Summary:

- PayPal’s revenue is rising, but there is weakness on the bottom line and a decline in active accounts for the third quarter in a row.

- Despite the recent mixed results, PayPal’s overall growth and cash flows are impressive, and shares are attractively priced.

- The decline in active accounts is the only factor holding back a more bullish stance on the company, but a return to growth could lead to an upgrade in the future.

- In the meantime, the company still warrants a much higher price than what it has today, and investors should take this opportunity seriously.

Justin Sullivan

In an ideal world, investments that we buy into would appreciate almost immediately. Unfortunately, the world is not that easy or simple. It takes time for investments to truly play out. And that sometimes means dealing with periods of underperformance relative to the broader market. A great example of this can be seen by looking at payment processing giant PayPal Holdings (NASDAQ:PYPL). Back when I last rated the company a ‘buy’ in early August of this year, I found myself impressed with the overall attractive financial performance on both its top and bottom lines. In addition to this, shares of the enterprise were trading on the cheap, both on an absolute basis and relative to similar firms. That is especially true when taking into consideration the rapid growth that the enterprise has demonstrated.

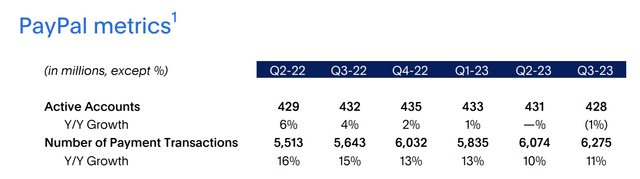

There was one big problem, however, that prevented me from taking an even more bullish stance on the business. And that is the fact that the number of active accounts using its services had actually declined for the second quarter in a row. Fast forward to today, and we have additional data that shows much of the same. Revenue is rising. However, we are unfortunately now seeing some weakness on the bottom line. On top of that, the number of active accounts has contracted once again. In the near term, this can be painful, as demonstrated by the fact that shares are down 1.5% since I last wrote about it at a time when the S&P 500 is up 6.2%. However, at the end of the day, I would argue that so long as we see a reversal of fortune, upside potential for the business is truly significant.

Recent mixed results

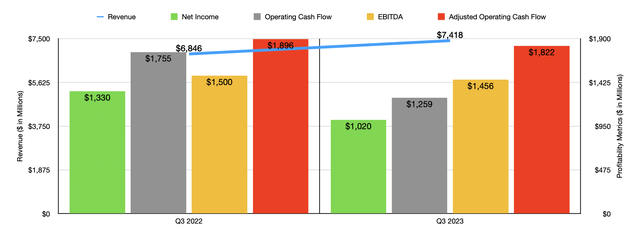

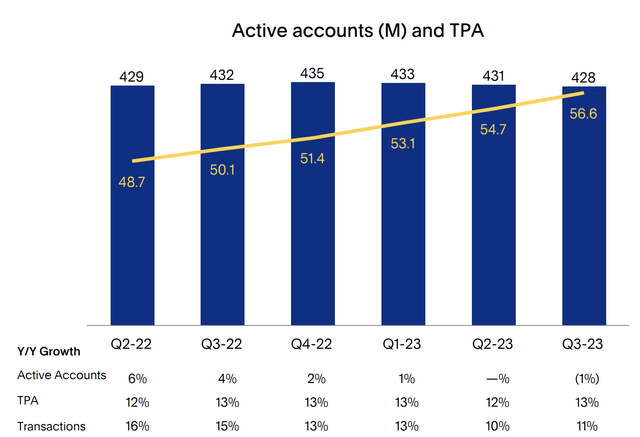

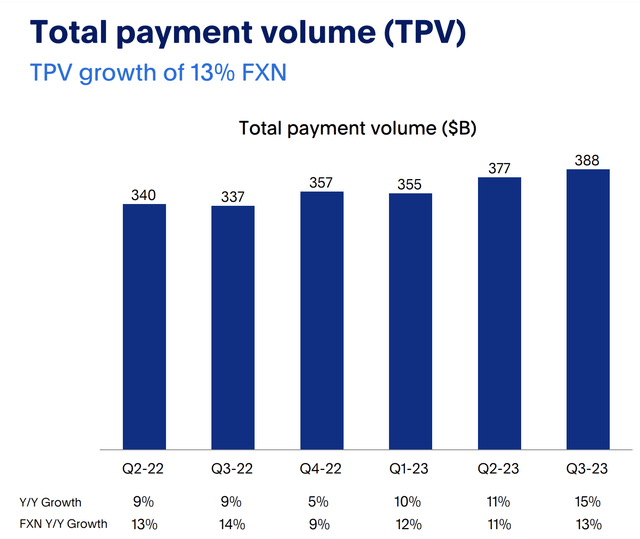

When I last wrote about PayPal in early August, we only had data covering through the second quarter of the company’s 2023 fiscal year. Fast forward to today, and we now have data covering through the third quarter. In some respects, the company continues to report robust results. As an example, we need only look at revenue data. During the quarter, sales totaled $7.42 billion. That’s 8.4% above the $6.85 billion the company reported one year earlier. At the end of the day, this growth was really driven by one big factor. This was a surge in the number of transactions from 5.64 billion to 6.28 billion. That’s an increase of 11.2%. And that increase was driven by a roughly 13% rise in the average number of transactions per active account from 50.1 to 56.6. This all culminated in an increase in total payment volume from $336.97 billion to $387.70 billion.

PayPal Holdings PayPal Holdings

All of this looks fantastic, especially during a year when a tremendous amount of economic uncertainty severely influenced the markets. However, there was a downside. And that was that, for the third quarter in a row, the number of active accounts utilizing the company’s services managed to drop. By the end of the third quarter, the company had 428 million active accounts. That’s down from the 431 million just one quarter earlier and it represents A decline from the 435 million reported at the end of 2022. Management’s claim is that this drop was driven by churn associated with accounts that were only ‘minimally engaged’ and by the company’s decision to focus on driving higher activity levels with already existing active accounts. By definition, I would expect churn to be associated with accounts that were not previously engaged all that much, so that’s not a surprise. As for the second part of that statement, the increase in transactions per active account does seem to support that claim.

On the bottom line, we did unfortunately see some weakness. Net profits of $1.02 billion came in lower than the $1.33 billion reported one year earlier. At first glance, this looks rather awful. But the good news is that it was because of a $387 million swing from one year to the next in the form of ‘other income’. This was largely attributable to net gains on strategic investments plunging from $495 million last year to $24 million this year. This is not a core operation of the company and, without it, profits would have actually increased modestly. Other profitability metrics followed suit. Operating cash flow dropped from $1.76 billion to $1.26 billion. But if we adjust for changes in working capital, we would get a decline from just under $1.90 billion to $1.82 billion. And lastly, EBITDA for the company dipped from $1.50 billion to $1.46 billion.

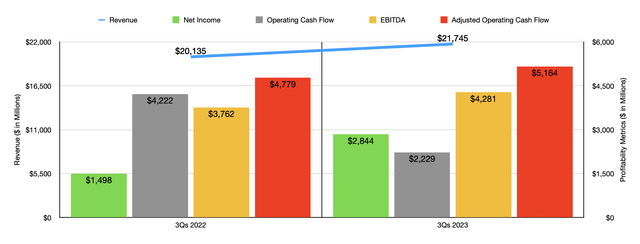

As you can see in the chart above, the first nine months of 2023 relative to the same nine months of 2022 were quite a bit different than just the third quarter alone. They do have the rise in revenue and the drop in operating cash flow on a year over year basis in common. But beyond that, the picture for the company has looked up year over year. Again, a lot of that activity is due to rising volumes and total activity from users. And it seems as though management expects the picture to remain appealing for the rest of 2023. I say this because they are forecasting earnings per share on an adjusted basis of around $4.98 compared to the $4.13 reported for 2022.

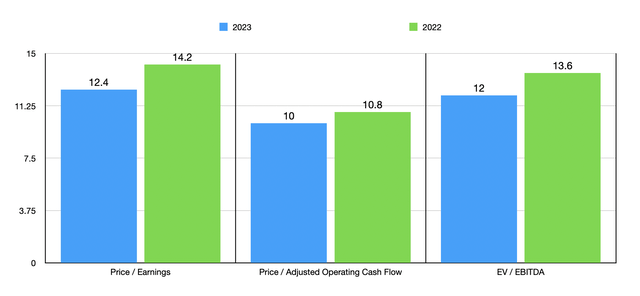

When it comes to valuing the company, I decided to forecast growth for the final quarter. Based on my estimates, adjusted earnings should be around $5.47 billion this year. Adjusted operating cash flow should be around $6.77 billion, while EBITDA should come in somewhere around $5.61 billion. I then took those figures and compared them with 2022 data as shown in the chart above. On an absolute basis, shares look attractively priced in my opinion. I then compared the company to five similar firms as shown in the table below. On a price to earnings basis, PayPal looks to be the cheapest of the group. And when it comes to the other two profitability metrics, only one of the five firms ended up being cheaper than it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| PayPal Holdings | 12.4 | 10.0 | 12.0 |

| Automatic Data Processing (ADP) | 27.6 | 25.2 | 18.2 |

| Fiserv (FI) | 27.8 | 15.9 | 13.2 |

| Fidelity National Information Services (FIS) | 44.4 | 8.8 | 10.6 |

| Global Payments (GPN) | 37.2 | 14.2 | 14.4 |

| Paychex (PAYX) | 29.0 | 23.3 | 19.7 |

Takeaway

All things considered, I would make the case that PayPal is still a very solid opportunity. The recent weakness on the bottom line is something that is non-core in nature and should not be repeated with any real regularity. Cash flows are robust while overall growth is impressive. When you consider how attractively priced shares now are, especially relative to similar firms, and you look at the continued expansion in revenue and cash flows, it’s very difficult for me not to rate the company a ‘strong buy’. The only thing holding me back is the decline in active accounts. Before I could take a more bullish stance on the business, I would need to see this decline cease and, ideally, a return to growth. If we do see stabilization on this front, I probably will upgrade the company further if everything else remains as it has been. But until then, I believe that a ‘buy’ rating still makes sense.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!