Summary:

- Due to massive pre-tax charges caused by two settlements, 3M Company had to report horrible results in the last two quarters.

- But it seems like the two major lawsuits – PFAS and earplugs – are close to being resolved and with payments stretched over several years, 3M Company will be fine.

- 3M Company will generate enough free cash flow to pay the fines and also be able to raise the dividend in the years to come.

- MMM stock is still undervalued.

josefkubes

My last article about 3M Company (NYSE:MMM) was published at the beginning of April 2023 – about nine months ago. At that point the stock was trading for $105, and I was bullish about 3M Company – as I have been in several articles in the past. And while the stock is trading now a little higher and an investment would have gained about 9%, the stock declined as low as $85 in the meantime.

And while the stock increased in value over several weeks, we should still be cautious about 3M Company as the stock is still in a downtrend. Despite gaining 25% in value in the last two months, there is no reason to be extremely optimistic yet. It still seems like the company is fighting on several fronts and an update seems to be overdue.

Quarterly Results

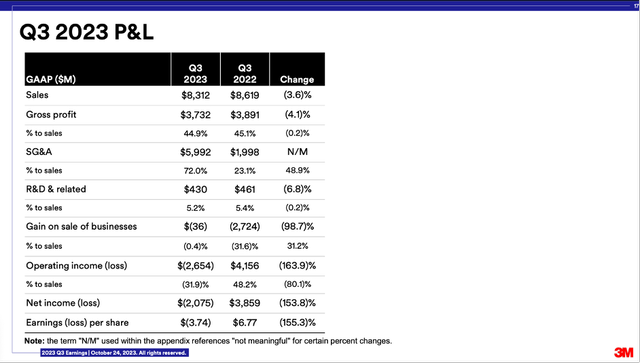

In the third quarter of fiscal 2023, 3M Company generated $8,312 million in revenue and compared to $8,619 million in revenue in the same quarter last year, this is a loss of 3.6% year-over-year. Organic sales declined 3.7% year-over-year. While it is still a not a huge loss, it is not a great sign that 3M Company had to report a declining revenue.

3M Company Q3/23 Presentation

And while revenue only declined, the company had to report an operating loss of $2,654 million in Q3/23 instead of an operating income of $4,156 million in Q3/22. Diluted earnings per share also switched from $6.77 in the same quarter last year to a loss of $3.74 per share this quarter. But while 3M Company had to report a loss per share, adjusted free cash flow was $1,930 million and compared to $1,390 million in the same quarter last year this is an increase of 38.9% year-over-year. This is certainly a good sign – especially as free cash flow conversion rate was 130%.

3M Company Q3/23 Presentation

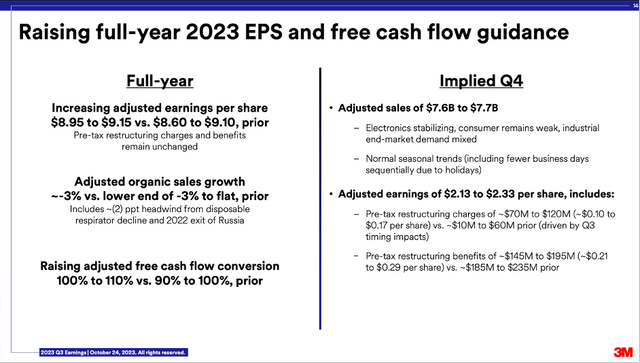

After beating estimates in the third quarter of fiscal 2023 (adjusted earnings per share of $2.68 compared to expectations of $2.25 to $2.40), management also raised its full-year guidance. Free cash flow conversion is now expected to be in a range of 100% to 110% instead of 90% to 100% previously. Adjusted earnings per share are now expected to be in a range of $8.95 to $9.15 (compared to a previous guidance of $8.60 to $9.10).

Dangerous Bets on Resolved Legal Disputes?

3M Company not only had to report a loss per share in the third quarter of fiscal 2023, but also in the previous quarter. While 3M Company reported a loss per share of $3.74 in Q3/23, it reported a loss per share of $12.35 in Q2/23. The major problem in both cases were the huge Selling, general and administrative expenses – in the third quarter, SG&A expenses were $5,992 million and in the second quarter SG&A expenses were $12,204 million. In the second quarter, the proposed settlement agreement regarding PFAS resulted in a pre-tax charge of $10.3 billion (leading to these horrible results) and in the third quarter the company took a pre-tax charge of $4.2 billion due to the Combat Arms settlement.

In the last few years, 3M Company was facing two major lawsuits – one was about earplugs and the other about PFAS. And it seems like the company made good progress during the last year and both legal disputes could be close to being resolved.

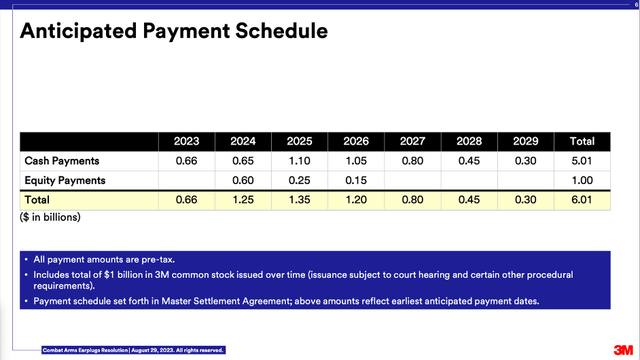

Over the next few years, 3M Company will have to pay $10.3 billion due to the PFAS settlement and $6.0 billion due to the Combat Arms settlement. For more information about the PFAS settlement, we can look at the 8-K Filing. And while $16.3 billion in payments certainly is a huge amount of money, the payments as part of the PFAS settlement are stretched over 13 years resulting in about $800 million in annual payments. And the Combat Arms payments are also stretched over several years with the following anticipated payment schedule.

3M Company Combat Arms Litigation Update Presentation

And of the total $6 billion in payments, $1 billion are equity payments in the years 2024 till 2026. From a shareholder perspective, we should always hope for higher stock prices and especially in case of the equity payments it would reduce the dilution. With a current market capitalization around $60 billion, paying out $1 billion in additional equity would lead to an 1.7% increase in outstanding shares, which is also acceptable.

So far, this sound quite positive and we have reason to be optimistic regarding the lawsuits and during the last earnings call management gave a positive sounding update:

We announced the combat arms settlement, and we are working with all parties and the courts to implement it. The settlement administration process has been established and funded. The bellwether trial verdicts have been settled, and the process for notifying and settling with claimants has begun. With respect to PFAS, the public water supplier settlement we announced last quarter has received preliminary court approval. We successfully resolved objections from state attorneys general and are working toward approval with the final hearing set for early February next year.

During the Wolfe Research Inaugural Reshoring Conference in December 2023, CEO Mike Roman also commented on the current situation:

And then a big focus for us is managing risk and uncertainty proactively and effectively managing the litigation in front of us. We had two settlements that we announced over the summer. Combat Arms, which is a settlement agreement that was announced in August, parties, the courts, overseas settlement, we’re all working towards full implementation of this.

Currently, we received more than 30,000 releases from the Combat Arms earplug claimants. We’ve resolved all the adverse bellwether verdicts, and we’re moving forward with the process to pay the settlement to the early releases by the end of the year. The registration process for climates continues, and we expect that to be — anticipate that to be completed by late March and next year.

When reading these statements, we can be positive about most legal issues being resolved, but we should not be too optimistic. But I think at this point in time, we can hope that 3M Company will not face additional billions in fines and settlements – aside from the $16 billion it already has to pay.

Healthcare Spinoff

Another important development in the last few quarters was the healthcare business spin-off and it is one of the company’s priorities. Right now, the company is trying to build a strong leadership team and board and the company is progressing toward completion in the first half of 2024. During the third quarter, 3M Company added two experienced leaders, naming Bryan Hanson as CEO and Kerry Cox as Board Chair.

During the earnings call, management was asked by an analyst if there are any big or major hurdles for the healthcare spin-off ahead. But CEO said he doesn’t see any hurdles ahead. A lot of work to do, but no hurdles. So we can expect the spin-off going through as planned and 3M Company will spin off its healthcare business, which is responsible for about 25% of the company’s sale.

Dividend and Share Buybacks

I would assume for many investors the dividend is an important issue for the investment decision. Right now, 3M Company is paying a quarterly dividend of $1.50 – resulting in a dividend yield of 5.5%. We can clearly see in the last few years that 3M Company is desperately trying to keep its status as dividend king – at a point when it would have been best to cut (or maybe even eliminate) the dividend. In the last few years, 3M Company increased the dividend only one cent each year.

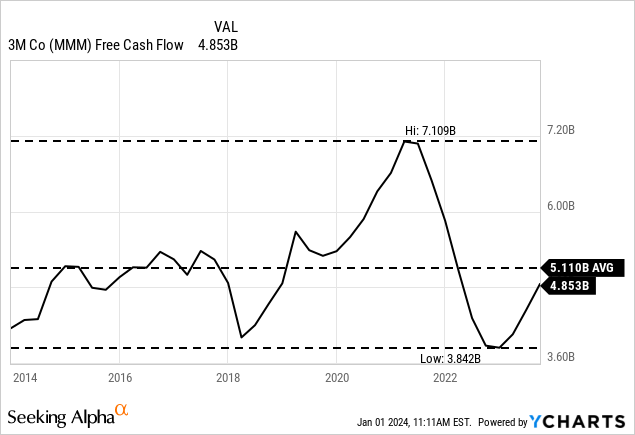

Nevertheless, I assume the dividend is safe. In the last four quarters, 3M Company paid out $3,302 million in dividends and compared to a free cash flow of $4,853 million, the payout ratio is 68% and although this is a rather high payout ratio, the dividend is still safe, and 3M Company should be able to increase the dividend slightly in the years to come to keep its status as dividend king.

And of course, when talking about the safety of the dividend we must take into account the payments of the two settlements. I listed below the payments 3M Company most likely has to make in the years to come.

|

Year |

PFAS Settlement |

Combat Arms Settlement |

Total |

|

2024 |

$792 million |

$650 million |

$1,442 million |

|

2025 |

$792 million |

$1,100 million |

$1,892 million |

|

2026 |

$792 million |

$1,050 million |

$1,842 million |

|

2027 |

$792 million |

$800 million |

$1,592 million |

|

2028 |

$792 million |

$450 million |

$1,242 million |

|

2029 |

$792 million |

$300 million |

$1,092 million |

|

2030 till 2036 |

$792 million per year |

$792 million per year |

And when taking the current free cash flow, 3M Company would not generate enough FCF in 2025 and 2026 to maintain the dividend and also pay the necessary amounts. But we can assume that 3M Company will be able to generate a higher free cash flow in the years to come and we should not be worried about 3M Company being able to make its payments.

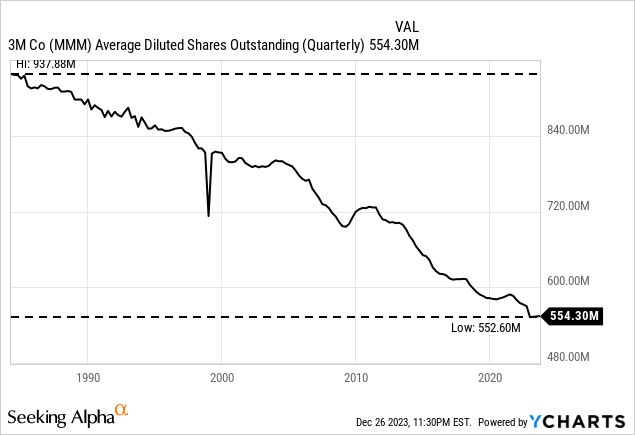

3M Company was also reducing the number of outstanding shares and I would assume that 3M Company will continue to repurchase shares and the company will generate enough cash to continuing doing so in the years to come – maybe with a slightly slower pace for the next few years.

High Quality Business

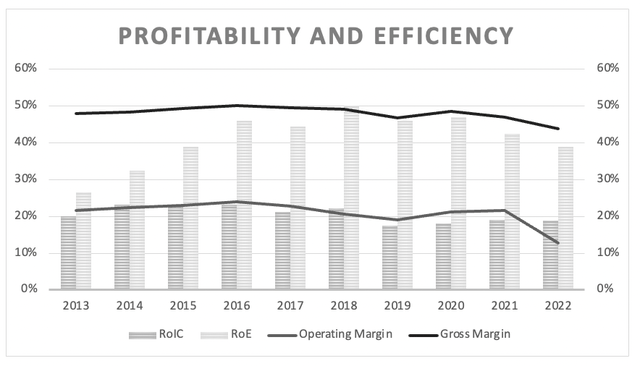

Aside from paying a high dividend yield, I like to point out that 3M Company is still a high-quality business with a wide economic moat around its business. I know many see 3M Company as a struggling business, but in my opinion the metrics still point towards a wide moat business. In the last five years, the company reported a return on invested capital of 19.15% – which is an extremely high RoIC for any business and clear hint for a wide economic moat.

3M Company: Margins and Return on invested capital (Author’s work)

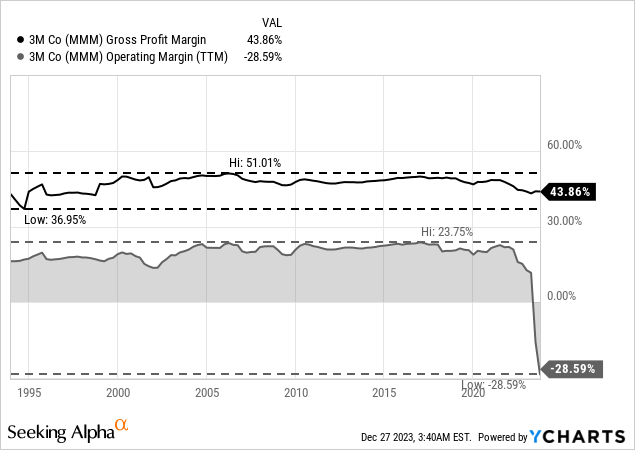

Additionally, the company is reporting very stable margins. We see declining margins in the last few quarters but when excluding these quarters, 3M Company is reporting a stable gross and operating margin over time. And of course, we should not cherry-pick data, but I would allow 3M Company to have a few mediocre quarters (and even quarters with negative margins) before kicking the business out of the ranks of wide moat companies.

And in another article I described the economic moat around 3M Company, which is based on intangible assets as well as switching costs:

3M Company has a wide economic moat based on intangible assets. This is including a wide list of patents, which are protecting products of 3M Company. Additionally, the company is great at branding its products and the brand name “3M” is a source for a competitive advantage and a short-cut in the decision process for customers.

Aside from intangible assets, 3M Company is also profiting from switching costs. The products, 3M sells are often small and cheap products. When a company is trying to reduce expenses and cut costs, these small products are rather seldom one of the victims as the cost advantage for such items is almost non-existent, but the effect of changing such small items could be dramatic – especially for safety and protection products. And due to these highs risks, customers will often keep on using 3M products.

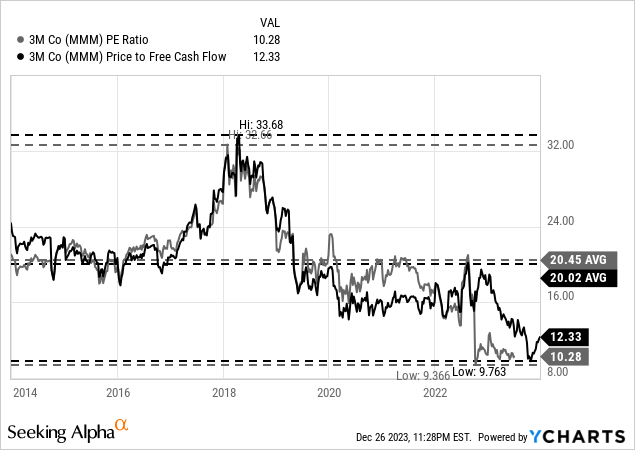

Of course, 3M Company did not really grow in the last few years. But the fact that 3M Company is still performing at a solid level while the stock price is constantly declining is visible in the constantly declining valuation multiples.

Intrinsic Value Calculation

At that point, we cannot calculate a P/E ratio as the trailing twelve months earnings per share were negative. Nevertheless, we can look at the price-free-cash-flow ratio (the more important metric in my opinion). At the time of writing, the company is trading for about 12.3 times free cash flow. This is not only one of the lowest valuation multiples in the last few years but also not a valuation multiple a high-quality business like 3M Company should trade for in the long run.

At the beginning of 2018, 3M Company was trading for 34 times free cash flow and a few months ago, it bottomed at 9.8 times free cash flow.

While the simple valuation multiples are already hinting towards undervaluation, we can back this up using a discount cash flow calculation. Let’s be very cautious and use the free cash flow of the last for quarters as basis – $4,853 million as trailing twelve months number. Additionally, we can assume 5% growth from now till perpetuity for 3M Company and we calculate with a 10% discount rate and 554.3 million outstanding shares. When calculating with these assumptions, we get an intrinsic value of $175.10. However, we must take into account the payments the company has to make between 2024 and 2036 and subtract the amounts mentioned above. Using all these assumptions, we get an intrinsic value of $150.72 for 3M Company and in my opinion this is a fair, intrinsic value based on reasonable assumptions.

We can discuss once again if these assumptions are realistic. For starters, free cash flow in the last four quarters seems like a realistic assumption and it is below the 10-year average of 3M Company and in the last few years, the company was really struggling.

Aside from the free cash flow being realistic we also must take a closer look at the growth rates we assume for the next few years. For starters, 3M Company grew with a CAGR of 4.88% in the last ten years (leading up to fiscal 2022 excluding the last few quarters). And analysts are also expecting growth rates in the mid-single digits in the next few years.

Conclusion

As I have been in my last few articles, I remain bullish about 3M Company and when considering the risk as well as the potential reward I think it is worth to take the bet. Clearly 3M Company is struggling right now and we can’t be too sure the lawsuits are resolved. But considering the low price we have to pay for 3M Company right now makes it a good investment – even if we should not assume high growth rates for the business at this point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.