Summary:

- McDonald’s has introduced its new concept, CosMc’s, entering the coffee business.

- CosMc’s menu includes a variety of drinks, with a focus on flavored coffee and afternoon snacking.

- McDonald’s plans to open nine more CosMc’s locations by the end of 2024, mainly in Texas.

- While CosMc’s still an experiment, it may change the landscape of coffee shops and pose a threat to Starbucks.

Scott Olson/Getty Images News

Introduction

“Our new business ventures team is in the process of developing a new concept we will call CosMc’s, which we will test in a small handful of sites in a limited geography beginning early next year.”

With these words, McDonald’s (NYSE:MCD) President and CEO Chris Kempczinski unveiled back in July CosMc’s. Well, it seems McDonald’s was able to speed up the process since a few weeks ago it opened its first CosMc’s in Bolingbrook, Ill.

McDonald’s wants to get yet another hold of the coffee business after the launch of its McCafes. So, here we are with another episode of the so-called coffee wars.

The market

The size

Let’s start with a few macro trends. After all, a company the size of McDonald’s would not move without a big opportunity before it. Just to get an idea of this market would require a few SA articles. So, I will try to summarize what I have learned in my research, linking back to many sources I have used.

Since we’re dealing with McDonald’s, let’s start from how the company views the market. During the 2023 Investor Update, Kempczinski explained why the company wants to expand into specialty beverages and coffee:

One area of focus has been identifying ways for McDonald’s to participate in attractive and fast-growing categories in IEO. We’ve honed in on specialty beverages and coffee, which played predominantly in the afternoon beverage pick-me-up occasion, where we are under indexed. In our top six markets, this is a $100 billion category, that’s growing faster than the rest of IEO and with superior margins. And it’s a space that we believe we have the right to win.

So, from these words, we know the size of the market McDonald’s sees before itself. After all, it has been all over the news how energy and caffeinated drinks are surging, and the annual growth rate is forecasted to be between 7% and 8% from 2023 to 2030.

The Consumer

According to the International Coffee Organization’s (ICO) December 2023 report: “For consumers, coffee is largely a need and not a want.” As a result, in case of high prices, consumers won’t give up on coffee, but will likely decide to drink it at home rather than in shops or move from Arabica blends to Robustas.

Around the world, the most mature market is North America. As the ICO reports:

Coffee is surveyed to be the most popular beverage within the USA – the largest consumer in the region and the world – with 63% of Americans reporting to have drunk coffee within the past day, according to the semi-annual report published by the NCA in September 2023. Despite the maturity of the market, North America’s coffee consumption has been on the up since the mid 1990s, rising from only 19.1 million bags in 1994 to 31.8 million bags in coffee year 2018/19.

Although global coffee output is affected by weather, the ICO’s forecast for next year is an output “increase by 5.8% to 178.0 million bags, with the Arabicas’ output rising to 102.2 million bags and the Robustas’ increasing to 75.8 million bags”. South America should increase its production by almost 10% to 89.3 million bags.

Global consumption also is expected to grow to 177 million bags, a 2.2% increase YoY. North America should outpace this growth rate, with a 3.8% increase.

These numbers make the picture clearer as to why McDonald’s wants to play a meaningful role in it.

There’s also another fact: these kinds of beverages enjoy high margins. If we take a look at a peer comparison including Monster Beverage (MNST), we see how Monster Beverage’s gross profit margin is well above 50%, with a net income margin of 22.6%. Of course, into these percentages we have to consider the whole operations of the company, but, still, they show how profitable the industry can be.

Now, one may wonder why McDonald’s, whose gross profit margin is currently above 57% and whose net income margin’s tops 33%, should pour its efforts into this new endeavor. Let’s then take a deeper look at CosMc.

CosMc

The name of the new concept comes from the McDonaldland mascot, who appeared in ads in the late 1980s and early 1990s. Here, CosMc was an alien from outer space who wanted to find and grab McDonald’s food. Now, CosMc has landed with a bunch of new recipes. Here’s the full menu of the new beverage concept, where we see drinks have the obvious lion’s share.

news.yahoo.com

The day the first CosMcDrive-thru opened, waiting time hovered around two hours, and it was reported some customers spent more than $100 on their orders. Nine more locations are expected to open by the end of 2024 in Texas, mainly in the Dallas-Fort Worth area and in San Antonio.

Why is McDonald’s exploring the possibility of opening up a new chain? The answer was given during the 2023 Investor Update:

We can’t capitalize this in our existing restaurants, because of the complexity that customized beverages would bring to our kitchens. So, a little over a year ago, we began to evaluate some potential concepts to break this compromise. We had a few key success criteria for the concept. First, we had to have a differentiated idea. We needed to be confident that the concept could bring a product or experience that’s unique and compelling to customers. Second, it had to have global appeal. McDonald’s doesn’t do hobbies well. It’s not worth our time to develop an idea that will only work in one market. We need big ideas that have global appeal and could work across multiple markets. Third is economics. The unit economics needs to work. The potential to offer strong returns and be highly incremental are critical to the adoption and execution of any future expansion of the concept.

These words are clear: McDonald’s existing kitchens can’t be customized to the needed level. This means McDonald’s doesn’t just want to sell a few cups of coffee as add-ons to its menus. It wants to be part of a new segment. And here, as far as I see it, the target is clear: McDonald’s wants to battle against Starbucks (SBUX).

Now, McDonald’s is not the only one wanting to eat Starbucks’ pie. Coffee shops pop up all over the place. While I believe many will probably fail, I believe McDonald’s can be highly successful – in this case its CosMc’s pilot experiment.

Why do I say this? Because McDonald’s can scale. To get an idea of what I mean, let’s break up this reasoning into two steps.

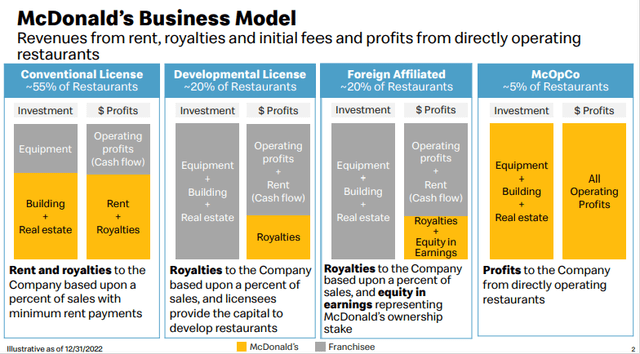

First of all, not everyone is aware of McDonald’s business model, which was recently shown during the 2023 Investor Update.

MCD 2023 Investor Update

As we can see, most of McDonald’s restaurants are licensed, with McDonald’s collecting royalties and, oftentimes, rent too. Only 5% of McDonald’s 40k restaurants are directly operated by the company. This makes McDonald’s a very strong component, with resilient cash flows and low operating risk. Moreover, since McDonald’s usually partners with a franchisee, it needs less capital to open up new restaurants.

This makes McDonald’s a rather nimble company, despite its size.

But let’s also look at another aspect more directly linked to McDonald’s scale. The company currently has 150 million active users in its app and its loyalty program. Actually, the company plans to increase its active loyalty user base to 250 million and deliver $45 billion in annual sales to loyalty members by 2027. With such a wide range of customers well aware of McDonald’s brand, it’s easy for the company to quickly add more users to its program, making them loyal members. This leads to McDonald’s gaining the ability to better monetize the effort. Digital and tech are a scale game. We have learned this by now. Considering McDonald’s also is using new AI models to sharpen its pricing tools and improve its restaurants’ operating efficiency, the network effect will be in favor of McDonald’s against many smaller and local competitors.

In addition, given its unmatched size, the company can bargain better deals with its suppliers. On top of this, the company’s blue-chip credit rating and its $50 billion balance sheet give it a financing scale, leading to low borrowing costs for the company’s franchisees too.

Let’s get back to CosMc. It may be too soon to see if CosMc will be able to undercut Starbucks’ prices. But it seems the company wants to position itself as a little cheaper. For example, a cold-brew Frappe costs $5.19 at CosMc’s while at Starbucks it costs $5.45. In general, CosMc’s seems about 20% cheaper than Starbucks. While this may be needed for CosMc’s to start and attract customers, McDonald’s will probably leverage as much as possible its industry-leading scale against Starbucks. This will lead to an interesting battle between two highly-efficient giants.

CosMc’s, in addition, seems to be only a drive-thru place, leading to lower costs compared to Starbucks.

Let’s recap what we know so far:

- Energy and caffeinated drinks seem to be the only industry with margins comparable to McDonald’s current margins

- It’s a faster-growing market than burgers

- Though heavily saturated, McDonald’s scale gives the company a high probability of success

What we don’t know is how much it costs to open a new CosMc’s and what kind of profits it can generate. From a quick look at the industry, we could expect each CosMc’s to generate around $1 million in yearly sales, with a gross margin between 35%-45%. This is highly possible due to the use of generative AI which will boost productivity. Considering an investment of $2 million per restaurant, we would be before a very interesting deal.

So, with the 10 shops experiment, the company should see around $3.5 million in gross profit. Peanuts, if we consider the company’s current gross profit is well above $14 billion.

However, what will matter most is whether the experiment succeeds or not. If it achieves numbers similar to the ones I have given above, I believe 2025 will see McDonald’s pouring a lot of effort into opening CosMc’s drive-thrus in many of the most important North American cities. This means fiscal year 2025 could see a major impact, which I believe will first be more on the cost side rather than revenue growth. So, we could actually see McDonald’s margins shrink a bit because of its investment. But investors should know what’s happening and what’s coming down the pipeline from 2026 onwards.

Conclusion

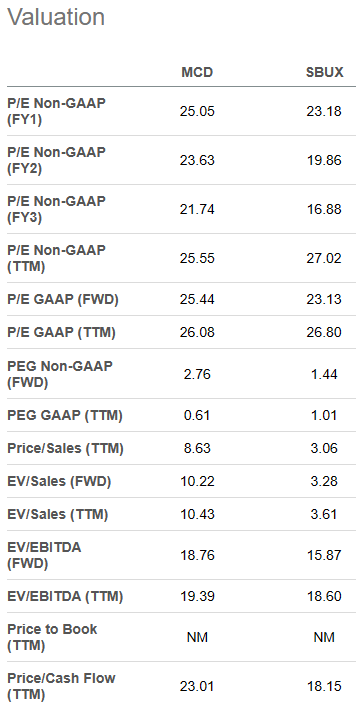

Currently, McDonald’s trades at a premium compared to Starbucks.

Seeking Alpha

Until I heard about CosMc’s, I actually believe it wasn’t that justified. But considering what may happen in a couple of years, I see it more reasonable. In fact, from this move, McDonald’s can only add top and bottom-line growth, while Starbucks will only try to defend its current business. Inevitably, it will lose a bit of market share to McDonald’s. I currently don’t hold McDonald’s, but I do own Starbucks. Therefore, I will give a rating according to where my money is: hold on McDonald’s and buy on Starbucks. But I feel compelled by McDonald’s bold move to keep a close eye on its development during 2024 because it may prove my overall bull case on Starbucks not as strong as I have believed it is up until now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.