Summary:

- Danaher is my low-risk SWAN stock pick for 2024, with a strong track record of growth and a focus on rational, data-driven decision-making at its core.

- The end market for Danaher’s healthcare and bioprocessing products is expected to return to growth, driven by new technology and increased funding.

- The spin-off of certain segments and potential future acquisitions, as well as operational improvements and new growth opportunities for Danaher, should increase cash flows over time.

- The stock is attractively valued on an inverse DCF and multiple basis.

Antagain

Danaher (NYSE:DHR) has been a core portfolio holding for me throughout this year and is my SWAN stock pick for 2024. SWAN stands for Sleep Well At Night, a business with a low-risk profile without much worry for investors. I bought my first share in 2020 and have since waited for the opportunity to buy at attractive prices, which has materialized in 2023. I built up a sizable position (#1 in my portfolio at 10%) and believe that Danaher is set to outperform the market again. Let’s get into my reasons why.

General thesis

Danaher is a holding company that operates through its Danaher Business System, a continuous improvement system based on the Japanese Kaizen business philosophy. Everything within the company is based on rational, data-driven decision-making based on clear and measurable goals as a team and throughout the organization. Throughout the years, this has led to a continual improvement of the businesses Danaher owns. Starting with Real Estate and manufacturing, Danaher is a pure play in the healthcare space after the successful spin-off of its EAS division through Veralto (VLTO).

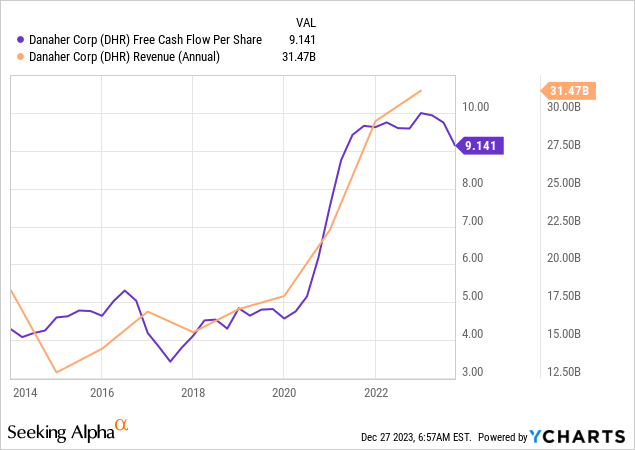

Danaher has grown its Free Cash Flow per share and revenue significantly over the last decade, with an immense contribution from Covid and the resulting unique circumstances. Also, we need to keep in mind that the growth shown below is understated, as the company spun off Fortive (FTV) in 2016 (current revenue of $6 billion and $1.26 billion in FCF), Envista (NVST) in 2019 (current revenue of $2.58 billion and $217 million in FCF) and Veralto in 2023 (current revenue of $5 billion and $1 billion in FCF). That’s $13.5 billion in revenue and $2.5 billion in FCF, spun off to shareholders. The investment relies on continued adherence to these principles of DBS through operational improvements, growth investments and acquisitions.

Looking ahead to 2024

There are three catalysts that I believe will help the stock in 2024:

- End market returning to growth

- Operational improvements after the spin-off

- New growth from acquisitions

End market returning to growth

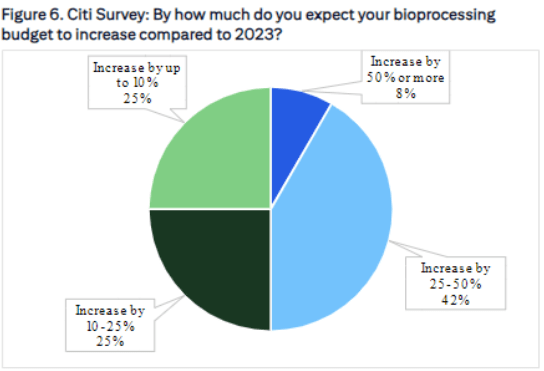

Danaher is now a pure play in the healthcare and bioprocessing market. During Covid, this market saw a boom, and after the situation returned to normal, there was a supply overhang. Revenue dropped 19% last quarter in the bioprocessing division of Danaher, with other pure plays like Sartorius Stedim, who have even more Bioprocessing exposure, seeing even worse declines (25% last quarter). According to several research firms like Precedence Research, the global bioprocessing market is expected to grow in the mid-teens. This structural growth is driven by new technology, accelerated research progress throughout Covid (i.e., mRNA technology) and the general emergence of new technological solutions (i.e., Cell & gene therapies). Besides the overhang from COVID-19, the customers also require funding from VC/PE firms and are rate-sensitive. Developing a new drug often takes 5-10 years to go through all trial stages and companies write heavy losses during that time. Based on a Citi Survey, Bioprocessing budgets are expected to increase throughout the board, with over half expecting at least a 25% increase. This is a temporary slowdown in a secular growth market and opened up an excellent opportunity to own one of the leaders in the space.

Budgets expected to increase significantly in 2024 (Citi survey)

Operational Improvements

I already talked about it in my previous comparison of Danaher to Veralto, but it is vital: The spin-off will improve Danaher’s business, as all spin-offs have done. The spun Water Quality and Product Quality & Innovation segments have inferior operating margins (23% and 25%) to the biotechnology (34%) and diagnostic (31%) segments but better than life sciences (20%). Recurring revenue is another KPI for Danaher, as the company continually increases the percentage of recurring sales in the mix. After the spin, Danaher should achieve 80% recurring sales and operating margins should increase from operating leverage as biotech returns to its historic margins and the improved business segments. It will take some time to streamline the current business, especially as during Covid, the main goal was getting scale. A lot of COVID-19 investments can get optimized now.

Eventually, I’d expect Danaher to spin off its life sciences business, too, as it currently has significantly lower margins and only 60% of recurring sales. This would further enhance the portfolio, but I don’t expect it to happen in the next few years.

New growth from Acquisitions

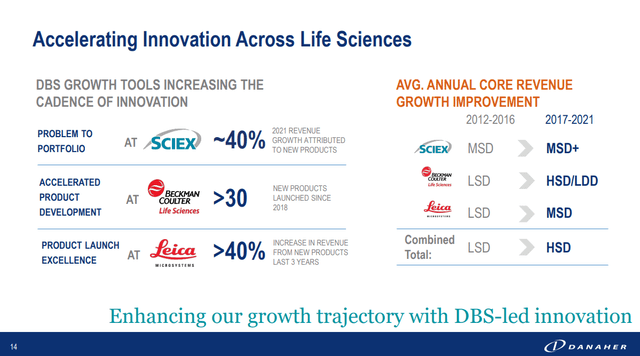

A lot of the Value Creation at Danaher is due to improving businesses post-acquisition. As seen below, Danaher usually reduces G&A spending while increasing R&D and S&M spending and drives operational improvements.

M&A track record (Danaher Investor Day 2022)

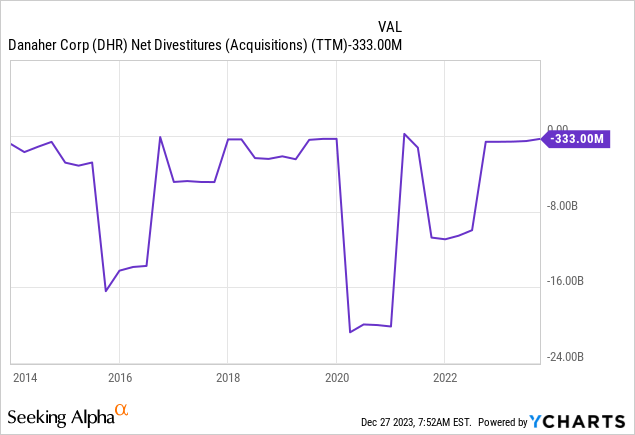

Below, we can see that 2023 was a slow year for Danaher without much M&A activity. With the closed $5.7 billion acquisition of Abcam, this will change and Danaher has a new growth catalyst. Management keeps commenting on the improvements in the deal environment and I could see another deal in the pipeline. Danaher is currently at a 1.1 times net debt/EBITDA ratio and could easily leverage another $20 billion (Danaher historically has been between 2.2 to 3.2 net debt/EBITDA).

Risks

While Danaher is a SWAN company, there are risks, especially in the short term. If the end market does not turn, we could be in for more ugly quarters and more declines in share price. On the other hand, this would further improve the deal environment, something Danaher can leverage in its favor.

As the global tensions between China and Taiwan continue to remain high, we need to keep in mind that Danaher generates 12% of sales in China and while this is not a critical part of the business, it is a risk. The Chinese bioprocessing market was also particularly hard hit in 2023, so the percentage of sales might increase as that market picks up again.

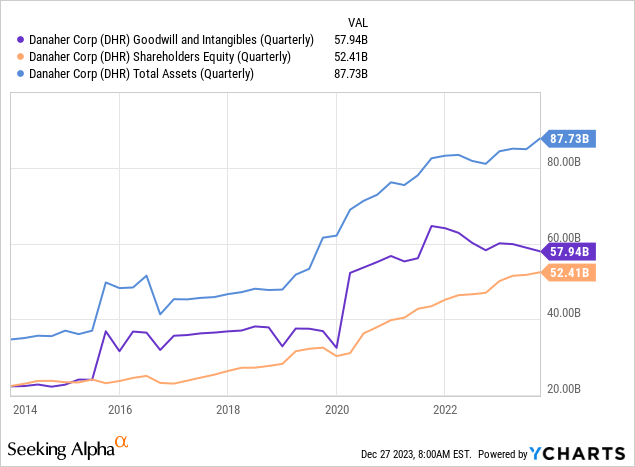

Although Danaher has an excellent M&A track record, there is the risk of a bad acquisition. Bioprocessing companies are rarely cheap and a lot of the value creation is in cross-selling and integrating the business. We can see this in the large portion of Goodwill and Intangibles in Danaher’s total assets and equity. While I trust management, this risk shouldn’t be ignored.

Valuation

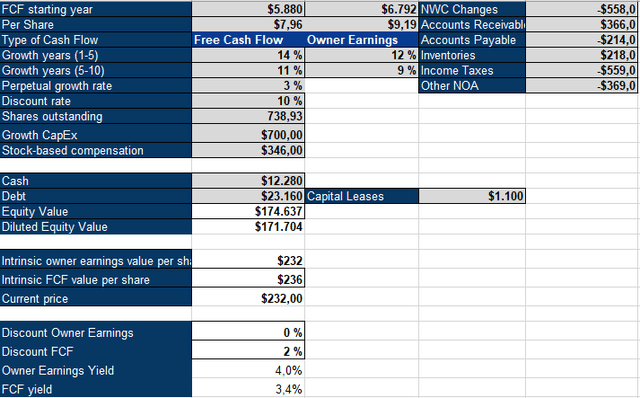

I’ll use an inverse DCF model to value Danaher and look at historical multiples. For the DCF, I subtracted the FCF Veralto contributed to the overall company. We can see that the current price implies a required growth rate of 12% for the next five years, followed by 9% for five years. Danaher aims to grow revenue at high single digits in an average year. On top of that, we can add margin improvement and M&A activity, and we should arrive at a low to mid-teens earnings growth rate. I’d estimate that this leaves a good margin of safety between the required growth rate and the growth rate.

Danaher Inverse DCF Model (Authors Model)

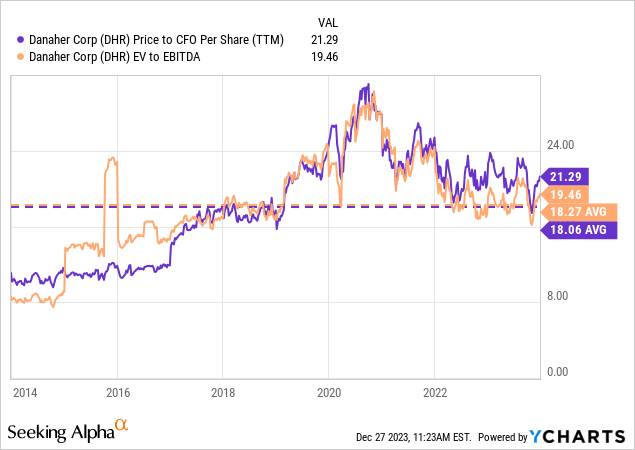

Looking at historic multiples, Danaher trades at elevated levels compared to its 10-year average Price/Operating cash flow and EV/EBITDA ratios. While this makes the stock appear overvalued, we must remember that Danaher has significantly transformed over the last decade and spun several lower-quality segments. The average multiples in the previous five years were 22.8(P/OCF) and 21.77(EV/EBITDA), so we are currently trading below the five-year average.

To conclude, I believe that Danaher will continue to outperform the index over the long term and will have a good 2024 due to the reasons in this article regarding its end markets, margins and M&A growth. The business is a high-quality SWAN stock and I am very comfortable holding it as a large investment. While there are stocks with higher return potential, I prefer to go the safer route with a high probability bet on a fantastic business like Danaher.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2024 Long/Short Pick investment competition, which runs through December 31. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advise.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.