Summary:

- Disney reported a 5% revenue growth in Q4 FY23, with their Direct-to-Consumer business showing strong year-over-year growth of 13.2%.

- The company expects their Direct-to-Consumer business to achieve profitability in Q4 FY24, aided by their diverse array of streaming assets and cost advantages.

- Disney+ gained nearly 7 million core subscribers, with over half opting for the ad-supported product, which has the potential to generate actual dollar profits for Disney.

HAYKIRDI/E+ via Getty Images

Disney (NYSE:DIS) reported a 5% revenue growth in Q4 FY23. Notably, their Direct-to-Consumer business showed a strong year-over-year growth of 13.2%, accompanied by improved operating margins. The company remains confident in achieving profitability four quarters later. I view these improvements as quite positive and upgrade Disney to a ‘Buy’ rating with a fair value price of $95 per share.

Financial Review and Outlook

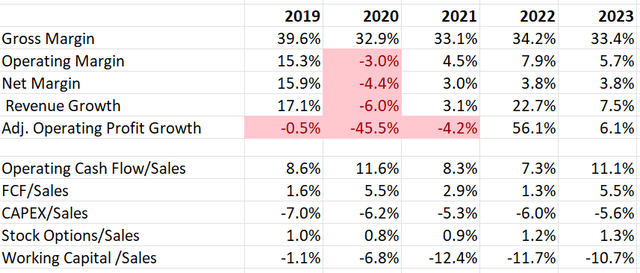

At the close of the fiscal year, they achieved a 7.5% revenue growth and a 6.1% increase in adjusted operating profit. However, their substantial cost-restructuring initiatives and the profit-losing Direct-to-Consumer business continued to impact their operating margin for FY23, resulting in only a 5.7% operating margin.

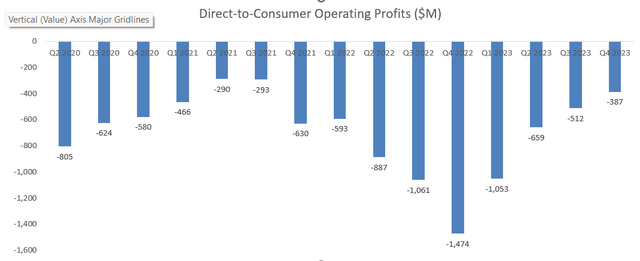

During Q4 FY23, their Direct-to-Consumer business is steadily improving profitability, currently at -7% operating margin. Management has expressed their expectation for the profitability turning point to occur in Q4 FY24, a projection I find quite reasonable for the following reasons.

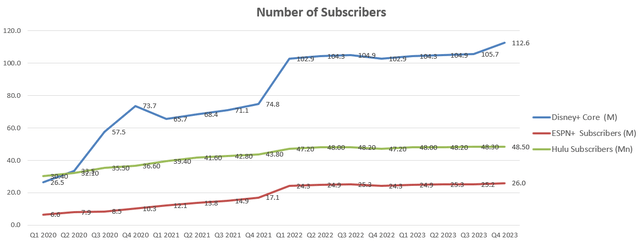

Firstly, Disney owns a broad portfolio of streaming assets, including Hulu, Disney+, and ESPN. It’s important to note that all streaming services require initial investments, encompassing both capital expenditures and operating expenses. However, as these services scale up, the incremental costs diminish gradually.

Secondly, as mentioned during the call, they planned to bring ESPN to Direct-to-Consumer as they shift their business model from cable to streaming. With this diverse array of streaming assets, Disney has the capability to create bundles that cater to different kinds of customers. For instance, they experimented with combining Hulu and Disney+ in December. These bundles could add more value for their subscribers, thereby aiding Disney in growing their subscriber base and reducing churn rates.

Lastly, while Hulu, Disney+, and ESPN are distinct streaming services, they share similar technologies in nature. As indicated during the call, this commonality allows these platforms to leverage the expertise of the same technology professionals and codes, resulting in a clear cost advantage. All streaming services are currently operated under one group led by Dana Walden and Alan Bergman.

In terms of guidance, they anticipate their total content spend in FY24 to be approximately $25 billion, marking a decrease of $2 billion compared to FY23. The capital expenditure is expected to reach $6 billion, which is $1 billion higher than the FY23 level, as previously communicated for increased spending in Experiences. In summary, they are guiding for $8 billion in free cash flow for FY24, representing a notable improvement from the $4.9 billion level in FY23. The reduction in content spending stands out as a significant factor contributing to the improvement in free cash flow.

Price Increase and Ad-supported Disney+

During Q4 FY23, Disney+ gained nearly 7 million core subscribers, with the disclosure that over half of new U.S. subscribers opted for an ad-supported Disney+ product. Over the past six months, these subscribers spent 34% more time watching the service.

I believe that the Ad-supported streaming service expands their addressable customer base. It is particularly suitable for low-income families or occasional viewers. It’s worth noting that, although Ad-supported streaming generates lower subscription fees, Disney earns additional advertising revenue. Moreover, the incremental costs for these services are limited, as Disney has already invested significantly in launching their streaming service in the past few years. In short, this service has the potential to generate actual dollar profits for Disney.

Additionally, Disney has increased the subscription price for Disney+ in the U.S. Consequently, they anticipate a slight decline in core Disney+ subscribers in Q1 FY24 compared to Q4. I think it’s reasonable to assume a slightly higher churn rate due to the price increase, and some subscribers might switch to Ad-supported services. However, the price increase should contribute to ARPU growth. As long as the churn rate is maintained within a reasonable range, Disney should benefit from the price increase over time.

Model Updates

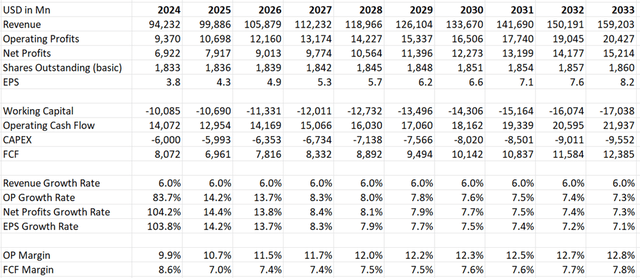

The Direct-to-Consumer segment represents more than 22% of the total revenue, making the gradual improvement in operating margin significant for Disney’s overall profits. Assuming their DTC business can start generating profits from Q4 FY24, the operating margin could return to double digits in the coming years. With the benefit of operating leverage, the forecasted normalized operating margin expansion is expected to be 30 basis points annually.

Disney DCF – Author’s Calculation

The revenue growth rate of 6% aligns with their historical average. The model incorporates a 10% discount rate, 4% terminal growth, and a 25% tax rate. The calculated fair value is $95 per share.

Verdict

With the expansive portfolio of streaming assets, including Hulu, Disney+, and ESPN, their Direct-to-Consumer business has a clear path toward profitability in the near future. As a result, I am upgrading Disney to a ‘Buy’ rating with a fair value price of $95 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.