Summary:

- Intel is set to deliver four process nodes in 2024, including two full nodes, marking a significant acceleration in execution after a decade of delays.

- Intel’s relatively competitive technology position to TSMC will advance by an astonishing 8 years in just 1 year. A true annus mirabilis.

- While the near-term stock gains may be gone, the long-term thesis remains on track. The 2024-25 turnaround products should drive the financials, and in turn the stock eventually.

- The recent Meteor Lake and Emerald Rapids launches, as some of the last pre-turnaround products, provide a decent baseline. The direction of further momentum in 2024 should provide the direction for future stock returns.

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

It has been just over a year since I detailed the Annus Horribilis Intel (NASDAQ:INTC) in 2022. Nevertheless, 2024 is set to become Intel’s Annus Mirabilis, delivering four process nodes in this one year. Even neglecting that two of those are ‘intra-node improvements’, that is still two full nodes, which historically would have taken at least two years. This is outright double the pace of Moore’s Law, delivering a pace of improvement not seen since the 1960s.

While from the start this plan received scepticism, a few months ago I detailed how the foundry prepayment Intel has received for 18A proves that the internal execution towards this roadmap has given a foundry customer such confidence that it is willing to put tangible money forward already: Intel Stock: Massive 18A Foundry Prepayment. Indeed, from some of the coverage posted on Seeking Alpha, Wall Street analysts are finally starting to pay attention.

Background

My most recent earnings coverage: Intel: Incredible Tech Execution, Steady Financial Improvement.

A key part of the discussion is regarding Intel’s December 14 AI Everywhere event.

Tech discussion

Emerald Rapids

Emerald Rapids represents a follow-up on Sapphire Rapids, which although a very important product for Intel, has become mostly known for its many delays due to continued design/execution issues. It slightly increases core count (from 60 to 64) and cash size, among some other changes. Despite not being a large upgrade, on the same process node, Intel nevertheless claimed some quite reasonable increases in performance and power efficiency. These claims have been verified by Phoronix, which for example noted that the 64-core part successfully competes against the N5-based (i.e. one node advantage) 64-core AMD (AMD) Genoa part.

Aside from performance, the main achievement arguably is that it is launching within 12 months from Sapphire Rapids, which should increase investor confidence in this segment’s execution. Interestingly, though, it would appear that its successor, Granite Rapids, is actually scheduled to have an even shorter time delta between the products, as Intel has said that it would launch “shortly after” Sierra Forest, which is scheduled for Q2. Of course, though, Intel is infamous for having quite a broad interpretation of such statements.

Overall, while the original roadmap with an Intel 4-based Granite Rapids part in 2023 obviously would have been preferable, Intel has now nevertheless delivered a nearly 3x improvement in performance in less than 3 years. Intel is still trailing AMD in performance, but the momentum remains in Intel’s favor, especially with Granite Rapids around the corner, which according to rumors would roughly double the core count.

Meteor Lake

At its recent AI Everywhere event, Intel also launched Meteor Lake. It is an important CPU as it is the first to bring to market both EUV and the new Intel 4 node, as well as its Foveros packaging and chiplet technology into the client space. It is also the first Intel CPU to integrate an NPU for AI, which Intel coined the AI PC.

On the CPU side, Meteor Lake does appear somewhat underwhelming. By now, Alder Lake’s Golden Cove architecture is two years old, which is about the timeline for a new architecture in the old Tick-Tock days. In fact, even during Tick-Tock, the Tick (new process node) would also get a slight architecture update. However, the new Redwood Cove appears to be the slightest of upgrades, rounding to zero IPC (performance per clock) improvement. So given that the new node due to its immaturity brings a bit of a clock frequency regression, single-threaded performance is even regressing at worst.

Despite using the new Intel 4 node and the Redwood Cove architecture apparently having been focused on power, the increase in energy efficiency appears underwhelming. It certainly isn’t any larger than when AMD moved from N7 to N5. Nevertheless, according to Intel’s own data, Meteor Lake does use lower power and has higher performance than AMD, so overall the part appears (although to be confirmed by more extensive independent reviews) competitive with AMD’s N5-based portfolio. As a major differentiator, though, the addition of the two new low-power E-cores on the SoC tile has resulted in a noticeable decrease in idle power, which seems most responsible for the battery life increase (more so than the move to Intel 4).

On a final note, while naturally a CPU gets mostly reviewed based on its CPU performance, there is a major bump in GPU performance (up to 50-100%) and as mentioned there’s the new NPU, making it overall a decent upgrade. That is, if it hadn’t been delayed by over a year, it could have been seen as a compelling Tick.

Of course, the Intel 4 delay that is the cause of the delay was also the reason Bob Swan got replaced by Pat Gelsinger, so do note that this is still a pre-turnaround chip. So in the grand scheme, as discussed in the next section, Arrow Lake and Lunar Lake are coming next year, with Arrow Lake on the post-turnaround 20A node. As mentioned, such a quick succession of new nodes is unprecedented.

Process technology

Although I called it 4 nodes in 1 year above, Intel’s parlance has been 5 nodes in 4 years. In any case, the overall significance is a vast acceleration in execution after about a decade plagued by delays.

For those who haven’t been paying as much attention, a quick recap:

- Intel 4, with Meteor Lake as its flagship product, is now in the market, although Intel had already said in December of last year that the node was “manufacturing-ready”. (This seems a bit similar to how in December 2022 TSMC (TSM) said the same about its N3 node, despite the first product only being the iPhone in September.)

- Intel 3, a major improvement of Intel 4, will launch with a line-up of data center CPUs through 2024, starting in Q2.

- Intel 20A, representing a full-node advance over Intel 4, is expected by the end of 2024 in Arrow Lake.

- Intel 18A, a major intra-node improvement over 20A, is targeted to be manufacturing-ready by the end of 2024, just 12 months after the launch of Intel 4. The first products are expected in (the second half of) 2025.

The ‘annus mirabilis’ does not just refer to this quick pace of product and development milestones, but just as much to the underlying technology, with the introduction of RibbonFET and PowerVia. Both are significant changes to the transistor and chip architecture, allowing for the continuation of Moore’s Law for the next decade.

Overall, Intel’s statement has been that it would reach parity in 2024 with 20A, and leadership in 2025 with 18A. In practice, since Intel’s primary competitors, AMD and Nvidia (NVDA), are not the first customers of new TSMC nodes (as that is Apple (AAPL)), Intel 3 in 2024 will already be a leadership node in the data center CPU segment, and 20A will be one in the client segment (both against N4).

Regarding the important data center AI silicon segment, Intel’s initial plan was that Falcon Shores would be based on angstrom-level technology (seemingly 20A), but Intel hasn’t confirmed this more recently. Assuming this plan is unchanged, then process technology certainly shouldn’t be the issue for it to be competitive against any other silicon, in particular obviously Nvidia which has been excessively capitalizing on AI silicon demand for LLMs.

As a comparison to TSMC, since Intel is moving from N7-class technology (which debuted in fall 2018) to N2-class technology (which will likely debut in fall 2026), Intel is basically advancing its relative competitive technology position by an astonishing 8 (!!) years in just 1 year. Pat Gelsinger said he couldn’t fix 10 years of mistakes in 100 days, but he’s actually getting pretty close.

Financials

Flywheel

While in the near term, the introduction of all this new technology will continue to put some burden on the capex side (impacting gross margin through ‘start-up costs’), for the history of Moore’s Law the benefits of moving to more advanced nodes have always outweighed any near-term investments. This is especially true for those leading in the pursuit of Moore’s Law, which as discussed will soon be Intel again. The (potential) benefits include pricing power, increased gross margin, and increased market share, all due to the ability to differentiate in areas like power and performance against the competition.

Most fundamentally, the scaling of transistors (although slightly offset by increased manufacturing cost) allows for the decline in cost per transistor, resulting in a fundamental cost advantage against competitors. So not only are products on new nodes higher performance and lower power, but they are also cheaper to manufacture.

Outlook

Due to factors such as compressed revenue amidst the downcycle, lower yield of especially its 10nm/7 node, but also decreased market share and pricing power (the opposite effects as Intel lost its leadership), Intel is looking to go back to more historical gross (60%) and operating (40%) margin performance. Delivering leadership products with a leadership cost structure is the recipe to accomplish this, and this will be possible with the new nodes.

So while financially 2024 likely will be mostly dependent on the macro side (and perhaps some initial adoption of foundry and Gaudi), the technology getting ready and into manufacturing over the next year will lay the foundation for the financials going forward.

Capex

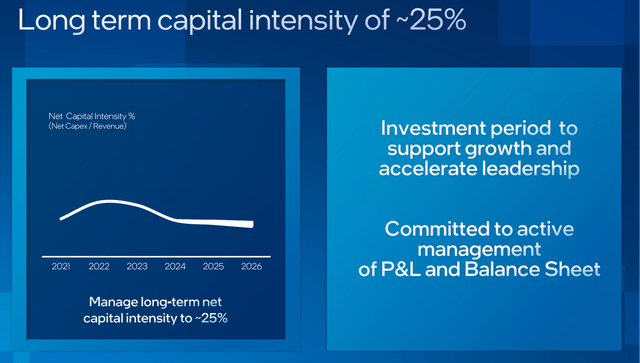

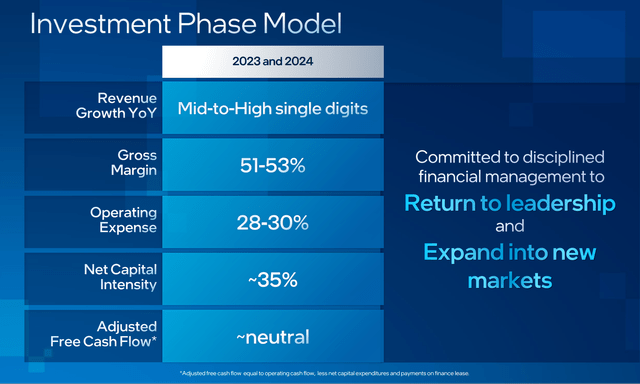

As a reminder, Intel is still in the investment phase of its multi-year plan to reposition the company.

The expected financials, from the February 2022 investor meeting, looked as follows:

Of course, the reality has been a bit more complicated, with notably gross margin dipping well below the target due to the massive drop in revenue. For Q3, Intel reported the following results:

Q3 operating cash flow was $5.8 billion, up $3 billion sequentially. (…) Net capex was $4.9 billion, resulting in positive adjusted free cash flow of approximately $950 million, and we paid dividends of half a billion dollars in the quarter.

One could observe that Intel delivering nearly $1B of adjusted FCF in Q3 is actually ahead of its plan of neutral FCF, although obviously due to the downturn, FCF had been substantially negative for multiple quarters, but with the financials stabilizing/recovering, Intel is getting back to its targets.

Intel also reiterated that its expectation for its aggregate net capital intensity across 2023-24 is unchanged (around 35%). Note that Intel also expects capital offsets trending towards 30% (range 20-30%), coming from its SCIP program for its Arizona fabs, as well as (more in 2024) from the Chips Act.

In general, semiconductor manufacturing requires quite some upfront costs. Nevertheless, besides some of the macro issues, Intel remains more or less on track to manage the business according to the original plan. So as those fabs start operating at a high utilization (and later on having been depreciated), of course on the assumption Intel finds enough demand (either from its own products or foundry customers), investors should expect to see a substantial increase in leverage over time as Intel exits this investment phase, notably those 10 points of capex intensity in addition to higher revenue (as much of the current investment is in fab shells and later on equipment, neither of which are generating any revenue yet).

As a reminder, the long-term model called for 20% adjusted FCF. In its earnings calls, Intel management (CEO/CFO) has also mentioned the aim for a 60/40 model for gross and operating margin.

Valuation

Qualitative overview

On a high level, I had expected that the stock revaluation would only follow after the financials improve, which would happen only after the leadership technology hits the market, in late 2024. In that regard, the (partial) stock recovery in 2023 should indeed be seen as merely a recovery from the macro downturn to more historical levels.

Given that (1) the financial recovery in PC and data center is still underway, (2) NEX is still in the midst of its own downturn, and (3) Intel has exited many businesses and continued to lose data center market share (which is even more apparent when grouping both CPU and GPU data center wallet share together given the rise of Nvidia), one could argue that the stock might actually be overextended in the near-term.

Tangent: progress of emerging businesses

While none of the businesses Intel has exited were particularly large, one potential question that remains ambiguous is Intel’s commitment to its gaming GPU roadmap, which was one of Intel’s three ‘big bets’ for growth businesses: since its reorganization, Intel is not separately reporting its GPU revenue anymore. Nevertheless, given the extraordinary growth in data center AI revenue, the client segment has arguably lost in importance compared to the data center segment, to which Intel obviously does remain committed, with the merging of the Gaudi and Italian bridges roadmaps with Falcon Shores in 2025.

Overall, although the near-term stock gains are likely gone, and the downside becomes more probable, the long-term turnaround thesis remains on track, although the thesis on the emerging growth businesses is more mixed in terms of execution and progress, with Mobileye (MBLY) not getting into the robotaxi service business (and the delay of robotaxi in general compared to initially announced schedule) and the uncertainty regarding the gaming Arc GPU roadmap and Falcon Shores in the data center.

Long-term target

Since the turnaround thesis (Pat Gelsinger unofficially aimed for a 4x return based on 2x EPS and 2x PE multiple) was initially based on the stock being around its current level, what investors stepping in today have over those who stepped in when Pat Gelsinger was appointed, is that Intel hasn’t had any process technology issues/delays for the last 3.5 years, significantly improving confidence in its execution. Of course, this also means three years less time required to wait to see results, which is (aside from the dynamics regarding the downturn) exactly in line with my original thesis when Pat Gelsinger stepped in.

For a more quantitative example, in the years prior to the recent downturn, Intel was trending around $70-80B revenue. So given that it was the explicit goal to accelerate revenue growth towards double digits, it is not unreasonable to assume Intel was aiming for >$100B revenue in the long term. Combining this with the aforementioned profitability targets suggests a target for perhaps $40B operating profit. This compares to a market cap of $200B currently. So clearly there should be (substantial) upside if the turnaround fully succeeds. Nevertheless, while technologically things seem to be heading in the right direction, that is still a long way from also converting this into financial performance.

Napkin math for current valuation

Given Intel is, as discussed, in its investment phase, which means operating near breakeven (neutral adjusted FCF), the P/E valuation is currently not an insightful metric.

Still, to approximation, one could observe Intel is/was (roughly, disregarding things like fab underutilization due to the downturn, to which Intel’s reaction was its $3B near-term and $10B long-term cost reduction program) trending towards $2 annual EPS (for example, Q3 EPS was ~$0.4, 2022 EPS was ~$1.80), which would support a stock price of around $20.

To bridge the gap with the current price, perhaps another $10 or so dollars in stock price ($1 in EPS) might perhaps be attributed to the (temporary) fab investments (although strictly speaking those shouldn’t be noticeably depreciating yet) as well as the start-up costs from the investment in 5 nodes in 4 years. Another part might be due to the fab underutilization and reduced gross margin. A last part might be the DCF guys baking in future expected profits into the stock price.

For a reality check, looking at the 10-Q report, Intel reported a collective over $8B hit in operating income across client ($3.5B), data center (nearly $3.5B), and network/edge ($1.5B) due to reduced revenue as well as higher product cost due to Intel 7. That is $2 is EPS that has been wiped out simply due to lower demand. Other factors such as underutilization and fab costs are negligible in comparison (although, to be sure, fab costs for the 5 nodes in 4 years already started in 2022, so while there might not be substantial additional costs, those costs are still there, with management noting that coming out of this phase around 2026 would provide a one-time boost to gross margin). As such, one has to conclude that a pretty much complete recovery in demand/revenue is already baked into the stock, which seems a bit premature.

So overall, one could make a case for a stock price in the $30-40 range or so. As noted, besides this just being napkin math as well as the additional variables such as the (temporary?) revenue reduction and the resulting cost-saving program, roughly speaking Intel stock could be somewhat overextended currently.

Risks

The whole Intel turnaround is fundamentally based on its process technology, restoring leadership. Intel at the December 14 launch event said (yet again) the roadmap remains on track, and Pat Gelsinger on the October earnings call said that with the shipping of the 18A 0.9 PDK, the node has basically exited the invention phase, moving towards productization. While there is still some minor risk of late issues resulting in delays, the main ‘risk’ is the uncertainty of the exact specs of the Intel 3, 20A and 18A nodes. This makes it impossible to independently confirm Intel’s claims regarding process leadership and compare how significant the lead quantitatively will be.

For example, when asked TSMC in October claimed that it would have leadership with N3 against 18A, which is quite an extraordinary claim as N3 lacks gate-all-around transistors as well as backside power delivery, and one that Pat Gelsinger subsequently denied. Note that since Intel is a TSMC customer, whereas the reverse isn’t true, Intel’s claim certainly is most credible, as in principle TSMC shouldn’t even have access to the details of 18A (basically knowing just as little as the public).

A second key risk is that at least some of the initial thesis was based on the general semiconductor market growth, which was expected to double by 2030 to $1T. With big bets in foundry, automotive (Mobileye) and GPU/AI, combined with data center and network and edge, Intel was broadly indexed to most of the highest growth markets. However, given the recent downturn, one might start to wonder/question if the $1T prediction will still materialize.

More in general, Intel does have a history of missing its revenue/growth targets (with one notable exception being around 2016-2018), so this is something that Pat Gelsinger still has to prove. At this point, the most promising business for growth is obviously foundry, and for now, the (massive) fab expansion and buildout plans to support the expected growth seem to remain mostly unchanged.

Investor Takeaway

With no less than four distinct nodes, representing two full nodes worth of Moore’s Law scaling, getting (ready for) manufacturing over the next year, with the launch of Meteor Lake Intel is now entering its annus mirabilis: it is starting the transition from the N7-class process technology that debuted in fall 2018 (by TSMC) towards having literally the most advanced transistor on the planet, all in just one year (advancing its technology position by an astonishing 8 years compared to TSMC).

While Meteor Lake is significant due to its introduction of several important (foundational) technologies, and Emerald Rapids for restoring some confidence in the data center segment’s ability to execute, both products still represent some of the last pre-turnaround products in the pipeline. After the delays of both products’ respective predecessors, they do not have any further issues, so these represent a decent, perhaps even promising, baseline for what’s in store in the next year as the new Intel emerges from the ashes.

When Pat Gelsinger joined Intel in 2021, it was basically universally agreed that the turnaround would take at least four years, and Intel is on track to deliver exactly that. Next year will also represent the first year where decisions made under Gelsinger and management will become more apparent (i.e. where they will be more responsible than prior management for the products coming to market), such as the redefined Granite Rapids Xeon.

So, while stock upside might be limited for the next one to perhaps two years, investors should keenly watch the next year as the direction of Intel’s momentum (and therefore future potential stock returns) should become apparent as the year progresses.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.