Summary:

- Tesla, Inc. ended the year with record Q4 deliveries, exceeding consensus estimates by wide margins with sequential expansion of 11%.

- But a deeper investigation shows the underlying drivers are not only unsustainable in the long term but foreshadow structural demand weakness to come.

- This is likely to further reduce the core auto business’ strength in maintaining Tesla’s valuation premium at current levels.

- As a result, investors’ focus is likely to divert further towards progress on full self-drive deployment and monetization in 2024, which, although it represents a major component of Tesla’s valuation premium, remains uncertain.

Justin Sullivan

Tesla, Inc. (NASDAQ:TSLA) has unsurprisingly ended the year with another record delivery. The company finished the year with 484,507 vehicles delivered in Q4, representing q/q expansion of 11%, which is commendable. The results also outperformed the consensus delivery estimate of 483,000 vehicles.

In our previous coverage, we discussed the ongoing macroeconomic uncertainties, narrowing profit margins, and structurally diminishing market share across Tesla’s core operating regions as reasons for its dulling luster. But a deeper look into the key volume drivers in Q4 potentially spells more structural headache heading into 2024. And this is likely to skew risks further to the downside for Tesla in the new year, and introduce further volatility to the stock.

Recall that Tesla experienced a disruption in Q3 volumes due to prescheduled maintenance shutdowns in July, hence the marked sequential expansion in deliveries. Q4 volumes likely also benefitted from pull-forward demand due to the elimination of certain federal tax incentives for eligible purchases across Tesla’s line-up, which took effect January 1, 2024. These sequential increments continue to hinge on non-durable growth factors in our opinion, and potentially highlights ongoing consumer sensitivity to price changes heading into 2024. The situation also bodes unfavorably for rising industry competition. Meanwhile, the broader EV demand environment also faces a structural slowdown due to the exhaustion of early adopters. This means an inherent shift in the underlying EV demand growth driver to mass market consumers, which are more price sensitive and less accustomed to brand loyalty, is likely well underway.

Taken together, Tesla is expected to experience a normalizing pace of delivery volume expansion in the new year, with limited profit margin recovery in sight. The modest outlook for Tesla’s core auto sales is likely to draw investors’ focus back to full self-driving (“FSD”) monetization, which could be the major headwind facing its stock performance. Specifically, the bulk of the Tesla stock’s lofty valuation premium over its EV and legacy automaking peers today is likely attributable to its FSD and robotaxi prospects. In contrast, its core auto sales business likely garners a much smaller valuation multiple. A major component of Tesla’s current valuation is inherently linked to substantial expectations for a business that has yet to come into fruition. This is corroborated by the Tesla stock’s relatively higher level of volatility in response to FSD-related recalls and headlines.

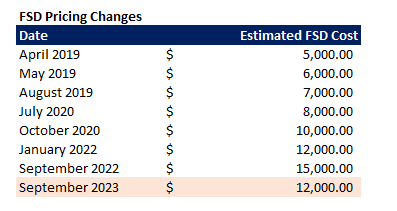

Although auto recalls are common in the auto industry, they are of particularly influence to the Tesla stock given their inference to FSD regulatory approval and, inadvertently, revenue recognition prospects. And the slew of FSD-related challenges observed at Tesla over the past year only means setbacks and uncertainties to obtaining regulatory approval are becoming more apparent. Meanwhile, the company has also quietly lowered FSD prices by 20% exiting Q3, with the stock not yet fully de-risked for the relevant impact in our opinion.

However, on another note, the energy generation and storage segment’s share of revenue mix is likely to remain stable, especially considering the normalizing pace of deceleration observed in 2023. Taken together, we believe the stock remains prone to further downsides given the lack of company-specific value-accretive factors in the near-term to sustain incremental multiple expansion beyond current levels.

Strong Q4 2023 Delivery Volumes Point to an Overhang in 2024

Tesla exited the year with strong Q4 delivery volumes. The company produced 494,989 vehicles, up 13% y/y and 15% q/q. Meanwhile, deliveries that get recognized into top line grew 11% from Q3 to 484,507 vehicles. This takes full year 2023 deliveries to 1,808,581 vehicles, exceeding the “about 1.8 million” vehicles previously guided by management.

However, a deeper dive into the numbers would reveal that the sequential improvement is likely driven by an unsustainable mechanic. Specifically, new vehicle registration data and observed trends reported by the European Automobile Manufacturers’ Association and the China Passenger Car Association through early December implied a -2% q/q and +14% q/q change in Tesla deliveries for Q4 across Europe and China, respectively. Meanwhile, in the U.S., preliminary estimates on new vehicle registration data reported by Motor Intelligence had suggested a greater decline of -9% q/q in December-quarter delivery volumes.

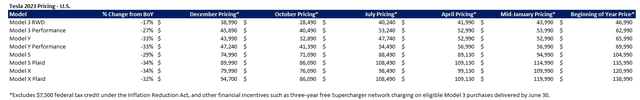

Yet Tesla’s outperforming 11% q/q expansion in total Q4 delivery volumes indicate a substantial jump exiting 2023. Admittedly, Tesla has had a history of period-end sales blitzes to maximize deliveries. But the combination of an easier prior quarter compare due to production disruptions in Q3, and IRA-related pull-forward of demand in Q4 has likely played a key role in ballooning end-of-December volumes this time around. Specifically, the U.S. Treasury Department issued additional details in December surrounding the “battery material sourcing requirements” that dictate eligibility for the $7,500 tax credit on EV purchases under the IRA. The rules which took effect on January 1, 2024 had essentially eliminated some of Tesla’s best-selling Model 3 variants from eligibility. The setup has likely encouraged a flurry of purchases exiting 2023, as consumers rushed to partake in what was left of the $7,500 tax credit on eligible Tesla vehicle purchases.

Increasing Consumer Sensitivity to Prices and Structural Shifts in Demand Drivers

We believe the stronger-than-expected year-end delivery boost underscores increasing sensitivity among prospective Tesla buyers. A little more than a year ago, when the IRA was announced, Tesla CEO Elon Musk had publicly denied the need for federal tax incentives to spur EV demand. Yet the company’s pricing strategy quickly took a turn thereafter. It began to offer discounts and price cuts that were in line with or greater than the $7,500 tax incentive across its lineup to improve competitiveness. Some of its higher-end models also saw price cuts to bring it below the IRA-eligibility threshold.

This compares to the relentless surge of demand for Tesla vehicles in the U.S. during and shortly after the pandemic. At the time, Tesla had just exhausted its 200,000-unit cap for the legacy EV purchase tax credits, yet maintained an elevated pricing strategy.

The pulled-forward demand observed in Q4 2023 likely foreshadows an even more normalized demand environment heading into 2024. Specifically, the IRA-induced pricing dynamics underscore the growing role of consumers’ inherent price sensitivity in stifling the previously resilient EV demand environment. Ongoing macroeconomic uncertainties have been a key overhang on discretionary spending, particularly on big ticket items like EVs. As debt and delinquency levels return to pre-pandemic highs, while Americans’ dwindling cash savings now walk a tightrope alongside the cooling labor market, Tesla faces limited headroom for staging a price recovery in 2024.

But worst off is the increasingly structural shift in EV demand drivers from loyal early adopters to the broader mass market. This cohort remains the most price-sensitive, and are likely to drive the dilution in Tesla’s market share going forward as competition ramps up. And this is already corroborated by Tesla’s gradually declining market share in North America to 42%. The figure represents Tesla’s lowest since introducing the Model 3 in 2018, despite still holding the top EV sales crown in the region. And the transition from early adopters to mass market demand will only further accelerate Tesla’s sensitivity to being a price taker in the auto industry over the near-term.

Intensifying Competition

The transition from early adopters to the mass market is also coupled with rising competition, as the pool of available EV models to expand at an accelerating rate year-on-year. The U.S. is expected to add another ~20 new EV models through 2024, after growing its catalogue by 40% in 2H23 alone to 95 models. The headwinds are stiffer in China, with Tesla’s rivals also introducing frequent refreshes to their new and existing line-ups.

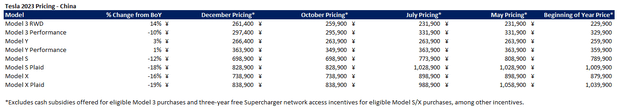

In addition to the U.S., Tesla’s market share in China is also diminishing at a rapid pace. Leading automaker BYD Company (OTCPK: BYDDF, OTCPK: BYDDY), as well as other local EV makers have been consistently diversifying their respective product portfolios to better penetrate opportunities across different price and vehicle segments in recent years. Meanwhile, Tesla faces a comparatively aging product line-up in the region. The setback is observed in Tesla’s rapidly declining Chinese market share, which dropped 18% y/y in November. This marks continued deterioration in Tesla’s Chinese market share from the 21% plummet in December 2022.

Normalizing Volumes

Looking ahead, we see two key volume drivers in 2024 for Tesla, though none of which are expected to be materially accretive on top of 2023 volumes. This includes company-specific changes to Tesla’s vehicle lineup, as well as broader industry factors pertaining to easing inventory levels and financial conditions.

On the company-specific front, we expect the anticipated overhaul to Tesla’s Model Y exterior, interior and performance this year to complement early signs of demand recovery following the Model 3’s revamp in September. This is corroborated by improving Tesla sales in China through Q4, which is likely attributable to the newly introduced long-range Model 3 that also boasts a sleek exterior upgrade. The observed trend also underscores the importance of a line-up refresh at Tesla to reinforce its competitiveness against emerging rivals. The updated Model 3 will also be entering the U.S. market later this year to accompany already-underway sales in China and Europe. Taken together with an anticipated overhaul of the Model Y in 2024, the refresh cycle could help offset some of the stiffening demand headwinds faced.

However, Tesla has yet to expand its product line-up since introducing the Model 3/Y in 2018/2019. The lack of a compelling product line-up to up its mass market appeal is likely to remain a limiting factor to near-term growth opportunities. The recent launch of Cybertruck is also unlikely to contribute materially to delivery volumes in 2024.

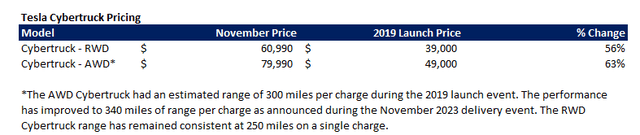

Specifically, the Cybertruck’s higher-than-expected price tag represents a potential setback, as it does not align with the increasingly mass market-dominated demand environment. During the vehicle’s delivery event in November, management gave a pricing range that was significantly higher than the $39,000 to $49,000 range announced in 2019. The RWD Cybertruck will start at $60,990, with a range of 250 miles on a single charge. The AWD variant will start at $79,990, with 340 miles of range on a single charge.

This is likely to levy a substantial setback on the anticipated sales conversion rate on reservations for the Cybertruck, which stood at more than 1 million shortly after launch. Meanwhile, the initial ramp-up of Cybertruck volume productions is likely to remain nominal relative to Tesla’s best-sellers. This, accordingly, supports our expectations for a limited volume contribution from the new model in the current year.

Meanwhile, on the industry front, we expect easing inventory levels and impending rate cuts to maintain demand in the U.S. market for Tesla through 2024. Specifically, U.S. auto inventory days have gradually increased to 52 days, recovering from pandemic-era lows due to acute supply chain constraints. However, the number remains substantially lower than the average 60-80 days prior to the pandemic. This is paired with stabilizing growth in auto transaction prices, which currently average $48,272 – or about 25.7% higher than pre-pandemic levels. Taken together with the expectation for lower financing costs heading into 2H24, the industry mechanics could be a tailwind to spurring mass market demand. This would represent another potential factor in offsetting some of the company-specific demand risks facing Tesla.

FSD Considerations

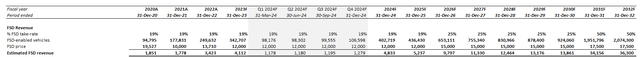

Despite stabilizing trends in Tesla’s core auto sales business in 2023, the stock’s valuation has staged a tremendous recovery. In addition to its participation in the surge of AI momentum over the past year, much of Tesla’s valuation premium continues to depend on investors’ steadfast optimism on FSD monetization prospects.

Specifically, FSD-related cash flows and growth prospects warrant a higher valuation multiple in line with the software sector. This is because of the FSD business’ inherent scalability and, inadvertently, higher-margin revenue stream. With Tesla’s core auto business likely facing structural normalization from its historical pace of breakneck growth, we expect greater investors’ focus on FSD monetization progress going forward.

Yet this could be an underestimated headwind facing the stock in the near-term. The Tesla stock has historically been more susceptible to volatility on news of recalls and other regulatory challenges facing FSD deployment. Intense coverage on Tesla recalls have typically differed from those pertaining to legacy OEMs, as they are often associated with FSD and Autopilot functions, and has adverse implications on the full monetization timeline for related revenues. And Tesla has continued to face an accelerating share of said challenges to its FSD deployment timeline over the past year. We expect these challenges to steepen in the coming year, especially with increasing regulatory oversight on AI-driven technologies and automated solutions. This potentially represents limited multiple expansion drivers attributable to FSD heading into 2024, especially as the comparable software sector’s run-up through 2023 has already priced in AI-related tailwinds and easing financial conditions ahead.

Meanwhile, Tesla has also quietly reduced FSD subscription prices in late Q3 by 20% from $15,000 to $12,000.

tesla.com

This is likely to driven incremental pressure on the fundamental component of the FSD-related valuation premium in the stock, which has yet to be de-risked at current levels. Taken together with an ongoing slowdown in the core auto sales business, the situation offers limited upside for the Tesla stock in the current year.

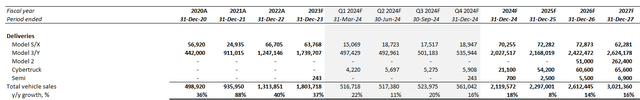

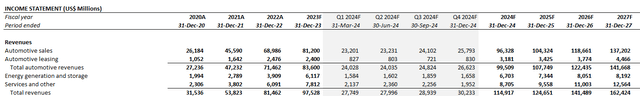

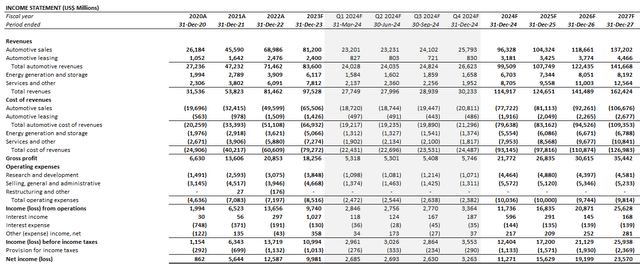

Fundamental Implications In 2024

Adjusting our previous forecast for Tesla’s updated Q4 deliveries, we expect full year 2024 volumes to expand by 18% y/y to 2.1 million units. We expect Model S/X volumes to reaccelerate towards full year growth of 10% in 2024 thanks to an easier PY compare with an expectation for less disruptions to production levels. Meanwhile, Model 3/Y volumes are likely to decelerate significantly to 17% y/y expansion in 2024, which is inline with our foregoing analysis. We expect first full year volume contributions from the Cybertruck to be relatively nominal. This considers the typical challenges associated with start of volume production challenges, and the anticipation for a lower-than-expected reservation conversion rate as EV industry demand remains mass market dominant.

This translates to estimated automotive sales revenue growth of 19% y/y to $94.1 billion. The assumption considers modest expansion in 2024 the vehicle average selling price to $44,411, which is in line with the modest increase in Model 3/Y prices recently observed following their respective upgrades.

Taken together with automotive regulatory credit sales and automotive leasing revenues, total automotive revenues are expected to expand at 19% y/y to $99.5 billion in 2024. Total net revenue are expected to grow 18% y/y to $114.9 billion in 2024, with a stable revenue mix coming from energy generation and storage sales, and services and other sales.

As discussed in the earlier section, we expect vehicle ASP to stay largely flat from the prior year. In the downside scenario, prices could also remain susceptible to modest declines in 2024 as Tesla potentially looks to better penetrate pent-up demand within the mass market. This is in line with the growing acceptance of EVs among all consumers, with “nearly a third” of Americans indicating high interest in buying an EV for their next car, as long as the price is right. This suggests limited margin expansion in 2024 coming from the top line.

Meanwhile, Cybertruck-related ramp-up costs are likely to be marginal in 2024, which is in line with modest volume contributions anticipated. This could potentially alleviate some of the bottom line pressure coming from limited ASP expansion moving forward.

Although battery material costs have come down significantly over the past year with a growing influx of supply, related benefits to Tesla’s bottom line will likely be marginal in the near term. We expect Tesla’s earlier procurement of raw materials when the supply chain was constrained to be somewhat of a near-term gatekeeper in allowing full participation in stabilizing commodity spot rates. Taken together, we expect a modest recovery in vehicle gross margins (ex-auto credit sales) to 18.2% in 2024, with further expansion to 21% thereafter with improved scale.

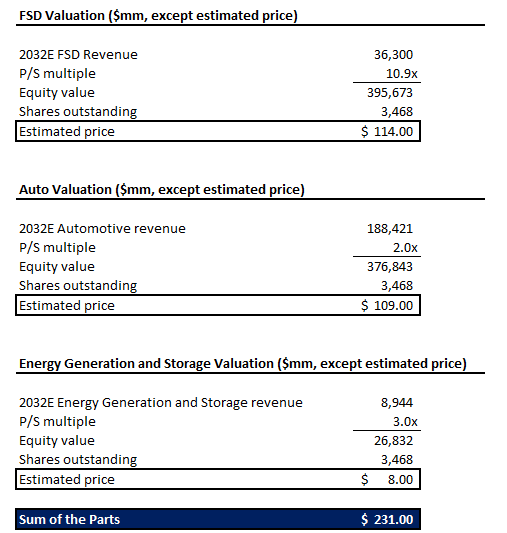

We are slightly increasing our previous price target of $221 to $231. The price target is derived using the same sum-of-the-parts approach previously discussed.

Author

However, the revision includes consideration of a nominal valuation contribution from Tesla’s non-core energy generation and storage business. The segment has experienced stabilizing growth and margin expansion in recent quarters, and is expected to play a more value accretive role to the stock in the longer term. We have applied a 3x sales multiple on anticipated terminal revenue generated from the energy generation and storage segment, which is in line with its peer group average.

We have also increased the valuation multiple on forecast 2032 FSD sales to 10.9x from the previous 10x. The revision offsets the anticipated decline in longer-term FSD revenue due to the service’s recent price reduction, and accounts for multiple expansion in line with easing financial conditions (i.e., lowering normalized interest rate environment).

We are maintaining the 2x P/S ratio applied on estimated terminal automotive sales. This is in line with the historical average valuation observed for “mid-cycle U.S. OEMs,” as well as the S&P 500’s forward average to reflect Tesla’s leadership position in driving EV market growth.

The Bottom Line

Despite Tesla’s global leadership in EV sales, impending demand weakness is likely to drive incremental volatility to the stock at its currently lofty premium. The anticipated increase in investors’ focus on FSD prospects, while the underlying solution continues to struggle from an uncertain deployment and monetization timeline, further skews risks to the downside for the stock. Taken together, we do not believe Tesla’s valuation premium at current levels are durable despite recent tailwinds surrounding its AI prospects and impending rate cuts. As a result, we expect Tesla stock to face some setback in 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!