Summary:

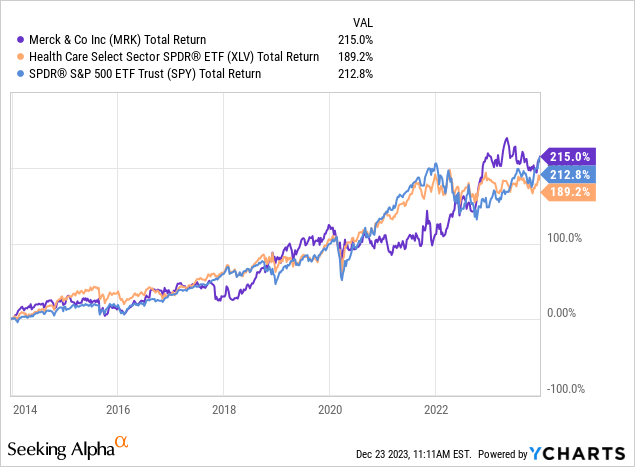

- Merck & Co. is a drug manufacturer that has outperformed the healthcare ETF and the S&P 500 over the past decade.

- The company’s pharmaceutical segment, including products like Keytruda and vaccines, contributes significantly to its revenue.

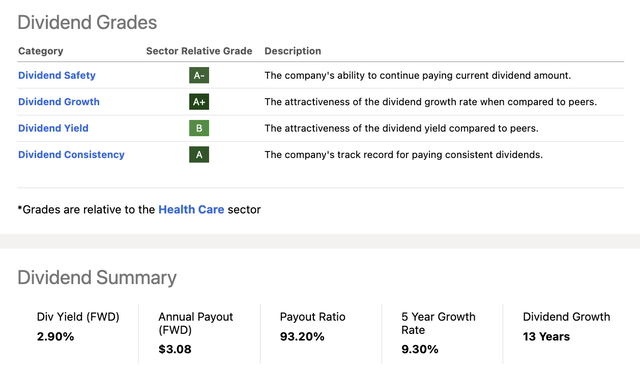

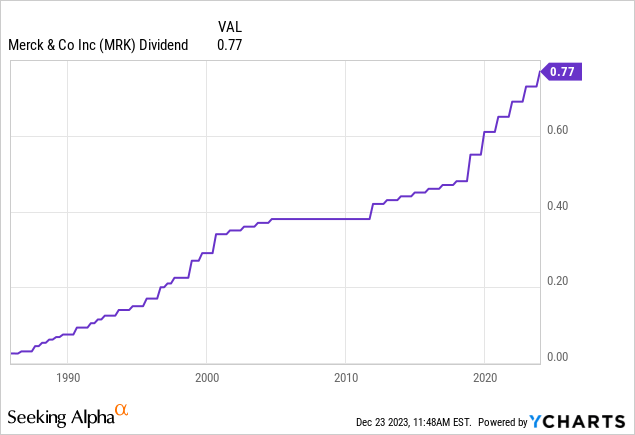

- MRK has a strong dividend scorecard, with consistent dividend growth, a high yield, and a healthy payout ratio.

Fischerrx6

Introduction

As we head into the last trading days of 2023, I wanted to cover a stock I haven’t discussed before on Seeking Alpha. That company is Merck & Co. (NYSE:MRK), a drug manufacturer with a market cap of more than $270 billion.

The reason why I never covered MRK is because I thought it was too boring. I was wrong. Very wrong.

Over the past ten years, MRK shares have returned 215%, beating both the healthcare ETF (XLV) and the S&P 500.

Moreover, the stock is yielding 2.9%. It has an A+ credit rating and consistent dividend growth.

In other words, as we will discuss in this article, the company is a mix of growth, value, and safety, the holy trinity of long-term dividend (growth) investing.

So, let’s keep this intro short and get right to it!

A Giant With Plenty Of Growth

Because this is my first article on MRK, let’s take a step back and look at what makes this company special.

As we can see below, the company makes most of its money from its Pharmaceutical segment, which did $52 billion in revenue last year.

Roughly 9% of its sales in 2022 were generated in the Animal Health segment. This segment generated roughly $6 billion in sales.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Pharmaceutical |

42,754 | 87.8 % | 52,005 | 87.7 % |

|

Animal Health |

5,568 | 11.4 % | 5,550 | 9.4 % |

|

Other |

382 | 0.8 % | 1,728 | 2.9 % |

The Animal Health segment not only provides a wide range of veterinary pharmaceuticals and vaccines but also offers health management solutions and digitally connected identification, traceability, and monitoring products.

Merck’s Pharmaceutical segment is characterized by a portfolio of products that address critical human health needs.

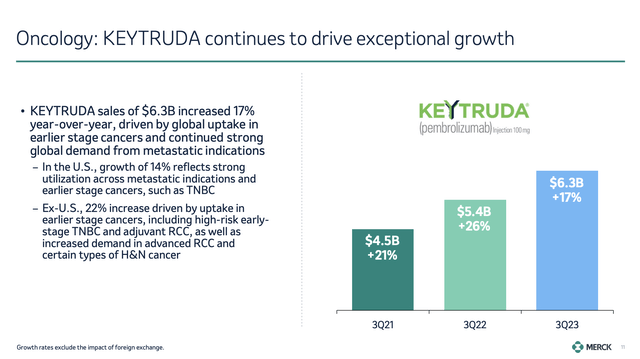

According to Merck, Keytruda, the company’s anti-PD-1 therapy, represents a paradigm shift in cancer treatment, offering hope to patients with various forms of cancer.

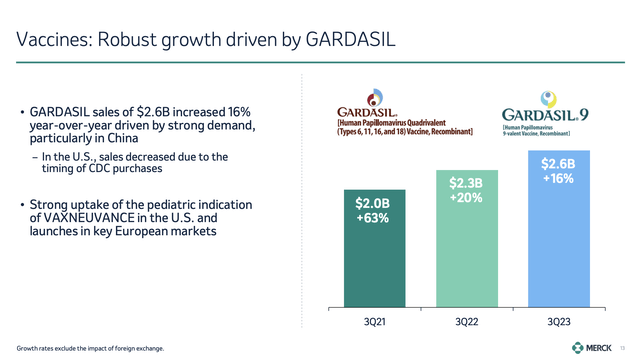

The company’s pharmaceutical advancements extend to vaccines like Gardasil, ProQuad, and RotaTeq, contributing significantly to preventive healthcare.

In general, Merck’s pharmaceutical portfolio includes diverse therapeutic areas, including Oncology, Hospital Acute Care, Cardiovascular, Virology, Neuroscience, Immunology, and Diabetes.

Two years ago, in 2021, the company spun off its women’s health company, Organon (OGN), which I covered in this article.

What triggered me to cover the company is its fantastic dividend scorecard.

Looking at the overview below, we see that the company scores high on safety, growth, consistency, and yield.

After hiking its dividend by 5.5% on November 28, the company currently pays a $0.77 quarterly dividend per share. The five-year dividend CAGR is 9.3%.

The $0.77 per quarter per share dividend translates to a 2.9% yield, which matches the number in the overview above.

MRK has never cut its dividend.

The dividend payout ratio, however, is misleading, as 2023 is impacted by special items (as I will cover in this article). The company is expected to generate $8.58 in adjusted earnings per share in 2024, which would translate to a sub-40% payout ratio, which is extremely healthy.

Furthermore, the company is expected to generate $18.4 billion in free cash flow next year. That would translate to a 6.7% free cash flow yield. That’s more than enough to protect the dividend, which is, as we just discussed, slightly less than 3% of its market cap.

The company is also expected to lower net debt to $16.5 billion in 2024, which translates to a 0.5x leverage ratio.

It has an A+ credit rating, one of the best ratings on the market.

With that in mind, let’s take a closer look at recent developments to establish how attractive MRK shares are at current prices.

MRK Continues To Grow Consistently

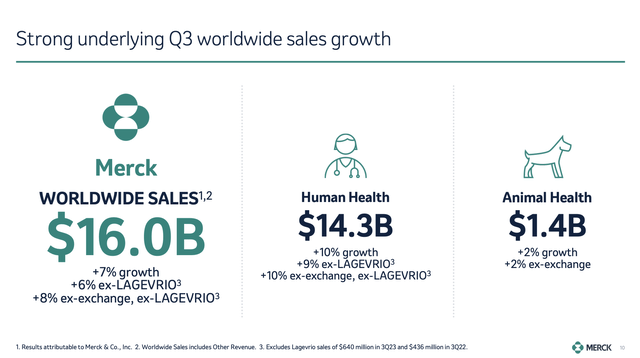

In its most recent quarter, 3Q23, the company’s revenues were $16 billion, with strong growth of 8% (excluding LAGEVRIO and foreign exchange impact).

The Human Health business sustained strong momentum with a 10% growth rate, driven by oncology and vaccines. Animal Health business sales increased by 2%.

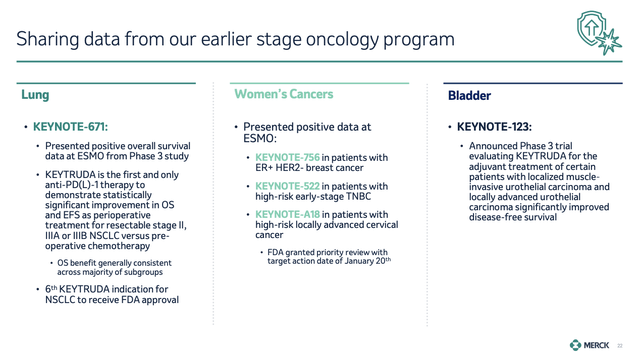

In oncology, KEYTRUDA sales grew 17% to $6.3 billion, driven by increased uptake in earlier-stage cancers.

The vaccine portfolio, led by GARDASIL, increased by 16% to $2.6 billion. Lynparza remained the market-leading PARP inhibitor with a 6% growth rate.

Additionally, the company believes it is well-positioned in non-small cell lung cancer, achieving brand leadership in earlier stages. There are plans to expand KEYTRUDA usage in bladder cancer based on positive results from the KEYNOTE-A39 study.

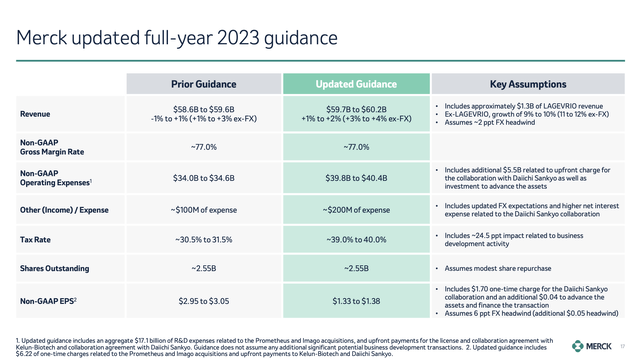

Thanks to these tailwinds, Merck raised and narrowed its full-year revenue guidance range to $59.7 to $60.2 billion, reflecting strong double-digit underlying year-over-year revenue growth.

Operating expenses are estimated between $39.8 billion and $40.4 billion, with other expenses of approximately $200 million.

The full-year tax rate is expected to be between 39% and 40%. Earnings per share are projected to be $1.33 to $1.38.

If you’re new to Merck, I know what you’re probably thinking right now.

Why is the company expecting less than $1.40 in EPS this year? That’s down from at least $2.95 when guidance was issued in 2Q23.

As the company’s guidance notes show, this is due to a one-time charge related to the Daiichi Sankyo collaboration.

Merck to pay Daiichi Sankyo a $4 billion upfront payment in addition to $1.5 billion in continuation payments over the next 24 months, and may make additional payments of up to $16.5 billion contingent upon the achievement of future sales milestones, for a total potential consideration of up to $22 billion. – Merck

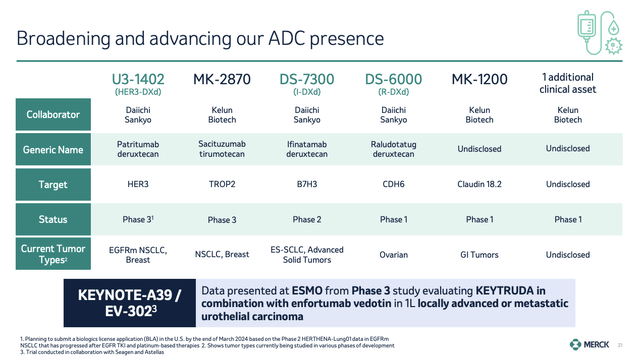

This collaboration centers around the development of potentially first-in-class antibody-drug conjugates (ADCs). Daiichi Sankyo’s proven innovation in ADC technology, leading to an already approved product for certain cancers, aligns with Merck’s commitment to advancing transformative science.

This partnership brings together the expertise of both companies to address a significant unmet patient need in oncology.

As a result, it sees multi-billion dollar commercial revenue potential on a non-risk-adjusted basis in the mid-2030s.

Beyond oncology, the collaboration contributes to Merck’s broader pipeline diversity. By accelerating the development of potentially transformative treatments, the company expands its reach into new therapeutic areas.

In general, MRK continues to benefit from a very supportive pipeline of new drugs.

According to the company, the positive data from studies like KEYNOTE-671, demonstrating the benefits of KEYTRUDA in earlier-stage cancers, particularly in non-small cell lung cancer, present a significant growth avenue.

With six FDA approvals for non-small cell lung cancer, KEYTRUDA solidifies its position in the immunotherapy landscape.

Moreover, the company’s focus on precision oncology, as shown by the HIF-2 alpha inhibitor WELIREG and the oral KRAS inhibitor MK-1084, reflects a dedication to addressing specific pathways and genetic mutations.

Adding to that, advancements in cardiometabolic disease programs, such as Sotatercept for pulmonary arterial hypertension and the clinical development of MK-0616 (PCSK9 inhibitor), show the company’s therapeutic innovation.

Positive outcomes in right heart catheterization and echocardiography data for Sotatercept provide a strong foundation for potential market entry.

All of this also helps its valuation.

Valuation

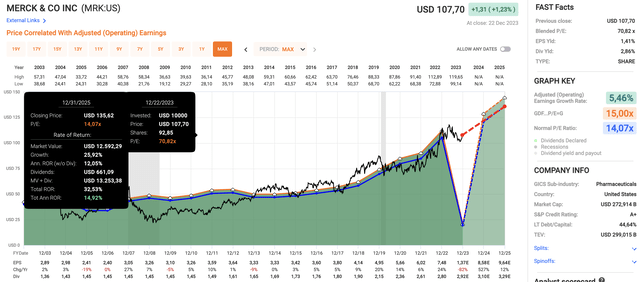

MRK is attractively valued. Using the data in the overview below:

- MRK is currently trading at a blended P/E ratio of 70.8x. However, this is entirely based on the expected 82% EPS decline caused by the aforementioned partnership (one-off item).

- Next year, EPS is expected to reach $8.58. In 2025, EPS is expected to grow by 12%. In general, it looks like the company is in a good spot to maintain mid-to-high-single-digit annual EPS growth.

- Hence, I believe that the normalized long-term valuation multiple of 14.1x is a fair multiple.

- If the company were to trade at 14.1x going forward by incorporation of expected EPS growth, it would have a fair price target of $136, which is roughly 26% above the current price.

When adding its dividend, the stock should be able to generate between 14% and 15% in annual returns through 2025.

Even if the company were to maintain a slightly lower valuation, it should be in a good spot to return north of 12% per year.

Since the Great Financial Crisis, MRK shares have returned 13.1% per year.

The only reason why I am not buying MRK at these levels is the fact that I’m long AbbVie (ABBV) and looking to expand my position in healthcare technologies.

If I were more income-focused, I would likely be a buyer at these levels.

Takeaway

Merck stands out as a compelling dividend stock, blending growth and stability.

Boasting a 215% return over the past decade, MRK combines a diverse pharmaceutical portfolio with consistent dividend growth.

With a current yield of 2.9%, an A+ credit rating, and a history of never cutting dividends, MRK offers a reliable income stream for investors.

Despite a temporary dip in earnings due to strategic collaboration, the company’s robust financials, including a healthy free cash flow yield of 6.7%, signal the ability to protect dividends.

All things considered, positioned for future growth in areas like oncology and vaccines, MRK presents an attractive opportunity for income-focused investors seeking a blend of dividends and potential capital appreciation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.