Summary:

- Since the launch of ChatGPT, many analysts have painted a doomsday scenario for Google Search.

- However, with the latest launch of Gemini and recent earnings results, it is unlikely that Google Search will face existential threats in the near term.

- Google’s search business faces challenges from other factors like the growth of Amazon’s advertising business, legal challenges and slower growth potential.

- The revenue share of Google’s search business has been decreasing in the last few years as cloud, YouTube, subscriptions and other businesses report faster growth.

- Google search will retain a large market share despite new AI tools and the overall impact could be positive as new monetization options open up.

Ole_CNX

Google’s (NASDAQ:GOOG) advances in launching new AI tools and chips suggests that its Search business will not likely be overtaken by ChatGPT. The meteoric rise in the usage of ChatGPT and other AI tools led some analysts to predict out that Google will likely lose market share in search business to these tools. ChatGPT has over a billion monthly users and has seen one of the fastest growth for new technology in recent years. Despite this usage, Google Search has been able to beat expectations and reported double-digit revenue growth in the recent quarter. In the previous article, we highlighted that Google was already improving margins and investing heavily in buybacks which will boost EPS growth trajectory. Google’s margins in the cloud business has improved by 10 percentage points in the recent quarter compared to year-ago quarter. Steady margin improvement is likely to improve the bullish sentiment towards the stock.

Google has launched its own AI version called Gemini which is showing promising results. The company has the resources and the skills to effectively compete in the AI era. There is an AI race where different companies are trying to bring better tools. However, the long-term impact on Google’s ability to monetize its customer base will likely not suffer as the company launches its own AI versions.

The main risk for Google stems from regulatory headwinds within its Play app store. The company has recently agreed to pay a staggering $700 million to settle lawsuit in the app store. This is only 1% of Google’s annual net income but it has set a big precedent. We could see additional lawsuits on Google in the near future. Google’s licensing agreement with Apple is also a major risk as regulators closely look at the antitrust laws.

Google Search is facing challenges from the rapid growth of Amazon’s (AMZN) advertising which has eliminated the duopoly of Google and Meta (META) in digital advertising. It will be important to gauge the future growth trajectory of Amazon and Google’s advertising business. The revenue share of Google Search is also declining as cloud, YouTube and other segments show faster growth. This should help Google diversify its revenue base and build a better growth runway. Google stock is quite cheap when we compare it to other peers and look at the growth potential of the company’s faster-growing segments.

Doomsday scenario or a new revenue stream

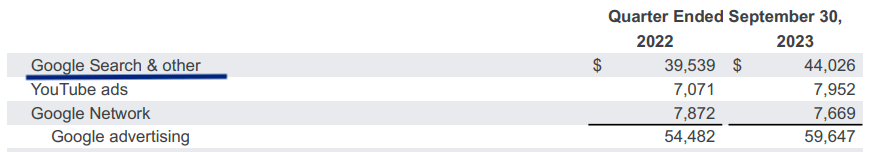

The growth of ChatGPT has had a massive impact on how Wall Street gauges the future growth of many tech companies. There are more than a billion users accessing ChatGPT every month for various queries and tasks. This has led many analysts to predict that it will cause a significant dip in the market share of Google. We have not seen any such issues in the recent quarter. Google was able to report double-digit growth in search business compared to year-ago quarter.

Company Filings

Figure: Google Search revenue in the recent quarter.

Google’s own AI version called Gemini is also showing promising results despite some hiccups in the launch. We believe it’s highly likely that Google will be able to match other competitors in the AI race due to its massive resources and technological depth. Over the next few quarters, we could see better tools launched by Google which should allow the company to meet any threat from the new AI companies.

Threat from Amazon advertising

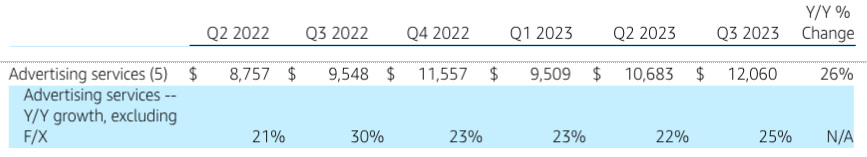

Despite the hype around ChatGPT, a bigger threat to Google’s search revenue is through the steady and strong growth in Amazon’s advertising business. Amazon has been able to report 20%-30% YoY growth in advertising segment for the last few quarters. The recent quarter showed advertising revenue of $12 billion or $48 billion on annualized basis. Amazon’s advertising revenue is already close to 30% of Google Search revenue.

Amazon’s filings

Figure: Rapid growth in Amazon’s advertising revenue.

Amazon is launching new tools for advertisers to improve their ability to reach customers and convert advertisements into sales. There are a number of advantages for advertisers who are spending on Amazon. The biggest advantage of Amazon’s platform is that customers are in a “buying mode”. This massively increases the ability to convert advertisements into actual sales. Amazon also offers a “cleaner” platform compared to Google and other digital advertisers. Advertisers who prefer less toxic platforms could opt for Amazon.

At the current growth trajectory in Google search and Amazon’s advertising business, we could see Amazon report advertising revenue equal to 50% of Google’s search revenue by the end of 2026. This is a massive change in the digital advertising arena. While Google is building some tools to improve product-based searches, the growth of Amazon advertising will continue to be a headwind for Google in the near to medium term.

Revenue share of Google Search getting smaller

Another major trend within Google’s search business is that its revenue share is declining rapidly. This has also reduced the positive and negative impact it has on the stock trajectory. We saw this in the recent earnings results. Google reported revenue in search business which beat estimates but underperformed in the cloud business. This led to a massive correction in the stock in the week after the recent earnings. Google stock has recouped most of the losses but this trend suggests that cloud performance could be more important for the investors.

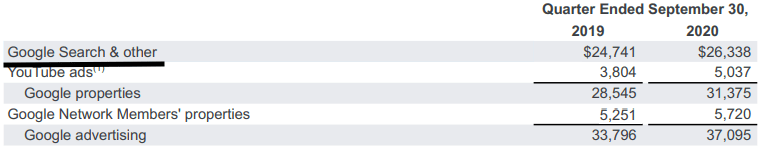

Google Filings

Figure: Google’s search revenue prior to the pandemic.

Prior to the pandemic, Google reported $30 billion in search revenue in Q3 2019 out of total revenue of $40 billion. This equates to a revenue share of 75%. In the recent quarter, Google’s search and network revenue was $51.5 billion out of a total revenue base of $76.5 billion. This equates to a revenue share of 67%. Hence, in the last four years, the revenue share of search has declined by 8 percentage points. If the current growth trends continue in different segments, Google’s search revenue share will likely be less than 50% by 2030. This will increase Wall Street’s focus on other growth segments.

Risks to the thesis

One of the biggest threats for Google is due to regulatory headwinds. It is facing pushback from regulators for its app store as well as the licensing agreement it has with Apple. The regulatory headwinds should not be underestimated as they can start making a big dent in Google’s bottom line. The European Union is already looking at Google closely and investigating for possible breaches of monopoly legislation.

Besides regulatory issues, Google will also need to deliver on its Gemini platform. The company is now competing with some of the biggest tech competitors. This can cause some erosion of market share within search business. Currently, Google has cornered over 90% of the search business and it is effectively the only game in the town. The growth of new AI features and the massive investment made by Microsoft is likely to be a challenge for Google’s massive market share in search.

Impact on stock trajectory

The launch of ChatGPT and other AI tools could open up new monetization options for Google. The company is investing massively in building its own AI capabilities including new chips. This will help the company in its cloud business and could also give new monetization options for these AI tools. The threat of AI to Google’s core search looks overheated. On the other hand, it is likely that Amazon will continue to increase its market share within digital advertising which will be a headwind for Google search. The future growth trajectory of Google search will have a lower impact on the stock valuation as Wall Street focuses more on Cloud, subscription, and other business revenue.

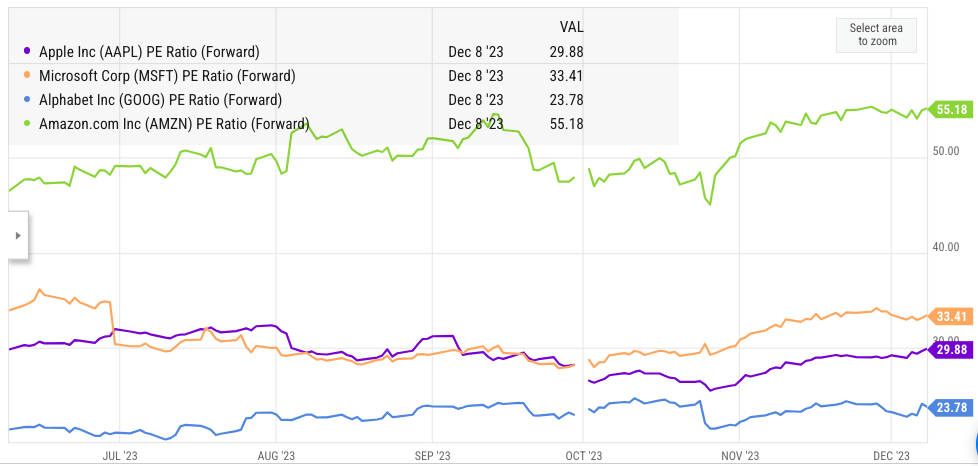

Ycharts

Figure: Comparison of forward PE ratio between Google and other big tech companies.

Google stock is trading at a significant discount compared to other big tech peers. The forward revenue growth and margin expansion trend are quite strong due to the growth of cloud and the improvement of operating margin within this segment. In the recent quarter, Google reported a massive 10 percentage point improvement in operating margin of Google Cloud as the operating income increased from negative $440 million to positive $266 million.

Despite some challenges, Google Search is a cash cow for the company, which allows it to invest in new growth segments and massive buybacks.

Investor takeaway

ChatGPT and other AI tools are unlikely to dethrone Google Search in the near term. It has been reported that ChatGPT is being used by over a billion users but this has not reduced the growth trajectory within Google Search as we saw in the recent earnings. Google will also launch new AI tools which should close the gap with other competitors. The company has a massive advertising network which is difficult to replicate giving it a good moat in this business.

Google Search is facing challenges from the rapid growth of Amazon advertising. Amazon’s advertising revenue is already 30% of that of Google Search and this could increase to 50% in next 3-4 years. There has been a reduction in revenue share of search business for Google which is reducing the importance of this business for stock price movement. We have seen a result of this in recent earnings when underperformance in cloud segment led to a correction in stock despite outperformance in search business. Google Search will likely continue to be a cash cow for the company which should allow it to diversify the revenue base and hunt for new growth businesses. We continue to rate Alphabet a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.