy business, and its newer business units, including the coveted very high-growth segment, Intel Foundry Services, which makes up 2% of its total revenues.

Intel’s Q3 2023 results showcased robust near-term prospects. Despite global challenges, Intel reported a solid quarter. The company demonstrated impressive financial performance, exceeding revenue guidance, with particular strength in operating leverage and expense discipline. Simply put, my bull case for Intel has less to do with its revenue growth opportunities, from the likes of Intel Foundry Services, which are too small a business line to meaningfully move the needle in the next couple of years, and more to do with its cost-cutting efforts. But I get ahead of myself, let’s first discuss its outlook for 2024.

Intel’s Growth Opportunity

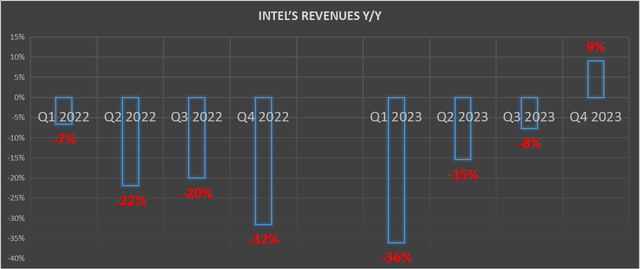

Intel has hit a rough spot, where its revenue growth rates have been negative for several quarters. However, I make the case that this is all already in its share price. What matters to investors is what the future holds. From this point forward, with its very easy comparables, it’s easy to imagine Intel delivering more than 10% y/y growth rates in 2024. A figure that analysts following this stock also appear to expect.

In contrast to 2023, 2024 could see +10% growth rates, which would be a terrific improvement, particularly after Intel’s two consecutive years of negative growth rates.

Think about this momentarily, how much better would Intel’s investment thesis look this time next year, if Intel could show concrete evidence of some topline growth rates, versus substantially negative growth rates investors witnessed in H1 2023?

Put in other words, Q4’s guidance for approximately 9% y/y growth rates is just the start of this turnaround. And yet, that’s not where the bull case for Intel is found.

Profitability Set to Improve; This is the Bull Case

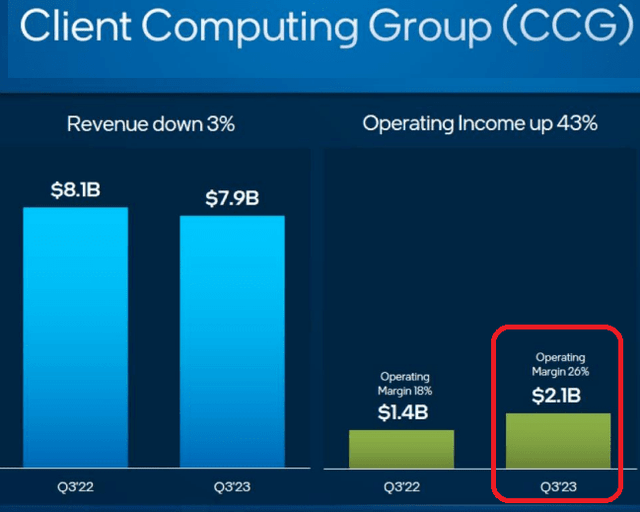

As previously introduced, Intel’s Client Computing segment is over half of Intel’s consolidated business. And that side of the operations will shrink over time. But the key question here is, how long will it take to shrink down?

Secondly, given that this side of the business is shrinking, can management cut back on its cost structure and improve this business unit’s profitability?

As you can see above, compared with Q3 of last year, Intel’s operating profits jumped 50% y/y. While I don’t expect this pace of increasing profits to be sustained indefinitely, it clearly shows that management is serious about driving profitability higher. Something that investors will undoubtedly reward, with a higher valuation.

Could Intel’s Client Computing segment end up reaching $10 billion of operating profits as a forward run-rate? Given this dramatic improvement, this appears very achievable. Meaning that investors would be paying 20x forward operating profits for Intel’s Client Computing segment, and getting the other half of Intel’s newer business units all for free! That certainly seems interesting, don’t you agree?

INTC’s Valuation – Forward Price/Earnings at 21x

Intel’s Q4 guidance points towards approximately $0.45 of EPS. This means that in all likelihood, the business is on a run-rate of about $2.00. If one presumes that this time next year there’s about 10% to 15% growth on its EPS line, this implies that Intel would probably reach about $2.20 of EPS.

Analysts have INTC’s EPS in 2024 at approximately $1.91, this leaves the stock priced at 24x forward EPS for Intel as a whole (that’s a forward P/E of ~24). This P/E multiple is higher than mine, but I wouldn’t be surprised to see analysts upward revising their EPS estimates for Intel as we get further into H1 2024.

In other words, the stock is priced at somewhere between 21x and 24x forward EPS. I believe this is a fair valuation, for a company with as much equity brand and scale as INTC has. Particularly given that Intel in 2024 should be delivering some positive revenue growth rates, which will leave the company in a much better position than it is right now, having delivered nearly two consecutive years of a shrinking revenue base.

Peer Group Comparison

Paying around 21x to 24x forward EPS valuation is a significant discount to AMD’s (AMD) forward valuation, which I believe to be higher than 60x forward EPS (P/E of +60). Although, it must be said that AMD has had substantially better growth rates of late, which goes a long way to justify its higher valuation.

On the other hand, admittedly, INTC carries a slight premium to TSMC (TSM). Although TSMC’s business carries a significant amount of geopolitical risk, that needs to be factored in, which is why the stock is traded the cheapest amongst its large-cap semiconductor peers.

Meanwhile, Nvidia (NVDA) is perhaps the most followed stock in 2023. It would be difficult to argue that all its upside potential and then some hasn’t already been factored into its valuation. The stock doesn’t look expensive if one believes that NVDA could still deliver some EPS growth next year. Of course, the question is what sort of growth can we truly rely on NVDA next fiscal year? After all, the comparable figures that NVDA is up against are very high next year. Essentially, I believe that NVDA doesn’t carry a compelling risk-reward profile.

Altogether, I believe that paying 21x to 24x forward EPS for INTC makes sense and isn’t a rich premium on its stock. Nevertheless, it must be said, that INTC’s balance sheet, with its approximate $25 billion of net debt, could hamper investors’ excitement for Intel, even if the business is on the cusp of a successful turnaround.

Risk Factors

While Intel aims to reestablish itself as a process technology leader, the rapid pace of innovation in the sector demands sustained excellence to stay ahead in this sector. And this surfaces the two main risk factors facing Intel, which are really just two sides of the same coin. Case in point, Intel’s competitors, including key foundry partners, are vying for market share and technological supremacy, intensifying the competitive pressures Intel faces. This element comes on top of the fact that the semiconductor industry, is highly cyclical and sensitive to macroeconomic trends.

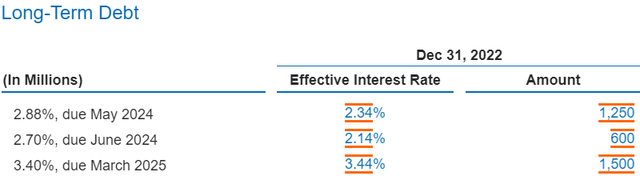

And then, restricting Intel’s ability to aggressively invest in its prospects is the fact that Intel carries approximately $25 billion of net debt. For example, Intel’s debt is laddered all the way up to 2052. But keep in mind that Intel has maturities nearly every year:

Furthermore, when Intel comes to refinance its recent maturities, Intel will most likely be refinancing debt which carries less than 3.5% interest rates, for notes that will have rates that will probably end up being higher than 5%.

This will increase Intel’s cost of capital, at a time when the company is already in the penalty box, and has to prove to investors that it can indeed turn around its operations.

The Bottom Line

In conclusion, Intel is undergoing a significant turnaround led by CEO Pat Gelsinger, aiming to reclaim market share. Despite carrying over $25 billion in net debt, the stock, priced at approximately 21x to 24x forward EPS (forward P/E of ~21x), appears reasonably valued compared to peers. While the company faces challenges in a competitive semiconductor landscape and the cyclical nature of the industry, its Q4 outlook indicates promising near-term prospects.

Despite recent negative revenue growth rates, the stock’s valuation at ~21x forward EPS suggests a potential for improvement. As noted in the analysis, its main peers, AMD and NVDA are both priced with unrewarding valuation profiles, while TSMC carries some geopolitical risk. Altogether, this makes INTC an intriguing opportunity for investors, especially considering its strong equity brand and scale.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.