Summary:

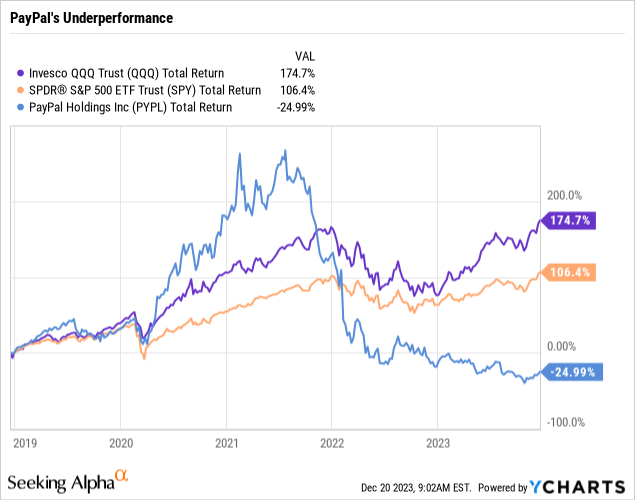

- PayPal’s stock has underperformed the market while leading in key high-growth markets, growing its core business metrics, accelerating share repurchases, decreasing operational expenses, and divesting ancillary businesses.

- Declining transaction margins and competition from Apple Pay are concerns for PayPal’s stock.

- The leading risk for PayPal is a global recession, but the stock is still undervalued and has numerous tailwinds.

- Despite risks and the bear case, PayPal enjoys a unique combination of short, medium, and long-term tailwinds that will drive strong price returns in the short and long run.

Justin Sullivan

A Great Paradox

What would you think if I told you a major American tech business that is growing its core operations while enjoying numerous tailwinds has dramatically underperformed the market in the past 5 years? While the market is great at allocating capital to good businesses over time, sometimes Wall Street can be far too pessimistic about stocks based on projections of future growth.

PayPal (NASDAQ:PYPL), a darling stock during COVID, has been trampled over the past two years. While total payment volume, monthly active users, and transactions per active account have all increased sequentially, there has also been an increase in competition with Apple Pay, a spotty track record of acquisitions, and in my view, a loss of management focus.

Despite risks, I believe PayPal stock is extremely attractive at current levels and will be a very profitable investment for long-term investors.

There is a lot to discuss, let’s dive right in.

The Bear Case

Declining Take Rate and User Base

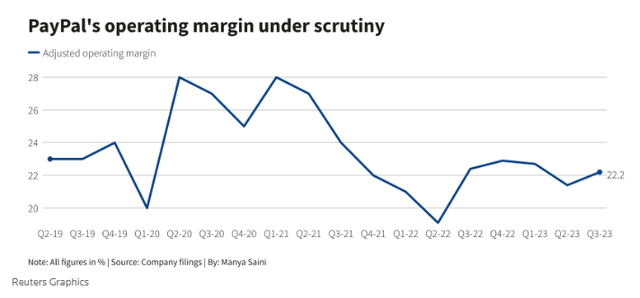

The leading cause for fear in PayPal stock is a protracted decline in overall take rate while the user base has been shrinking. This has led to operating margins shrinking from roughly 23% in Q2 2019 to 22.2% in Q3 2023, after jumping toward the roof during COVID:

Analysts weren’t enthused with the lack of an inflection following a few quarters of falling margins. An analyst at Jefferies said, “New quarter, same story as gross profit headwinds persist on continued take rate pressure, offsetting better TPV growth”.

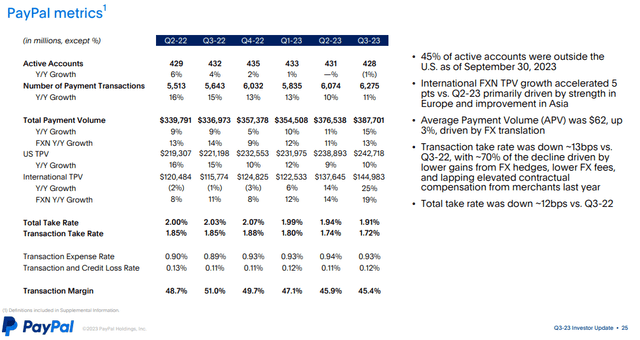

PayPal’s take rate is the colloquial term for their transaction margins. This is how much PayPal makes on payments between the variety of its services. The recent decline in overall take rate is due to PayPal’s unbranded growth outpacing branded payments growth. Branded refers to checking out with the PayPal button, while unbranded does not have a PayPal button. Unbranded is mostly referred to as Braintree.

Braintree’s pricing is lower than PayPal branded at a base of 2.59% + $0.49 per transaction, with negotiable rates for large enterprise customers ($80,000+ sales monthly). According to Alex Chriss, Intuit veteran and PayPal’s new CEO, Braintree has roughly 10% market share globally in the enterprise payment service provider market. Braintree touts customers like Adobe (ADBE), booking.com (BKNG), Ticketmaster, DoorDash (DASH), and Uber (UBER). It’s not fundamentally bad for the take rate to decrease given the root cause is strong growth. Keep in mind that PayPal branded is still growing.

Braintree’s growth has outpaced PayPal branded’s growth in recent quarters, which has been applying consistent downward pressure on overall transaction margins. The cause is two-fold: Increasing competition in the branded space and the growing pie in the enterprise PSP (payment service provider) market. Braintree has two primary competitors in Stripe and Adyen (OTCPK:ADYEY), and it’s positioned quite well in the e-commerce space. It’s not as competitive for merchants looking for physical point-of-sale solutions but has a strong digital offering.

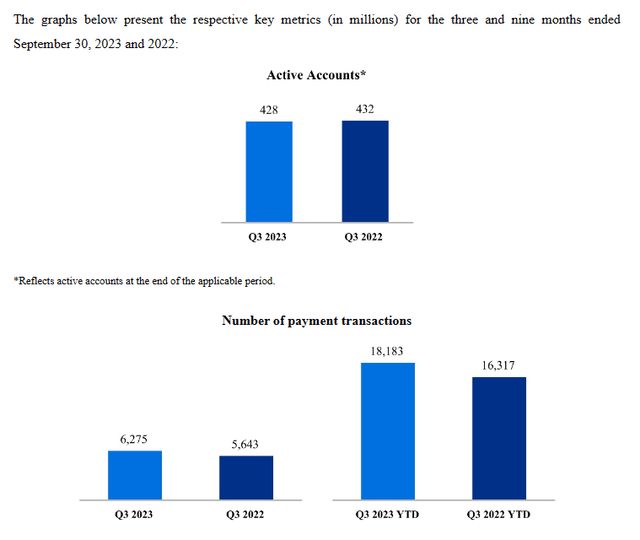

PayPal’s active user base meanwhile has shrunk YoY from 432 million to 428 million. The total number of transactions has still increased though, with 13% growth YoY in transactions per active account (TPAA). While a shrinking user base is never good for a network-effect-based business, it’s clear that management has shifted focus to growing user base at any cost to strong engagement with higher-value users.

What we’ve seen time and time again with digital wallets / financial services apps is that users become significantly stickier and generate higher revenue when they use multiple products or services within the app. PayPal mostly depends on peer-to-peer (P2P) payments as the top-of-funnel customer acquisition channel. From there, they try to further engage customers and deepen relationships with additional product offers. Management has shifted toward deepening relationships with existing engaged users rather than acquiring as many new users as possible. This model will work over time as the flywheel effect of PayPal’s extensive and trusted network further locks customers into the network.

Increasingly Disruptive Competition

Braintree’s impressive growth has hurt operating margins. While Braintree has been showing consistent double-digit growth, PayPal branded has been growing in the single digits for a few consecutive quarters. Part of this lagging growth is increasing competition in the payments space.

PayPal bears are quick to mention Apple and its Apple Pay offering as a serious competitive headwind for PayPal Branded. Apple Pay is eating share in physical transactions given its ease and safety.

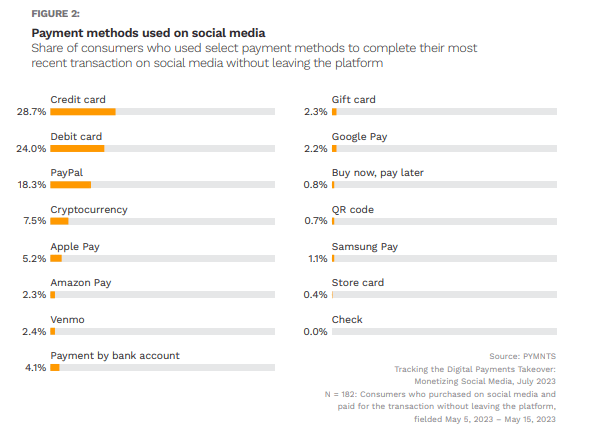

I believe the market is overestimating the impact of Apple Pay on PayPal’s core business. PayPal has always been in the business of online payments. Apple Pay is not taking share in the online payments space, only physical payments. PayPal is still the leading online payment processor and will continue as such despite Apple Pay’s growth. PayPal is a leader in both social media and web-based payments, while Apple Pay still trails Crypto as a method for social media payments, according to pymnts.com report “Tracking the Digital Payments Takeover“.

pymtns.com

PayPal itself (note that most social media payments will be through PayPal Branded) has nearly 1 of every 5 transactions. Social media commerce has major potential but is stymied by a lack of consumer trust, according to pymnts.com:

Despite the potential of social media as a retail platform, many consumers still have concerns about the authenticity of merchants. The survey revealed that 37% of consumers who do not transact on social media are skeptical about sharing their personal data safely, and 31% doubt the legitimacy of sellers on social media platforms.

One of the leading value propositions for PayPal is that it’s one of the most trusted names globally. Consumers feel comfortable with PayPal and their merchants and PayPal has a history of protecting both consumers and merchants. They have a compelling value proposition in social media commerce.

Apple has also made forays into the credit card and buy-now-pay-later segments. Apple’s lending products are backed up by its fortress balance sheet, with nearly $200b in cash. Presumably, Apple will enjoy significantly lower costs of capital to finance these credit products and could exhibit “race to the bottom” pricing behavior to gobble up market share. While smaller competitors like Affirm (AFRM) and Klarna could be materially hurt by this, I believe PayPal can weather these competitive pressures. This may lead to industry consolidation over time, but PayPal benefits from fewer choices at checkout.

PayPal is in the ‘A’ credit rating range from both Fitch and Moody’s (MCO). Their wealth of consumer data allows them to give safer loans. They have grown cash and short-term investments from $5.6b in 2017 to $11.5b in the most recent quarter. Increasing competition is not an imminent threat.

Meanwhile, PayPal benefits from the explosion in BNPL usage, but this exposes them to increased credit risk. PayPal has a great strategy to limit credit risk with their BNPL loans: selling some. In this model, PayPal earns money on the initial BNPL transaction, earns money on the sale of the book, and has protection from default risk while servicing the loans. Any repayment risk is shifted to the buyer (in this case, KKR (KKR)), who presumably earns a bit of money on interest for late loans.

Some important details of this deal were not publicly disclosed though. PayPal’s “Pay Later” product offers two types of loans: “Pay in 4” and “Pay Monthly”. Pay in 4 is the well-advertised BNPL offering: buy an item now and pay it off in 4 interest-free installments. Pay Monthly is the more secretive BNPL product in that it does carry an interest rate anywhere from 9.99% to 35.99% (the maximum interest rate allowable by US law is 36%). This is geared toward larger transactions, around $10,000 and up. Most BNPL vendors offer a similar structure. The split between Pay in 4 and Pay Monthly should be of great concern to KKR as it will greatly impact the expected interest receivables from the loans. These Pay Monthly loans face a much higher risk of non-repayment, so PayPal is offloading credit risk regardless.

PayPal mentioned that the proceeds of this sale will fund some share buybacks. I view this as an overwhelmingly positive transaction for PayPal as they are offloading risk and buying back their significantly undervalued stock.

The bear case that PayPal’s core business is being disrupted by competition does not hold its weight. Now let’s discuss the leading risk of a PayPal investment – recession.

The Leading Risk: Global Recession

Regardless of price, all investment carries risk. Although I am making the case that PayPal offers an extremely compelling risk/reward at current levels, there are still risks to this thesis. The leading risk is a global recession causing a slowdown in TPV, or Total Payment Volume. Since PayPal makes money mostly through a percentage of TPV + a flat fee per transaction, any slowdown in overall transactions and payment volume will naturally erode PayPal’s profitability. With the combination of lower take rates, a recession could immediately re-ignite the worst of Wall Street pessimism and send PayPal back down toward a 5-year low.

At the onset of 2023, I was convinced we were marching face-first into a recession this year. Despite my conviction, I didn’t comment on this in any articles. How wrong everyone was who predicted doom and gloom, as the market and economy have drastically outperformed even the rosiest of predictions from the beginning of the year.

I can’t tell you the likelihood of a recession in 2024. I can tell you that a global recession is a serious risk to PayPal. I can also tell you that a global recession is a serious risk to most other equities and would likely cause a material drawdown in equity markets. It is up to each investor’s risk tolerance and outlook on the global economy to measure this risk. For me, I do not feel the threat of a recession poses a serious concern to an investment in PayPal at current levels. It is still drastically undervalued, even considerable macro headwinds will have a hard time slowing this stock down in 2024.

With that said, let’s discuss tailwinds for PayPal and why I believe this is the top stock to pick for 2024.

Tailwinds

Short-term

New Management – Alex Chriss

The most notable among many changes to PayPal’s leadership team is the addition of Alex Chriss as CEO. After Dan Schulmann, whose tenure on the board will end at the turn of 2024, PayPal was stymied by a lack of focus and a dubious acquisition history.

Chriss, an industry veteran who grew Intuit’s (INTU) SMB business immensely, brings a renewed focus to the team. In his first earnings call as CEO, Chriss posed a couple of important questions:

Are we executing with excellence behind the most important work to provide customers with a compelling and differentiated value proposition? Are we partnering with customers in a way that brings them deep value, but also rewards the PayPal shareholder? These are questions I am maniacally focused on answering with the team and doing a better job of executing across the board. But let me be clear, notwithstanding those realities, this is a growth company with great prospects.

A maniacal focus on driving value for customers and shareholders is a welcome message. PayPal has been rewarding shareholders with buybacks and continues to build on its world-class reach and trusted brand. Investors also ought to consider the likelihood of additional asset sales in 2024. Former CFO Gabrielle Rabinovitch noted that the team will look to offload assets that aren’t serving their core purpose:

As you heard from Alex, we’re evaluating our growth priorities and aligning our resources to accelerate our velocity… In September, we entered into an agreement to sell Happy Returns to UPS for $465 million in cash, meaningfully higher than our acquisition price… This sale, which is expected to close in the current quarter, will enable us to put even more focus on our core business and priorities.

Intense management focus on productive assets while cutting some chaff is a net benefit for shareholders.

Explosive Growth of BNPL

As discussed earlier, PayPal’s BNPL proposition “Pay Later” is enjoying secular growth. The entire BNPL sector is exploding in popularity as American consumers seek to reduce their exposure to high-interest credit card debt. According to Adobe Analytics, BNPL grew 17% YoY for November, contributing $8.3B to e-commerce sales. On Cyber Monday alone, BNPL attributed to $940m of online spending, up over 40% YoY. Adobe has also noted outright deflation in their Digital Price Index, something that will drive more consumers to spend online where PayPal is dominant. All this combined with PayPal’s willingness to offload risk by selling BNPL loan books paints a very rosy picture for shareholders. The leading risk with BNPL is that it’s booming amidst a backdrop of rocketing consumer debt which exacerbates credit risk. PayPal protects itself against this increased risk by selling the loans.

Seasonality

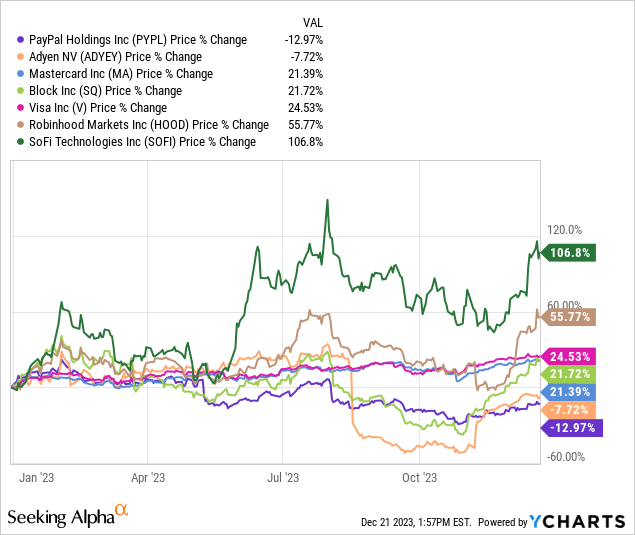

The final short-term tailwind is seasonality. Q4 is a seasonally strong year for businesses that benefit from consumer spending. As noted earlier, consumer spending is surprisingly strong this year and breaking records. Although many investors believe seasonality is always priced in, I believe PayPal’s first earnings release of 2024 will be exceptionally strong on the back of holiday spending, which will drive a larger-than-expected beat and raise of 2024 guidance. This beat and raise will reprice the stock at a higher multiple. Further to the thesis that seasonality is not priced into PayPal yet is that PayPal has underperformed its Fintech competitors:

PayPal has performed the worst YTD. Meanwhile, PayPal is a leader in the BNPL space, growing its core business metrics TPV and TPAA, accelerating share repurchases, decreasing OpEx, and will likely report a margin inflection in 2024. These are significant short-term catalysts for PayPal.

Medium-term

Buybacks

Share buybacks provide organic EPS growth without underlying earnings growth. YTD through September 2023 PayPal repurchased approximately 64 million shares for $4.4 billion at an average price of $69.06. They also have a total of $11.5 billion remaining available for future repurchases as of September 30, 2023. Share repurchases have been accelerating in recent years and with so much capital remaining for further repurchases, there could be significant upward movement in EPS.

I consider PayPal one of the biggest bargains being offered by the market currently. Management has approximately 1/6th of the current market cap of PayPal available to repurchase shares at these bargain prices, which I believe will allow current shareholders to enjoy strong EPS growth in the coming years.

Margin Inflection

The other medium-term tailwind for PayPal stock is an inflection in the take rate. I expect this as early as Q1 2024. When margins do finally inflect, the market will reward PayPal heavily for it in my view. Although they have been declining sequentially, the rate of decline is slowing in recent quarters (since Q4-22, QoQ change has been -8 bps, -6 bps, -2 bps), hinting at the impending inflection:

Chriss noted on the recent earnings call that the team is focused on expanding Braintree margins and accelerating their right to win in the PSP sector. With 10% market share, PayPal is solidified as one of three major enterprise PSPs, something that will serve as an ongoing topline growth engine. However, the sequential decline in transaction take rates needs to inflect before Wall Street begins to reward PayPal. Considering management focus, the growth of the higher-margin BNPL product, and the slowing rate of sequential declines, I expect this inflection sometime in 2024.

Long-term

Crypto: PYUSD

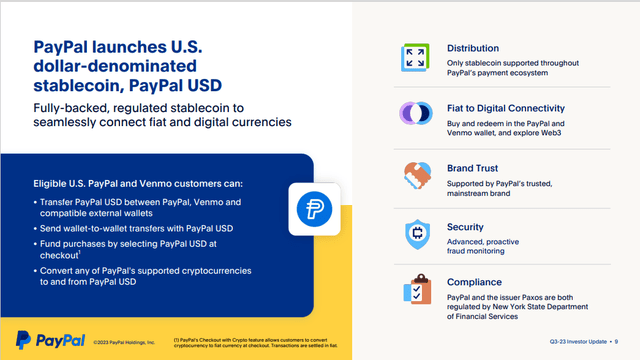

The strongest long-term tailwind for PayPal (aside from secular industry growth and increased regulatory scrutiny of competitors like Visa (V) and Mastercard (MA)) is PYUSD. PYUSD is an Ethereum-based Stablecoin backed by Paxos. This is the only stablecoin that is accessible throughout the entire PayPal network and will make it significantly easier for PayPal to process international payments.

The leading early use of Stablecoins is as a store of value and exchange between international currencies. For example, I can convert my USD to PYUSD and then the PYUSD to GBP. This is significantly cheaper than exchanging USD to GBP or otherwise sending money overseas using legacy payment rails. International payments are already one of PayPal’s leading margin products, and PYUSD should improve international transaction margins while making international transactions cheaper, safer, and faster for customers.

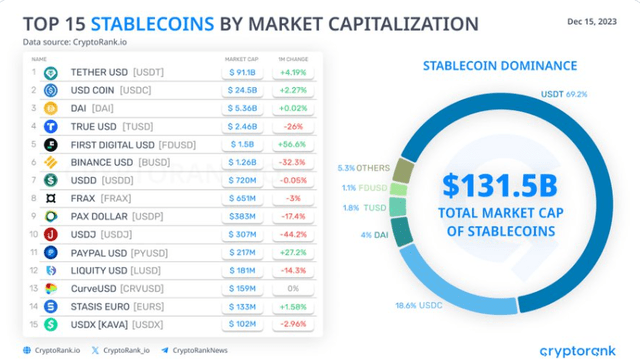

PYUSD is one of the quickest-growing Stablecoins by market cap and is set to break through the top 10 soon:

As the crypto ecosystem continues its global expansion and widespread adoption, PayPal will be on the frontlines of early use cases. This will form a first-mover advantage over time, as PayPal’s brand recognition will help alleviate customer mistrust in crypto. I expect PYUSD to become a major growth engine for PayPal that will help compound shareholder value over time.

Valuation

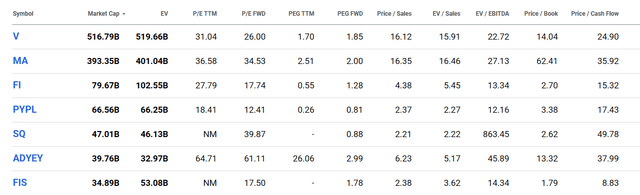

PayPal is currently graded as a ‘D’ valuation by Seeking Alpha’s Quant model, but this is because the valuation is relative to the Financials sector as a whole. This includes businesses that trade at far lower multiples like insurance companies and banks. When refined down to an industry-specific view, we see PayPal is significantly undervalued relative to all leading Fintechs:

PayPal touts both TTM and FWD P/E ratios that are materially lower than competitors. Its PEG is expected to increase materially in 2024 from its drastically undervalued current level. Further, only Block beats out PayPal from a Price/Sales perspective. From a relative standpoint, PayPal is considerably undervalued.

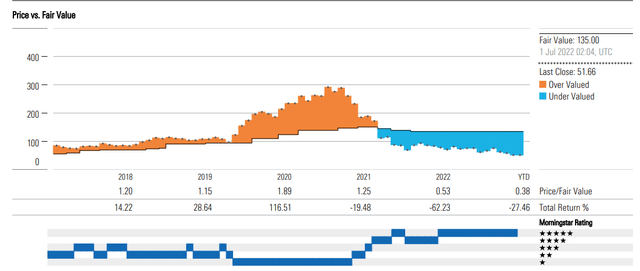

This is supported by Morningstar’s valuation of Paypal as well. Morningstar estimates PayPal’s fair value to be $135 and ranks it 5 out of 5 stars:

Morningstar’s estimate of PayPal’s intrinsic value is slightly above my own. I was quite conservative in my valuation of PayPal, assuming less than 5% earnings CAGR through 2033 with a 15% discount rate and an earnings multiple of 15. This is quite a conservative estimate for earnings growth of a Fintech firm with a new growth-minded CEO, and yet still yields an estimated value of $110-$130. As shares outstanding continue to decrease in parallel, I believe PayPal’s share price will jump back out of its rough 2023 trading range.

Across really any measurable valuation estimate, PayPal is considerably undervalued within the $60-$80 price range.

Conclusion

All this goes to say that I think PayPal offers one of the most compelling risk/reward profiles of any stock today. Patient, long-term investors should be greatly rewarded over time, however at its current levels I even expect significant short-term upside. For these reasons, PayPal is my top pick for 2024.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2024 Long/Short Pick investment competition, which runs through December 31. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.