Summary:

- Apple may face a ban on the sale of its Series 9 and Ultra 2 smartwatches in the US due to a patent dispute with medical technology company Masimo.

- The ban, if upheld, could potentially jeopardize around $5 billion in quarterly revenue for Apple.

- Apple is actively working on legal and technical solutions to resolve the issue and resume sales of its wearables as soon as possible.

- Apple’s trading at 30x its FY24 earnings, so any hiccup in growth could seriously impact its stock price.

- I still see Apple as a solid stock to own. If any weakness in the stock price follows the ruling, I plan to buy more.

Scott Olson

The last time I covered Apple Inc. (NASDAQ:AAPL) was in September, following the release of the iPhone 15 lineup, which proved to be a reasonable success, largely attributed to the effective pricing strategy of the world’s most valuable company.

At the time of publishing the article, the main topics were the risks associated with the Chinese government potentially banning the usage of iPhones and Huawei eating Apple’s lunch amidst potential pullback in customer spending. It’s important to understand that in the realm of the economy or within a specific company, there’s always something to be worried about.

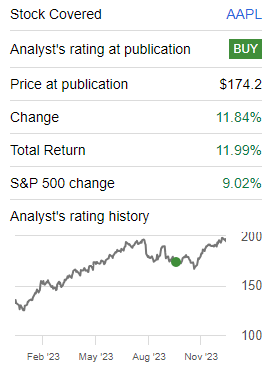

While some naysayers were busy claiming that the company was overvalued, they overlooked a perfect buying opportunity. Since I initiated a buy rating on Apple, the company has not only reclaimed its $3 trillion valuation but has also outperformed the market (SPY) by a margin of 3% and is trading near its all-time-high of $199.62.

Last Coverage (Seeking Alpha)

Yet again, Apple is encountering a fresh legal hurdle that might halt sales of its latest Series 9 and Ultra 2 smartwatches in the United States starting this week. This arises from a patent dispute concerning the technology behind the blood oxygen feature in these devices.

This action follows a directive issued in October by the US International Trade Commission “ITC”, which potentially prohibits Apple from importing its Apple Watches. The ITC found that these devices infringe upon the patent rights of medical technology company Masimo (MASI).

Apple vs. Masimo

Back in 2013, Masimo, a health tech company, developed a mobile pulse oximeter – a sensor for tracking blood oxygen levels – that could sync up with the iPhone, iPad, and iPod touch.

When this tech was unveiled, Apple showed keen interest in incorporating this feature into its own devices. Instead of buying or licensing the intellectual property, Apple opted to onboard several key players from Masimo, including Michael O’Reilly, who transitioned from being Masimo’s chief medical officer to Apple’s vice president of medical technology.

Fast forward to 2020, and things got tense between the two companies. Masimo sued Apple, citing allegations of trade secret misappropriation and patent infringement. Coincidentally, later that year, Apple rolled out the Apple Watch Series 6, the first of its wearables to include a pulse oximeter.

The initial lawsuit didn’t settle things, and the legal battles continued and intensified, leading to the current scenario at the ITC, where there’s a possibility of a ban on Apple’s watches featuring the oximeter.

As a result, Apple is gearing up to completely halt sales of these new watches, with uncertainty looming over the duration of this restriction.

Confirmed by Apple, these devices won’t be accessible via its online store from December 21st or in physical Apple stores starting December 24th due to an “order from the US International Trade Commission regarding a technical intellectual property dispute.”

While awaiting President Joe Biden’s decision until December 25th, Apple is preparing to comply should the ruling remain unchanged. The Office of the US Trade Representative, managed by the Biden administration, is thoroughly considering all aspects of the case.

If not overturned, the ban is set to come into effect on December 26th with Apple not being able to sell its most popular wearable devices.

So what does that mean for Apple?

Wearables Represent 10% Of The Sales

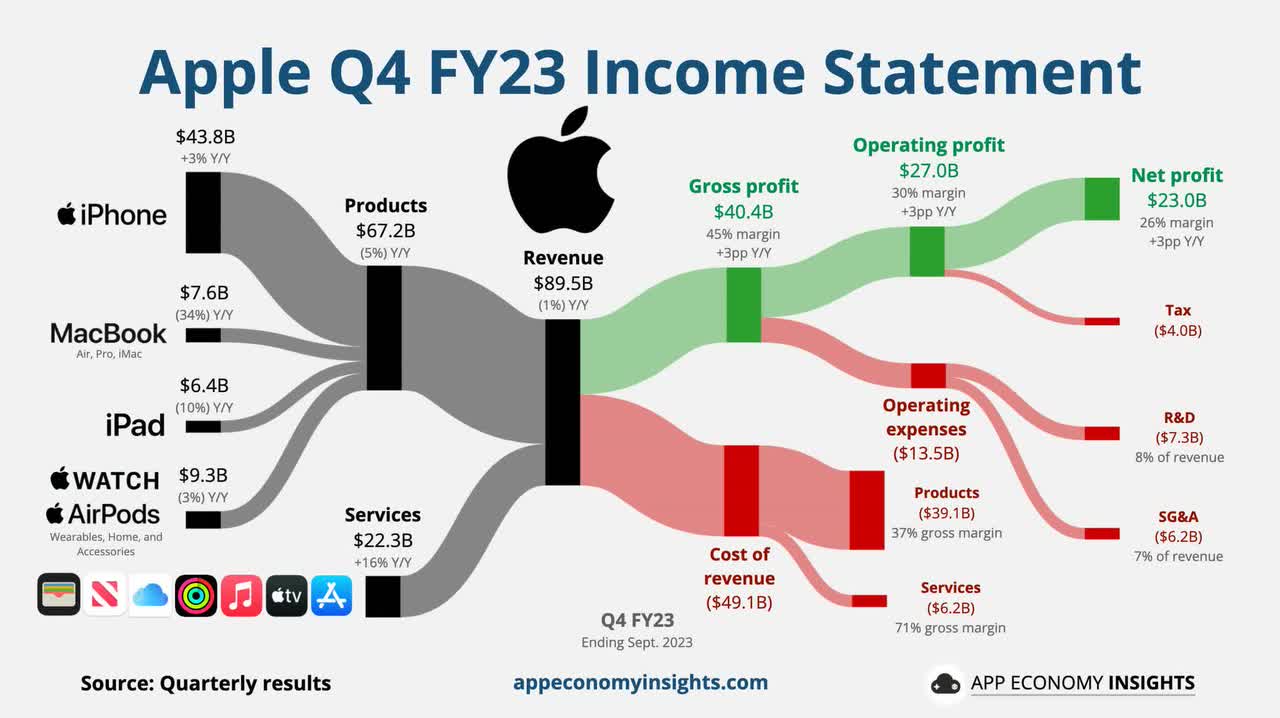

In Q4 FY23, Apple recorded a quarterly revenue of $89.5 billion, marking a 1% decrease compared to the previous year, primarily due to declining sales in Greater China and Japan. However, the EPS stood at $1.46, surpassing analyst estimates by $0.07 and showing a 13.2% year-over-year growth.

Apple Q4 FY23 Earnings (App Economy Insights)

While Apple boasts multiple strong revenue streams, the company is trading at a significant premium compared to its historical valuation. A small looming threat that could potentially hamper growth might exert a significant drag on the stock price. The Q4 breakdown appeared as follows:

- iPhone: $43.8 billion revenue, contributing 49% to the total revenue, with a 3% YoY growth.

- MacBook: $7.6 billion revenue, contributing 8.5% to the total revenue, with a -34% YoY growth.

- iPad: $6.4 billion revenue, contributing 7.2% to the total revenue, with an -11% YoY growth.

- Wearables: $9.3 billion revenue, contributing 10% to the total revenue, with a -4% YoY growth.

- Services: $22.3 billion revenue, contributing 24.9% to the total revenue, with a 16% YoY growth.

This breakdown indicates that wearables, encompassing both Apple Watch and AirPods, contribute a solid 10% to the overall revenue, making it a significant income stream.

Although Apple doesn’t offer specific insights into this category, detailing the contribution from AirPods versus Apple Watch, I believe it’s reasonable to estimate that roughly half of the revenue stems from Apple Watches. This means that if the ban takes effect, around $5 billion in quarterly revenue could potentially be in jeopardy moving forward.

Considering the ban’s effective date of December 26th, it hasn’t impacted the holiday shopping season encompassing Black Friday and Christmas-traditionally a robust period for Apple.

However, the ban’s duration remains uncertain. The real repercussions, if the ruling holds, are likely to surface in January and February, typically slower sales months for Apple in the US.

Let’s also consider that Apple has a substantial inventory of Watch 8 and SE, ensuring product availability during this period. However, the larger concern revolves around whether Apple can utilize the disputed blood oxygen sensor technology in future devices or if they’ll need to negotiate a settlement or devise an alternative solution.

So, beyond waiting for the ruling, what options does Apple have?

In a statement, Apple mentioned it’s “pursuing a range of legal and technical options” to address the issue and resume sales of its popular smartwatches, although specific plans were not disclosed. However, the company does have a few potential avenues.

According to media, there’s a significant internal effort aimed at altering how the Apple Watch collects and presents blood oxygen data. Yet, a simple software update might not satisfy all parties involved. Apple has a track record of resolving patent disputes through settlements and licensing deals, as demonstrated with Qualcomm in 2019.

No Room For Error At This Valuation

While the $5 billion quarterly revenue at stake might seem relatively small compared to the anticipated $397.2 billion revenue for Apple in FY24, it actually accounts for approximately 5% of the total annual sales.

What’s more critical is the potential aftermath if the ruling stands and Apple is forced to reengineer its Apple Watch or settle through a financial agreement. This could set a precedent for other companies to possibly sue Apple for patent infringement, leading to trouble in the coming years.

However, where I perceive the primary risk lies is in Apple’s valuation.

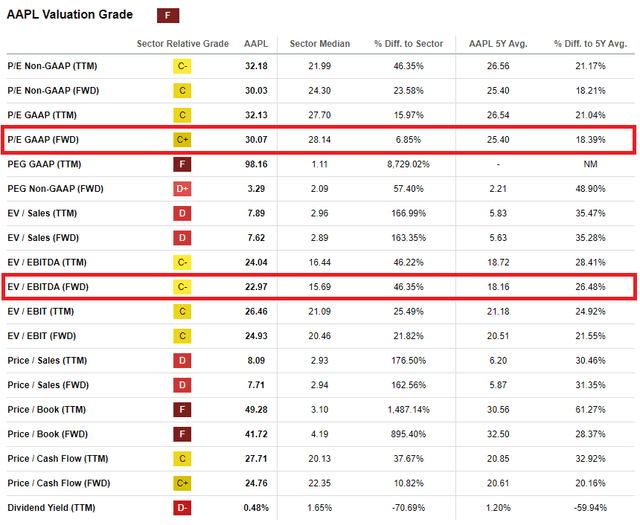

The stock is presently trading at a whopping 30.07x its FY24 earnings, marking an 18% premium compared to its valuation over the last 5 years.

This trend is confirmed by the forward EV/EBITDA, currently sitting at 22.97x, representing a 26.5% increase from its historical valuation.

What concerns me here is that as Apple already delivered negative year-over-year revenue growth during Q4 FY23, with this valuation, it can’t afford many setbacks.

Any hiccups could significantly impact the stock as it’s trading at historical highs, leaving little room for error. Executing flawlessly becomes crucial to justify this valuation.

Over the next five years, analysts anticipate Apple to boost its Revenue by a CAGR of 6.4% and its EPS by 8.5%, thanks to aggressive stock buybacks.

For reference, Apple has decreased its shares outstanding by 38% over the past decade.

Now, to put Apple’s forward looking valuation in relation to other fundamentally strong tech companies, let’s take a look at the following comparison:

This suggests that Apple’s forward valuation in relation to EPS growth is significantly higher compared to the other selected companies, leaving minimal margin for error in execution, as any misstep might result in a significant stock drawback.

Nevertheless, if Apple swiftly resolves the dispute with Masimo and gets back to selling its Apple Watch range, I anticipate the stock could reasonably appreciate by 7% annually, potentially reaching a stock price of $276 by the end of 2028. This assumption considers a slight contraction in the elevated valuation to approximately 28x its forward earnings.

| Fiscal Year | 2024 | 2025 | 2026 | 2027 | 2028 |

| Revenue (b) | $ 397.2 | $ 420.2 | $ 448.6 | $ 502.9 | $ 541.6 |

| Revenue Growth | 3.6% | 5.8% | 6.8% | 12.1% | 7.7% |

| EPS | $ 6.6 | $ 7.1 | $ 7.8 | $ 8.8 | $ 9.9 |

| EPS Growth | 7.0% | 8.5% | 10.1% | 12.0% | 12.2% |

| Forward PE | 30.0 | 29.0 | 28.0 | 28.0 | 28.0 |

| Stock Price | $ 197 | $ 206 | $ 220 | $ 246 | $ 276 |

Conversely, if the dispute remains unresolved, my projection is that the EPS impact could range between 2-3% in FY24. This indicates that instead of Apple reaching an EPS of $6.6 next year, I anticipate it might land around $6.4, resulting in a target stock price of $192 instead of $197.

Takeaway

The legal tussle between Apple and Masimo regarding the blood oxygen sensor patent might force Apple to halt sales of its smartwatches. Depending on how long this pause lasts, it could dent Apple’s sales by a significant $5 billion each quarter when the wearable devices aren’t sold.

While this accounts for just about 5% of Apple’s revenue, and if the ban takes effect, it’s likely to impact the slower sales period from January to March, Apple is actively engaged in addressing both the legal and technical aspects to swiftly resolve the issue and resume sales of the wearables.

I don’t necessarily perceive this temporary pause in wearables as an outright threat to Apple. However, considering its trading at an elevated range, standing at 30x its FY24 earnings with a 3.25 PEG ratio, any minor hurdle could profoundly impact the stock price if growth doesn’t materialize or worsens.

Nonetheless, I still see Apple as a robust, core holding in portfolios, worth acquiring at today’s price. If any weakness in the stock price arises due to the dispute, I’m inclined to seize the opportunity and capitalize on it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT, NVDA, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.