Summary:

- Recent corrections in Exxon Mobil Corporation stock prices are overdone.

- Geopolitical disruptions and demand-supplier imbalances could drive both oil prices and Exxon stock prices higher.

- In the meantime, Exxon’s current valuation is too compressed, offering a sizable margin of safety.

designer491

XOM: Recent corrections are overdone

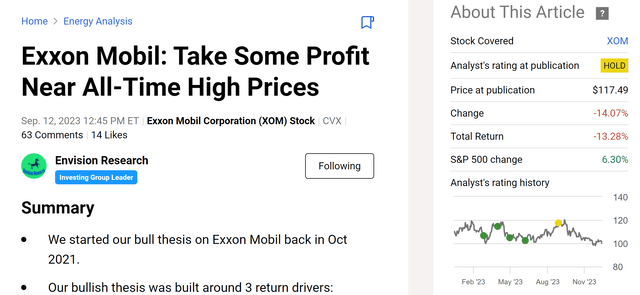

We last wrote on Exxon Mobil Corporation (NYSE:XOM) about 4 months ago with the goal of urging investors to take some profits (see the chart below). The stock prices indeed suffered substantial corrections afterward, losing about 14%. In contrast, the S&P 500 (SP500) advanced more than 6%.

Against this backdrop, this article will argue that such large price corrections are overdone. In the remainder of this article, I will detail a few immediate positive catalysts that could potentially drive both oil prices and XOM stock prices substantially higher. In summary, the key factors for my arguments are:

- Geopolitical disruptions to oil production

- Demand-supplier imbalances

- And finally, XOM’s overly compressed valuation under its current stock prices.

$100 oil price could be a 2024 black swan

The chart below shows the price (CL1:COM) of West Texas Intermediate (“WTI”) crude oil from ~2005 to the present. As seen, the price of oil has been highly volatile – something you already know. In the recent 2~3 years alone, oil prices have risen from below $50 to a peak of around $125, then corrected to the current level of ~$73. Behind all these roller coaster activities, the point I want to make is quite simple. I do not see $73 oil as lasting. The current oil price of ~$73 is close to the average price between 2005 and 2010, as seen. If oil prices were only to keep up with inflation since then, its current price should be well above $100. At the same time, bear in mind that in the long term (say the past 3~4 decades), the pace of oil prices has outpaced general inflation.

In addition to the above megatrend, there are a few more immediate catalysts afoot in my view that could drive up oil prices and XOM’s profits in tandem. First, there are substantial risks of geopolitical disruptions that could limit oil production. Some top risks in my mind include OPEC+ production cuts and transportation network disruption. The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) have used the strategy of cutting production to stabilize (or even boost) oil prices. In the meantime, with the Russian/Ukraine war dragging and the Middle East conflicts ongoing, I see substantial risks for supply shortages and transportation disruptions.

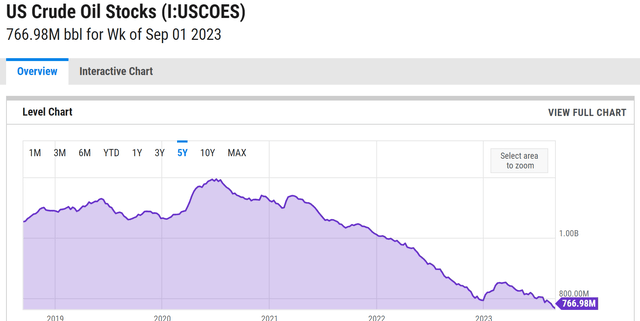

On the supply side, the U.S. crude oil stocks now hover near a multi-year bottom as seen below. The chart below shows the stocks from 2019 to the end of 2023 in millions of barrels. The current level of 766.98 million barrels is the lowest level in the past 5 years. There are a range of factors that have contributed to the low level of the current U.S. crude oil stocks (including the production interruptions just mentioned). However, among all these factors, the top factor in my mind is the stagnation of our energy infrastructure.

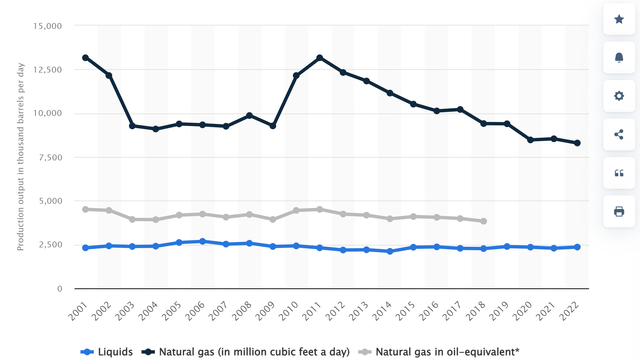

Take XOM as an example. The second chart below shows XOM’s liquid oil and natural gas production in the past ~20 years between 2001 and 2022. As seen, despite the tremendous growth of economic activities and energy consumption since 2001, both XOM’s liquid oil production and NG production have either stayed flat or declined. To wit, its liquid production has stagnated at a level of around 2.5 million barrels per day (“bpd”) during this long period. Its NG production, when measured in million cubic feet per day, has dramatically decreased from 12,500+ per day in 2001 to a level of around 7,500.

I see no short-term solution to increase production substantially. Developing new oil and/or NG production capacity is a complex and time-consuming process, involving significant upfront investments, navigating through a web of environmental regulations, and securing a suite of equipment, materials, and skilled personnel. As such, in the near term, I see prices as the only variable that can change if the above imbalance worsens.

Valuation discount offers a sizable margin of safety

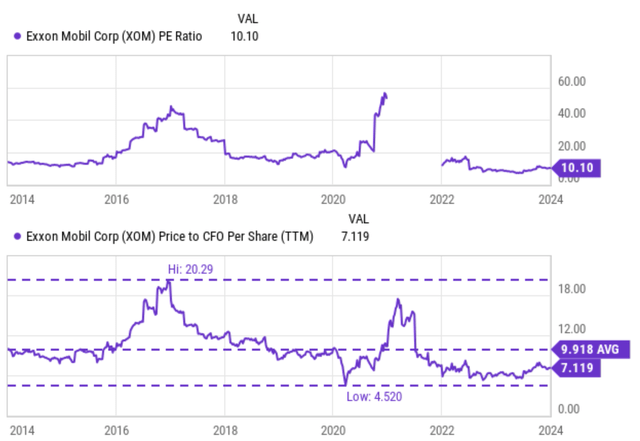

Despite the above catalysts, XOM is now trading at a very compressed valuation. Its P/E hovers around 10x at the time of this writing, very cheap both by horizontal comparison (e.g., against the overall market) and by vertical comparison (e.g., against its own historical averages).

Due to the highly cyclical behavior of its accounting EPS, its historical P/E offers little insight (as seen from the top panel in the chart below). So here I will use its P/CFO ratio (cash from operations) as the main valuation metric. As seen in the bottom panel of the chart below, the stock is now trading at 7.1x of its CFO, far below its long-term average of 9.9x, translating into a sizable margin of safety of ~28%.

Other risks and final thoughts

There are a couple of downside risks to my thesis, both in the near term and longer term. In the near term, the weather is a large uncertainty. Mild weather could translate into a softened demand for both oil and NG (both are used for heating or cooling purposes). In the longer term, the increasing utilization of renewable energy sources like solar and wind power can gradually decrease demand for oil, contributing to lower stock levels. Although, these risks are common to the entire energy sector.

A key risk/uncertainty that is unique to XOM but not to other oil stocks involves its Guyana project in my mind. XOM’s Guyana Stabroek Block is a wild card. If the block is successfully drilled and developed into production, I do not think it is an exaggeration to consider it a game-changing project. However, on the other hand, the project could face unexpected delays or production issues due to infrastructure hurdles, regulatory constraints, or environmental concerns.

All told, my conclusion is that the positive catalysts far outweigh the negatives for Exxon Mobil Corporation under current conditions. To recap, the key positives in my view are twofold. First, I see it as a very likely scenario for the supply-demand imbalance to worsen in the near term, given the ongoing geopolitical risks and production limitations. Second, its compressed valuation offers a margin of safety too wide to ignore.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.