Summary:

- 3M’s stock has seen a turnaround, gaining 18% since September 2021, with potential for further upside.

- The company’s valuation is currently low compared to historical levels, indicating potential for a significant increase in stock price.

- 3M’s recent earnings report showed resilience in revenue performance and margin management, signaling stability and potential for sustained growth.

Vladislav Stepanov

Introduction

One of the first things we’re doing in 2024 is taking another look at one of America’s largest industrial companies.

Founded in 1902, 3M Company (NYSE:MMM) has a $60 billion market cap, which makes it a heavyweight in its sector.

However, as most investors know and have felt in their portfolios, the company used to be much larger.

In early 2018, the company’s market cap almost reached $160 billion, which was followed by a steep decline triggered by economic headwinds, litigation cases, and other risks.

On September 29, I wrote an article titled “3M: A 7%-Yielding, 30% Undervalued Dumpster Fire.” Since then, the stock has added 18%, including dividends, beating the S&P 500 by roughly 800 basis points.

However, amidst the challenges, there’s a glimmer of hope. The three-pillar strategy discussed during the annual Morgan Stanley Laguna Conference suggests a potential turnaround, including a strategic healthcare spin-off and risk reduction initiatives.

Despite economic headwinds, 3M’s resilience in revenue performance and prudent margin management indicate signs of stability.

While the stock’s valuation has suffered, projections hint at a potential upside, making MMM a speculative buy.

In this article, I will elaborate on my bullish thesis and explain why the company has significant total return potential if it is able to continue the current turnaround.

So, let’s get to it!

High Total Return Potential

Normally, I show the valuation chart at the end of my articles.

However, I’m starting this article by showing why the current turnaround is so important, as it could unlock a lot of value. I also need to justify a very bullish title.

- Currently, 3M trades at a blended P/E ratio of 12.0x.

- The normalized P/E ratio of the past two decades was 18.9x.

- As we can see in the lower part of the chart below, the company had four years of EPS contraction since 2018, including a 10% expected contraction in 2023.

- Needless to say, these poor numbers, on top of litigation risks, warranted a much lower valuation.

- However, going forward, analysts expect 8% EPS growth in 2024, followed by 7% potential growth in 2025.

Here’s the thing: while these numbers are obviously subject to change (analysts often revise growth expectations), they see a path to sustainable growth.

The problem is that this does not necessarily indicate a prolonged stock price recovery. After all, we need a higher multiple to keep this rally going.

Technically speaking, a return to an 18.9x multiple could result in a fair stock price of roughly $200, which is 83% above the current price.

When adding its 5.6% dividend, the total return of the next few years could be north of 100%.

Then again, the company needs to win back investor confidence to get a higher multiple.

Luckily for its investors, it is (obviously) working on that.

3M’s Recovery

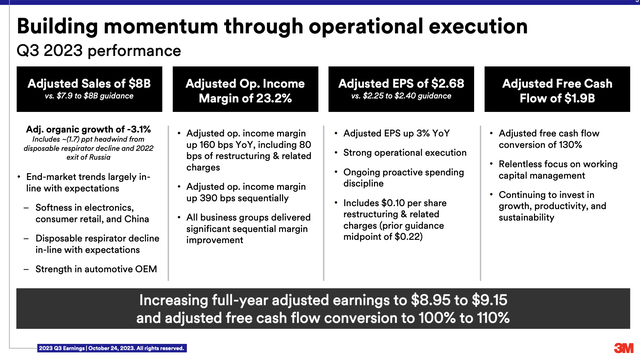

In its most recent quarter, 3Q23, 3M reported earnings ahead of expectations, expanded margins sequentially across all four businesses, and achieved a third consecutive quarter of double-digit year-on-year growth in free cash flow.

On top of that, the adjusted earnings per share guidance range for the full year was increased to $8.95-$9.15, up from $8.60-$9.10.

While these numbers were decent, the company suffered from cyclical weakness, which is quite common in the industrial sector since early 2023.

- Safety and Industrial Business: 3M’s Safety and Industrial business faced challenges in Q3 with declining organic sales, influenced by the Russia exit and reduced demand for disposable respirators. Despite this, the segment achieved an adjusted operating income of $708 million and improved margins to 25.7%.

- Transportation and Electronics: The Transportation and Electronics segment reported $1.9 billion in adjusted sales, experiencing a 1.8% decline in organic growth due to weak demand in semiconductor and data center end markets. However, the auto OEM business thrived, contributing to a 16% YoY increase in adjusted operating income ($494 million) and improved operating margins of 26.3%.

- Health Care Business: 3M’s Health Care business demonstrated positive momentum in Q3 with $2.1 billion in sales, reflecting 2.4% organic growth. Strong performances in oral care and medical solutions contributed to an operating income of $460 million, up 2% YoY, and improved operating margins of 22.2%.

- Consumer Business: The Consumer business faced challenges with a 7.2% decline in organic sales, reaching $1.3 billion in Q3. Soft discretionary spending and a subdued back-to-school season impacted the segment. Despite a 10% YoY decrease in operating income ($269 million), sequential improvement in operating margins to 20.5% was notable, driven by productivity actions and spending discipline.

Nonetheless, as I already mentioned, most of these headwinds were expected, which explains why these numbers were better than expected.

Furthermore, with regard to its aforementioned outlook, the adjusted free cash flow conversion guidance range was also revised to 100% to 110%, up from 90% to 100%. Despite an estimated full-year adjusted organic growth decline of approximately 3%, the company remains optimistic about its strong performance and ability to navigate challenges.

It also had some good news with regard to its limitations.

During its earnings call, the company announced the Combat Arms settlement and is actively working with parties and the courts to implement it.

This was reported on December 28:

In a press release issued on December 27, 3M Company announced that it has made a payment of $250 million to the Qualified Settlement Fund, which will be used to compensate between 25,000 and 30,000 veterans who elected to receive smaller “expedited” payments.

Terms of the agreement allow the company to fund the 3M earplug settlement in several waves between now and 2029, with claimants overall receiving an average of about $24,000. However, with some damage awards expected to be substantially higher, most veterans may only see about half of that amount to resolve their claims.

For PFAS litigation, a public water supplier settlement received preliminary court approval, overcoming objections from state attorneys general.

The company is set for a final hearing in early February.

Furthermore, during last month’s Wolfe Research Inaugural Reshoring Conference, the company elaborated on these key issues.

It mentioned that it has been actively engaged in settling legal claims, particularly those related to water contamination issues associated with its products.

It also addressed concerns regarding the opt-outs in these settlements, emphasizing the importance of reaching final agreements and maintaining confidence in the overall settlement process.

Managing legal challenges is a critical aspect of the company’s commitment to resolving issues transparently and ensuring a fair outcome for all stakeholders (regaining investor trust).

I called out the early — it’s expedited payment settlements that we’re talking about because of the numbers that we’re seeing, that’s something that we anticipate paying by the end of the year. So that’s the reason I called it out. That’s a $250 million settlement fund that we would expect to pay by the end of the year. We’ll continue to progress there. It’s March where we get to the final dates for the number of participants that are finalized as well as the — getting to the levels that are called out in the settlement for the next set of payments.

So again, focusing on from the bellwether verdicts to the wave cases to the early releases and expect to continue to make progress towards the March final days. – 3M Wolfe Research Inaugural Reshoring Conference

Meanwhile, 3M is increasingly focused on its core business to enhance margins, which also supported the business in 3Q23.

During the Wolfe call, the company noted that it has made significant improvements in enhancing factory productivity, operational efficiency, and supply chain resilience.

The company attributed these improvements to investments in automation, data analytics, and a focus on reliable raw material supply.

These efforts are expected to contribute to the company’s momentum in 2024 and beyond.

This turnaround also includes the spin-off of its healthcare business, which will be named Solventum.

3M will maintain a 20% stake in this company, which covers wound care, oral care, and healthcare technology.

For now, things are going smoothly, as the company has worked on leadership changes and related issues to further streamline its core business this year.

The spin-off is expected to be executed in the first half of this year.

Balance Sheet Health & Dividends

Adding to that, the company has a healthy balance sheet. It has a BBB+ credit rating, backed by a net leverage ratio in the low-1x range.

In the third quarter, the company noted that net debt stood at $10.8 billion, which is 11% lower compared to 3Q22.

On a full-year basis (2023), the company is expected to generate $4.5 billion in free cash flow, which would translate to a 7.5% free cash flow yield.

For now, this protects the company’s dividend.

After hiking its dividend by 0.7% to $1.50 per share per quarter on February 7, 2023, the stock currently yields 5.5%.

This dividend is protected by the implied 7.5% free cash flow yield and a normalized earnings payout ratio of 60%.

Although a dividend cut cannot be ruled out if the business transition were to see additional headwinds, I believe that on a long-term basis, 3M is in a good spot to remain a source of income for millions of long-term investors.

All things considered, I continue to be bullish on the stock.

While this investment comes with elevated risks, it could continue to result in elevated gains.

If 3M is successful in limiting litigation risks and growing margins, it could see substantial gains once it gets support from bottoming economic growth.

On a longer-term basis, I do not rule out total returns of more than 100%.

Takeaway

Despite recent setbacks, 3M’s resilience in revenue and margin management signals stability.

The current valuation, trading at a blended P/E ratio of 12.0x, presents a unique entry point for investors eyeing long-term gains.

As 3M actively addresses legal challenges and enhances core business efficiency, the groundwork for sustained growth is strong.

With a robust balance sheet, dividend protection, and a focus on innovation, 3M positions itself as a long-term investment opportunity, suggesting potential returns that could beat the market by a wide margin.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.