Summary:

- 3M has faced significant legal challenges and financial setbacks in 2023, but Wall Street is looking ahead as these events are now quantified.

- The stock has risen sharply but is overbought, and a pullback is expected, potentially offering a better buying opportunity.

- While 3M has struggled with growth and margins, it is currently trading at a cheap valuation and offers a high dividend yield.

jetcityimage

Beleaguered industrial giant 3M (NYSE:MMM) may just be turning the corner after an extremely rough 2023. The company was hammered with lawsuits of unprecedented size from so-called “forever chemicals“, agreeing to pay up to $12.5 billion in damages. As if that weren’t enough, 3M is also on the hook for about $6 billion for defective earplugs in another financial and reputational blow to the company. However, as we know, Wall Street looks forward and these events are now known and quantified.

The stock has risen quite sharply off its October low, but I see at least temporary issues ahead for shares. If you’re a dividend and/or value investor, you’re probably licking your proverbial chops right now at 3M’s yield and forward P/E ratio. There’s some merit to that, but I think you should wait because you’ll likely get a better price in the weeks to come. For these offsetting factors, I’m placing a hold on 3M at the moment. Let’s dig in.

First, the bad news

I mentioned 3M has been in the midst of a massive uptrend, and we can see the magnitude of it below. 3M is well and truly in an uptrend now, and any pullbacks can be bought. The problem is that I believe a pullback is imminent, and would not chase the stock here.

I’ve marked the downtrend line that was in play for pretty much all of 2023, but it’s no longer a factor; as long as shares remain over that downtrend line on any pullbacks, it’s a thing of the past. We also have sharply rising moving averages that can and should serve as support, aiding the burgeoning uptrend.

However, 3M is extremely overbought. The PPO is +3, and the 14-day RSI has been in overbought territory for weeks. I’ve marked the prior three occasions of the PPO reaching ~3, and all three resulted in massive pullbacks. Does that guarantee anything for this time? Of course not. However, history does usually rhyme, and I’m fully expecting a pullback here. We also have very consequential resistance at ~$109, which is exactly where the stock last closed. This confluence of factors makes a pullback much more likely.

The logical question then becomes how much? Given the extreme momentum we see here, I’d favor a pullback to the rising 50-day moving average in blue. It’s $97 currently, but rising quickly. We could easily see a move to $100 or $102 to meet the 50-day MA, and I’d see that as the buying chance.

Not only is the stock very overbought, but seasonality is pretty rough for the next two months, again favoring patience.

3M’s last five Jan/Feb periods have produced positive returns just 40% of the time, and -36% annualized average returns. That’s not amazing, and I think the combination of overbought shares and very negative seasonality is a bad combination for bulls right now. Just be patient and average into your position, if you’re so inclined.

Now for some (relatively) good news

Let’s be clear; 3M shares have nosedived because it was well-deserved, not because Wall Street is misunderstanding the company’s prospects. The company is facing enormous, multi-year litigation payouts, but apart from that, growth just hasn’t been there.

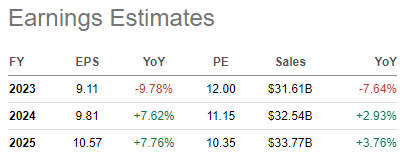

Seeking Alpha

EPS for 2023 is set to be about 10% lower than 2022, which itself was lower than 2018. This company is struggling to move the needle, and I don’t see that materially changing going forward. Management continues to expect the spinoff of the healthcare business to happen in the first half of this year, so that introduces a wildcard. The interesting thing is that of the major operating segments, healthcare was the only one in the most recent quarter to produce organic growth. If growth is going to get worse for 3M after the spinoff, the stock will leave a lot to be desired, to say the least. We shall see.

On the plus side, the healthcare segment’s margins are near the bottom for 3M, so it’s entirely possible we see a margin profile upgrade post-spinoff. That would help, and 3M desperately needs some help in that area.

Gross and operating margins have been on slow, steady declines for years, although some slight improvement has been seen recently. 3M has to figure out a way to grow the top line, and it needs better margins. If the spinoff helps the latter, that’s part of the battle won. But again, this company is not necessarily in very good shape, which is why its stock was mercilessly pounded throughout 2023.

In case it wasn’t clear, I’m not a huge fan of 3M from an EPS growth perspective, as it has some core issues surrounding top-line growth and margins. However, it’s very cheap at the moment, and that’s just enough to steer me away from a sell rating.

It’s…so…cheap

Shares trade for just 11X forward earnings right now, which is 5X lower than its 5-year average, and 10X lower than its peak multiple for the past five years. The company’s growth profile is worse than it was in the past, as we already covered, and that accounts for some of the multiple contraction. I also think the overhang from litigation is responsible for quite a lot of multiple contraction, but with the outcomes of those largely quantified now, I think that overhang will begin to lift. That could drive additional multiple expansion in the months to come. Wall Street can deal with known risks; it is uncertainty that drives share prices down, but I think the substantial majority of uncertainty has been lifted here.

Given 3M is a legendary dividend stock, there is another way we can value it, and that is through the yield itself.

3M’s historical yields were generally around 3%, but it’s almost double that level now, even after the big rally we’ve seen. The 5.5% yield is not only outstanding on an absolute basis, but on a relative basis, is very high. That means that the P/E ratio and dividend yield are both well within ‘buy’ territory, and as I said, I believe these are effectively pricing in the bad news we have seen for the company in recent quarters.

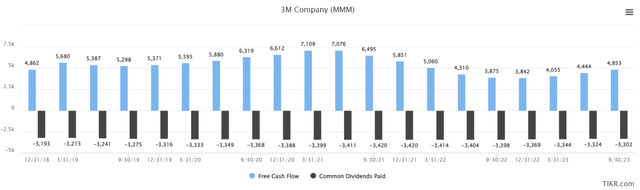

Finally, it is my belief that the dividend could continue to be paid given the current known litigation exposures and earnings profile. Below, we have free cash flow and common dividend outlays on a trailing twelve-month basis for the past few years, in millions of dollars.

The dividend is about $3.3 billion annually currently, and even with depressed earnings, 3M is producing almost $5 billion in FCF annually. Could this change? Sure. However, given its Dividend King status with 64 consecutive years of increases, I think the dividend can and will be defended.

Putting all of this together, we have a stock in a rough spot fundamentally, but with a valuation and yield to account for this risk. The price chart of the stock, however, suggests caution to me. I think if you want to own 3M, you will likely get a chance to buy at a better price in the coming weeks. For now, it’s a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.