Summary:

- Apple demonstrated solid profitability resilience in FY 2023 thanks to the pricing power in services.

- However, Apple’s services cannot exist without its products and my analysis suggests there is a massive creativity crisis in Apple from the new products perspective.

- The Vision Pro sales launch, which is scheduled for February 2024, will highly likely disappoint investors.

- My valuation analysis suggests the stock is substantially overvalued at a $3 trillion market cap.

Justin Sullivan/Getty Images News

Investment thesis

My previous bearish thesis about Apple (NASDAQ:AAPL) did not age well since the stock rallied by 14% over the last quarter, substantially outperforming the broader U.S. market. The stock closed at an all-time high last week after the rally caused by the news that the Fed will start cutting rates in 2024. However, I would like not to miss the forest for trees as the company demonstrates a massive crisis of new ideas. The last fiscal year’s drop in product sales cannot be explained by the harsh environment because the U.S. economy demonstrates massive resilience despite all challenges and the unemployment rate is close to historical lows. Furthermore, my valuation analysis suggests the stock is substantially overvalued. All in all, I assign AAPL a “Sell” rating.

Recent developments

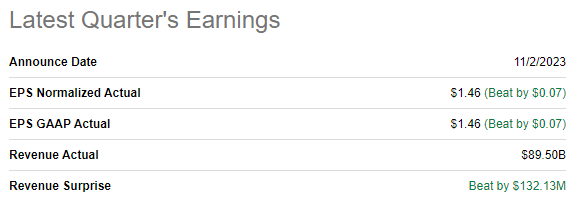

The latest quarterly earnings were released on November 2, when AAPL topped consensus estimates. Although revenue was flat on a YoY basis, the adjusted EPS expanded from $1.29 to $1.46. The bottom line expansion was achieved due to solid operating leverage, with the EBIT expanding YoY from 27.6% to 30.1%.

Seeking Alpha

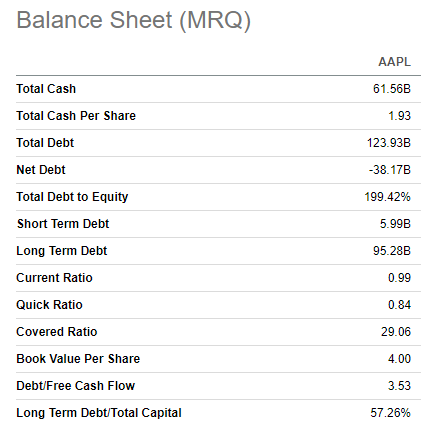

Despite having a solid operating margin, the free cash flow [FCF] did not expand mainly due to adverse dynamics in the net working capital. Still, the TTM levered FCF margin was stellar at 21.4%, enabling AAPL to solidify its fortress financial position. The company’s wide profitability metrics and strong balance sheet position AAPL well to drive revenue and innovation, but I would like to underline several warning signs that can weigh on the ability to drive further revenue growth and profitability expansion.

Seeking Alpha

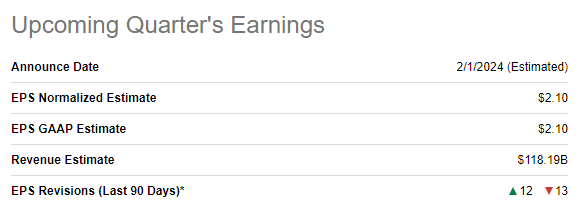

The most apparent factor is the cautious near-term guidance shared during the latest earnings call. The earnings release for the upcoming quarter is scheduled for February 1, 2024. Consensus estimates forecast quarterly revenue at $118 billion, which indicates a mere 0.8% YoY revenue growth. Apple’s profitability, however, is expected to expand YoY from $1.88 to $2.10.

Seeking Alpha

Apple’s unmatched ecosystem allows it to exercise massive pricing power in services, which is the main profitability driver in the current soft environment for products. However, it is important to understand that the pricing power in services is not infinite. Apart from that, the products segment is the core, with subscriptions serving as the auxiliary. From this perspective, the company’s prospects look cloudy as the product revenue declined by 6% in FY 2023, and the outlook for 2024 is cautious. While the challenging environment of high-interest rates is the main explanation by Apple’s bulls, I would like to underline a couple of crucial facts indicating that the company’s problems are more secular than temporary.

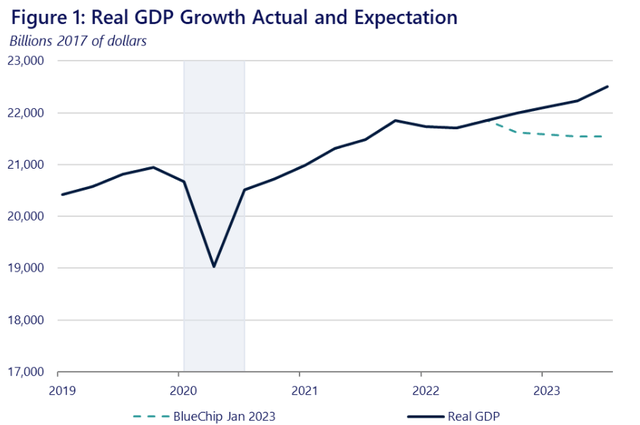

The global economy demonstrates impressive resilience even amid all the challenges the world faced in 2022-2023. All the panic and 2023 recession predictions did not age well, as the U.S. economy demonstrated a very strong dynamic this year across all key metrics. So, I believe that the effect of the global macro headwinds on Apple’s top line might be overestimated, and we need to seek problems’ roots deeper.

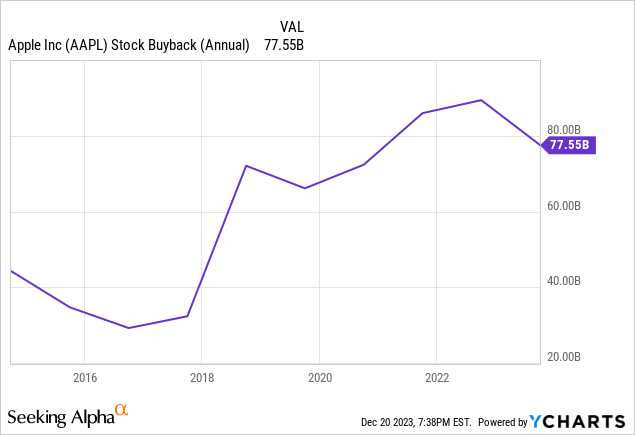

The fact that product sales declined across all products and all geographies is a warning secular sign, indicating the low resilience of the company’s product mix. And this looks unsurprising to me given the fact that about 87% of the total product revenue is generated by iPhone, iPad, and Mac. All these products were brought to market during the legendary reign of Steve Jobs, who passed away twelve years ago. The prospects of the remaining 13% of product revenue look cloudy with the patent infringement saga around Apple Watch 9. The overreliance on legacy products, even as iconic as the iPhone, is not a good business practice. The fact that the company spent a staggering $600 billion on stock buybacks over the last decade underscores the crisis of new ideas in the company.

Apple’s credit card collaboration with Goldman Sachs failed, which also highlights the weakness in innovation as the new credit card was assumed “to revolutionize the credit card experience“. The last time Apple launched a successful brand-new product was the AirPods, released seven years ago, alongside the iPhone 7!

Apple’s “new next big thing” is expected to be released in early 2024, a $3.5 thousand mixed-reality Vision Pro headset. But it also looks like a really risky bet. First, the virtual and augmented reality field is still very controversial, and whether humanity is ready for such technologies is not obvious. Second, it is important to remember that Apple was extremely successful at improving products that already existed: we all had mobile phones before the iPhone revolutionized the industry, and computers were also widely spread before the Mac renaissance, and the same with watches and earpads. But the VR headsets field is a different animal, where Meta’s (META) Quest already failed. On the Apple Vision Pro’s web page, the product is positioned as a mix for a brand-new entertainment experience and to make meetings with colleagues “more meaningful”. This value for potential users looks controversial to me.

Let me start my reasoning with the entertainment experience side. First, people are inherently social, and the idea of sitting at home alone watching movies via a $3.5 thousand VR headset is very unlikely to attract a vast audience. Second, it is difficult to explain why people might need another expensive device to watch movies or series when we all have TV sets in our homes and our handsets are with us 24/7 if we want to watch video content while traveling. Third, Vision Pro’s battery capacity will be enough to work for two hours without charging, which also does not add to its competitive advantages if a person wants to have entertainment while traveling.

If we look at Vision Pro’s prospects as a disruption for business use, I am also not very optimistic. Apple’s promise to make users’ meetings with colleagues “more meaningful” does not look like a strong argument for businesses to start massively ordering this expensive device. The work-from-home trend, which spiked during the pandemic, is cooling off as even Zoom ordered workers back to the office.

All in all, I see a massive ideas crisis in Apple. This fact looks like a major long-term problem for the company’s top-line struggles and not the weak macro environment. The company’s last successful brand-new product launch was seven years ago, and every new iPhone release is a slight modernization of the previous one. The bet in the VR/AR field looks very controversial to me and I expect the Vision Pro headset sales, which are expected to launch in February, to likely disappoint investors.

Valuation update

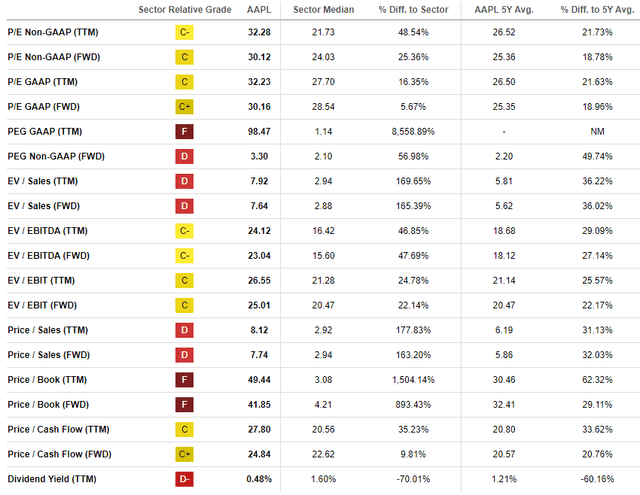

AAPL rallied by 58% year-to-date, significantly outperforming the broader U.S. stock market. The fact that Apple’s valuation ratios are substantially higher than the sector median does not surprise me, given the company’s unmatched ecosystem and stellar profitability. However, it is crucial to underline that the current valuation ratios are notably higher than historical averages. This indicates overvaluation to me.

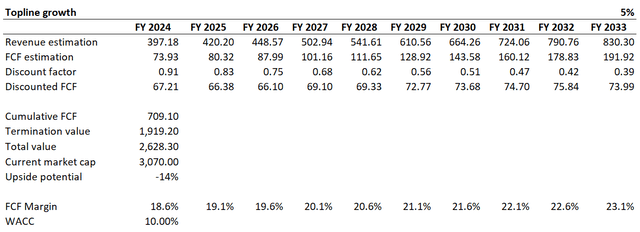

I want to proceed with the discounted cash flow [DCF] simulation. I use a 10% WACC for discounting, a round-up from the level suggested by valueinvesting.io. I have long-term earnings consensus estimates, projecting a 9% CAGR for the next decade. I consider it fair enough to incorporate this growth profile into my DCF simulation. I use an 18.6% TTM FCF ex-SBC margin and expect 50 basis points yearly expansion.

According to my DCF simulation, the business’s fair value is around $2.6 trillion, substantially lower than the current market cap above $3 trillion. That said, the stock is around 14% overvalued. While I think that Apple’s unmatched ecosystem and vast brand loyalty deserve a premium to the stock price, it is also crucial to underline that the company faces multiple challenges, both internal and external. Moreover, the company’s current market cap is higher than late 2021 levels, but the current environment is much more challenging. In December 2021, Federal funds rates were at the lowest possible levels while they are currently above 5%. Geopolitical risks at the end of 2021 also were much lower than we currently see. That said, I cannot conclude that AAPL is attractively valued.

Risks to my bearish thesis

Betting against the world’s largest company is risky; my previous bearish thesis proves it. The company’s extensive ecosystem and vast loyal customer base positions the company to unlock new revenue streams or exercise solid pricing power by increasing fees for its subscription services like Apple TV+, or iCloud+. On the other hand, services generate far less revenue than the iPhone, and even having strong pricing power in services will not offset challenges for the company’s hardware revenues. Moreover, this year’s subscription fee increases were already quite aggressive and the pricing power cannot be infinite.

Apart from solid opportunities to unlock new revenue streams, it is important to take into account the fact that Apple has not only very loyal customers but also very loyal investors who support positive market sentiment around the stock. The fact that almost half of the great Warren Buffett’s portfolio is invested in AAPL is also a massive factor supporting Apple’s stock price. However, the strong sentiment around AAPL did not protect it from the -27% yearly return in 2022.

Bottom line

To conclude, Apple’s stock is a “Sell”. The company has massive problems with new product ideas, which are masked under the services segment pricing power. However, Apple services cannot exist without its products, and the declining product sales across all offerings and all geographies is a big red flag to me. Vision Pro is expected to go live in February 2024, but there are numerous reasons why this product is likely to fail. The stock is also substantially overvalued.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.